How School Zones and Market Trends are Shaping Australian Property in 2025

An in-depth analysis of the financial trade-offs for families and the key economic factors every buyer needs to know.

The High Stakes of School Catchments

For Australian families, the search for a home is often intertwined with the search for the right school. This creates a significant financial dilemma: is it better to pay a premium for a property within a desirable public school catchment, or to buy elsewhere and budget for private education fees? This decision weighs heavily on homebuyers, as the cost savings from public education can be substantial.

The demand for places in top-performing public schools is so intense that some families resort to desperate measures, such as fraudulently registering rental addresses within a catchment zone. This highlights a broader societal issue about access to quality education and the direct impact it has on local property markets. Ultimately, the choice depends on a family's financial capacity, their values around education, and their long-term investment goals.

Affordability Caps and Market Pressures

While buying into a top school zone is a priority for many, affordability remains a major hurdle. The high price points in these sought-after areas can limit capital growth potential, as fewer families can afford to enter the market, even if they want to. This creates a ceiling effect where prices may not appreciate as quickly as in other areas with more room for growth.

This dynamic is part of a larger market reality: a fundamental mismatch between supply and demand. Across Australia's major capital cities and large regional centres, there is a chronic shortage of housing. Good schools, both public and independent, are often bursting at the seams with long waiting lists, mirroring the intense competition for property in the surrounding suburbs. Buyers are not just competing for a home; they are competing for a place in a community with desirable amenities.

