Is the Sydney Property Boom Over? A Data-Driven Analysis

An in-depth look at the latest data, from falling clearance rates to buyer sentiment, revealing why Sydney's housing market is finally cooling down.

Introduction

Sydney's property market has long been defined by fierce competition and soaring prices. However, recent data suggests that the relentless upward momentum is finally meeting resistance. A combination of extreme unaffordability and shifting buyer sentiment is causing a noticeable slowdown, creating a new landscape for prospective buyers and investors. Understanding these changes is crucial for anyone looking to navigate the market effectively.

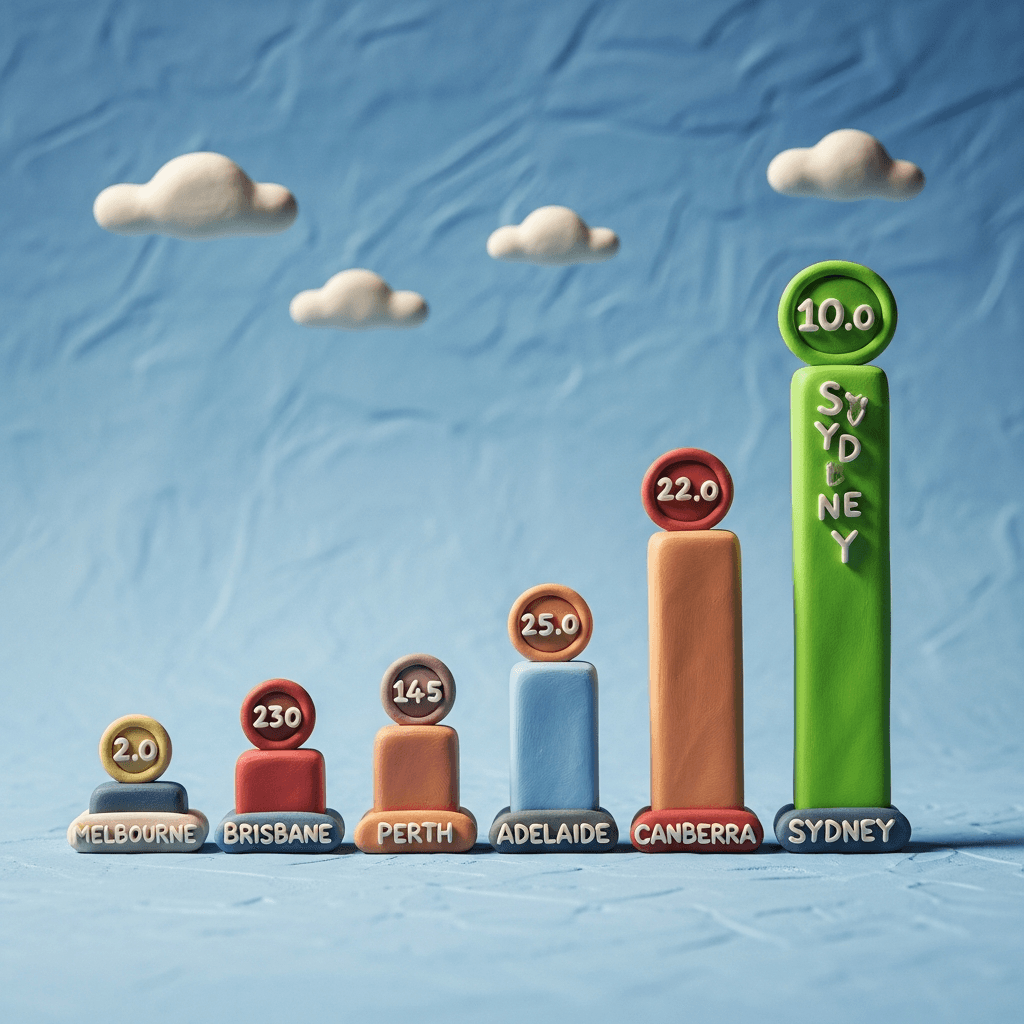

The Unaffordability Wall

Recent analysis paints a stark picture of the financial strain on Sydney homebuyers. According to CoreLogic’s September housing affordability report, Sydney stands as the nation's most expensive market, with a dwelling price-to-income ratio hitting a staggering 10.0. Furthermore, a household earning a median income would need to allocate 54.5% of it just to service a mortgage on a median-priced home. These figures highlight a critical affordability ceiling that the market has now hit, especially with the Reserve Bank of Australia expected to keep interest rates on hold for the foreseeable future.

