Property Investment Analysis: A Data-Driven Guide to Cash Flow & ROI

Learn how to calculate rental yields, forecast expenses, and measure the true return on investment for any Australian property before you buy.

Navigating the Australian property market in mid-2025 can feel overwhelming. Headlines scream about rising rates and market shifts, making it difficult to know if you're making a sound investment or a costly mistake. To succeed, you must look beyond the noise and learn to analyse a property like a business—by focusing on the numbers. This guide will walk you through the essential steps to calculate cash flow and determine the true return on investment (ROI), empowering you to make confident, data-driven decisions.

Step 1: Master Your Personal Cash Flow

Before you can analyse an investment property, you must first have a rock-solid understanding of your own financial position. An investment property should support your long-term goals, not become a strain on your daily life. The key is to determine your 'surplus'—the money left over after all your personal expenses are paid.

Fixed vs. Variable Costs

Start by categorizing your personal expenses:

Fixed Costs: These are consistent, recurring expenses that are hard to change, such as mortgage or rent payments, insurance premiums, and existing loan repayments.

Variable Costs: These are lifestyle expenses that fluctuate, including groceries, dining out, entertainment, holidays, and subscriptions. This is where you have the most control.

Once you know your surplus, you have a clear picture of what you can comfortably afford to contribute to an investment property if it's negatively geared. If your surplus is only $5,000 a year, taking on a property that costs you $10,000 annually is unsustainable. The first step is always to optimise your personal budget.

Common Areas for Improving Your Surplus

Dining Out & Takeaways: This is often the biggest leak in a household budget. Setting a weekly limit can free up significant cash.

Car Leases: While appealing, car leases can be a major drain on both your cash flow and your borrowing capacity due to the associated debt and depreciation.

Subscriptions & Phone Plans: Review all recurring payments. Moving from a phone plan to a prepaid SIM-only plan can save over a thousand dollars a year.

Step 2: Analyse the Investment Property's Cash Flow

Think of an investment property as a small business. It has income (rent) and expenses (mortgage, rates, etc.). The goal is to accurately forecast these numbers to understand its annual performance.

The Income Side: Rent and Yield

Your primary income is the weekly rent. To calculate the gross annual rental income, you multiply the weekly rent by 52. However, it's crucial to factor in potential vacancies.

Occupancy Rate: No property is tenanted 100% of the time. A conservative approach is to assume a 96% occupancy rate, which accounts for approximately two weeks of vacancy per year. To find high-demand areas with low vacancy rates, you need robust [real estate analytics](https://houseseeker.com.au/features/real-estate-analytics).

Rental Yield: This is a critical metric for comparing properties. It's calculated as:

`(Annual Rental Income / Property Purchase Price) x 100` A higher yield means better cash flow, but it often needs to be balanced with capital growth potential.

The Expense Breakdown

This is where many new investors get caught out. A comprehensive expense list is non-negotiable.

Loan Repayments: This is your largest expense and is directly tied to interest rates. When modelling, it's wise to use a conservative interest rate (e.g., 7%) rather than the current rate to stress-test the property's viability.

Council & Water Rates: These vary significantly by location.

Insurance: Landlord insurance is essential to protect your asset.

Property Management Fees: Typically 6-8% of the rental income.

Maintenance: A good rule of thumb is to budget 1-2% of the property's value annually for repairs and upkeep, especially for older properties.

Land Tax: This state-based tax is levied on the total value of the land you own (excluding your primary residence). It becomes a significant factor as you build a larger portfolio.

Step 3: Understanding Profit, Growth, and Tax

Once you subtract your total annual expenses from your annual rental income, you have your pre-tax cash flow position. Often, especially in the early years, this will be a negative number.

Demystifying Negative Gearing

If your property's expenses exceed its income, it is 'negatively geared'. This annual loss can be claimed against your taxable income, reducing the amount of tax you pay. For example, if you earn $100,000 and your property has a $10,000 loss, you are only taxed on a $90,000 income. This tax credit effectively reduces the out-of-pocket cost of holding the property.

While some investors chase positive cash flow from day one, it's important to remember that negative gearing is a common strategy. The short-term cash flow loss is often a trade-off for a much more powerful wealth creator: capital growth. For more information on tax implications, refer to the official Australian Taxation Office (ATO) guidelines.

Capital Growth: The Real Engine of Wealth

Capital growth is the increase in your property's value over time. This is where true wealth is built. A property that costs you $6,000 a year to hold might seem like a burden, but if it grows in value by $22,000 in the same year, your net position has increased by $16,000. This is the fundamental reason investors accept negative gearing.

Forecasting growth is speculative, but by using deep [data-driven decisions](https://houseseeker.com.au/features/real-estate-analytics), you can identify suburbs with strong long-term growth drivers like population growth, infrastructure investment, and low supply.

Step 4: Calculating Your True Return on Investment (ROI)

ROI measures the efficiency of your investment. It tells you how hard your initial capital is working for you.

The Formula: `ROI = (Annual Net Profit / Total Initial Cash Invested) x 100`

Annual Net Profit: This is your estimated annual capital growth minus your after-tax cash flow loss.

Total Initial Cash Invested: This includes your deposit, stamp duty, legal fees, and any other purchase costs.

Using a conservative example of a $400,000 property with a 5.5% growth rate and a 7% interest rate, the ROI can often be around 15-20%—significantly outperforming cash in the bank or even long-term share market averages. This is due to the power of leverage: you control a $400,000 asset with only a fraction of that amount in cash.

Is Lenders Mortgage Insurance (LMI) a Waste of Money?

