Australia's $3M Super Tax Backflip: A Guide for Property Investors

A detailed breakdown of the revised superannuation tax changes, from indexed thresholds to the removal of the controversial unrealized gains tax.

Introduction

Navigating Australia's financial landscape often feels like preparing for constant tax changes. However, in a rare piece of good news for investors, the federal government has significantly revised its proposed tax on superannuation balances over $3 million. The initial plan, which included a controversial tax on unrealized gains, has been overhauled.

This guide breaks down the new two-tiered tax structure, the critical introduction of indexed thresholds, and what these changes mean for your long-term wealth strategy, particularly if your portfolio includes property.

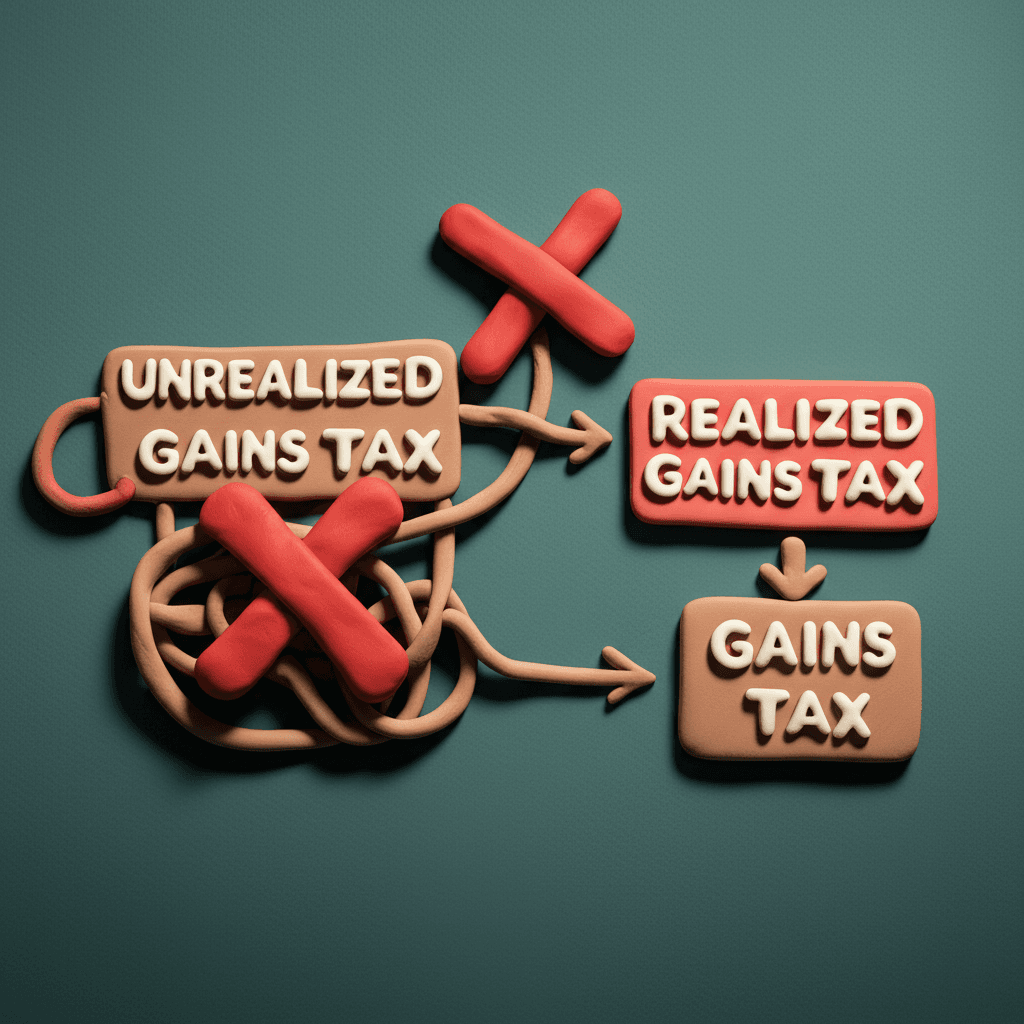

The End of the Unrealized Gains Tax

One of the most contentious elements of the original proposal was the plan to tax unrealized capital gains on super balances exceeding $3 million. This meant if your assets, such as investment properties or shares within your super, increased in value on paper, you would face a tax bill even without selling them. This created a significant cash flow problem: how do you pay tax on gains you haven't actually received? It also failed to account for market volatility, where a subsequent drop in asset value wouldn't result in a tax refund. This flawed system could have forced investors to sell assets prematurely, disrupting long-term strategies. Fortunately, this proposal has been completely reversed.

The New Tiered Tax System on Realized Gains

Under the revised plan, the tax will only apply to realized earnings, such as profits from selling an asset, dividends, or interest payments. The tax system will now be structured in tiers:

Up to $3 Million Balance: Earnings are taxed at the standard concessional rate of 15%.

$3 Million to $10 Million Balance: Earnings generated on the portion of the balance above $3 million will be taxed at 30%.

Over $10 Million Balance: Earnings on the portion of the balance above $10 million will be taxed at 40%.

This change provides certainty for investors, aligning the tax obligation with the moment cash is actually generated from an investment's success.

