Brisbane's Property Frenzy: Will the New First Home Buyer Scheme Help or Hinder?

An analysis of how government incentives and soaring prices are reshaping the dream of homeownership for Queenslanders.

The Dream Meets a Red-Hot Reality

The dream of owning a first home in Southeast Queensland is clashing with a scorching property market. For aspiring buyers like Thomas and Courtney, the search has become an exhausting cycle of hope and disappointment. After four months of hunting, a 1960s home expected to fetch double its price from six years ago starts at their maximum budget, only to be sold for $200,000 more in just two bids. This scenario has become all too common, leaving many feeling that the market is simply unattainable.

A 'Hunger Games' Market Fueled by Unprecedented Growth

Brisbane's property market is moving at a pace that defies traditional analysis. In the past year alone, the city's median prices have surged by $86,000—the steepest increase among Australia's capitals. House prices have climbed by almost 9%, while the unit market has exploded, jumping nearly 18%. This rapid appreciation means that historical sales data, once a reliable guide for buyers, is now almost obsolete. Buyers are forced to look at sales from the previous week to gauge value in what many describe as a 'hunger games' environment, where prices can increase weekly. Understanding these volatile trends requires access to the latest real estate data and analytics.

Seeking an Edge: The Rise of the Buyer's Agent

Faced with a defeated outlook after months of unsuccessful searching, many are turning to professionals for help. Buyer's agents like Sam Hunter offer a strategic advantage, guiding clients through the chaos. By helping buyers define a comfortable budget, identify compromises, and navigate intense negotiations, they can turn a months-long struggle into a successful purchase in a matter of weeks. For one family, this professional guidance was the key to securing a home, a feat they felt would have been impossible on their own. This tailored support is becoming essential for many, similar to the personalised experience offered by an AI Buyer's Agent.

The Ripple Effect: Ipswich and the Shifting Suburbs

The intense pressure in Brisbane is creating a ripple effect, pushing buyers to look for value further afield. Cities like Ipswich, once considered a distant alternative, are now prestige markets in their own right. A property that might have taken six months to sell six years ago can now be snapped up in just two weeks. Buyers are discovering that areas 40km from the CBD offer an attractive lifestyle with larger homes, pools, and great schools for a fraction of the inner-city price. This migration is rapidly closing the price gap between the capital and its surrounding regions, transforming the entire Southeast Queensland property landscape.