Many investors strive for a 20% deposit to avoid LMI. However, paying LMI to get into the market sooner with a smaller deposit (e.g., 12%) can be a powerful strategy. While your loan is larger, your initial cash outlay is much smaller. This can dramatically increase your ROI because the 'return' (your net profit) is generated from a much smaller 'investment' (your cash deposit). It also prevents you from being priced out of a rising market while you save for a larger deposit.

Conclusion: Strategy Over Speculation

Successful property investing isn't about luck; it's about a clear, repeatable strategy grounded in numbers. By first mastering your personal budget, then meticulously analysing a property's cash flow, and finally focusing on the powerful combination of capital growth and leverage, you can build a robust portfolio. Remember to hold your advisors accountable—whether it's a broker or a buyer's agent, their advice should lead to assets that outperform the market average.

Ready to stop guessing and start making data-driven investment decisions? Explore HouseSeeker's powerful [real estate analytics tools](https://houseseeker.com.au/features/real-estate-analytics) to find your next high-performing property.

Frequently Asked Questions

Is a negatively geared property a bad investment?

Not at all. A property is a bad investment if its total return (capital growth minus holding costs) is poor. Many of the best-performing assets in Australia are negatively geared, as their exceptional capital growth far outweighs the modest annual cash shortfall. The key is ensuring you have the surplus cash flow to cover the costs comfortably.

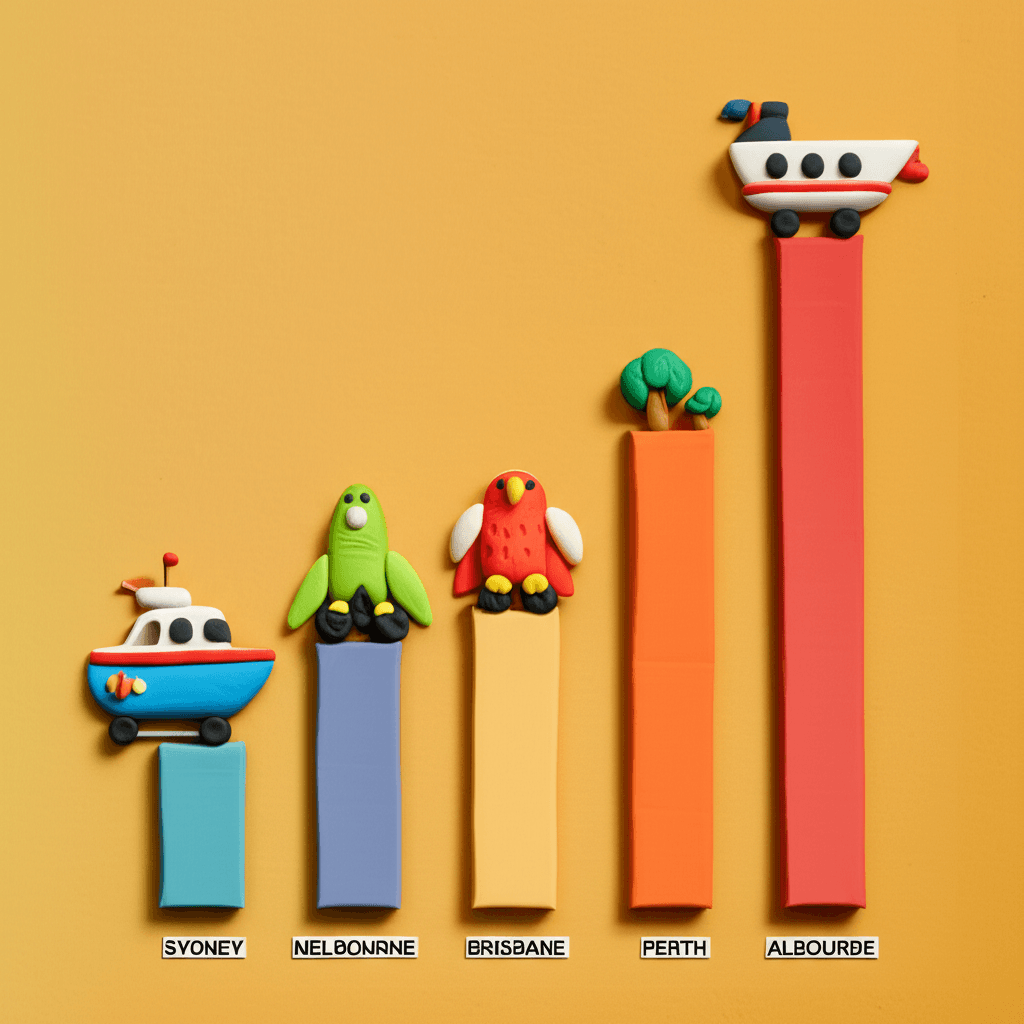

What is a good rental yield in Australia?

A 'good' rental yield is relative. In major capital cities, yields might be lower (3-4%), but capital growth prospects are often stronger. In regional areas, you might find higher yields (5-6%+) but potentially slower long-term growth. The ideal property has a healthy balance of both. You can use an [AI-powered property search](https://houseseeker.com.au/features/ai-property-search) to find properties that match your specific yield and growth criteria.

How can I reliably forecast capital growth?

While no one can predict the future with 100% certainty, you can make highly educated forecasts. This involves analysing long-term historical trends, population growth projections, infrastructure spending, local economic drivers, and supply-demand dynamics at a suburb level. Using sophisticated [real estate analytics](https://houseseeker.com.au/features/real-estate-analytics) is the best way to move from speculation to strategic forecasting.