How Pro Investors Spot High-Growth Properties Before the Media Does

A deep dive into the data-driven strategies used to identify market bottoms and uncover opportunities for long-term capital growth.

Introduction

Navigating the Australian property market can feel like trying to find a clear signal amidst a sea of noise. While mainstream media often focuses on negative sentiment and broad-stroke predictions, professional investors are busy looking at the underlying data to uncover opportunities. They understand that true market insights aren't found in headlines, but in the numbers that drive supply, demand, and long-term value. This guide will reveal the key metrics and strategies that seasoned investors use to identify high-performing properties before they become common knowledge.

Decoding the Market Bottom: Beyond the Hype

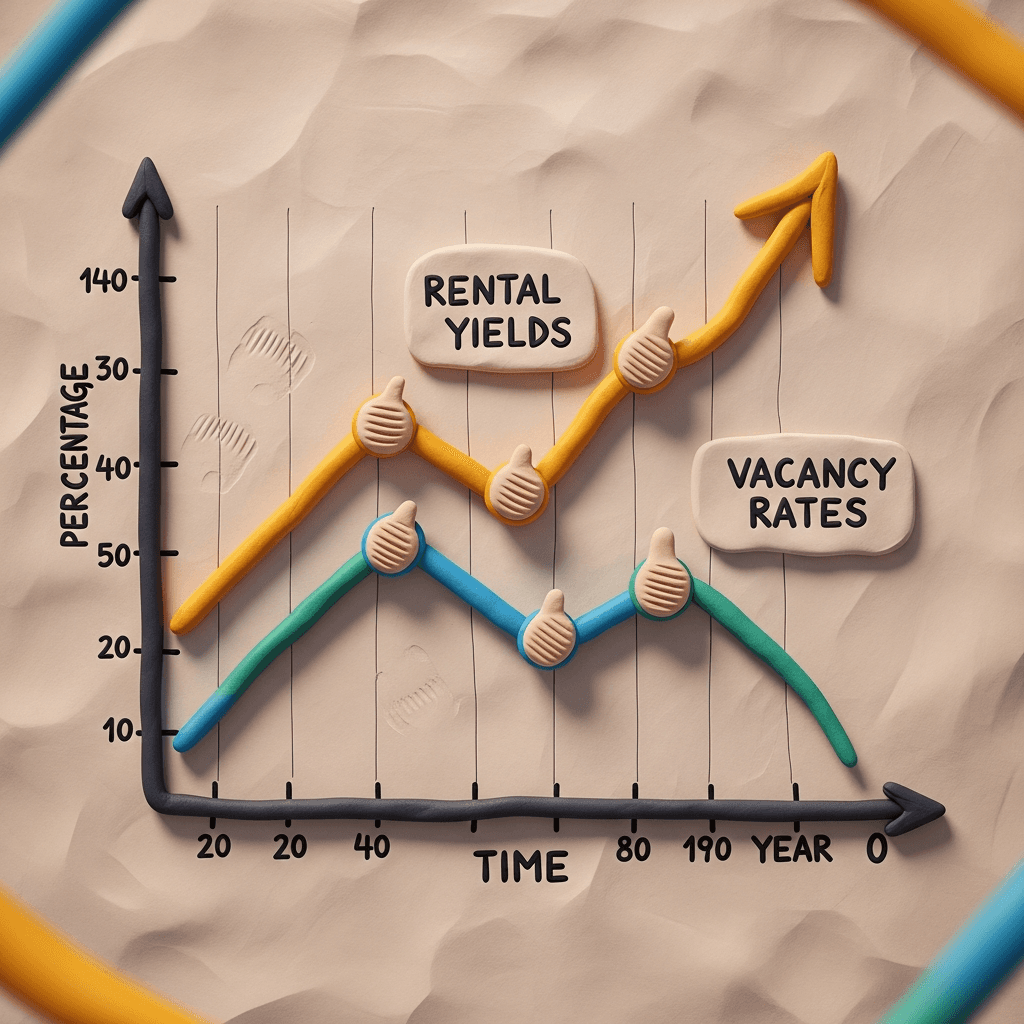

One of the most challenging feats in property investing is identifying the bottom of the market. While most can only spot it in hindsight, experts use leading indicators to make informed decisions in real-time. For example, when Melbourne's market sentiment was low, astute investors saw compelling signals. Low rental vacancy rates combined with rising rental yields—jumping from 2.5% to over 4% in metro areas—indicated that the market was undervalued and poised for a recovery. These are the kinds of key data points that signal a prime buying opportunity, allowing investors to act with confidence while others hesitate.