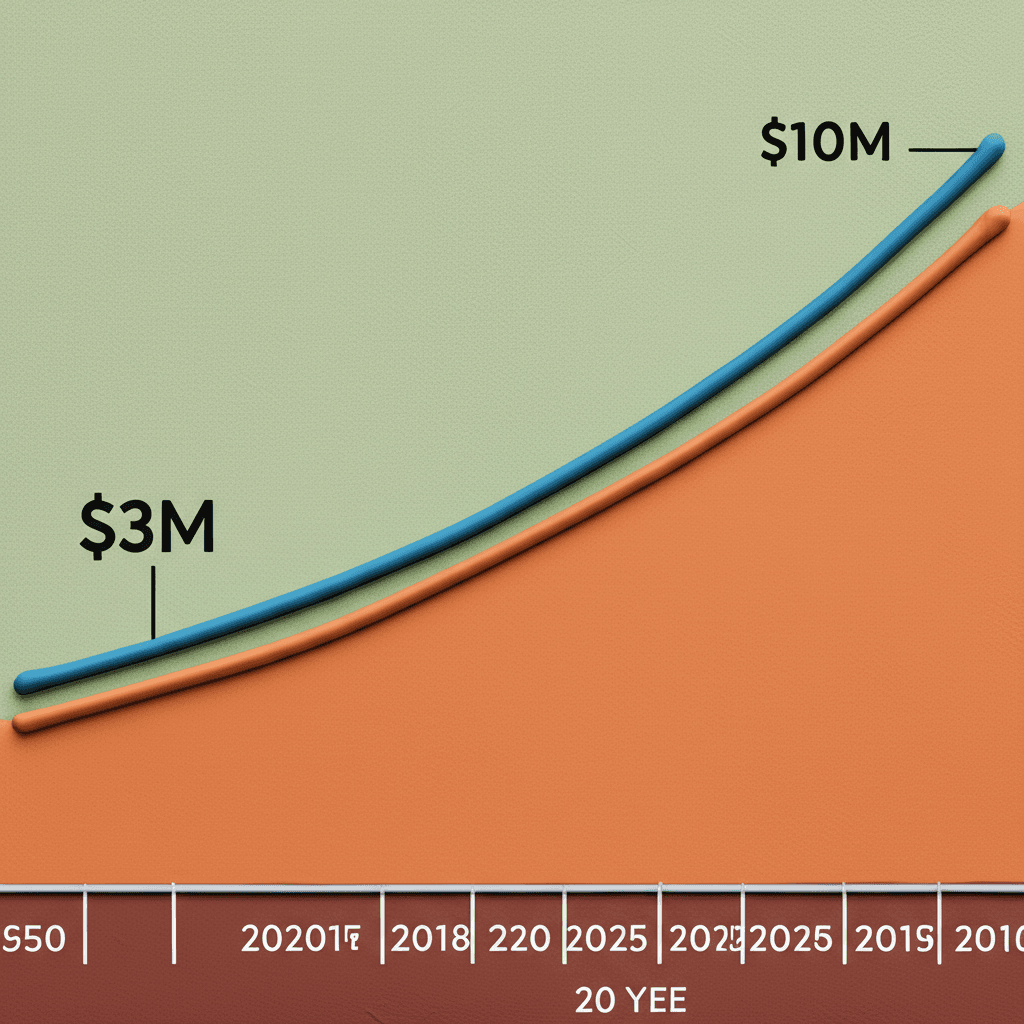

The Game-Changer: Indexed Thresholds

The most significant and welcome change is the decision to index the $3 million and $10 million thresholds to inflation annually. The original proposal featured a fixed $3 million cap, which would have ensnared more Australians over time due to inflation and asset growth—a phenomenon known as bracket creep. Indexing ensures the thresholds maintain their real value over the decades.

To illustrate the impact, let's assume a 4% annual indexation rate. Over 20 years, today's $3 million threshold would grow to approximately $6.57 million. The $10 million threshold would increase to nearly $22 million. This adjustment is crucial for younger investors, as it ensures they aren't unfairly penalized by long-term inflation. Understanding these long-term financial projections is vital for any serious investor, which is why leveraging sophisticated tools is essential. For deeper insights into market trends and investment forecasting, explore HouseSeeker's Data Analytics Hub.

Minor Changes for Low-Income Earners

The reform package also includes adjustments at the lower end of the income scale. The Low-Income Super Tax Offset (LISTO) will be increased from $500 to $810, effective from 1 July 2027. The income eligibility threshold for this offset will also rise from $37,000 to $45,000. While a positive step, the real-world impact of this change on retirement outcomes may be modest in the face of rising living costs and inflation.

Industry Reaction and Implementation

The revised plan has been met with broad approval from industry bodies like CPA Australia and ASPA, who have praised the changes as a common-sense approach that makes the superannuation system fairer and more sustainable. The government acknowledges the new structure will raise slightly less revenue in the short term, but it provides much-needed stability for investors.

