Australia's Top Property Hotspots: A Data-Driven Forecast for 2025-2026

Uncover the fundamental drivers of market growth and pinpoint the capital city and regional areas poised for significant returns.

Understanding the 2025 Property Market Fundamentals

As the Australian property market intensifies, investors and homebuyers are keenly searching for the next high-growth locations. Before pinpointing specific suburbs, it's crucial to understand the fundamental market dynamics at play. A deep dive into supply, demand, and construction trends reveals why prices are set to continue their upward trajectory through 2025 and beyond.

The Foundation: Australia's Housing Supply Crisis

Australia is grappling with a severe housing supply problem. While factors like interest rates and immigration fuel demand, the core issue lies in construction completions. The government has set ambitious housing targets—around 240,000 new homes a year—but has never met them. Current tracking suggests we are completing closer to 180,000 homes annually. Projections indicate that the housing market won't find a supply-demand balance until at least 2030, assuming immigration levels don't accelerate further.

This isn't just about approvals; it's about finished homes. A pre-approval for a loan doesn't mean you own a house, and a council approval doesn't mean a house has been built. The construction pipeline is currently saturated, with around 220,000 dwellings under construction. This figure, similar to 2016-2018 levels, signifies major delays. Rising construction costs and a wave of liquidations in the building industry have concentrated the market, creating bottlenecks that prevent supply from meeting overwhelming demand.

Demand Dynamics: The Auction Flywheel Effect

This supply-demand imbalance creates a powerful 'flywheel effect' in the market. With supply at a 4 out of 10 and demand at a 10 out of 10, auctions become fiercely competitive. For every successful buyer, there are often 10-15 others who miss out. This builds frustration and emotional bidding at subsequent auctions, often leading to overpayment and new suburb records. This cycle continuously sets a new, higher floor for property prices, fuelling rapid market growth. To stay ahead, it's vital to leverage powerful tools like our AI Property Search to identify opportunities before the competition heats up.

The Soaring Cost of Construction and Land

While the rate of increase for construction costs has started to taper, building a new home today can cost over 50% more than it did in 2019. This is compounded by the staggering rise in land value. In Sydney, the median price for a lot has surged from $325,000 in 2014 to over $710,000 today. Similar dramatic increases are visible in Melbourne, Brisbane, Adelaide, and Perth.