The Investor's Toolkit: Three Metrics That Matter

To effectively differentiate between markets and identify pockets of growth, you need to analyze more than just median house prices. Professionals rely on a specific set of metrics to guide their decisions.

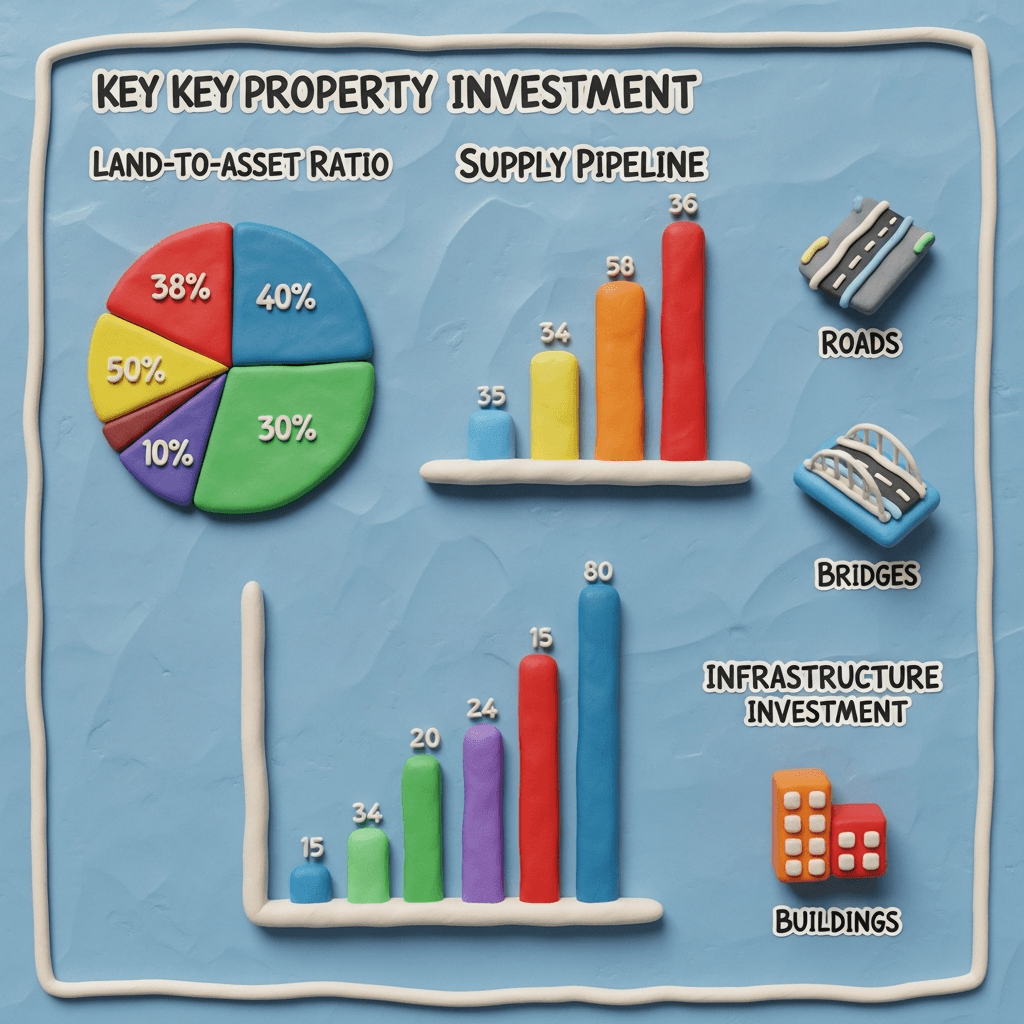

1. Land-to-Asset Ratio (LAR): A high LAR is a powerful indicator of future capital growth. It means a larger portion of the property's value is in the land itself, which appreciates, rather than the building, which depreciates. For an $800,000 property with a land value of $650,000, the investment is primarily in the appreciating asset. In contrast, new builds in developing areas often have a 50/50 LAR, meaning growth can be significantly slower.