If passed by parliament, the new tax package is scheduled to take effect from 1 July 2026, a year later than originally planned.

Conclusion

This backflip on the proposed superannuation tax is a significant win for long-term investors in Australia. The key takeaways are:

No Tax on Unrealized Gains: You will only be taxed on actual profits when you sell an asset.

New Tiered Rates: A 30% rate applies to earnings on balances between $3M and $10M, and 40% above that.

Indexed Thresholds: The thresholds will rise with inflation, protecting investors from bracket creep over time.

These sensible adjustments provide greater certainty and support strategic, long-term wealth creation within superannuation.

To effectively plan your investment strategy and navigate complex market dynamics, it's crucial to have the best data at your fingertips. Discover how to make smarter, data-driven decisions with the tools on HouseSeeker's Data Analytics Hub.

Frequently Asked Questions

What is the biggest change in the new super tax proposal?

The most significant change is the removal of the tax on unrealized capital gains. The new system only taxes realized earnings (e.g., profit from a property sale) and introduces annual indexing for the $3 million and $10 million thresholds to combat the effects of inflation.

How does indexing the super tax thresholds help me?

Indexing means the thresholds will increase each year in line with inflation. This prevents 'bracket creep,' where a growing asset base due to inflation, rather than exceptional performance, pushes you into a higher tax bracket. It ensures the tax targets genuinely high balances in real terms over the long run.

Are these new super tax rules official law yet?

No, not yet. The changes have been agreed to by the federal cabinet but must still be passed through parliament. If passed, the new tax package is expected to take effect from 1 July 2026.