Commercial vs. Residential Property: An Investor's Guide for 2025

Explore the critical differences in rental yields, capital growth, risks, and entry costs to determine the right investment strategy for your portfolio.

Choosing Your Path: Commercial vs. Residential Property Investment

For most Australian property investors, the primary goal is universal: to build wealth and secure a stronger financial future. The well-trodden path has traditionally been residential real estate, a familiar landscape for 'mum and dad' investors. However, as the market evolves in mid-2025, a crucial question emerges: does limiting our focus to residential property mean we're overlooking superior opportunities?

Commercial property, with its higher yields and different risk profile, is increasingly entering the conversation. This guide unpacks the data and settles the debate, providing a clear comparison to help you determine which asset class aligns best with your investment objectives, risk tolerance, and long-term goals.

Understanding the Fundamentals: Goals, Growth, and Yield

Before diving into the numbers, it's essential to understand the fundamental strategic differences between residential and commercial property investment. Your personal objectives—whether you're chasing long-term capital appreciation or immediate cash flow—will heavily influence which path is right for you.

Investor Objectives: Capital Growth vs. Rental Yield

The primary appeal of residential property has long been its potential for significant capital growth. The classic Australian dream involves holding a property for the long term, perhaps over a 30-year loan period, and benefiting from the land value doubling every decade or so. While rental income is a factor, it often serves to cover the mortgage and costs, with the real profit realised upon selling.

Conversely, commercial real estate is typically sought after by investors chasing a strong rental yield. While capital growth is still possible, the main attraction is generating a robust and consistent income stream. This is why commercial properties are often valued based on the strength of their lease and the quality of their tenant.

Market Drivers: People vs. Economy

While there are crossovers, the core drivers for each sector differ. Residential demand is heavily influenced by demographic trends.

Residential Drivers: Factors like population growth, as tracked by the Australian Bureau of Statistics (ABS), directly create housing demand. An undersupply of homes, coupled with a growing population, leads to rising rents and property prices. These are the metrics savvy investors analyse using powerful real estate analytics to predict which suburbs are poised for a boom.

Commercial Drivers: Commercial property demand is tied more directly to the health of the local and national economy. A thriving local economy means businesses are expanding, creating demand for office, retail, and industrial spaces. Key considerations include business growth, consumer spending habits, and infrastructure development that supports commerce.

The Financials: A Tale of Two Investments

The financial commitment and potential returns vary dramatically between commercial and residential properties. Understanding these differences in deposits, yields, and ongoing costs is critical to making an informed decision.

Entry Costs and Deposits

The barrier to entry is significantly higher for commercial real estate.

Residential: An investor typically needs a deposit of 20% of the purchase price plus stamp duty costs to secure a loan.

Commercial: Lenders are more conservative due to the higher perceived risk. A commercial investor may need to contribute anywhere from 25% to 40% of the property's value as a deposit, plus stamp duty. This means a much larger initial capital outlay is required.

Unpacking Rental Yields

Rental yield is a measure of the annual rental income as a percentage of the property's value. This is where commercial property truly shines.

Residential Yields: Currently sit in the 3.5% to 4.5% range. It is considered a lower-risk asset class, which is reflected in its more modest yields.

Commercial Yields: A 4.5% yield would be a starting point, with returns often reaching 8% or higher depending on the asset type and its location. This higher yield compensates the investor for the increased risk, particularly the potential for longer vacancy periods. A residential property might be vacant for a few weeks, but a commercial space could remain empty for months or even years.

Ongoing Costs: Who Pays for What?

One of the most attractive aspects of commercial investment is the allocation of ongoing costs.

In a residential tenancy, the landlord is responsible for almost all outgoings, including council rates, land tax, insurance, and repairs and maintenance.

In a commercial lease, it's common for these costs to be passed on to the tenant. A well-negotiated lease often stipulates that the tenant pays for rates, land tax, insurance, and general repairs. This leaves the landlord primarily responsible for the mortgage, resulting in a more passive, hands-off investment.

The Legal Landscape: Leases and Contracts

The differences extend deep into the legal agreements that govern the tenancy. Commercial leases are far more complex and require meticulous due diligence.

Lease Terms and Tenant Quality

Residential leases are relatively straightforward, typically lasting 6 to 12 months. Commercial leases, however, are long-term agreements, often spanning 3, 5, or even 10+ years, with options for renewal.

The success of a commercial investment is intrinsically linked to the quality of the tenant. Before purchasing, an investor must conduct thorough due diligence on the tenant's business, its industry, and its financial stability. Reviewing the lease agreement with a solicitor is non-negotiable to understand terms related to rent reviews, maintenance responsibilities, and any incentives like rent-free periods or contributions to fit-out costs.

Market Dynamics in 2025: Current Trends

The post-pandemic landscape has reshaped both property markets. While residential fundamentals remain strong due to population growth and housing shortages, the commercial sector is more varied.