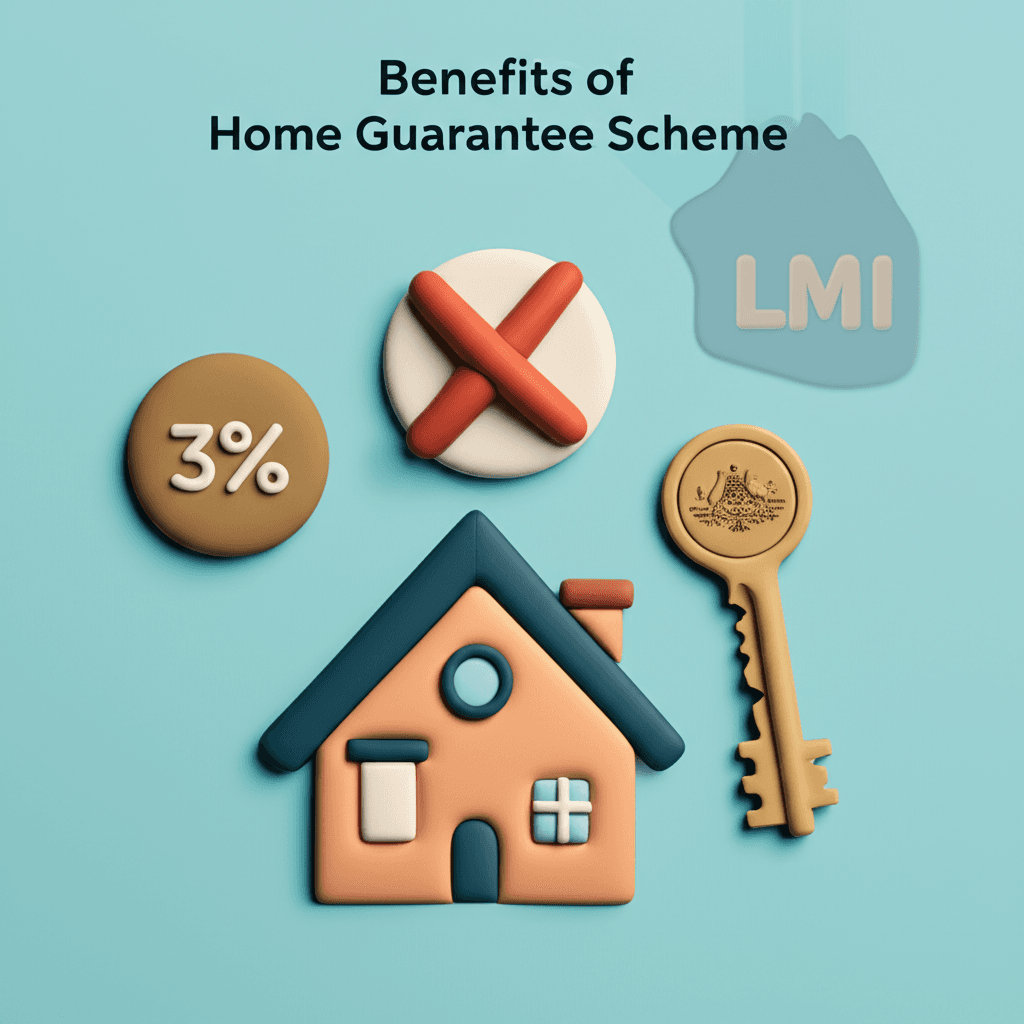

A New Lifeline? Decoding the Home Guarantee Scheme

To address the affordability crisis, the federal government has updated its Home Guarantee Scheme. This initiative allows first home buyers to purchase a property with as little as a 5% deposit, without the need for costly Lenders Mortgage Insurance (LMI), as the government acts as guarantor. The income caps to access the scheme have been removed, and the property price ceilings have been raised—up to $1 million in major Queensland cities. In theory, this means a buyer could enter the market with a $50,000 deposit for a million-dollar home, a significant reduction in the barrier to entry.

An Unintended Consequence: Fuelling the Fire?

While the scheme is designed to help, many experts fear it could have the opposite effect. By allowing more buyers, including high-income earners, to compete for properties at the lower end of the market with smaller deposits, the policy risks increasing demand even further. This surge in competition for a limited supply of homes is likely to push prices up, particularly in the $700,000 to $1 million bracket. The concern is that this will consume available stock and accelerate price growth, making homeownership an even more distant dream for those without existing family wealth. The federal government's prediction of a mere 0.5% price increase over six years is being met with significant skepticism from those on the ground.

Conclusion

The Brisbane property market presents a complex challenge for first home buyers. Intense competition, rapid price growth, and population pressures have created a difficult landscape. While the revamped Home Guarantee Scheme aims to lower the barrier to entry, it may inadvertently intensify the very competition it seeks to alleviate. For prospective buyers, success in this market is no longer just about saving a deposit; it requires a deep understanding of micro-market trends, a willingness to be flexible on location, and a clear, data-informed strategy.

Navigating these complex conditions requires the right tools. Stay ahead of market shifts and make informed decisions with HouseSeeker's advanced real estate analytics.

Frequently Asked Questions

What is the updated Home Guarantee Scheme for first home buyers?

The scheme allows eligible first home buyers to purchase a home with a deposit as low as 5% without needing to pay Lenders Mortgage Insurance (LMI). The federal government guarantees up to 15% of the property value to the lender, and recent changes have removed income caps and increased property price limits to $1 million in major Queensland cities.

Why are property prices in Brisbane and Ipswich rising so quickly?

Several factors are driving the price surge. These include strong population growth from both interstate and international migration, a shortage of housing supply, and increased demand related to infrastructure projects for the upcoming Olympics. This combination of high demand and low supply is pushing prices to record levels.

How can a buyer's agent help in a competitive market?

In a market where properties receive multiple offers and sell quickly, a buyer's agent provides expertise and a competitive edge. They can help buyers clarify their budget, identify suitable properties (including off-market opportunities), assess fair value in a fast-moving market, and handle negotiations, saving buyers time, stress, and potentially money.