Blue Chip vs. Blue Collar Property: A Data-Driven Investment Showdown

Unpacking the numbers on cash flow, capital growth, and portfolio potential to reveal the smarter choice for Aussie investors.

The Great Debate: Prestige vs. Profitability

For decades, Australian investors have debated the best path to wealth through property: chasing the prestige of 'blue chip' suburbs or the cash flow of 'blue collar' areas. Blue chip properties feel safe and secure, often located in affluent, highly desirable postcodes. In contrast, blue collar areas are more affordable, but often come with stereotypes about lower growth and difficult tenants. But what does the actual data say? By analysing the numbers, we can move beyond perception and uncover which strategy truly builds a successful property portfolio for the average Aussie investor.

Breaking Down the Contenders: Price Point and Accessibility

The most immediate difference between these two asset classes is the barrier to entry. For many investors, this single factor can dictate their entire strategy.

Blue Chip Properties: These are typically priced at $1.5 million and above. For an average investor, securing a loan of this size for a single asset is a significant hurdle, often consuming their entire borrowing capacity in one go.

Blue Collar Properties: These are far more accessible, with price points generally ranging from $400,000 to $800,000. This affordability means an investor with a $1.5 million budget could potentially purchase two separate properties instead of just one.

This fundamental difference in price sets the stage for a crucial comparison in portfolio performance, especially when it comes to the lifeblood of an investment: cash flow.

The Critical Role of Rental Yield and Cash Flow

While capital growth is often the long-term goal, rental yield and cash flow determine your ability to hold assets and grow your portfolio. Here, the data reveals a stark contrast.

Blue chip properties typically offer a low rental yield, usually between 2.5% to 3.5%. On a $1.5 million property, this results in a significant negative cash flow. Based on a 6.4% interest rate, an investor could be facing an out-of-pocket expense of over $41,000 per year.

Conversely, blue collar properties are known for their strong rental yields, often ranging from 4% to 6% or even higher. For the same $1.5 million budget, an investor could acquire two $750,000 properties. With a 5% yield, the combined negative cash flow would be around $20,000 per year—less than half the cost of holding the single blue chip asset. This cash flow advantage is critical for servicing debt and securing finance for future purchases.

