Interest-Only vs. Principal & Interest: The Investor's Guide to Building Wealth Faster

Discover how a strategic approach to loan structures can maximise your cash flow, accelerate portfolio growth, and help you achieve a debt-free property portfolio sooner.

Introduction

Navigating the Australian property market requires more than just finding the right property; it demands the right financial strategy. For decades, the conventional wisdom has been to pay down debt as quickly as possible. However, for savvy investors in their accumulation phase, a counterintuitive approach can unlock wealth far more effectively. This guide breaks down the powerful strategy of using interest-only loans to build a substantial, debt-free property portfolio, transforming a simple loan choice into your most powerful wealth-creation tool.

The Fundamental Choice: Defining Your Loan Structure

When you secure a mortgage for an investment property, you're faced with a critical decision that will dictate your cash flow and portfolio's potential. Understanding the two primary repayment structures is the first step.

Principal and Interest (P&I) Loans: This is the traditional home loan structure. Each repayment consists of two parts: the 'interest', which is the cost of borrowing the money, and the 'principal', which is a small portion of the original loan amount. Over a 30-year term, these repayments gradually reduce your debt, leaving you with a fully paid-off property at the end.

Interest-Only (IO) Loans: With an interest-only loan, your repayments only cover the interest cost for an agreed period (typically one to five years). You are not paying down the principal loan balance during this time. This results in significantly lower monthly repayments compared to a P&I loan.

The Strategic Advantage: Why Cash Flow is King for Investors

The single biggest barrier to building and holding a property portfolio is not borrowing capacity—it's cash flow. Assets need time in the market to generate meaningful capital growth, and your ability to hold them through market cycles is paramount. This is where the IO strategy shines. By minimising your monthly outgoings, you create a cash flow buffer that protects you from financial strain and, more importantly, enables you to acquire more assets.

Consider an investment property that is negatively geared by $20,000 per year on a P&I loan. For an investor with $30,000 in annual savings, this one property consumes two-thirds of their surplus cash, making it nearly impossible to purchase a second. By switching to an IO loan, the monthly repayments decrease, potentially improving cash flow by thousands per year. This surplus doesn't just provide a safety net; it provides the capacity to service the debt on another investment, effectively allowing you to buy two properties instead of one.

