Melbourne's Top Investment Suburbs Under $700K: A 2025 Guide

Discover the exact data-backed suburbs in Melbourne's north and west that offer strong capital growth and healthy rental yields for savvy investors.

Melbourne's Investor Influx: Why the Market is Heating Up in 2025

Navigating the Australian property landscape in mid-2025 can feel overwhelming, especially for first-time investors. Yet, amid the noise, a clear trend is emerging: Melbourne is capturing the attention of savvy investors nationwide. While local homebuyer confidence is returning, a significant driver of the market's momentum is the influx of capital from interstate, particularly from Sydney.

Investors are looking past outdated narratives of low yields and land tax concerns, instead focusing on the compelling data. Melbourne presents a rare opportunity to enter a well-established capital city market at a price point that has become unattainable elsewhere. With rental yields pushing above 4% in key areas—surpassing many parts of Brisbane and Sydney—the city's affordability and growth potential are undeniable. This guide cuts through the speculation to provide a data-driven roadmap, identifying the exact Melbourne suburbs where a budget of under $700,000 can secure a high-performing asset with long-term growth potential.

Key Metrics for Identifying High-Growth Suburbs

To make a successful investment, you must move beyond emotional decisions and focus on the fundamental data points that underpin a suburb's long-term value. A sophisticated investment strategy relies on powerful real estate analytics to identify areas poised for growth. Here are the critical metrics we analyze to pinpoint investment-grade locations.

Stock on Market (SOM)

Stock on Market measures the percentage of total properties in a suburb currently listed for sale. A low SOM, ideally under 1%, signals a tightly held market where supply is scarce. This creates a competitive environment where buyers must act decisively, putting upward pressure on prices. It's a strong indicator of high demand and a resilient market.

Days on Market (DOM)

Days on Market tracks the average number of days a property takes to sell. A low DOM, typically under 60 days, indicates that properties are being snapped up quickly. In a hot market like Melbourne, seeing DOM figures around 30-40 days is a clear sign of robust buyer demand and a market that is moving into a strong growth phase.

Owner-Occupier vs. Renter Ratio

A high proportion of owner-occupiers in a suburb fosters stability and resilience. Homeowners are invested in their community, leading to better-maintained streets and properties. Crucially, they are less likely to sell during periods of mortgage stress compared to investors, which helps to prevent panic-selling and protect property values during economic downturns.

Social Housing Concentration

While not a deal-breaker, the percentage of social housing in a specific pocket is an important due diligence step. As a general rule, we target areas with 8% or less. It's essential to conduct on-the-ground research, such as driving through the streets, to assess the quality of the neighborhood. Pockets with well-maintained properties, regardless of tenure, are preferable as they won't negatively impact your property's future value.

Capital Growth Momentum

Historical performance is useful, but recent momentum is a more powerful indicator of a suburb's current trajectory. We analyze capital growth over the past three months to identify suburbs that have already entered their growth cycle. A quarterly growth figure of 2-3% suggests an annualized growth rate of over 10%, indicating you're buying into a market with proven upward momentum.

