Your 2025 Guide to Buying Your First Home in Australia

From navigating deposit hurdles to understanding government schemes, here's how to secure your first property in today's challenging market.

Navigating the 2025 Property Market

For first home buyers, the current Australian property market presents a complex landscape. With high property prices and challenging interest rates, the dream of homeownership can feel distant. However, despite mortgage serviceability being at its toughest level in three decades, getting into the market is far from impossible. Understanding the key hurdles—the deposit and loan serviceability—is the first step to turning your homeownership goals into reality.

The Twin Hurdles: Deposit and Serviceability

Two primary challenges stand in the way of most first home buyers. The first is saving the deposit, the initial lump sum required to secure a mortgage. The second is serviceability, which is your ongoing ability to meet mortgage repayments based on your income, expenses, and current interest rates. While borrowing capacities are currently lower than in recent years, strategic planning and knowledge of available support can make a significant difference.

The 20% Deposit Myth

The idea that you need a 20% deposit is a persistent but outdated belief. While it's true that saving this amount is taking longer than ever—now averaging just under six years nationally—the reality is that most first home buyers don't put down 20%. Data shows that the average loan-to-value ratio (LVR) for first home buyers is around 85%, meaning most are entering the market with a 15% deposit or less. In fact, RBA data suggests that three in four first home buyers purchase their property with a deposit smaller than 20%.

Pathways to Home Ownership with a Lower Deposit

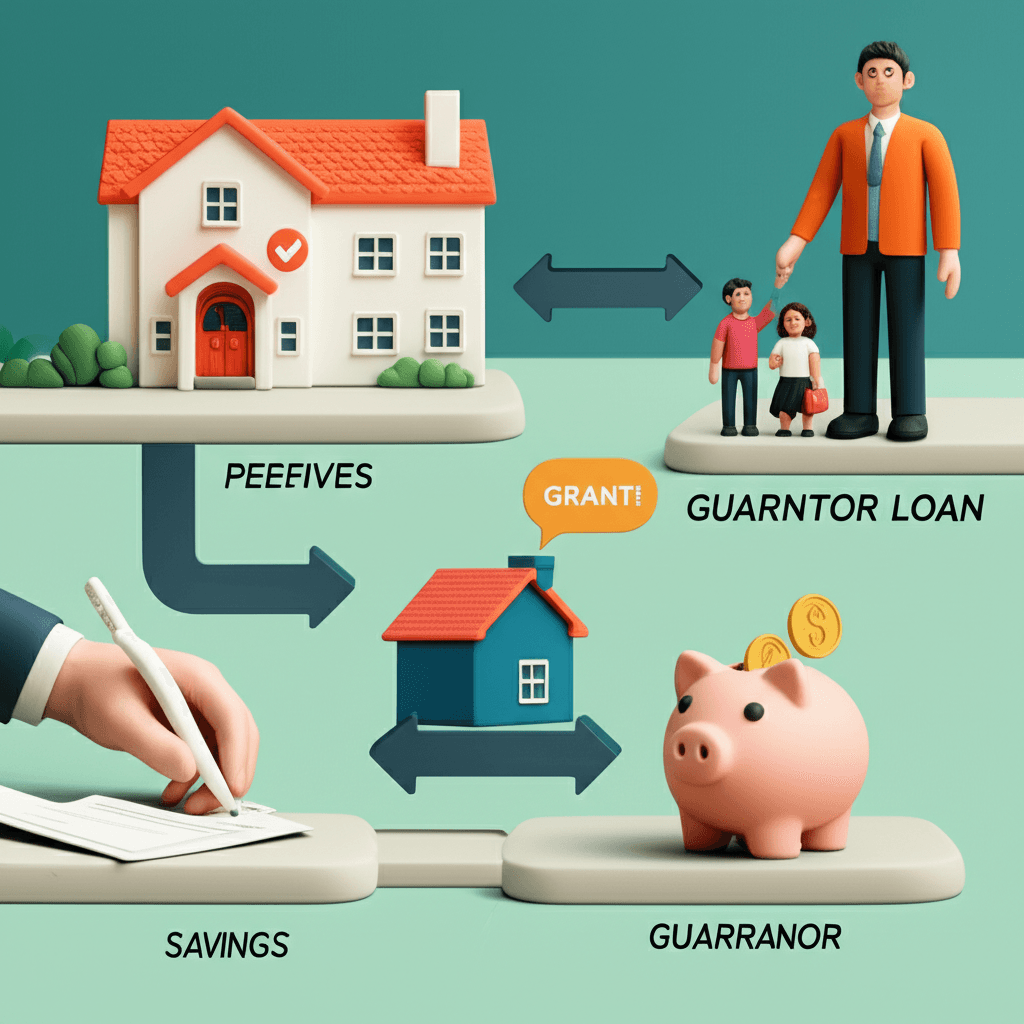

Fortunately, a range of government schemes and financial products are available to help you buy a home with a much smaller deposit. These initiatives are designed to bridge the gap and make homeownership more accessible.