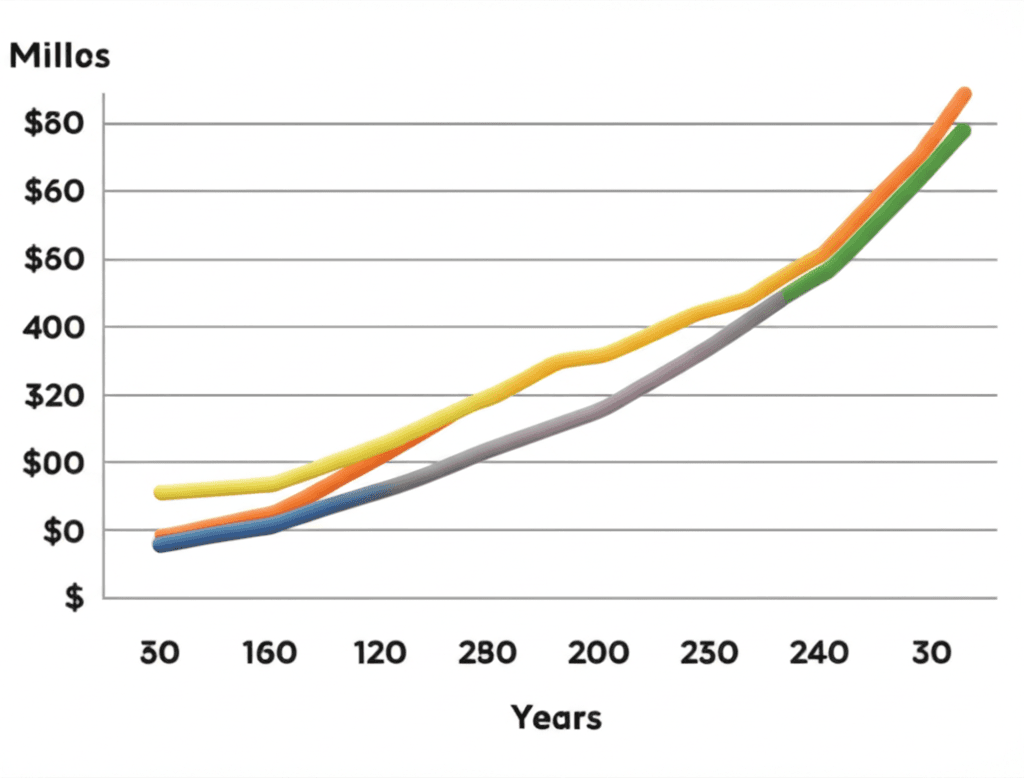

The Power of Compounding: A Tale of One vs. Two Properties

Let's analyse how this strategic choice plays out over the long term. We'll assume a conservative long-term average capital growth rate of 6% per annum.

Scenario 1: P&I Strategy

You buy one property for $700,000.

After 30 years at 6% compounding growth, its value is approximately $4 million.

Scenario 2: IO Strategy

Your improved cash flow allows you to use your deposit to buy two properties at $700,000 each (total initial value of $1.4 million).

After 30 years at 6% compounding growth, their combined value is approximately $8 million.

The difference is staggering. While you paid more interest over the period, the wealth generated through owning an additional appreciating asset vastly outweighs that cost. The goal during the accumulation phase isn't to eliminate debt; it's to acquire high-quality assets that will grow in value.

The Endgame: Engineering a Debt-Free Future

The ultimate goal is financial freedom, which often means owning your assets outright. The IO strategy provides a clear pathway to this outcome without sacrificing decades to slowly pay down debt.

Using the two-property scenario above, let's say your initial debt was $1.2 million ($600k per property). After 30 years, your portfolio is worth $8 million. You can then execute your exit strategy:

1. Sell one property for its market value of $4 million. 2. Use the proceeds to completely pay off the remaining $1.2 million debt on both properties. 3. After accounting for taxes and selling costs, you are left with a completely debt-free property worth $4 million, plus a significant cash surplus.

This method can be scaled across a larger portfolio. An investor with six properties might only need to sell two or three to eliminate the entire portfolio's debt, leaving them with several high-value, income-producing assets free and clear.

Conclusion

For property investors focused on accumulation, the choice between Interest-Only and Principal & Interest is a strategic one. While P&I loans provide the psychological comfort of debt reduction, IO loans offer a powerful tool to maximise cash flow, expand your asset base, and leverage compounding growth more effectively. By focusing on acquiring more high-quality assets that are positioned for strong market growth, you can build wealth faster and engineer a debt-free portfolio on an accelerated timeline. The key is to see debt not as something to be feared, but as a tool to be managed in the pursuit of greater assets.

Ready to identify investment-grade properties with strong growth potential? Leverage powerful data and market insights with HouseSeeker's Real Estate Analytics Platform to make smarter, data-driven decisions.

Frequently Asked Questions

What happens when my interest-only period ends?

When your fixed IO period (e.g., 5 years) concludes, your loan will typically revert to a P&I repayment schedule. However, investors still in their accumulation phase can often refinance the loan with their current or a new lender to secure another interest-only term, effectively extending the strategy.

Is an interest-only loan a good idea for the home I live in?

This strategy is designed primarily for investment properties. For your principal place of residence (the home you live in), the debt is not tax-deductible. Therefore, a traditional Principal & Interest loan is generally the most suitable approach, as the primary goal is to pay it off and own your home outright.

Doesn't paying only interest mean I'm wasting money?

The extra interest paid on an IO loan should be viewed as a cost of acquiring and holding a larger asset base. The core principle of this strategy is that the capital growth achieved from owning additional properties will far exceed the total interest costs over the long term, resulting in a much higher net worth.