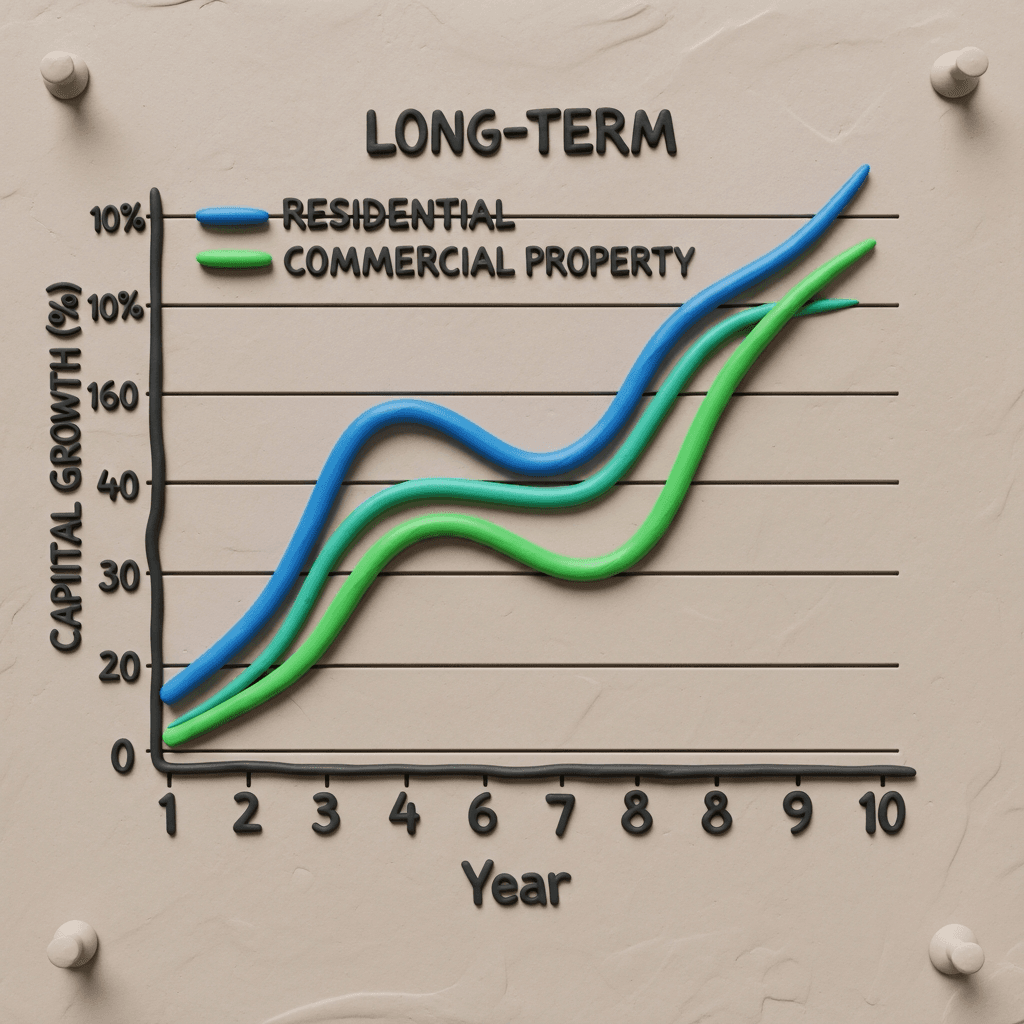

Debunking the Capital Growth Myth

The primary argument for blue chip investing is the belief in superior, more reliable capital growth. However, long-term data challenges this assumption. When comparing historical performance, many blue collar areas have demonstrated growth rates that are on par with—or even exceed—their blue chip counterparts.

For example, historical data shows blue chip suburbs like Mosman (NSW) and Ascot (QLD) have a compounded annual growth rate of around 6% over 10 years. In comparison, blue collar areas like Logan (QLD) have seen 8% growth, while St. Mary's (NSW) has achieved 6.4%. Assuming a consistent 6% growth rate, a single $1.5 million blue chip property and two $750,000 blue collar properties would both be worth approximately $2.6 million in 10 years. The data shows that investors don't necessarily have to sacrifice capital growth for better cash flow.

Comparing the Risk Profiles: Volatility and Tenant Quality

No investment strategy is without risk. While blue collar properties present a compelling financial case, investors must be aware of the potential downsides.

Price Volatility: Blue collar markets can experience more short-term price fluctuations. While blue chip areas tend to have a smoother, more consistent upward trend, blue collar areas might see more pronounced dips and rises. A long-term holding strategy is key to riding out this volatility.

Tenant Quality: The concern about tenants 'trashing' a property is a common stereotype associated with blue collar areas. While this risk exists in any rental property, it's not exclusive to one demographic. The best way to mitigate this is through rigorous due diligence. Speaking directly with multiple local property managers provides invaluable, on-the-ground insight into tenant demand, demographics, and any potential issues specific to a neighbourhood.

Conclusion: The Verdict for Portfolio Growth

While a blue chip property can be a sound investment for someone with very deep pockets and the ability to absorb significant negative cash flow, the data presents a clear winner for the average Aussie investor focused on building a multi-property portfolio.

Blue collar properties offer a more accessible entry point, substantially better cash flow, and comparable long-term capital growth. The superior cash flow is not just a minor benefit; it is the engine that reduces holding costs, improves serviceability, and ultimately allows an investor to acquire more assets and accelerate their wealth creation journey. The numbers show that a portfolio-focused strategy is often best served by the powerful combination of affordability and high yield found in blue collar markets.

Ready to dive into the data yourself? Explore suburbs, compare growth trends, and analyse yields with the powerful tools in our Data Analytics Hub.

Frequently Asked Questions

What is the main advantage of blue collar property investing?

The primary advantage is superior cash flow. Higher rental yields significantly reduce the annual cost of holding a property compared to a blue chip asset, which improves your borrowing capacity and allows you to build a portfolio faster.

Do blue chip properties always have better capital growth?

No. While they are generally stable, long-term data shows that well-selected blue collar areas can deliver comparable, and sometimes even higher, capital growth rates over a 10-year period.

How can I mitigate the risks associated with blue collar properties?

The key is a long-term hold strategy to overcome short-term price volatility. Furthermore, conducting thorough due diligence, including speaking with local property managers to understand tenant demographics and demand, is essential for selecting the right location and mitigating tenant-related risks.