Escaping the Rent Trap: A First Home Buyer's Guide for 2024

Navigate Australia's tough property market with expert strategies on saving a deposit, using government schemes, and securing your first home.

Introduction: The Great Australian Dream Feels Further Away

Are you tired of seeing your hard-earned money disappear into rent each month, feeling like you're running on a treadmill with no end in sight? You're not alone. For countless Australians, the dream of home ownership feels increasingly out of reach. With soaring rents eating into savings, rising interest rates slashing borrowing power, and property prices remaining stubbornly high, it's easy to feel dejected and stuck in the rental cycle forever. Many aspiring buyers feel they have to make impossible sacrifices, choosing between where they want to live and the chance to own a piece of it.

But is it truly impossible to make the leap from renting to buying in today's market? While the journey is undoubtedly one of the toughest it's been in recent memory, it is not a lost cause. This guide cuts through the noise to provide a clear, data-driven roadmap for aspiring first home buyers. We'll break down the state of the market, explore creative strategies to build your deposit, and uncover the support systems available to help you finally turn the key in the door of your own home.

The Market Challenge: A Perfect Storm for Renters

To understand the solution, we must first grasp the problem. Australia's property market is currently a landscape of immense pressure, particularly for renters. According to Cameron Kusher, Director of Economic Research at PropTrack, a confluence of factors has created a fiercely competitive environment.

Record-Low Vacancy Rates

Before the pandemic, rental vacancy rates hovered around a more balanced 2.5%. Today, they have plummeted to below 1% in some major cities. This critical shortage of available rental properties means landlords have significant leverage. With huge demand and scarce supply, the power dynamic has shifted, leading to relentless rent increases.

