From Zero to 62 Properties: How Michael Xia Built a $42,000/Week Rental Empire

Unlock the strategies, mindset shifts, and data-driven decisions that fueled one of Australia's most remarkable property investment journeys.

Introduction: The Making of a Property Magnate

What does it take to build a property portfolio of 62 rentals generating over $42,000 in weekly income? For investor Michael Xia, the journey wasn't a straight line to success. It was a path paved with early mistakes, critical mindset shifts, and a relentless focus on data and strategy. From an unmotivated university student to a cashflow machine, Michael's story offers a powerful blueprint for any aspiring Australian investor. This is a deep dive into the lessons, strategies, and pivotal moments that built an empire.

The First Mistake: A Lesson in Off-the-Plan Pitfalls

Like many first-time investors, Michael’s journey began with a common but costly error. In his early twenties, guided by a friend's advice rather than research, he purchased a small, off-the-plan studio apartment in Epping for $340,000. Lured by the appeal of a new build with amenities and a delayed settlement, he committed to the purchase with zero due diligence. This decision became what he calls an "absolute disaster," a property that underperformed significantly and taught him the cardinal sin of property investing: never buy without comprehensive research and analysis. It’s a crucial lesson in understanding that shiny new builds don't always equate to strong investment performance.

The Turning Point: Data, Inspiration, and a New Strategy

It wasn't until age 28 that the penny truly dropped. A realisation that his corporate job wouldn't lead to his desired lifestyle, combined with discovering property investor Nathan Birch's renovation videos on YouTube, ignited a new passion. Seeing someone his age achieve massive success by buying undervalued properties and adding value was an inspiration. This pushed Michael to abandon guesswork and adopt a more analytical approach. He began to immerse himself in property forums, connect with seasoned investors, and fundamentally change his strategy from speculative buying to calculated, data-driven acquisitions. This shift towards using market data to identify opportunities is a cornerstone of modern property investing, a strategy you can explore further with our Real Estate Analytics Hub.

