Australia's Rental Crisis: A Data-Driven 2025 Market Guide

Unpacking the data behind soaring rents, demographic shifts, and how tenants can regain control in a challenging market.

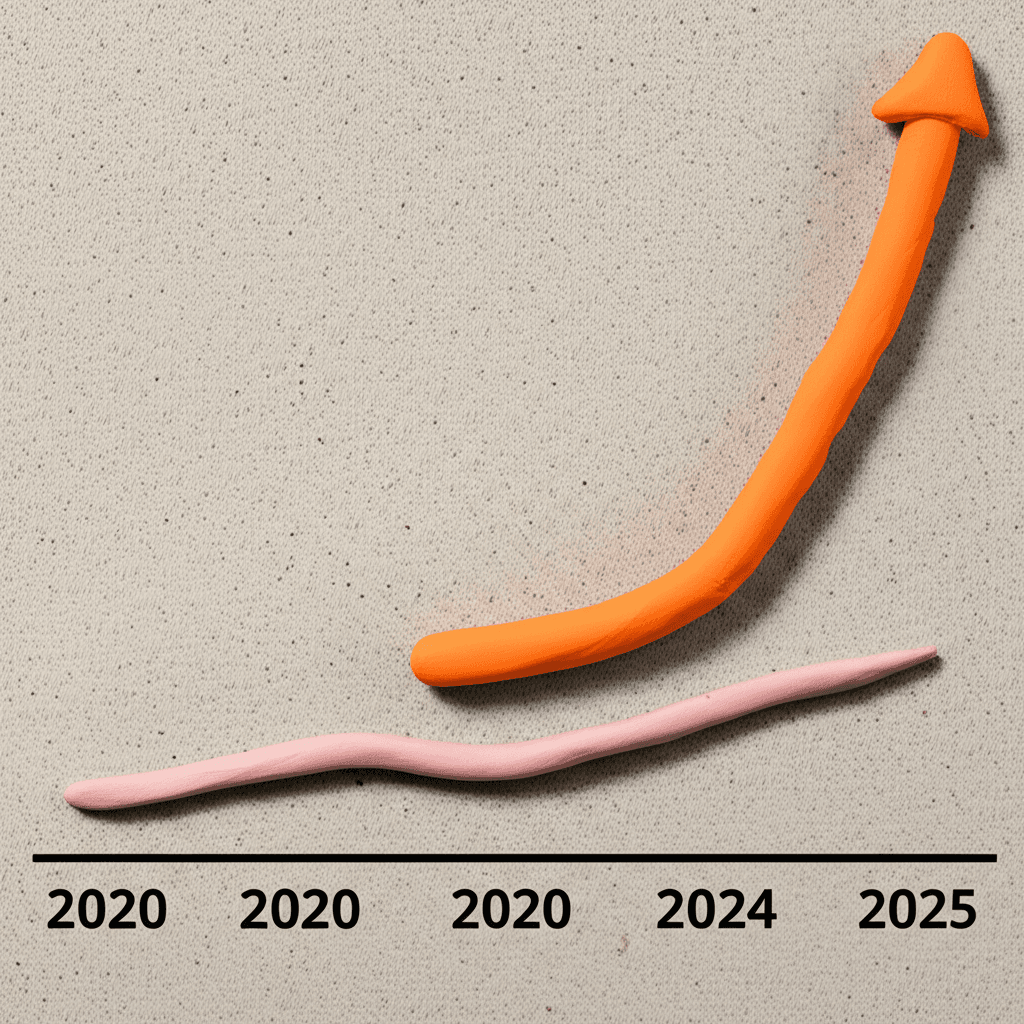

Navigating the Australian rental market in mid-2025 can feel overwhelming. With nearly a third of all households renting, the landscape has become fiercely competitive, pushing affordability to its limits. Recent data reveals that, on average, Australian renters are paying a staggering $11,000 more per year than they were just five years ago. This isn't just a headline; it's the lived reality for millions facing unprecedented financial pressure.

This article cuts through the noise. We'll dive deep into the data behind the crisis, exploring the core drivers of rent inflation, identifying the hardest-hit regions, and examining the changing face of the modern renter. More importantly, we'll provide actionable strategies, particularly around energy efficiency, to help you regain a sense of control and reduce household costs in a market that often feels out of your hands.

The State of the Australian Rental Market: A 2025 Snapshot

To understand the challenges, we first need to grasp the scale. Approximately 3 million Australian households are currently renting, a figure that has likely grown since the last census in 2021. This surge in demand, coupled with insufficient supply, has created the most challenging rental conditions in a generation. The financial impact is stark, but it's not uniform across the country.

Understanding these market dynamics is the first step toward making informed decisions. By leveraging powerful real estate analytics, we can dissect these trends to see the full picture, from national averages down to specific suburb performance.