Government Guarantee Schemes: The most significant program is now called the Australian Government 5% Deposit Guarantee. This allows eligible buyers to purchase a home with as little as a 5% deposit, with the government guaranteeing the remaining 15% to the lender. This helps you avoid Lenders Mortgage Insurance (LMI). Recent updates have removed income caps and increased the property price caps, making more homes and buyers eligible.

Guarantor Loans: This option allows a close relative, typically a parent, to use the equity in their own home as additional security for your loan, reducing the deposit you need to save.

Property Share Products: Some lenders offer innovative products that allow friends or relatives to co-purchase a property by sharing the deposit while keeping their finances and loan obligations separate.

Beyond the Deposit: Can You Service the Loan?

Securing a deposit is only half the battle; you also need to demonstrate that you can afford the repayments. High interest rates have reduced borrowing capacities, meaning a typical first home buyer household can currently afford only about 15% of homes sold in the past year. To navigate this, it's crucial to understand your financial position and what the market offers. You can use powerful tools like the HouseSeeker Data Analytics Hub to analyse market trends and compare suburb affordability, helping you identify areas where your budget will go further.

Don't Forget Stamp Duty

Stamp duty is a significant upfront cost that can catch many first home buyers by surprise. In a market like Sydney, stamp duty on a home just over $1 million can amount to nearly $40,000—a substantial sum to save on top of a deposit. The good news is that most states and territories offer generous stamp duty concessions or even full exemptions for first home buyers, provided the property price is below a certain threshold. It's essential to research the specific rules in your state early in your journey.

Smart Strategies for Finding Your First Home

With affordability being a major constraint, flexible and strategic thinking is key. Consider trade-offs, such as opting for a unit or townhouse in a preferred area or looking for a larger house in a more affordable suburb. Popular areas for first home buyers often include city fringes like Parramatta in Sydney, Dandenong in Melbourne, and the Logan-Ipswich corridor in Brisbane. Exploring these options requires in-depth market knowledge, which is why it's beneficial to research affordable suburbs where your budget can go further.

Another strategy gaining traction is 'rentvesting'. This involves buying an investment property in an affordable area while continuing to rent in a location you prefer to live in. While not yet mainstream—only about 6% of first home buyers take this path—it offers a viable way to enter the property market without compromising on lifestyle.

The Outlook is Improving

While the market remains challenging, the outlook for first home buyers is improving. Recent and anticipated interest rate cuts are beginning to boost borrowing capacities. Combined with healthy wage growth and a moderation in the pace of price growth, these factors are creating a more favourable environment. The path to homeownership is becoming clearer for those who are well-prepared and informed.

Conclusion

Buying your first home in 2025 requires a clear understanding of the modern property landscape. The 20% deposit is no longer a strict requirement thanks to innovative lending products and crucial government support like the 5% Deposit Guarantee. By focusing on serviceability, planning for costs like stamp duty, and employing smart strategies like exploring affordable suburbs or considering rentvesting, you can successfully navigate the market's challenges.

Ready to turn these strategies into action? Discover personalised property recommendations and get expert guidance with the HouseSeeker AI Buyer's Agent. Start your smarter home search today.

Frequently Asked Questions

Do I really need a 20% deposit for my first home?

No, it's largely a myth. Data shows the average first home buyer has a deposit of around 15%, and government schemes like the Australian Government 5% Deposit Guarantee allow eligible buyers to purchase a home with as little as a 5% deposit without paying Lenders Mortgage Insurance (LMI).

What is 'rentvesting'?

Rentvesting is a strategy where you buy a property in an affordable location as an investment and rent it out, while you continue to rent and live in an area that better suits your lifestyle but may be too expensive to buy in. It allows you to enter the property market sooner and build equity.

How do I find out about stamp duty concessions?

Stamp duty concessions and exemptions for first home buyers are offered by state and territory governments. The rules, eligibility criteria, and property price caps vary significantly between states. The best approach is to visit the revenue office website for your specific state or territory to get the most accurate and up-to-date information.