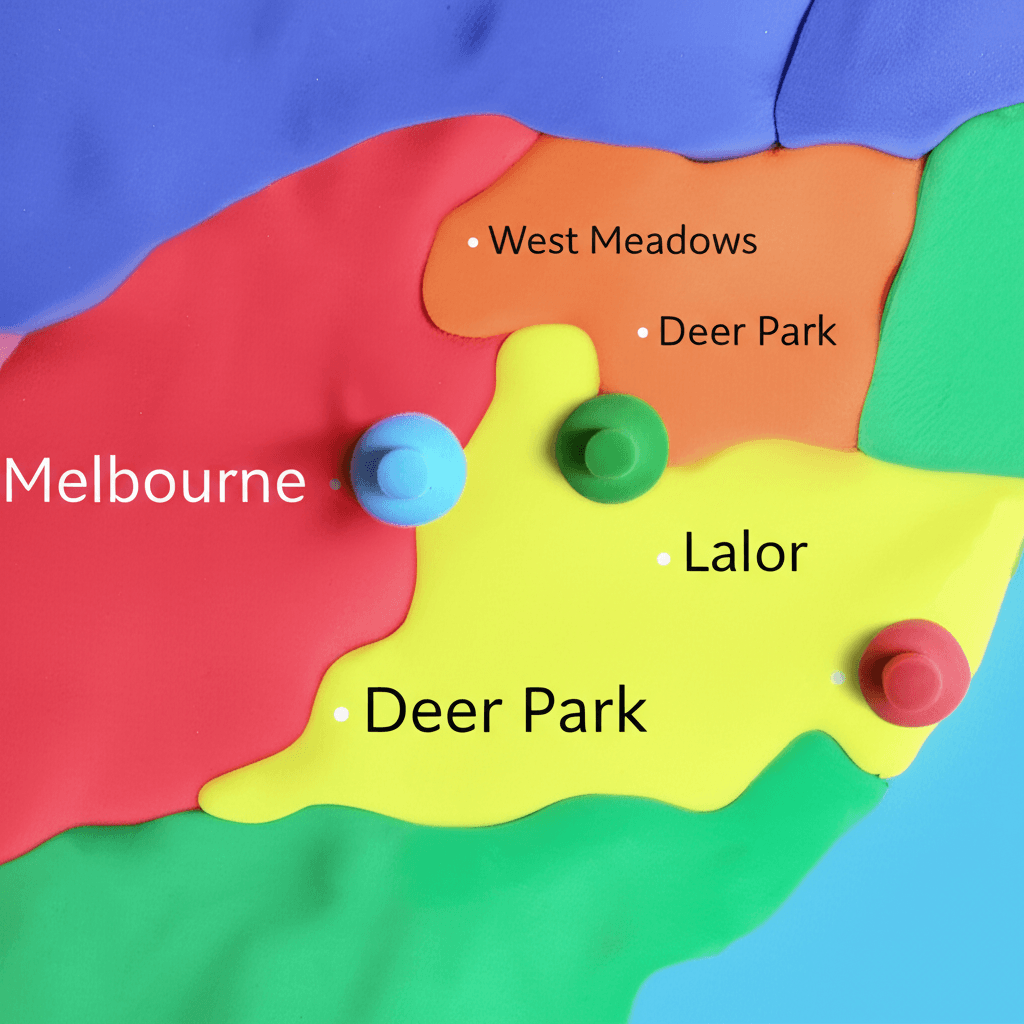

Uncovered: Three Melbourne Suburbs to Target Under $700K

Armed with these key metrics, we've identified three specific suburbs in Melbourne's north and west that represent outstanding value for investors with a budget of around $650,000 to $700,000. These are not speculative hotspots but established areas with solid fundamentals poised for significant growth.

1. West Meadows (Northern Suburb)

West Meadows is a prime example of an affordable suburb benefiting from the ripple effect of its more expensive neighbors like Glenroy and Pascoe Vale. It offers a direct path to strong capital growth without the premium price tag.

Median Price: ~$705,000 (though well-presented three-bedroom homes can be secured for as little as $650,000).

Market Heat: The data shows extreme demand. Stock on Market is exceptionally low at just 0.4%, while Days on Market is a rapid 32 days.

Community Stability: It's a predominantly owner-occupied area, with only 26% of households being rentals. This creates a stable and resilient local market.

Growth: West Meadows has already demonstrated strong momentum, with property values growing by 2.8% in the last quarter alone—an annualized rate of over 11%.

2. Deer Park (Western Suburb)

Historically overlooked, Melbourne's west is undergoing significant gentrification, and Deer Park is at the forefront of this transformation. Driven by affordability, it is currently outperforming many northern suburbs in terms of growth.

Median Price: A typical property value sits around $680,000, making it highly accessible.

Growth Trajectory: The suburb is on track to achieve an impressive 14.7% annualized growth rate, fueled by buyers seeking value within the metropolitan area.