Why Are Rents Skyrocketing? The Core Drivers

The current rental crisis is a textbook case of supply and demand imbalance, fueled by several key factors:

Strong Population Growth: Australia has experienced a significant increase in population, largely driven by immigration. New arrivals are overwhelmingly more likely to rent for their first few years, placing immediate and immense pressure on the available housing stock. This demographic data, tracked by authorities like the Australian Bureau of Statistics (ABS), directly correlates with rental demand.

Housing Affordability Barriers: The dream of homeownership is becoming more distant for many. With property prices remaining high and the time required to save a deposit stretching longer than ever, more people are remaining in the rental market for extended periods. This 'renter trap' means fewer people are transitioning to homeownership, keeping rental demand perpetually high. For those looking to make the leap, tools like our AI Buyer's Agent can provide a guided pathway through the complex purchasing process.

Mismatch in Housing Supply: The construction of new homes has struggled to keep pace with demand, particularly for medium and high-density housing suitable for the rental market in key urban areas.

A Tale of Many Cities: The Regional Rent Breakdown

While the national average tells one story, the reality on the ground varies dramatically from state to state. The past five years have seen explosive rent growth in several key markets:

Perth: Leading the nation with a shocking 90% increase in rental costs over five years. Both Greater Perth and regional WA have experienced intense growth.

Brisbane & Adelaide: These cities are not far behind, with rents surging by approximately 60%.

Sydney: Australia's largest city has seen rents climb by around 50%.

Melbourne: After a softer period during the pandemic, Melbourne has caught up, with a 40% increase.

Canberra: Even the nation's capital has seen a significant, albeit lower, increase of 20%.

These figures highlight that rental affordability is not just a capital city problem. Regional areas in Queensland, Western Australia, and New South Wales have often seen even stronger rent growth than their metropolitan counterparts, reflecting a nationwide squeeze.

The Shifting Face of the Australian Renter

The stereotype of a renter being a young person in their early twenties is long outdated. The data paints a picture of a much more diverse renting population:

Older Demographics: An increasing number of people in their 30s, 40s, and beyond are long-term renters.

Renting Families: Couples with children are a significant and growing segment of the rental market, often unable to afford a home large enough for their needs.

Middle and High-Income Earners: Renting is no longer exclusively a matter of income. Many professionals and higher-income households are choosing to rent due to lifestyle preferences, career flexibility, or being priced out of their desired suburbs.

This demographic shift means that the needs of renters have evolved. They are looking for stability, quality homes, and features that support a long-term lifestyle—a reality that the current market, with its typical 12-month leases, often fails to accommodate.

The Energy Efficiency Dilemma

With rents consuming a larger portion of income, secondary costs like energy bills have come under intense scrutiny. However, renters often feel powerless to improve their home's energy efficiency. The research shows that half of all renters feel that adopting energy-efficient features is out of their control, despite the significant impact on their budget.

Shockingly, one-third of renters reported having zero energy-efficient features in their homes. Furthermore, a report found that only 8% of rental properties have sufficient insulation—a basic feature for providing a quality, comfortable home.

Barriers for Tenants: Cost and Control

The primary barriers for renters are straightforward:

1. Lack of Ownership: Renters cannot make significant structural changes like installing solar panels, double-glazing windows, or adding insulation. 2. Upfront Costs: Even for smaller, temporary changes, the initial cost can be a barrier for households already stretched by high rents. 27% of renters cited cost as a key obstacle. 3. Short-Term Leases: With over 90% of leases being for 12 months or less, there is little incentive for a renter to invest their own money in a property they may have to leave in a year.

Low-Cost, High-Impact Solutions for Renters

Despite these challenges, renters are not entirely without options. Nearly one in two renters plan to improve their home's energy efficiency in the next five years, focusing on sub-$5,000 investments. Here are some of the most effective, low-cost strategies you can implement:

Draft-Proofing: Use door snakes and self-adhesive weather strips for windows and doors. A surprising amount of energy is lost through drafts in older homes.

Temporary Window Insulation: Inexpensive window insulation film, which acts like a sticker for your glass, can provide an extra layer of protection against heat loss in winter and heat gain in summer.

Curtains and Blinds: Installing your own heavy, block-out curtains (with the landlord's permission) is one of the best ways to insulate your windows.

