Lending Crackdown: Why Major Banks Are Targeting Property Investors

APRA's recent moves have prompted CBA and Macquarie to change the rules. Here’s what you need to know to protect and grow your portfolio in this new landscape.

A Sudden Shift in the Lending Landscape

Australia's property investors are facing a significant new hurdle. In a move that signals a systemic shift, the Commonwealth Bank (CBA), the nation's largest bank, has announced major changes to its lending policies for non-individual borrowers. Effective immediately, loan applications from company and trust structures will only be accepted if the applicants have had an existing lending relationship with CBA for at least six months.

This follows a similar move by Macquarie Bank just weeks ago, effectively removing two of the most popular lenders for sophisticated investors using these structures. This isn't a coincidence; it's a clear, regulator-driven change designed to cool a specific segment of the market. Understanding these changes is crucial for any investor looking to build or expand their portfolio.

Why is This Happening Now? The Regulator Steps In

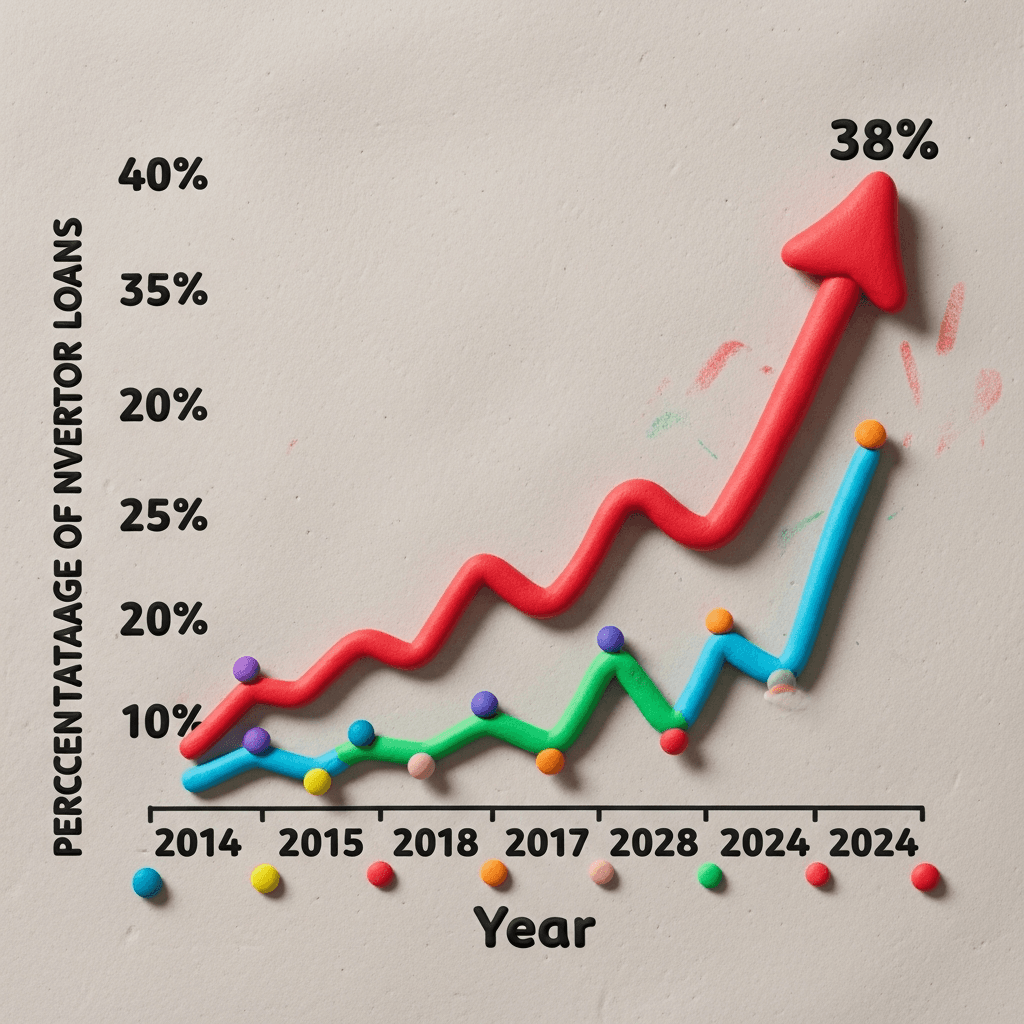

The Australian Prudential Regulation Authority (APRA) has been watching the market closely. In a recent statement, APRA noted that while housing lending standards remain generally sound, they are "seeing some signs of higher-risk lending picking up," specifically calling out a rise in activity among investors. This concern is backed by compelling data.

Investor lending now makes up nearly 40% of the market, a peak not seen since APRA's last major intervention back in 2017. History shows that when investor activity reaches these levels, the regulator acts to mitigate systemic risk. This time, their focus is on a clever strategy that some investors have used to maximise their borrowing capacity.