Market Dynamics: While the crime rate is slightly higher than in the north, the fundamentals remain strong. Stock on Market is a tight 0.76%, ensuring that available properties are met with strong competition.

Social Housing: At 4.2%, it has less social housing than West Meadows, though pocket-by-pocket due diligence remains crucial.

3. Lalor (Northern Suburb)

Lalor's strategic advantage is its proximity to more premium suburbs like Bundoora, which is home to major universities and amenities. It allows investors to buy into an area with established, high-quality infrastructure at a more accessible price point.

Median Price: Investors can comfortably acquire a solid asset for under $700,000.

Established Infrastructure: Unlike fringe estates, Lalor offers excellent access to transport, schools, and shopping, enhancing its livability and rental appeal.

Market Scarcity: The Stock on Market is a very low 0.66%, indicating a tightly held market where opportunities are scarce.

Selling Speed: Properties in Lalor sell in an average of 43 days, demonstrating consistent and healthy buyer demand.

Common Pitfalls: Where Not to Invest Your $700K Budget

Just as important as knowing where to buy is knowing what to avoid. Many first-time investors are lured into common traps that severely limit their potential for capital growth. With a $700,000 budget, steering clear of these pitfalls is essential for success.

The Lure of New House & Land Packages

Fringe suburbs like Beveridge and Thornhill Park are often marketed with the promise of a brand-new home and significant depreciation benefits. However, this is a classic investment trap. The core issue is the endless supply of surrounding land zoned for residential development, which you can track through resources like the Australian Bureau of Statistics. This future supply creates two major problems:

1. Sales Competition: When you decide to sell, your established home will be competing with thousands of newer, identical properties, suppressing price growth. 2. Rental Competition: Why would a tenant rent your 10-year-old house when they can rent a brand-new one down the road for a similar price?

Remember, land appreciates while buildings depreciate. In these estates, you are paying a premium for a depreciating asset (the new building) on land with limited scarcity.

The High-Rise Apartment Fallacy

An inner-city apartment may seem like a glamorous investment, but it's often a poor choice for capital growth. A $700,000 budget could secure a two-bedroom apartment in an area like South Bank, but it comes with significant downsides. High body corporate fees eat into your cash flow, and more importantly, you own very little of the most valuable asset: the land. An established house on its own block of land in a middle-ring suburb like West Meadows or Lalor will almost always outperform an inner-city apartment in long-term value appreciation.

Your Path to a Smarter Melbourne Investment

The key takeaway is simple: a $700,000 budget is more than enough to secure a high-quality investment property in Melbourne, provided you follow a disciplined, data-driven strategy. Focus on established houses on solid blocks of land in middle-ring suburbs with proven growth fundamentals. Prioritize land appreciation over building depreciation and avoid the common traps of new builds and high-rise apartments.

By targeting areas with tight supply, high demand, and strong owner-occupier communities, you position yourself to ride Melbourne's next wave of growth. Don't let market noise distract you; let the data guide you to a successful investment.

Ready to uncover your next investment opportunity? Dive deep into suburb performance, track market trends, and make your next move with confidence using HouseSeeker's powerful real estate analytics.

Frequently Asked Questions

Is $700,000 enough to buy a good investment property in Melbourne?

Absolutely. As this guide shows, a $700,000 budget allows you to purchase an established house on a good-sized block of land in several middle-ring suburbs with excellent growth prospects. The key is to avoid overpriced new builds and inner-city apartments where the land-to-asset ratio is poor.

Should I buy a new property for depreciation benefits?

While depreciation offers tax benefits, it should never be the primary reason for an investment decision. Long-term wealth is built through capital growth, which comes from the appreciation of well-located land. A 20-year-old house in an established suburb with scarce supply will almost always be a better investment than a new house in a fringe estate with endless supply.

How can I find properties before they hit the market?

Finding off-market properties often requires deep relationships with local selling agents, which can be time-consuming to build. A modern approach is to leverage technology and expert guidance that can identify and secure properties before they are advertised to the general public. Services like our AI Buyer's Agent are designed to give you a competitive edge in fast-moving markets.