SMSF Property Investing: A Guide to Boosting Your Super in Australia

Learn how a Self-Managed Super Fund can unlock the power of real estate to accelerate your journey towards a comfortable and wealthy retirement.

Is Your Superannuation on Track for a Comfortable Retirement?

For many Australians, the gap between the superannuation balance they need to retire comfortably and the amount they will actually have can be alarming. It's a common concern that often gets pushed aside until retirement is just around the corner, by which point the options for significant growth are limited. The traditional path of relying solely on employer contributions into a standard super fund may not be enough to secure the future you envision.

This is particularly true if you are in your 20s, 30s, 40s, or 50s. The decisions you make now have a profound impact on your financial future due to the power of compound growth. The sooner you take control, the more time your assets have to grow. This guide is designed to show you one of the most powerful strategies available for supercharging your retirement savings: investing in real estate through a Self-Managed Super Fund (SMSF). We'll break down the numbers, explain the process, and reveal how strategic property acquisition can potentially multiply your nest egg.

The Australian Superannuation Gap: A Reality Check

The standard superannuation system was designed as a forced savings mechanism to ensure Australians have some funds for retirement. However, the average balances often fall short of providing a truly comfortable lifestyle.

According to industry data, the average super balance for men aged 60-64 is around $435,000, and for women, it's approximately $314,000. While these figures may seem substantial, let's look at the income they generate.

A single male with $435,000: In a term deposit earning 4%, this provides an annual income of just $17,400.

A single female with $314,000: At the same 4% rate, this generates about $12,560 per year.

A couple combining their balances ($749,000): Their combined income would be just under $30,000 per year, or about $575 per week.

While having a paid-off home makes this situation more manageable, this income level leaves little room for travel, hobbies, or unexpected expenses. To maintain your lifestyle, you risk eroding your principal balance, which in turn reduces your future income. This is why many Australians seek greater control and better growth potential for their retirement funds.

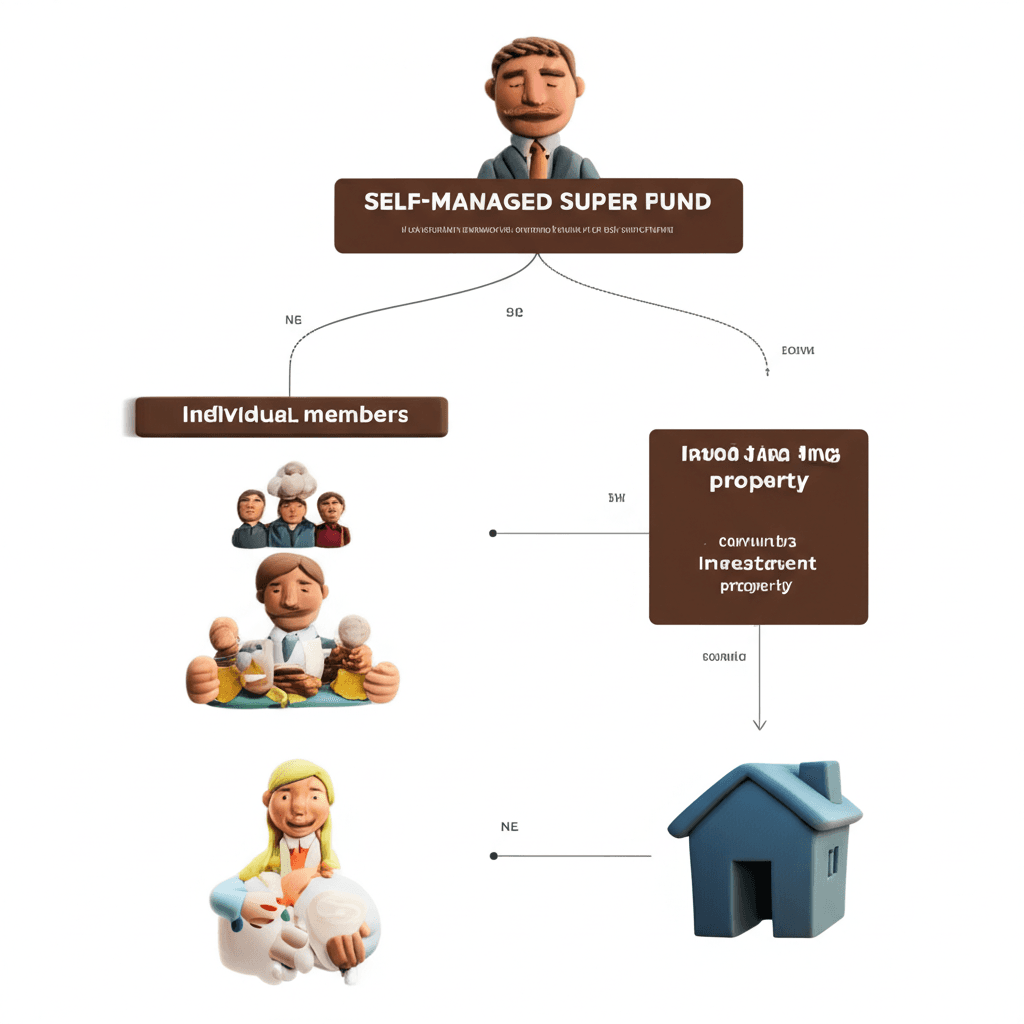

Unlocking Control with a Self-Managed Super Fund (SMSF)

An SMSF is a private super fund that you manage yourself. Unlike industry or retail super funds where your money is invested in shares or managed funds by someone else, an SMSF gives you direct control over your investment strategy and asset selection. One of the key advantages is the ability to invest in direct property.