2. Supply Pipeline Analysis: Areas with a high pipeline of new land releases and construction, such as Melbourne's western corridor, can experience dampened growth rates. The constant influx of new stock makes it harder for existing properties to appreciate. Conversely, established suburbs that are 'supply tight'—with limited land for new development—offer greater potential for strong, sustained growth.

3. Infrastructure Investment: Government and private sector spending on infrastructure like transport, hospitals, and schools is a massive driver of economic activity and job creation. These projects attract more people to an area, increasing demand for housing. Following the infrastructure pipeline is a reliable way to forecast future growth hotspots. Advanced tools can help you perform detailed suburb comparisons based on these crucial factors.

Quality Over Quantity: The $1 Million Dollar Question

A common dilemma for investors is whether to buy two properties at $500,000 each or one property for $1 million. The consensus among experts is clear: prioritise quality over quantity. A single, high-quality asset in a supply-tight area with value-add potential will almost always outperform two lower-grade properties in remote or high-supply locations. A quality asset offers multiple exit strategies, such as renovating, subdividing, or adding a granny flat, providing flexibility and greater control over your investment's performance.

Value-Add Strategies: The Granny Flat Play

For investors focused on a long-term hold, adding a granny flat can be a powerful strategy to improve cash flow and holding capacity. It can significantly boost rental yield, with some investors achieving yields over 5.6% on properties in established metro areas. However, it's crucial to understand the exit strategy. Properties with granny flats appeal to a smaller pool of buyers—typically other investors or multi-generational families. The best approach is to use the granny flat to comfortably hold the asset for 10-15 years, pay it off with the extra rent, and then potentially demolish both dwellings to build a duplex or townhouse development, unlocking the land's true value.

The Three Phases of a Successful Property Journey

Every successful investor moves through three distinct phases:

1. Acquisition: The initial phase focused on accumulating high-growth residential assets. The goal is to build an equity base by buying well and letting the market do the heavy lifting. 2. Optimisation: Once a portfolio is established, the focus shifts to optimising each asset. This involves renovations, adding secondary dwellings, or subdividing to extract further equity and improve cash flow. 3. Consolidation: In the final phase, often nearing retirement, investors consolidate their portfolio to reduce debt and maximise passive income. This is where many sell down residential properties and transition to higher-yielding commercial assets, which provide strong, stable income streams with less management overhead.

Conclusion

Spotting property opportunities like a professional requires shifting your focus from media noise to fundamental data. By analysing metrics like rental yields, supply pipelines, and land-to-asset ratios, you can make informed, strategic decisions. Prioritise acquiring high-quality assets in growth corridors and have a clear, long-term plan that moves from acquisition to optimisation and finally, to consolidation. This data-driven approach is the key to building a robust and successful property portfolio.

Ready to move beyond the headlines and make data-driven investment decisions? Explore HouseSeeker's Real Estate Analytics Hub to access the tools and insights you need to find your next high-performing property.

Frequently Asked Questions

What's more important for a first investment: cash flow or capital growth?

For your first property, the primary goal should be capital growth. Building equity is what allows you to borrow for subsequent purchases and expand your portfolio. You can become your own 'cash flow asset' by focusing on your career income while your property grows in value.

How do I analyze a suburb's growth potential?

Look for a combination of factors: strong historical growth is a good start, but forward-looking indicators are more important. Prioritise areas that are supply-tight, have a high land-to-asset ratio on typical properties, and have a significant pipeline of government or private infrastructure investment.

Is commercial property a good investment for beginners?

Commercial property is typically better suited for experienced investors who are in the 'consolidation' phase of their journey. It's an excellent vehicle for generating passive income but often requires a larger capital outlay and a different skill set than residential investing. Beginners should first focus on building a strong equity base with high-growth residential assets.