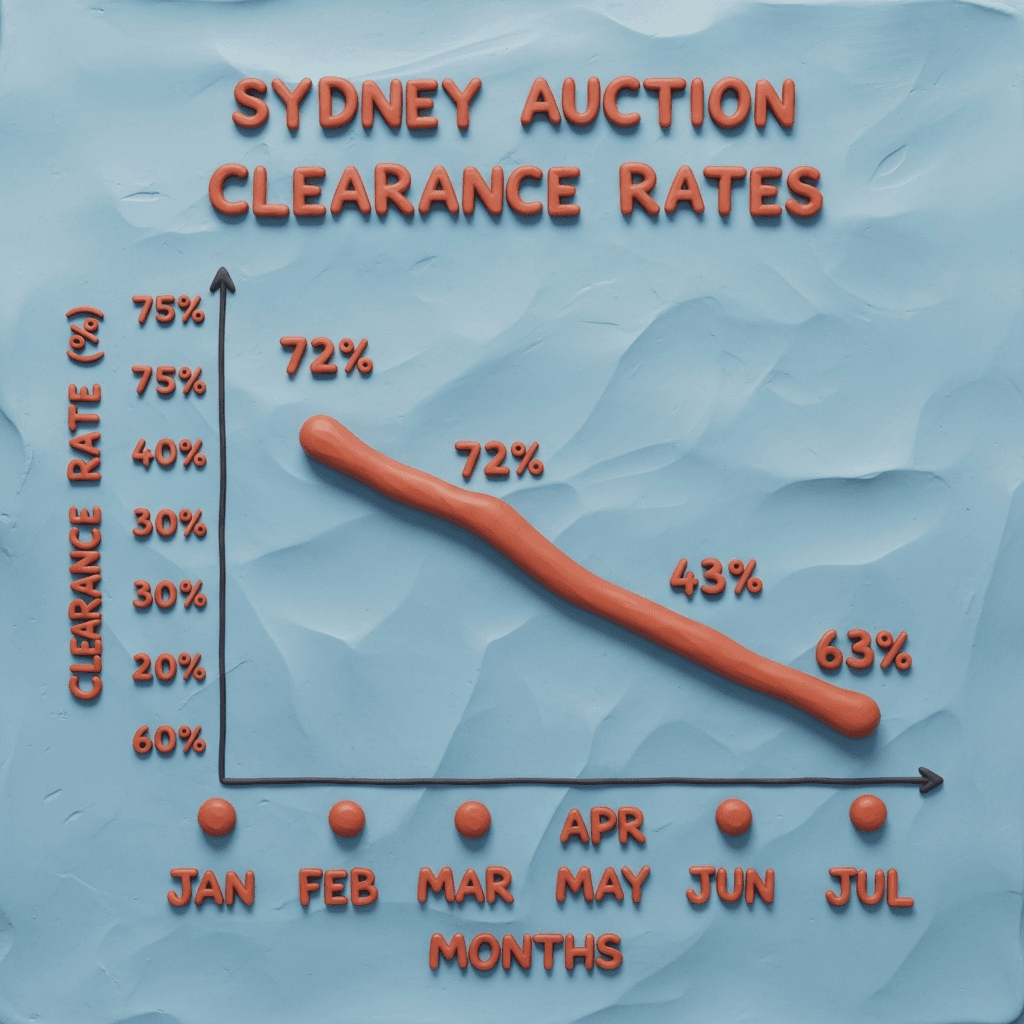

Key Market Indicators Point to a Cooling Trend

The data reflects a clear shift in momentum. Sydney’s auction clearance rates, a key barometer of market health, have seen a significant decline. After peaking at an average of 72% in August, they fell sharply to just 63% in November. This trend is mirrored in price growth. CoreLogic’s daily dwelling values index shows that Sydney's growth on a rolling 28-day basis has slowed from a recent high of 0.9% to only 0.3%. This slowdown is particularly notable when compared to the aggregate 5-city growth rate of 0.8%, indicating that Sydney is now lagging behind other major capitals.

Expert Insight: Buyer FOMO Evaporates

Leading auctioneer Tom Panos confirms this change in market dynamics, noting that “it has become easier for the buyer.” The 'fear of missing out' (FOMO) that fueled the boom in July and August has dissipated. Panos attributes this to two main factors: the realisation that interest rates are unlikely to fall soon, and a dramatic increase in the supply of properties for sale. With more choice and less urgency, “buyers are walking away” from overpriced properties. This sentiment is shared across the industry, with auctioneers reporting that the last few weeks have been “absolutely harder.”

Conclusion

The verdict is clear: Sydney's housing market has reached its limit. Extreme unaffordability, coupled with stable interest rates and a surplus of listings, has extinguished the FOMO that was driving unsustainable growth. This shift creates a more balanced market, offering a crucial window of opportunity for discerning buyers who are prepared to do their research and act strategically. For those equipped with the right insights, this cooling-off period could be the ideal time to find value.

Ready to navigate this changing market? Use HouseSeeker's powerful real estate analytics tools to uncover opportunities and make data-backed decisions.

Frequently Asked Questions

Why is the Sydney property market slowing down?

The primary reasons are severe housing unaffordability, stable interest rates which are no longer expected to be cut, and a significant increase in the number of properties listed for sale. This combination has reduced buyer urgency and competition.

Is now a good time to buy property in Sydney?

The market is becoming more favourable for buyers. With less competition and more properties to choose from, there are greater opportunities to negotiate and find value. Using advanced data analytics is key to identifying the right properties in this new environment.

What does a lower auction clearance rate mean for buyers?

A lower clearance rate indicates a shift from a seller's market to a buyer's market. It means fewer properties are selling under the pressure of auction, giving buyers more negotiating power and time to perform due diligence before making an offer.