This strategy is not about taking wild risks; it's about making informed decisions based on solid numbers and long-term trends. By leveraging an asset class like property, which has a long history of growth in Australia, you can build a tangible and appreciating asset base within your super.

Key Rules for Buying Property in an SMSF

Investing in property through an SMSF comes with a specific set of rules regulated by the Australian Taxation Office (ATO). Understanding these is crucial before you begin.

Minimum Deposit: You typically need a minimum of a 20% deposit plus costs (like stamp duty), meaning you'll need around 25-30% of the property's value in cash within your SMSF.

No Equity Release for Deposits: Unlike investing in your personal name, you cannot use the equity from one SMSF property as a deposit to purchase another. Each purchase requires a new cash deposit.

Borrowing is a 'Limited Recourse Loan': The loan taken out by the SMSF is a 'Limited Recourse Borrowing Arrangement' (LRBA). This means if the loan defaults, the lender's recourse is limited to the specific property and not the other assets in your SMSF.

Sole Purpose Test: The property must be for the sole purpose of providing retirement benefits to the fund members. You or your relatives cannot live in it or rent it.

Case Study: How a Couple Supercharged Their Retirement

Let's explore a real-world scenario to see the numbers in action. Consider a couple in their 40s with a combined super balance of $300,000. They feel their current fund's growth is too slow and want to take a more active role.

1. Setup and Initial Purchase: They transition to an SMSF. Using their balance, they purchase two investment properties.

Required Funds: For a $500,000 property, they need roughly $100,000 (20% deposit) + $30,000 (stamp duty & costs) = $130,000.

The Acquisition: They purchase two properties for a combined value of approximately $957,000, using about $250,000 of their super and taking out loans for the rest. They are left with a $50,000 cash buffer in their SMSF.

2. Projected Growth (Conservative 5% Annually): The key to this strategy is selecting areas with strong growth drivers, a task that requires in-depth real estate analytics.

In 10 Years (at age 50): Their property portfolio value grows to approximately $1.56 million.

In 20 Years (at age 60): The portfolio value reaches $2.54 million.

3. Retirement Outcome: By their 60s, the loans on both properties are likely paid off. This happens faster than a standard 30-year mortgage because rental income and ongoing employer super contributions are used to accelerate debt reduction.

Passive Income: Assuming a conservative 4% rental yield on the $2.54 million portfolio, they would generate $101,600 per year in passive income.

This represents a more than 3x increase in annual retirement income compared to their original trajectory, providing them with financial freedom and choice. Their principal asset base also continues to grow, protecting them against inflation.

Advanced Strategy: The 'Sell and Re-invest' Method

While you can't use equity for deposits, there is a powerful way to replicate the effect and scale your portfolio. After a period of strong growth, you can sell assets to unlock capital for reinvestment.

Let's revisit our case study after 10 years:

Portfolio Value: $1.56 million

Remaining Debt: ~$800,000

Equity: ~$760,000

If they decide to sell both properties, after paying costs and the reduced capital gains tax within super, they could be left with approximately $600,000 in cash inside their SMSF.

With this capital, they now have the ability to purchase four new investment properties at $500k each (4 x $130k deposit = $520k). They now control a $2 million property portfolio. After another 10 years, this new portfolio could be worth over $3.2 million, generating even more income and providing greater diversification.

This strategy allows you to compound your growth exponentially, but it requires careful planning and precise execution to identify the right time to sell and the right assets to buy.

Take Control of Your Financial Future

The difference between a standard retirement and a truly prosperous one often comes down to knowledge and action. Using property within an SMSF is a proven strategy for building substantial wealth, but it's not a passive journey. It demands proactive management, a clear understanding of the rules, and a data-driven approach to asset selection.

By understanding market trends, rental yields, and capital growth drivers, you can make informed decisions that align with your long-term goals. The tools and insights available today can empower you to move beyond hope and build a retirement on your own terms.

Ready to make smarter, data-driven decisions for your property investments? Explore HouseSeeker's powerful real estate analytics to uncover high-growth opportunities and build a more secure financial future.

Frequently Asked Questions

Can I live in the property I buy with my SMSF?

No. The 'sole purpose test' strictly prohibits you or any related parties from living in or renting a residential property owned by your SMSF. It must be held purely for investment purposes to generate retirement benefits.

What are the main risks of buying property in an SMSF?

Key risks include lack of diversification (a large portion of your super might be in one or two assets), liquidity risk (property can't be sold quickly to access cash), and market risk (a downturn in the property market could impact your fund's value). It's crucial to have a long-term investment horizon and a cash buffer within your SMSF to manage expenses and vacancies.

How much super do I need to start an SMSF for property?

While there's no official minimum, most financial professionals suggest a starting balance of at least $200,000 to $250,000. This ensures you have enough funds to cover the purchase deposit and associated costs, pay for the ongoing administration of the SMSF, and maintain some diversification and a cash buffer.