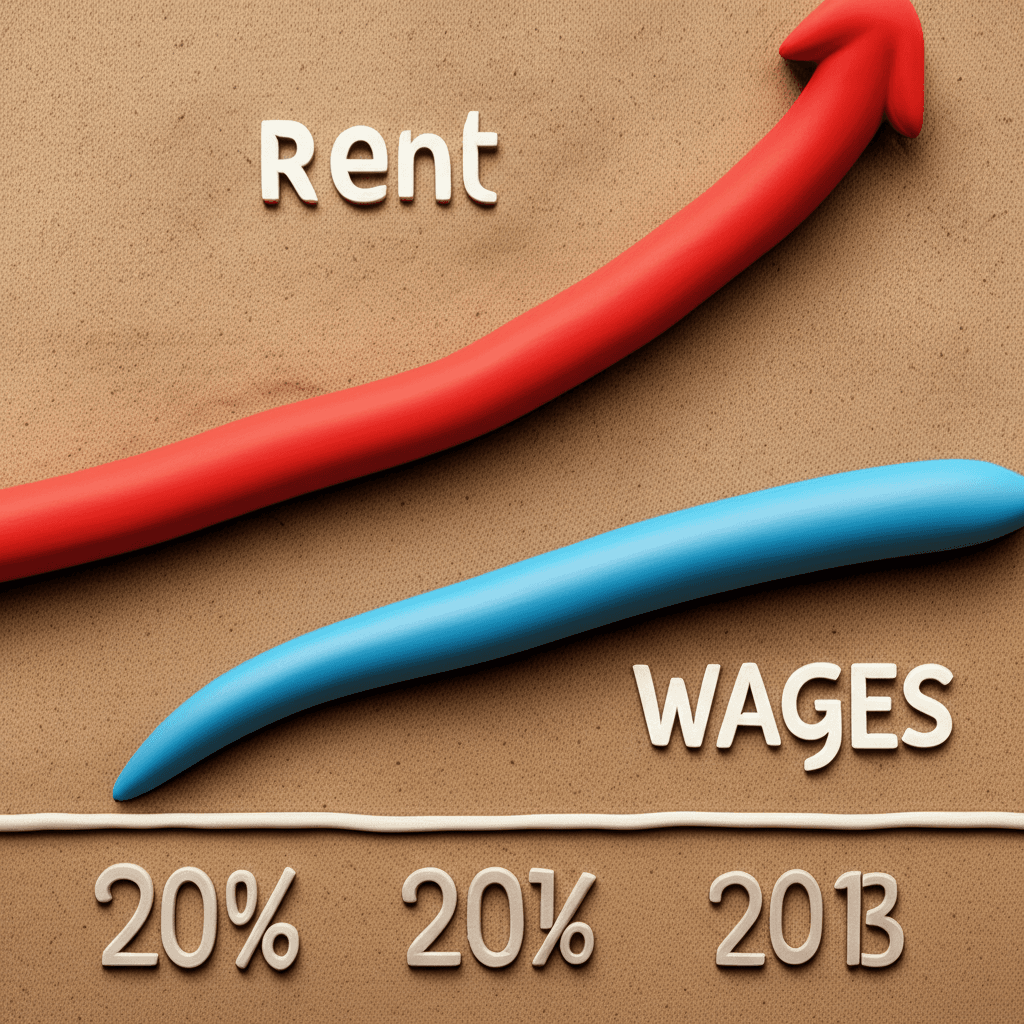

The Double-Digit Dilemma

This isn't just a minor increase. Over the past two years, Australia has witnessed staggering double-digit rental growth. In 2022, rents surged by approximately 15.5%, followed by another 11% in 2023. Combined, that's a monumental 25-30% increase in just 24 months. This directly impacts your ability to save, as a larger portion of your income is consumed by rent, leaving less to put aside for a deposit.

The Borrowing Capacity Squeeze

Simultaneously, the series of interest rate hikes by the Reserve Bank of Australia has dramatically reduced borrowing capacity for all buyers. For first home buyers, who are already targeting the more affordable end of the market, a reduction of 30-40% in borrowing power is devastating. It pushes their purchasing goals further away and forces a significant reassessment of what—and where—they can afford to buy.

These market fundamentals are essential to grasp. By using advanced real estate analytics, we can track these trends to identify suburbs that may offer better value or future growth potential, helping you make a smarter, data-backed decision.

Adjusting Expectations: The New First Home Buyer Reality

For many, the first step towards home ownership is a mental one: letting go of the dream of a 'forever home' on the first attempt. The reality is that for most people, the first property is a stepping stone, not a final destination. It's about getting a foothold in the market to start building equity.

This involves a crucial readjustment of expectations:

Property Type: You might have dreamed of a three-bedroom house with a backyard, but the more realistic entry point could be a two-bedroom apartment, unit, or townhouse.

Location: The desirable inner-city suburb you love renting in may be out of reach for a purchase. Expanding your search to areas further from the CBD can reveal more affordable options with strong growth potential.

Condition: An older, established home might be more financially viable than a brand-new build, especially as construction costs have skyrocketed. A property that needs some cosmetic work could be a hidden gem.

This strategic shift is where modern tools can make all the difference. Instead of spending endless weekends at open homes, an AI Property Search can help you filter for these specific criteria, finding established units in suburbs with good transport links that match your revised budget.

Building Your Deposit: How Much Do You Really Need?

The 20% deposit is the traditional benchmark, but it's not the only way. For a $600,000 property, a 20% deposit is a hefty $120,000—a figure that feels insurmountable for many renters.

However, mortgage expert James Alga from Mortgage Choice highlights that entry is possible with much less. Thanks to government initiatives, a 5% deposit, or $30,000 on a $600,000 home, can be enough to get you started.

5% Deposit vs. 20% Deposit: The Pros and Cons

Getting in with 5%: The major advantage is speed. It allows you to enter the market sooner, potentially benefiting from capital growth that could outpace your ability to save. The downside is that you'll likely pay Lenders Mortgage Insurance (LMI), which can cost thousands, and may face a higher interest rate. However, some government schemes can help you avoid LMI.

Waiting for 20%: The primary benefit is avoiding LMI and securing a better interest rate, saving you significant money over the life of the loan. The risk is that while you're saving, property prices could continue to rise, effectively moving the goalposts further away.

The right choice depends on your personal financial situation and the conditions of your local market. If saving the extra 15% will take multiple years, getting in sooner with a smaller deposit often makes more financial sense.