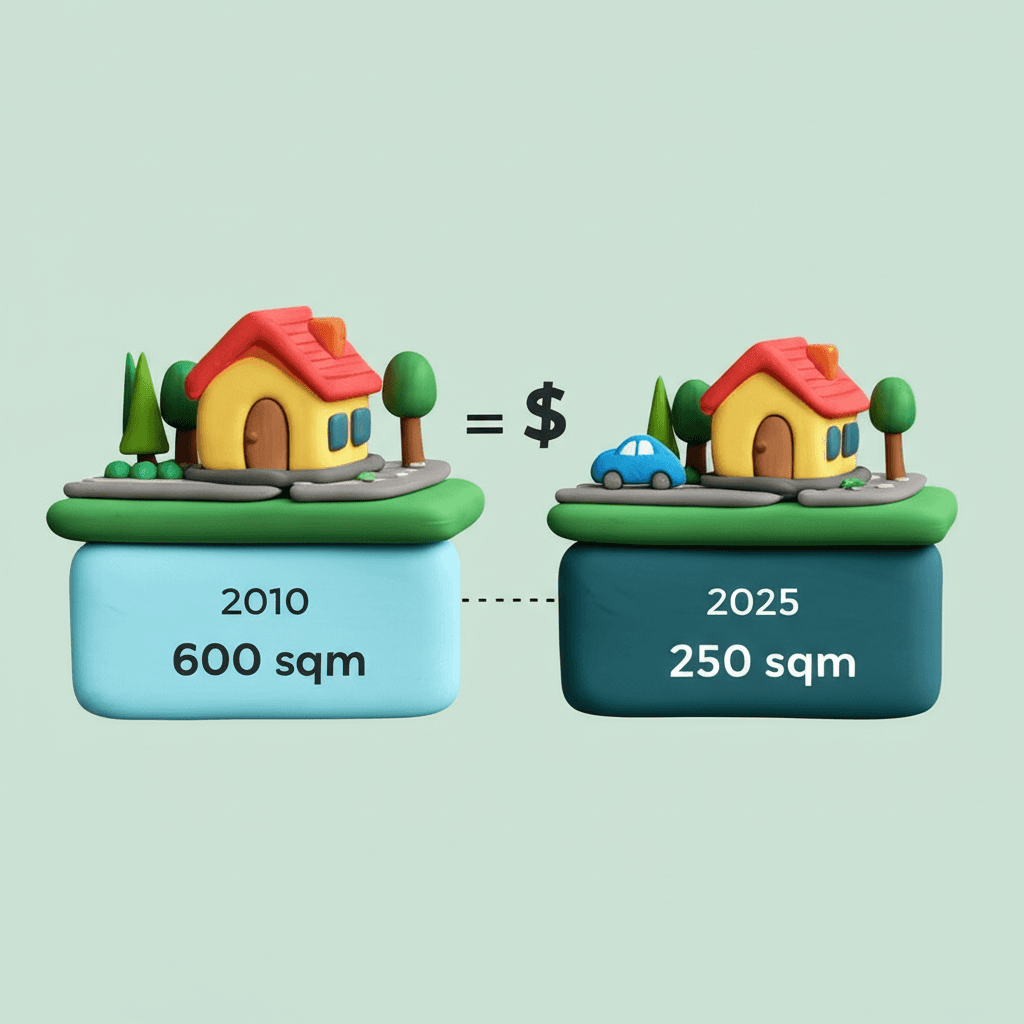

To maintain an illusion of affordability, we've seen a trend of 'shrinkflation' in land development. Where a standard block was once 600-700 square metres, new developments now offer lots as small as 150-250 square metres for a similar price. While the price tag may seem accessible, buyers are getting significantly less land, effectively baking inflation into the market.

Pressure Cooker: The National Rental Market

Asking rents in capital cities have skyrocketed, a trend that began even before the post-pandemic surge in immigration. Rental vacancy rates remain at record lows across the country. As property prices climb, more people are priced out of buying, which in turn places even greater demand on the rental market.

Typically, rising house prices lead to stabilizing rents, and vice versa. However, we are in a unique situation where both are likely to increase simultaneously. A combination of external demand, government interventions like first-home buyer grants, and insufficient supply creates a difficult environment for renters and a compelling case for investors.

Market Performance Snapshot: Where is the Momentum?

Analysis of recent market data reveals key momentum indicators. Nationally, dwelling values have seen a 4.1% annual increase. However, the real story is the divergence between markets:

Regional Markets: Have outperformed capitals, with a 6.0% annual increase.

Capital Cities: Show a combined 3.6% annual increase, though momentum is building.

Looking at quarterly changes, the strongest performers are Perth (+3.1%), Brisbane (+3.0%), and Adelaide (+2.1%). This data underscores a clear shift in market dynamics, with affordability and lifestyle driving growth outside the traditional powerhouses of Sydney and Melbourne. These trends are critical for investors to monitor using sophisticated platforms available on our Data Analytics Hub.

Expert Analysis: Top Performing Markets for 2025-2026

Based on these fundamentals, several markets stand out for their growth potential:

Perth: Despite significant recent gains, Perth is poised for continued growth. A strong economy, ongoing supply constraints, and a median value still catching up to eastern capitals suggest its run is far from over. Projections indicate its median value could hit $1 million by early 2027.

Brisbane: The narrative around the upcoming Olympics is strong, but Brisbane's growth is supported by solid fundamentals. High demand, population growth, and significant government and private investment in infrastructure make it a top-tier market.

Regional Queensland: This market continues to offer compelling value. It benefits from the same demand drivers as Brisbane but with more affordable entry points, making it a hotspot for both investors and lifestyle seekers.

While Sydney remains a blue-chip market, the data suggests superior returns can be found elsewhere. Interpreting this data and acting decisively is key. Navigating these complexities requires deep analysis, and a service like our AI Buyer's Agent can provide the strategic guidance needed to execute successful purchases in a competitive landscape.

Conclusion

The Australian property market in 2025 is defined by a critical lack of supply, intense demand, and rising costs. This environment creates a clear path for continued price growth. Data-driven analysis points to Perth, Brisbane, and key regional markets as the standout locations for investment returns over the next 12-24 months. The window to purchase affordable properties in these high-growth corridors is closing fast, making informed and swift action more important than ever.

Ready to dive deeper and uncover your next investment? Explore real-time trends and suburb-level data on the HouseSeeker Data Analytics Hub.

Frequently Asked Questions

What is the single biggest factor driving Australian property prices in 2025?

The most significant factor is the severe and chronic undersupply of housing. Despite high demand from population growth and immigration, the rate of new home completions is failing to keep pace, creating intense competition for available properties and consistently pushing prices higher.

Are regional areas still a better investment than capital cities?

Currently, the data shows that combined regional markets are outperforming combined capital cities in terms of annual growth. This is driven by relative affordability and lifestyle demand. However, momentum is building in specific capitals like Perth and Brisbane, so the 'better' investment depends on an investor's specific strategy, risk tolerance, and goals.

Why is a market like Perth performing so well right now?

Perth's strong performance is due to a combination of factors. It's experiencing a 'catch-up' phase after many years of stagnant growth, its property values remain affordable compared to the east coast, and it's backed by a strong state economy. These elements, combined with the national supply shortage, have created a perfect storm for rapid price appreciation.