Your Toughest Property Investment Questions Answered: A Data-Driven Guide

From market timing and suburb selection to leveraging LMI and buyer's agents, we tackle common investor dilemmas with expert analysis.

Navigating the Australian property market in mid-2025 can feel overwhelming. With conflicting headlines and endless advice, it's easy to fall into 'analysis paralysis' or make costly emotional decisions. Whether you're a first-time investor wondering how to get started or a seasoned owner questioning your portfolio's performance, you need clarity and confidence. This guide cuts through the noise by tackling your most pressing questions with a clear, data-driven approach. We'll break down complex scenarios, from deciding when to sell a property to understanding the true value of a buyer's agent, giving you the strategic framework to invest successfully.

Market Timing: When to Sell an Underperforming Property

One of the most challenging decisions for an investor is whether to hold onto a stagnant property or sell it and reinvest elsewhere. Many are trapped by a 'sunk cost bias,' holding on simply because they've already invested significant time and money, hoping it will eventually turn around. The key to making an objective decision lies in a simple, yet powerful, calculation.

The Cost-Benefit Analysis: Recycling vs. Opportunity Costs

To decide whether to sell, you must compare two key figures:

Recycling Costs: These are the total expenses incurred when you sell one property and buy another. This includes capital gains tax, agent commissions, legal fees for the sale, and stamp duty and legal fees for the new purchase. It's the cost of reallocating your equity.

Opportunity Cost: This is the potential growth you are missing out on by keeping your capital tied up in an underperforming asset instead of moving it to a superior investment.

The rule is straightforward: if the opportunity cost of staying put is greater than the recycling costs of moving, it’s time to seriously consider selling. Waiting years for a dud property to match the national average means you're not getting ahead. To make this assessment accurately, you need robust [real estate analytics](https://houseseeker.com.au/features/real-estate-analytics) that can forecast growth potential based on solid market fundamentals, not just guesswork.

Navigating a Competitive Market

Sandy asked, "Is it better to avoid a suburb with too much competition? Properties in all my shortlisted suburbs were receiving 20 offers and selling for $50k over asking." It's a common frustration in a heated market.

Why Competition is a Good Sign

While challenging, intense competition is the very definition of a high-growth market. It's a clear signal that demand is overwhelmingly outstripping supply. The polar opposite—a cold market with no competition where you can easily buy under market value—is often a sign of a declining area where prices could be in freefall.

Paying $50,000 above the asking price in a market that's surging might feel painful today, but in six months, it could look like a bargain. The key is not to avoid hot markets but to be better prepared for them. This means:

Expanding Your Search: Don't limit yourself to just two or three suburbs. Broaden your scope to 10-15 suburbs across different local government areas or even cities to increase your chances of success.

Acting Decisively: In a fast-moving market, you need to be ready to act quickly with a clean, compelling offer.

Leveraging Technology: Use an [AI property search](https://houseseeker.com.au/features/ai-property-search) tool to identify overlooked suburbs that share the same growth drivers as the hyper-competitive ones, giving you an edge.

[INSERT_IMAGE: "A vibrant chart showing capital growth trends in major Australian cities"]

Are Buyer's Agents Worth the Cost?

Eric raised a common question: is a buyer's agent worth a $16,000 fee, especially when you're skeptical of the 'financial freedom' sales pitch? The answer depends entirely on the quality and approach of the agent.

The Good vs. The Bad

A great buyer's agent is invaluable. They have deep market knowledge, industry contacts that provide off-market opportunities, and the expertise to navigate tough negotiations in competitive markets. They save you time and can outperform what you might achieve on your own.

However, be wary of 'volume-based' agents who focus on burning through clients quickly. Their goal is to get you into any property fast, often resorting to a lazy strategy of only recommending so-called 'blue-chip' suburbs near the CBD without rigorous data analysis. You need a trusted advisor, not a salesperson.

An alternative is to leverage technology. HouseSeeker’s [AI Buyer's Agent](https://houseseeker.com.au/features/ai-buyers-agent) offers a modern, data-centric approach. It provides personalised, goal-oriented recommendations and guides you through the buying process, empowering you with the same deep insights an expert would use, but with greater transparency and control.

