Debt Recycling Australia: Turn Your Home Loan into a Wealth-Building Machine

Learn how to convert non-deductible mortgage debt into tax-deductible investment loans to accelerate your property portfolio and financial freedom.

Introduction: Rethinking Your Mortgage

For generations, the Australian dream has included paying off the family home as quickly as possible. We're taught to save diligently, make extra repayments, and chip away at our mortgage. But what if there was a smarter way to manage your finances? A strategy that could not only help you pay off your home loan faster but also build significant wealth and reduce your taxable income simultaneously? This is the power of debt recycling.

This guide will break down the debt recycling strategy, moving beyond the traditional offset account approach to reveal how savvy investors turn their home loan from a liability into a powerful asset-building tool. We'll explore how to transform 'bad debt' into 'good debt' and create a system for long-term financial success.

Good Debt vs. Bad Debt: A Core Concept

Financial author Robert Kiyosaki famously argued that your primary residence is a liability, not an asset, because it takes money out of your pocket through loan repayments without generating income. In Australia, the interest paid on your home loan is not tax-deductible, making it what we call 'bad debt'. It's a necessary cost, but it doesn't actively work to improve your financial position.

'Good debt', on the other hand, is debt used to purchase an income-producing asset, like an investment property. The interest on this type of loan is generally tax-deductible, reducing your overall tax burden and helping the asset pay for itself over time. The goal of debt recycling is to systematically convert this unproductive bad debt into productive, tax-efficient good debt.

A Step-by-Step Guide to Debt Recycling

Let's break down the process with a common scenario. Imagine you own a home valued at $1.2 million with an $800,000 mortgage, and you have $200,000 in savings sitting in an offset account.

The typical approach would be to use that $200,000 as a deposit for an investment property. While this works, it's not the most efficient method. Here’s how to do it using debt recycling:

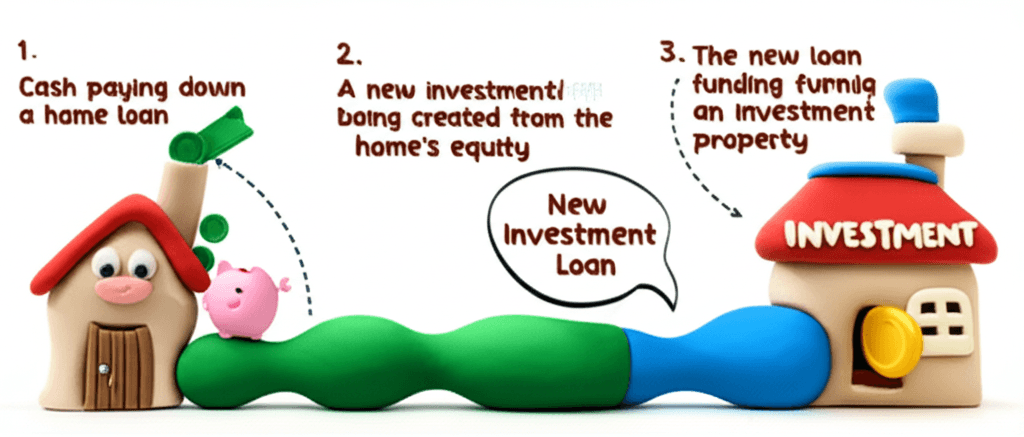

1. Pay Down Your Home Loan: Instead of using the $200,000 for a deposit, pay it directly onto your non-deductible home loan. This reduces your mortgage from $800,000 down to $600,000.

2. Redraw the Funds via a Separate Loan: Work with your mortgage broker to re-borrow the $200,000 you just paid off. Crucially, this must be structured as a new, separate loan or split from your original mortgage. Your total debt is back to $800,000, but it's now split into two parts: a $600,000 non-deductible home loan and a $200,000 investment loan.

3. Invest in an Income-Producing Asset: Use the entire $200,000 from the new investment loan to purchase an asset. This could be a deposit and costs for an investment property or a portfolio of shares. Because the sole purpose of this new loan is for investment, the interest on it becomes tax-deductible.

Why It Works: The Purpose of the Debt

A common misconception is that because the loan is secured against your family home, it remains non-deductible. However, the Australian Taxation Office (ATO) is concerned with the purpose of the loan, not the security behind it. As long as you can clearly demonstrate that the funds from the separate loan split were used exclusively for investment purposes, the interest can be claimed as a tax deduction.

Let's look at the numbers. On a $200,000 loan at an interest rate of 5.5%, you would pay $11,000 in annual interest. Through debt recycling, this $11,000 becomes a tax-deductible expense. If your taxable income is $100,000, it is now reduced to $89,000, resulting in a significant tax saving that can be used to further pay down your non-deductible home loan.

The Advanced Strategy: Scaling Your Portfolio for Retirement

Debt recycling isn't a one-time trick; it's a scalable system for wealth creation. As your first investment property grows in value, you gain more equity. This new equity can be accessed to repeat the process, allowing you to acquire a second, third, or even fourth property over time.

This creates a powerful cycle:

Tax Benefits: Each new investment loan adds to your tax deductions.

Capital Growth: Your portfolio of assets grows in value.

Passive Income: As rents increase and loans are paid down, your properties generate positive cash flow.

This passive income can then be directed towards aggressively paying down your original non-deductible home loan, clearing it in a fraction of the time. You are effectively using your tenants' rent and tax savings to pay off your own home. This is the strategy that allows investors to build a substantial asset base and achieve financial independence, rather than simply owning a paid-off home and relying on the pension.

Building a successful portfolio requires careful planning and execution. Identifying properties with strong growth potential is critical to making this strategy work. Using sophisticated tools like our Real Estate Analytics Hub allows you to analyse market trends and make informed decisions.

Conclusion

Simply saving your way to retirement is becoming increasingly difficult in the face of inflation. You must invest to build real wealth. Debt recycling is a proven strategy that transforms your largest liability—your mortgage—into your greatest asset-building tool. By correctly structuring your loans, you can reduce your taxable income, acquire appreciating assets, and use the returns to pay off your family home years earlier.

Ready to identify high-performing properties to kickstart your debt recycling journey? Explore the HouseSeeker Real Estate Analytics Hub to uncover data-driven insights and find investment-grade opportunities across Australia.

Frequently Asked Questions

Is debt recycling risky?

Yes, like all investment strategies, debt recycling involves risk. It increases your total debt, and the success of the strategy relies on the performance of your chosen investments. It's crucial to understand the risks and have a long-term perspective before proceeding.

Do I need a financial advisor and a good mortgage broker?

It is highly recommended. A qualified financial advisor can assess if the strategy is right for your personal circumstances, while an experienced mortgage broker is essential for setting up the correct loan structures. Incorrect structuring can nullify the potential tax benefits.

Can I use debt recycling for assets other than property?

Yes, the principle of debt recycling can be applied to any income-producing asset, such as a managed fund or a share portfolio. The key is that the borrowed funds are used to generate assessable income, which makes the interest on the loan deductible.