The Australian Property Paradox: Why $11.8 Trillion in Real Estate Doesn't Equal Real Wealth

A deep dive into the data revealing the truth behind Australia's property-driven wealth, record household debt, and what it means for homebuyers.

The Illusion of Wealth in the Australian Property Market

Australians are frequently ranked among the wealthiest people globally. The 2025 UBS Global Wealth Report, for instance, placed Australians second in the world for median wealth. A significant portion of this prosperity is tied directly to real estate. With Australia's residential housing stock valued at a staggering $11.8 trillion across 11.4 million dwellings, it's easy to see why. This valuation breaks down to an average dwelling price of over $1 million and a per capita housing value of approximately $424,766. However, this headline number masks a more complex and challenging reality for the average household.

The Hidden Cost: Record-Breaking Household Debt

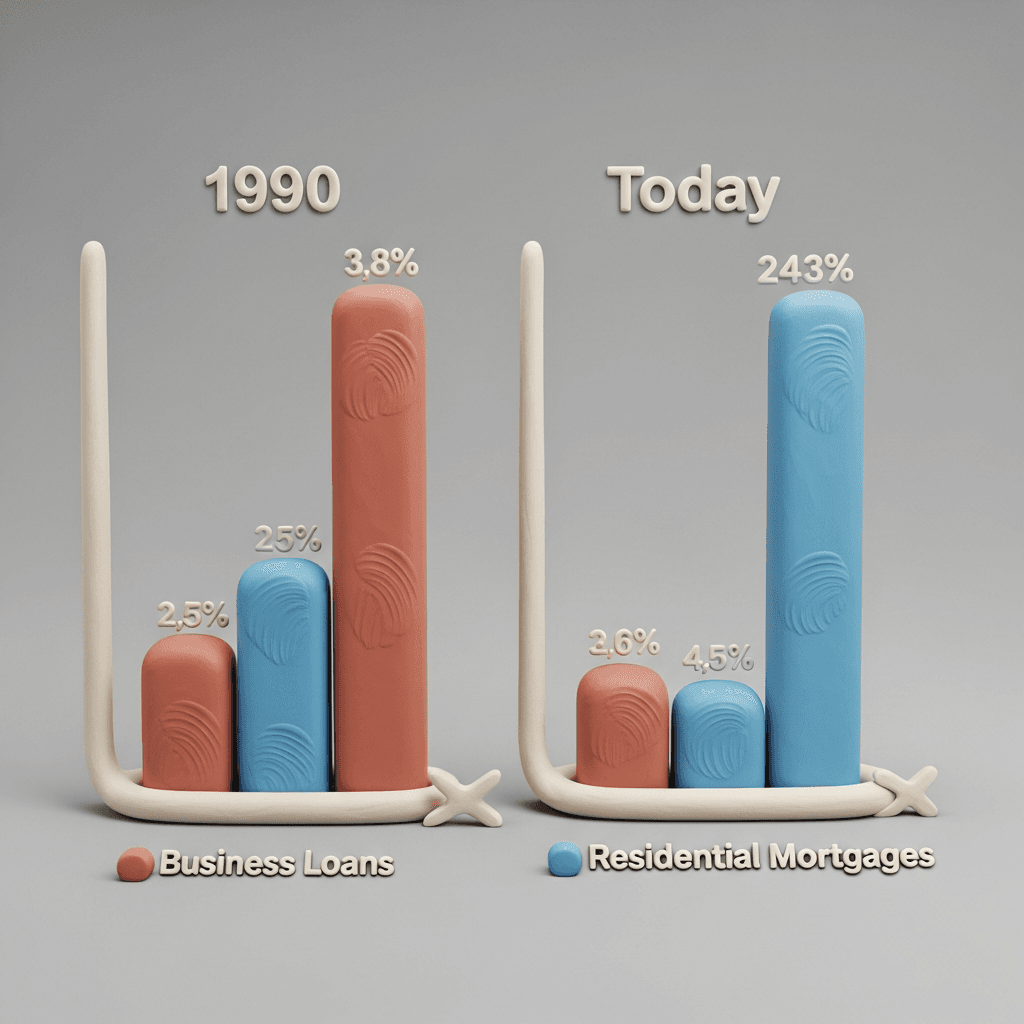

The foundation of this property wealth is built on an ever-growing mountain of debt. While high property values benefit those who are selling, they offer little practical advantage to owner-occupiers who simply need a place to live. To afford these rising prices, Australians have taken on some of the world's highest levels of household debt. This financial strain is significant, with mortgage and rent payments consuming an unprecedented portion of household income. This trend has also reshaped our financial landscape, with Australian banks shifting focus dramatically from productive business lending to residential mortgages. In 1990, business loans constituted nearly two-thirds of all bank lending; today, that ratio has flipped, potentially stifling innovation and economic diversity.

The Affordability Crisis and Its Generational Impact

The true cost of the $11.8 trillion market is most deeply felt in housing affordability, which has plummeted to an all-time low. For younger generations, the dream of homeownership is becoming increasingly distant without significant parental aid or government subsidies. A look back to 1991 highlights the stark contrast: homes cost roughly three times the average income, and household debt was a manageable 70% of income. Today, the average home costs over eight times the average income, and household debt has soared to 180%. While we may be wealthier on paper, the financial well-being and security of households in 1991 were arguably stronger, supported by a more balanced and productive economy.

Navigating the Market with a Data-First Approach