The Investor's Blueprint: How to Select the Right Suburb

A listener asked for a guide on selecting a suburb with high growth, good cash flow, and low risk. This is the trifecta every investor seeks, and it's achievable by focusing on specific data points.

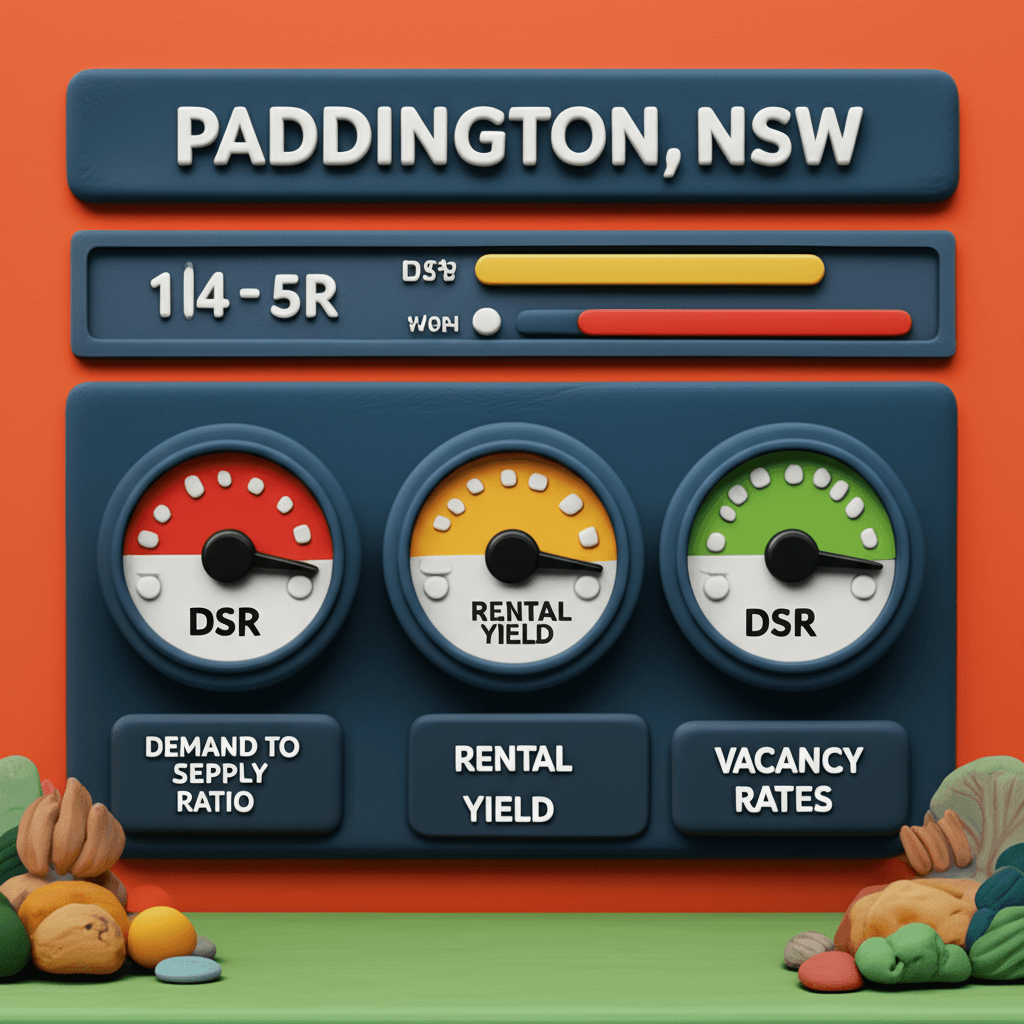

High Growth: The most reliable predictor of future capital growth is the Demand to Supply Ratio (DSR). A high DSR indicates that demand from buyers is significantly higher than the number of properties available for sale, creating upward pressure on prices.