The 'Trust Loophole' Explained

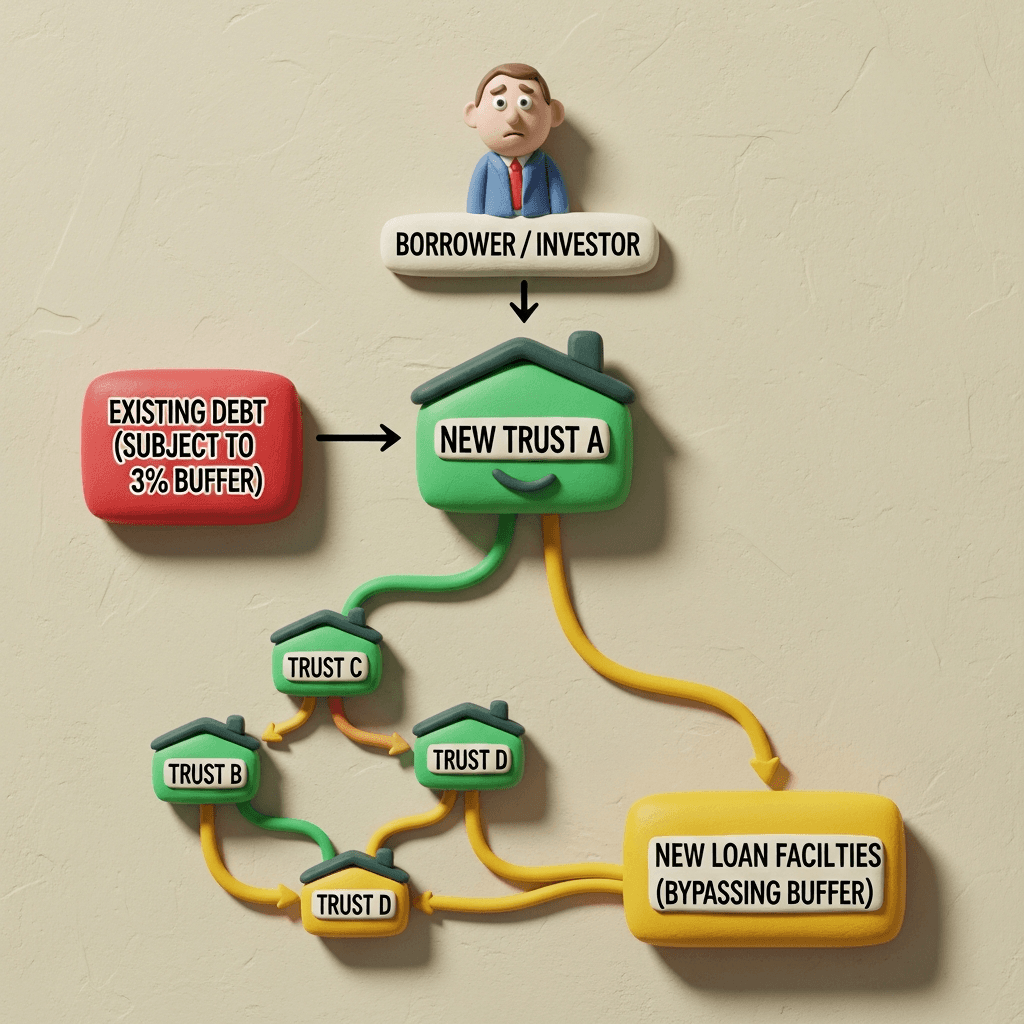

At the heart of this crackdown is the 3% serviceability buffer. When you apply for a loan, banks assess your ability to repay it not at the current interest rate, but at a rate that's 3% higher. This stress test is a core pillar of Australia's financial stability. However, a loophole emerged for investors using multiple company or trust structures.

Sophisticated investors could establish multiple trusts. When applying for a new loan in a new trust, the 3% buffer was often not applied to the debts held in their other trusts. Lenders would simply verify that the existing loans were being paid, without stress-testing the entire portfolio against a future rate rise. This allowed investors to borrow significantly more than they otherwise could. APRA has identified this as a potential risk, and these new policies from CBA and Macquarie are a direct response designed to close this loophole.

How to Adapt Your Investment Strategy

With this popular strategy now off the table, investors must pivot. The focus must return to the fundamentals of building a strong financial position to secure funding. Relying on loopholes is no longer a viable long-term plan.

Here are the key strategies to consider in this new environment:

1. Strategic Lender Sequencing: The lending market is diverse. Not all banks have the same policies. Working with a skilled mortgage broker can help you structure your loans and approach lenders in the right order. Some lenders are more favourable early in your journey, while others offer more flexible options for established portfolios.

2. Explore Alternative Structures: For advanced investors, options like using a Self-Managed Super Fund (SMSF) or exploring commercial property loans may become more attractive. These require specialist advice but offer different pathways to portfolio growth.

3. Focus on the Fundamentals: Your Income: Ultimately, your borrowing capacity is determined by your income minus your expenses. The most powerful and sustainable way to grow a property portfolio is to increase your income. This factor is entirely within your control and is the foundation upon which all successful property investment is built.

Conclusion