Residential Resilience

Despite interest rate hikes, the demand for residential property investment is returning. Strong fundamentals, including a national housing undersupply and robust rental growth, continue to attract investors. Historically, houses with land have outperformed apartments in terms of capital growth, a trend that continues to hold true.

The Diverse World of Commercial

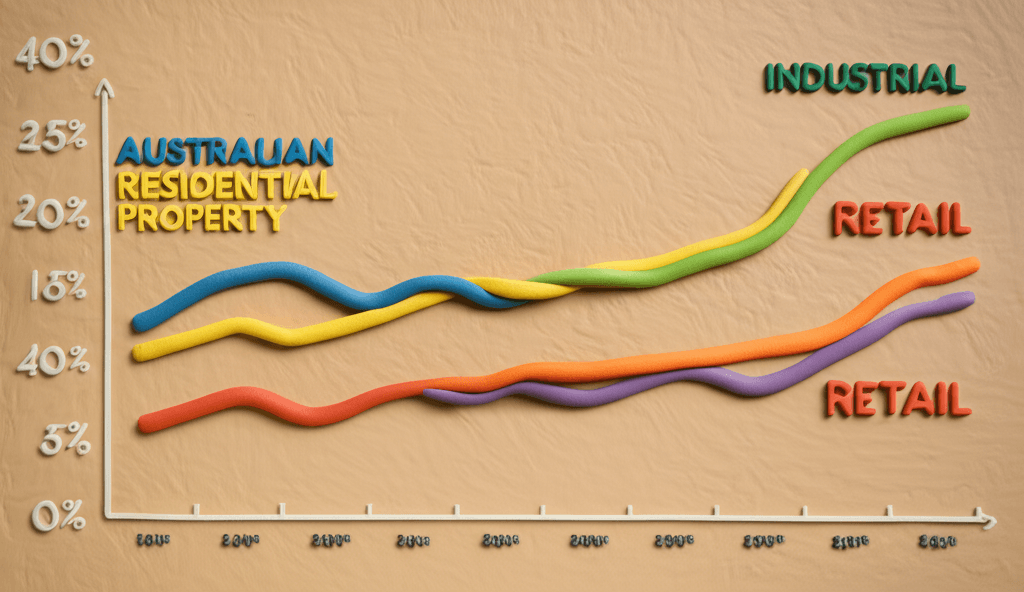

The commercial market is not monolithic. Performance varies significantly by asset class:

Industrial: Warehousing and logistics spaces have boomed, driven by the surge in e-commerce. These assets have seen incredible land value appreciation over the past decade.

Office: This sector has faced headwinds with the rise of remote and hybrid work, leading to cooling values and higher vacancy rates in some central business districts.

Retail: While large shopping centres face challenges, smaller 'strip retail' and neighbourhood centres with essential services remain resilient.

Niche Assets: Other popular commercial types include childcare centres and service stations, which are perceived as lower-risk due to consistent demand.

Finding these specific opportunities requires sophisticated tools. An AI property search can help investors filter for specific asset types, like 'warehousing with high-yield potential' or 'suburbs with growing populations', streamlining the discovery process.

The Verdict: Which Investment Is Better for You?

There is no silver bullet. The ideal investment hinges entirely on your personal circumstances, financial capacity, risk appetite, and investment goals.

Residential property may be the better choice if:

You are primarily focused on long-term capital growth.

You have a lower initial deposit and are more comfortable with a familiar asset class.

You are prepared to actively manage the property and cover its ongoing costs.

Commercial property could be your winner if:

Your main objective is to generate strong, consistent rental income (cash flow).

You have a substantial deposit and are looking for a more passive, hands-off investment.

You are willing to conduct extensive due diligence on tenants and complex lease agreements.

Ultimately, the decision requires careful research and analysis. The first step is to dive into the data. By using powerful real estate analytics, you can compare suburb performance, track capital growth, and model potential rental yields for both property types, empowering you to make a decision based on facts, not feelings.

Frequently Asked Questions

Is commercial property significantly riskier than residential?

Yes, it is generally considered higher risk. The primary risk is longer vacancy periods. If a commercial property becomes vacant, it can take months or even years to find a new tenant, during which you receive no income. The higher rental yields are designed to compensate investors for taking on this additional risk.

What type of investor typically buys commercial property?

Historically, it was the domain of self-employed business owners buying their own premises or larger institutional investors. However, 'mum and dad' investors are increasingly entering the market, typically at the sub-$1 million price point. They are often attracted by the higher yields and the potential for tenants to cover most outgoings.

Can you negatively gear a commercial property?

While it is possible to negatively gear a commercial property (where expenses exceed income), it is not a common investment strategy. The primary motivation for buying commercial real estate is to generate positive cash flow and income, not to obtain a tax deduction by running at a loss.