Positive Cash Flow: This is driven by strong rental yields and low vacancy rates. A vacancy rate below 1% signals intense tenant demand, allowing for consistent rental income and the potential for future rent increases.

Low Risk: Risk can be mitigated by analysing several factors. Look for a high 'statistical reliability' score, which confirms the data is robust. Also, assess 'infill risk' by using satellite maps to check for large tracts of vacant land nearby that could be developed, flooding the market with new supply. Finally, examine demographic trends from sources like the [Australian Bureau of Statistics (ABS)](https://www.abs.gov.au/statistics/people/population) to ensure the area has a growing population.

Strategic Finance: LMI, Cash Purchases, and Leverage

Financial strategy is just as important as location selection. Here are data-driven answers to common financial dilemmas.

LMI: A Liability or a Smart Leverage Tool?

Liam, a 23-year-old engineer, asked if he should buy now with a small deposit and pay Lenders Mortgage Insurance (LMI) or wait to save a 20% deposit. In most growing markets, waiting is the riskier option.

LMI is an insurance premium you pay the bank for borrowing more than 80% of a property's value. While it's an added cost, it allows you to enter the market sooner. Consider this: if a $400,000 property grows by just 5% in a year ($20,000), that growth far outweighs the one-off LMI cost of around $5,000-$7,000. By waiting to save the extra deposit, you risk the market running away from you, and the property price could increase by far more than the LMI would have cost. LMI is a powerful tool for leveraging your capital to secure an asset and begin building equity earlier.

Cash vs. Leverage: Maximising Your Returns

What if you have a large sum of cash and don't need a loan? While buying a property outright with cash feels safe, it dramatically reduces your return on investment (ROI). Leverage is the key to wealth creation in property.

With Leverage (e.g., 20% deposit): Your return is calculated on the small amount of cash you invested, but you benefit from capital growth on the entire asset value. This magnifies your ROI, often to 15-20% or more annually.

With Cash (0% deposit): Your return is simply the capital growth and rental income on the cash you invested, often resulting in a much lower ROI of around 7-8%, similar to what you might get from index funds but with less liquidity.

Instead of buying one $700,000 property with cash, a smarter strategy would be to use that money as a deposit for three separate properties. This diversifies your risk across different markets and gives you exposure to a much larger asset base ($2.1 million instead of $700,000), exponentially increasing your potential for capital growth.

Conclusion: From Confusion to Confidence

Successful property investing isn't about timing the market perfectly or finding a secret 'hotspot.' It's about consistently applying a sound, data-driven strategy. By understanding the interplay between costs and opportunities, recognising the signs of a strong market, and using financial tools like leverage intelligently, you can move from a state of uncertainty to one of confident action. The data holds the answers; you just need the right tools to interpret it.

Ready to move beyond guesswork? Explore HouseSeeker's powerful [real estate analytics](https://houseseeker.com.au/features/real-estate-analytics) to uncover high-growth suburbs and make your next investment your best one.

Frequently Asked Questions

Should I sell an underperforming property I've held for years?

It depends on a data-driven comparison. Calculate your 'recycling costs' (agent fees, stamp duty, etc.) to sell and buy a new property. Then, use [real estate analytics](https://houseseeker.com.au/features/real-estate-analytics) to estimate the 'opportunity cost'—the growth you're missing out on by not being in a better market. If the opportunity cost is significantly higher than the recycling costs, it's time to consider selling.

Is paying over the asking price in a hot market a bad financial decision?

A high number of offers and prices exceeding the asking price are hallmarks of a market experiencing strong capital growth. While you should never overpay recklessly, paying a premium in a market where demand is clobbering supply often means you are buying into growth. In six months, today's premium price may look like a great deal. The real mistake is often avoiding these markets and buying in stagnant areas with no competition.

What is the most important metric for choosing an investment suburb?

There's no single magic number, but the Demand to Supply Ratio (DSR) is one of the most powerful leading indicators of short-to-medium-term capital growth. It encapsulates the balance between buyer demand and available stock. A comprehensive analysis should also include vacancy rates (for cash flow), population growth trends, and risk factors like new land supply. A holistic approach using multiple data points always yields the best results.