The recent policy changes from CBA and Macquarie, driven by APRA, represent a significant tightening of the lending environment for Australian property investors. The era of using complex trust structures to bypass serviceability buffers is coming to an end. The key takeaway for investors is to shift focus from finding loopholes to strengthening their core financial position. By increasing your income and working with experts to navigate the diverse lender market, you can continue to scale your portfolio successfully, even in this more regulated landscape. For investors, understanding market dynamics through robust real estate analytics is more critical than ever.

Ready to navigate this changing market with confidence? Discover how HouseSeeker's powerful real estate analytics can help you identify high-performing investment opportunities and build a resilient property portfolio.

Frequently Asked Questions

What is the 3% assessment rate buffer?

The 3% assessment rate buffer, also known as a serviceability buffer, is a measure used by lenders as mandated by APRA. It means they calculate your ability to repay a loan at an interest rate that is at least 3 percentage points higher than the actual loan's interest rate. This ensures borrowers can still afford their repayments if interest rates rise significantly.

Does this lending crackdown affect investors buying in their personal name?

These specific policy changes from CBA and Macquarie directly target non-individual borrowers, meaning those using company and trust structures. However, the underlying reason for the crackdown—APRA's concern about rising investor activity—could lead to broader tightening across the market. All investors should focus on maintaining a strong financial position.

What is the first step I should take after learning about these changes?

The best first step is to review your current investment strategy and financial situation. If you were planning to use company or trust structures, it's essential to speak with a qualified mortgage broker who specialises in investor lending. They can provide up-to-date advice on which lenders are still suitable and help you create a new plan for acquiring your next property. A tool like an AI Buyer's Agent can then help you execute that plan efficiently.