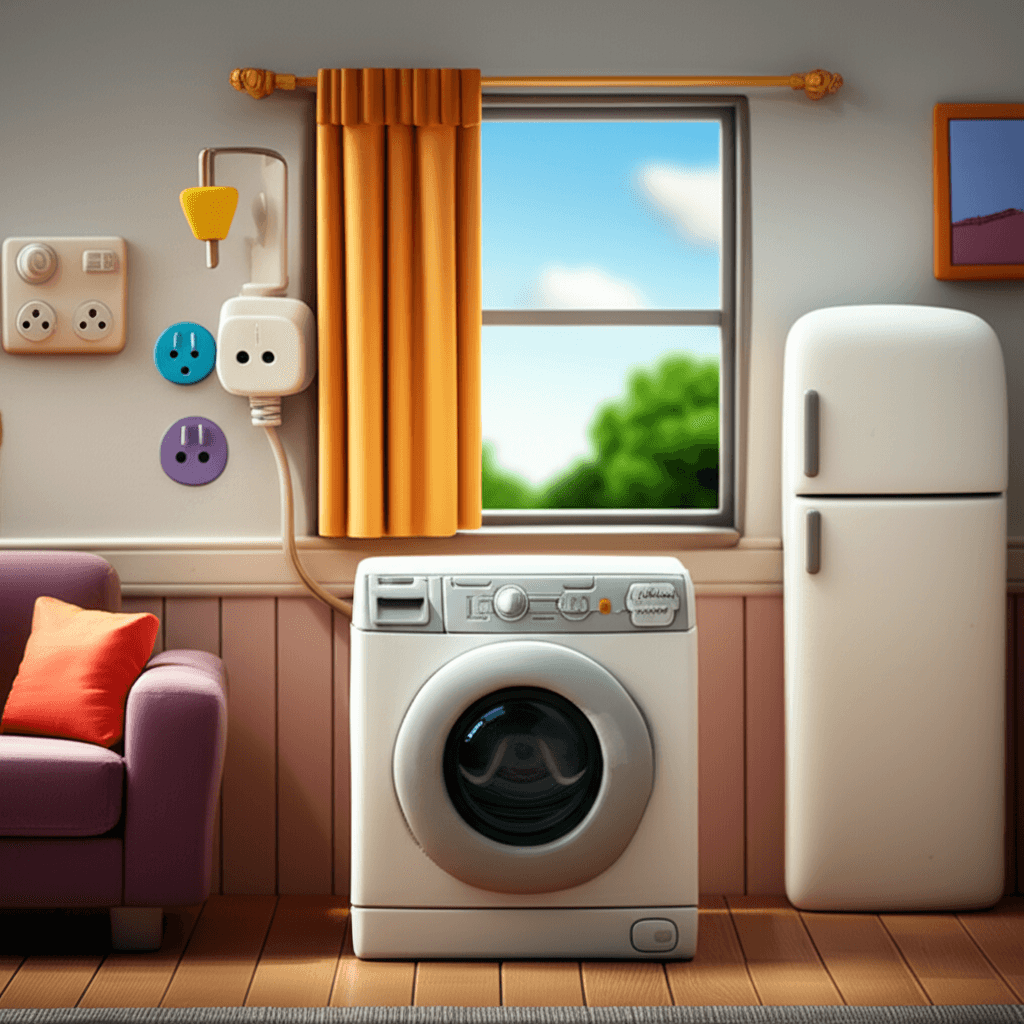

Smart Plugs: These affordable devices allow you to set timers for appliances, ensuring they are completely off and not drawing standby power when not in use.

Efficient Appliances: When it's time to buy a new washing machine, dryer, or refrigerator, choose one with a high energy-star rating. This is an investment you take with you to your next property.

Heated Throws and Localized Heating: Instead of heating an entire house, use a low-wattage heated throw blanket or a small, efficient space heater to warm yourself in one room.

Mindful Hot Water Usage: Opt for shorter showers and use the cold wash setting on your washing machine to significantly reduce hot water energy consumption.

Conclusion: Finding Control in a Tough Market

The Australian rental market is undeniably tough. Structural issues of supply and demand, coupled with affordability challenges, have created a perfect storm for tenants. The data shows a market under strain and a renting population that is older, more diverse, and staying in the market for longer.

While renters may feel they lack control over major aspects of their housing, there is power in knowledge and small actions. By understanding the market trends and implementing smart, low-cost energy efficiency measures, you can reduce financial pressure and improve your quality of life. For landlords, investing in these features is a win-win: it increases a property's value, attracts high-quality, long-term tenants, and contributes to a more sustainable housing market for everyone.

Ready to dive deeper into the property data for your suburb? Explore market trends, rental yields, and investment potential with HouseSeeker's powerful real estate analytics platform and make your next move with confidence.

Frequently Asked Questions

What are the main factors causing the rental crisis in Australia?

The crisis is primarily driven by a severe imbalance between supply and demand. Key factors include strong population growth from immigration, existing homeowners not upgrading and freeing up stock, and significant barriers to homeownership that keep more people renting for longer.

As a renter, what's the most effective way to save on energy bills?

Start with the basics: draft-proofing is the cheapest and one of the most effective strategies. Sealing gaps under doors and around windows can drastically reduce heating and cooling costs. Beyond that, being mindful of hot water usage and using smart plugs to eliminate standby power are highly effective, low-effort changes.

Can I ask my landlord to install energy-efficient features like insulation or solar panels?

Absolutely. You can and should have a conversation with your landlord or property manager. Frame it as a mutually beneficial investment. By making the property more attractive and cheaper to run, they are more likely to secure a reliable, long-term tenant (you), reducing their own costs associated with vacancy periods.