Australia's Property Market Outlook for 2025

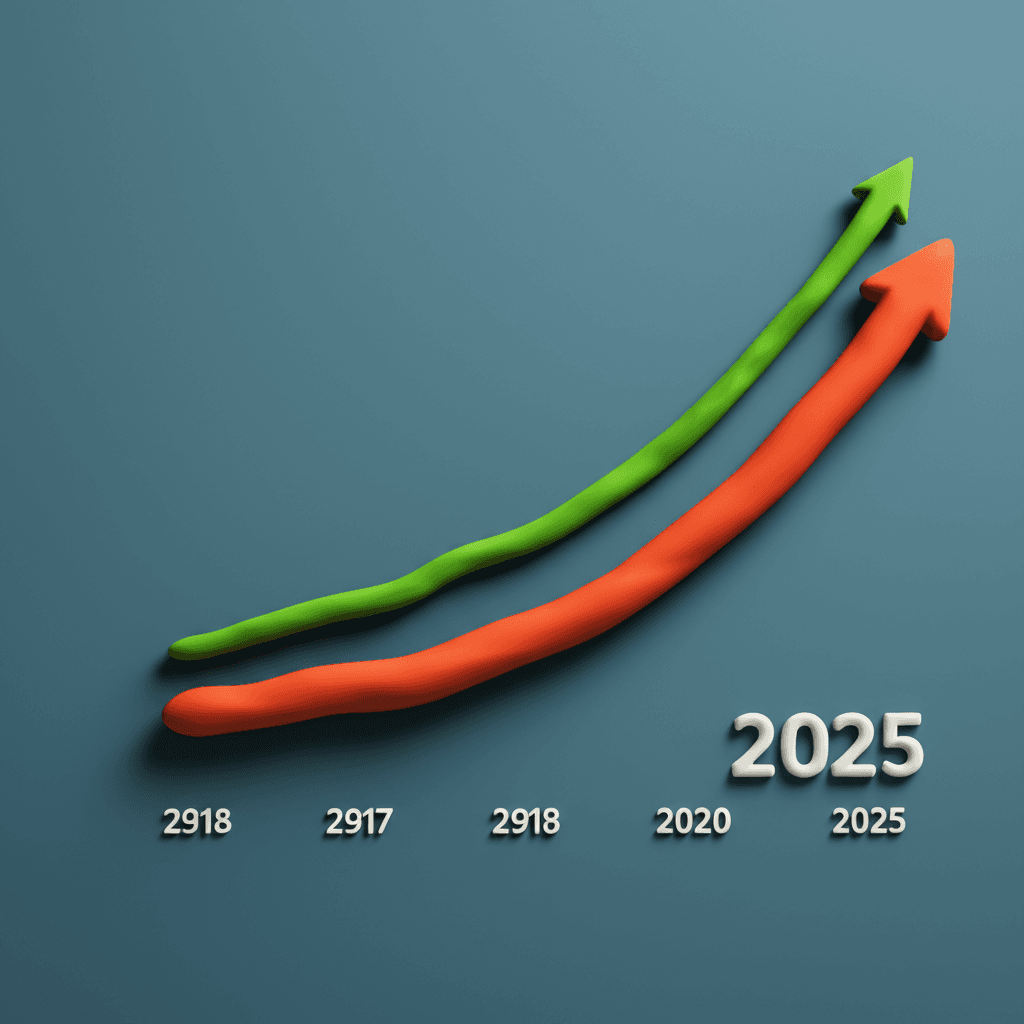

Looking ahead to 2025, the market is in a fascinating position. After a minor dip, a combination of factors is reigniting buyer activity. Improving household finances, the prospect of lower interest rates, and stronger real income growth have boosted consumer sentiment significantly. More households now feel it is a good time to buy a dwelling.

However, this renewed demand is clashing with constrained supply. Many potential sellers have been holding back due to economic uncertainty. As a result, new listings are trending approximately 10% below the historic five-year average, with total listings down by around 20%. This imbalance is setting the stage for a strong spring selling season for sellers and a highly competitive environment for buyers. Understanding these market trends and data analytics is crucial for making informed decisions.

The Impact of Government Intervention: The First Home Guarantee

Adding another layer of complexity is the First Home Guarantee scheme. While government predictions suggest a minimal 0.5% impact on housing prices, many experts anticipate a more significant short-term effect as buyers rush to take advantage of the opportunity. The scheme helps individuals overcome the massive deposit hurdle, but it's essential to understand the trade-offs.

A 5% deposit means a 95% loan-to-valuation ratio (LVR), which can result in paying hundreds of thousands of dollars more in interest over the life of the loan. While Australia's conservative lending environment includes serviceability buffers to protect borrowers, buyers must carefully consider their long-term repayment capacity. For renters in expensive cities like Sydney, the savings on rent and Lenders Mortgage Insurance (LMI) might outweigh the extra interest. However, at a systemic level, such demand-side policies often contribute to pushing prices higher without addressing the core issue of housing supply. Navigating these complexities is where a guided AI buyer's agent can provide invaluable support.

Conclusion

Navigating the 2025 Australian property market requires a multifaceted strategy. Buyers, particularly families, must balance lifestyle priorities like school zones with the financial realities of an increasingly competitive and supply-constrained market. Economic factors and government schemes add further layers that can either create opportunities or pitfalls. Success in this environment depends on thorough research, a clear understanding of long-term financial implications, and leveraging powerful tools to analyse the market.

Ready to cut through the noise and make a data-driven property decision? Explore real-time market trends and suburb insights with HouseSeeker's Real Estate Analytics to find your perfect home.

Frequently Asked Questions

Is it always more expensive to buy in a top public school zone?

Often, yes. Properties within the catchments of highly-rated public schools typically command a price premium. Buyers are essentially capitalising future school fees into the purchase price of the home. Families should calculate the total cost of private school for all their children and compare it against the property price difference to see which option makes more financial sense for them.

What are the key drivers of the property market heading into 2025?

The market is being shaped by a combination of high buyer demand and low housing supply. Demand is fueled by improved consumer sentiment, potential interest rate cuts, and real income growth. Supply remains constrained as fewer homeowners are listing their properties compared to historical averages. This supply-demand imbalance is expected to put upward pressure on prices.

How does the First Home Guarantee scheme affect my borrowing capacity?

The scheme primarily helps you enter the market with a smaller deposit (as little as 5%) without needing to pay LMI. However, it does not necessarily increase your borrowing capacity. You must still pass the lender's serviceability tests, which include a buffer to ensure you can handle potential interest rate rises. A smaller deposit also means a larger loan and higher total interest payments over time.