Creative Pathways to Home Ownership

With the challenges clear, it's time to focus on solutions. A growing number of first home buyers are using a combination of creative strategies to break into the market.

1. Leverage Government Schemes

State and federal governments offer several schemes designed to help first home buyers. Two of the most impactful are:

First Home Guarantee (FHG): This allows eligible buyers to purchase a home with as little as a 5% deposit without paying LMI. The government essentially acts as a guarantor for the remaining 15%, giving you access to the benefits of a 20% deposit. Income caps apply ($125,000 for individuals, $200,000 for couples as of 2023-24).

Stamp Duty Exemptions/Concessions: Most states offer significant savings on stamp duty, a major upfront cost. In NSW, for example, first home buyers pay no stamp duty on properties up to $800,000. These thresholds vary by state, but the savings can be tens of thousands of dollars.

2. The Bank of Mum and Dad

It's a privilege not available to everyone, but family assistance is a major trend. This can take many forms:

Moving Back Home: Living rent-free with parents, even for 6-12 months, can dramatically accelerate deposit savings.

Financial Gift: A direct contribution towards the deposit.

Guarantor Loan: A parent uses the equity in their own home as security for a portion of your loan, helping you avoid LMI.

3. Use Your Rental History as Proof

While not all lenders do it, a growing number are recognising a strong rental ledger as evidence of your capacity to make regular mortgage repayments. If you have a flawless record of paying $600 per week in rent, it's a powerful argument that you can handle a mortgage of a similar amount. When speaking to a mortgage broker, specifically ask about lenders who place a high value on rental history—it could strengthen your application, especially if your deposit is on the smaller side.

4. Re-evaluating Rentvesting

Rentvesting—buying an investment property where you can afford and renting where you want to live—was once a popular strategy. However, the current economic climate has made it much more challenging. High interest rates mean the rental income from an investment property rarely covers the mortgage and other costs, leaving you to fund a significant shortfall each month. This, combined with your own high rent, makes it a difficult path. Furthermore, holding an investment loan can reduce your borrowing capacity when you eventually want to buy your own home to live in. For most first home buyers today, securing a primary place of residence is the more secure and financially viable goal.

Conclusion: Your Path Forward Is Possible

The journey from renter to homeowner in Australia is undeniably challenging, marked by financial hurdles and emotional fatigue. However, armed with the right information and a flexible strategy, breaking the cycle is achievable. The key takeaways are clear: success hinges on realistically adjusting your expectations, diligently exploring every available government scheme, and being open to creative solutions like leveraging family support or your rental history.

It’s not about finding a perfect 'forever home' on day one. It’s about making a strategic first step onto the property ladder to begin building wealth and security for your future. The market is tough, but with persistence and the right guidance, you can navigate it.

Ready to stop dreaming and start planning? The journey to your first home can be complex, but you don't have to do it alone. Discover how HouseSeeker's AI Buyer's Agent can provide personalized guidance, identify properties that match your true budget, and help you craft a winning strategy to finally escape the rent trap.

Frequently Asked Questions

How much deposit do I really need for my first home?

While a 20% deposit is ideal as it helps you avoid Lenders Mortgage Insurance (LMI) and secure better interest rates, it's not the only option. Through government initiatives like the First Home Guarantee, it's possible to buy a home with as little as a 5% deposit without having to pay for LMI. For a $600,000 property, this could be as low as $30,000.

Is rentvesting still a good strategy for first home buyers?

Rentvesting has become significantly more difficult in the current high-interest-rate environment. The cost of holding an investment property often exceeds the rental income, creating a financial shortfall for the owner. This, combined with paying high rent yourself, makes it a challenging strategy. Most experts now recommend focusing on buying a home to live in first.

Can my history of paying rent help my home loan application?

A strong, consistent rental history can absolutely bolster your home loan application. While not all banks place a heavy emphasis on it, many lenders will view a clean rental ledger as strong proof of your discipline and capacity to handle regular mortgage repayments. It's particularly useful if your deposit is less than the traditional 20%.