For today's buyers and investors, these statistics underscore a critical point: headline market values are not enough to base decisions on. A home's primary purpose is to provide shelter, not just to act as a wealth-building asset. The massive misallocation of capital into inflating housing prices has created a complex and challenging environment. To make sound financial decisions, it's essential to look beyond the hype and dive into the specifics. Understanding local market trends, rental yields, capital growth potential, and debt serviceability is more crucial than ever. This is where leveraging comprehensive data and sophisticated analysis becomes a non-negotiable part of the property journey, allowing you to cut through the noise and identify genuine opportunities. By using powerful platforms, you can transform complex data into actionable insights, helping you navigate everything from suburb selection to investment analysis. A smarter approach involves using tools like an AI property search to find homes that fit your lifestyle and financial goals, not just the market's expectations.

Conclusion

The narrative that Australia is a wealthy nation due to its high property values is a double-edged sword. While the $11.8 trillion figure is impressive, it is propped up by record household debt, crippling affordability, and a potential misallocation of national resources. True wealth is about financial security and well-being, not just illiquid equity in an overpriced asset. A more balanced economy with lower house prices and less debt would likely lead to greater prosperity and equality for all Australians. For those navigating the market today, a data-driven strategy is the key to making decisions that build genuine, sustainable wealth.

Ready to cut through the noise and make smarter property decisions? Explore HouseSeeker's advanced real estate analytics tools to gain a true understanding of the market and find opportunities that align with your financial goals.

Frequently Asked Questions

Is Australian property still a good investment?

Yes, property can still be a strong investment, but it requires a more nuanced approach than in the past. Instead of relying on broad market growth, investors should use detailed data to analyse specific suburbs, focusing on factors like rental yield, infrastructure development, population growth, and local economic health to identify high-performing assets.

What does 'housing stress' mean for a typical household?

Housing stress is generally defined as lower-income households spending more than 30% of their gross income on housing costs, such as mortgage repayments or rent. With property prices and interest rates rising, a growing number of Australian households are facing this pressure, which impacts their ability to save and spend on other essential goods and services.

How can data analytics help me find the right property?

Data analytics tools, like those available on our Real Estate Analytics Hub, move beyond simple price listings. They allow you to compare suburbs on dozens of metrics, track historical growth, forecast market trends, and assess a property's investment potential. This empowers you to make an informed decision based on comprehensive insights rather than just emotion or market hype.