Building the Foundation: Smart Acquisitions and The 'Aha!' Moment

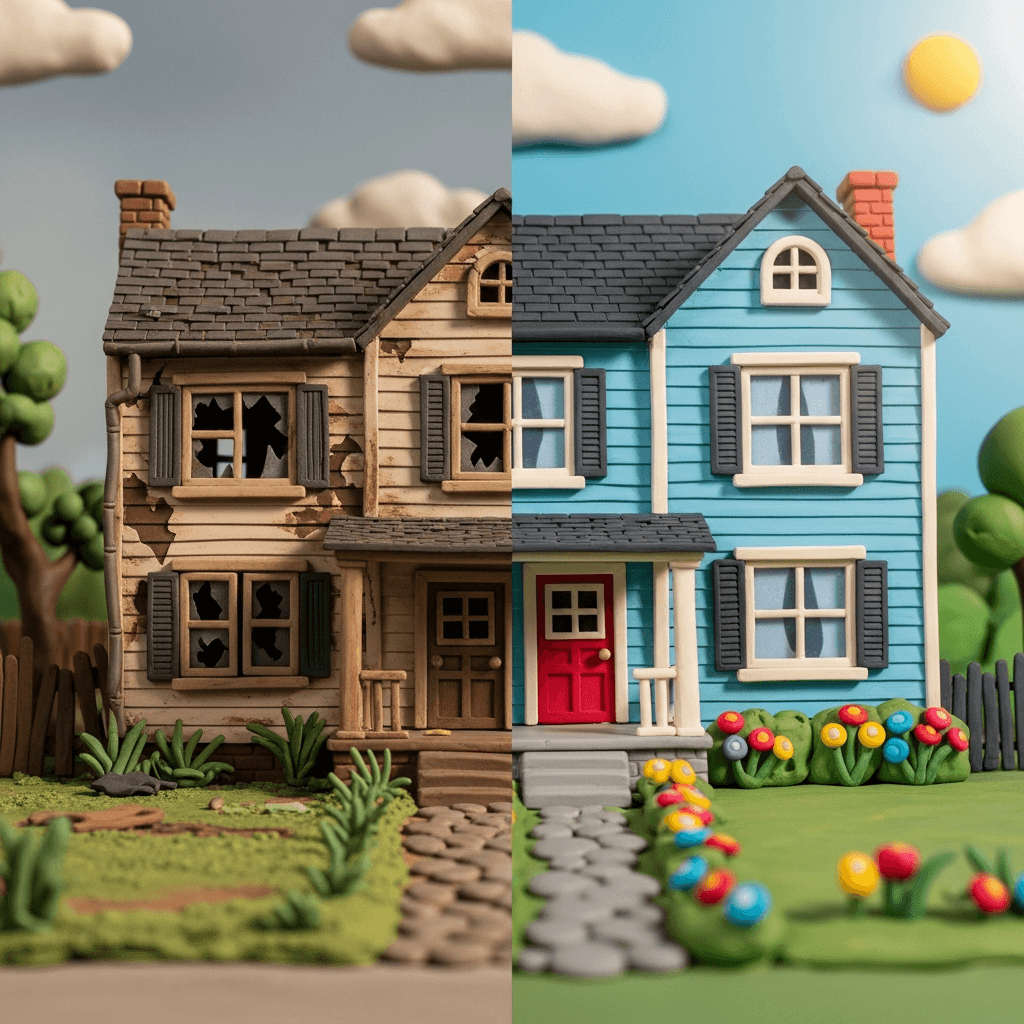

Michael's second purchase, an older two-bedroom unit in Macquarie Park, was a stark contrast to his first. Its prime location, proximity to a university, and strong rental demand made it a solid performer. More importantly, its position in a low-rise complex on a large block gave it a high land-to-asset ratio, which later presented a lucrative opportunity to sell to developers for a massive profit. However, the true 'aha!' moment came with his fourth and fifth properties in the Newcastle area. He purchased a house in Gateshead for $195,000, spent $35,000 on renovations, and three months later, it was valued at $295,000—a $65,000 equity gain. This was the moment he realised he could generate more wealth in three months than he could save from his salary in over a year. It proved the power of a value-add strategy: forcing appreciation through strategic improvements rather than just waiting for the market to rise.

Scaling Up: Specialisation and the Power of Networking

With newfound equity and confidence, Michael's strategy evolved. He recognised that to keep buying, he needed properties with high rental returns to satisfy lender servicing requirements. His research led him to Logan, Brisbane, an area where he could buy houses for under $300,000 with rental yields of 6-7%. While the market remained stagnant for years, he held his conviction, believing the numbers were too compelling to ignore. He became an expert in the area, flying to Brisbane fortnightly to inspect properties and, crucially, build relationships with local real estate agents. This dedication paid off, giving him access to off-market deals and opportunities others missed. His strategy underscores a key principle: it's often better to become an expert in one undervalued market than to diversify too broadly without deep knowledge.

The Three Pillars of Success: Mindset, Knowledge, and Action

Michael attributes his success to three core pillars that any investor can adopt:

1. Mindset: It all started with a clear, burning goal—to quit his corporate job. This powerful 'why' fueled his sacrifices and kept him focused. He stresses the importance of self-development, reading books like The Slight Edge, and working on personal belief systems to overcome the inevitable challenges and tests of an investment journey. 2. Knowledge: Success requires a constant feedback loop between theory and practice. Reading forums and listening to podcasts is the start, but true knowledge is gained by applying those theories in the real world, learning from the results, and refining your approach. Whether it's negotiating with an agent or assessing a renovation's ROI, practical application turns information into expertise. 3. Action: The biggest hurdle for many is taking action. Michael's advice is to start small and focus on the process, not just the end goal. Instead of being overwhelmed by the idea of buying a property, focus on daily actions: speak to two agents, analyse one deal, make one offer. This philosophy of consistent, small steps—the 'slight edge'—builds momentum and eventually leads to significant results.

The Unspoken Rule: High Income is the Accelerator

To scale from a handful of properties to over sixty, Michael had to face a hard truth: a standard salary has its limits. His borrowing capacity was a major constraint. The pivotal decision to leave his corporate job and start his own mortgage broking business in 2015 was the accelerator. While it meant a two-year pause on purchasing as he built the business, the subsequent increase in income unlocked the ability to secure significantly more financing, allowing him to acquire properties at a pace that would have otherwise been impossible. This is a critical lesson for anyone dreaming of building a mega-portfolio—at a certain scale, increasing your personal income becomes as important as your investment strategy.

Conclusion: Your Blueprint for Success

Michael Xia's journey from a single, flawed investment to a 62-property empire is a masterclass in strategic property investing. The key takeaways are universal: educate yourself to avoid early mistakes, use data to find undervalued markets with strong fundamentals, and don't be afraid to add value through renovation. Build a strong team, cultivate an unstoppable mindset with a clear goal, and understand that to truly scale, your income must grow alongside your portfolio. While not everyone will build a portfolio of this size, the principles Michael followed can be applied by any investor to build substantial wealth over time.

Ready to uncover the next high-growth area or analyse a potential deal? Our Real Estate Analytics Hub provides the powerful data you need to make informed decisions and build your own property success story.

Frequently Asked Questions

Is it too late to start investing in Australian property?

Not at all. Michael's philosophy is that at any point in time, there is an opportunity to invest somewhere in Australia. While one market like Sydney might be hot, another like Perth or a regional centre could be undervalued. The key is to do your research and look for markets where the numbers and growth drivers make sense, rather than feeling like you've 'missed the boat' on a specific city.

Do I need to start a business to build a large property portfolio?

To build a portfolio of the size Michael has (30+ properties), a high income is essential to satisfy lender servicing requirements. While a high-paying corporate job can help you build a solid portfolio (e.g., 5-10 properties), accelerating to a mega-portfolio often requires the uncapped income potential that comes from running a successful business.

What's more important: capital growth or rental yield?

Michael's strategy shows the symbiotic relationship between the two. He initially targeted high-yield properties (6-7% in Logan) out of necessity to maximise his borrowing capacity. This cash flow supported the portfolio. While he was waiting, the market eventually caught up, delivering massive capital growth. The lesson is that a strong rental yield can make a portfolio sustainable while you wait for the long-term capital appreciation to occur.