Funding Your First Investment Property: A Data-Driven Guide

Discover how to calculate your true entry costs, leverage LMI, and explore smart strategies to enter the Australian property market sooner.

Navigating the path to property investment in mid-2025 can feel daunting, especially when the biggest hurdle is understanding exactly how much capital you need. Conflicting advice about 5%, 10%, or 20% deposits creates confusion and can delay your entry into the market. This guide cuts through the noise, providing a clear, data-driven breakdown of the real costs involved and the strategic pathways available to you. We'll explore everything from calculating upfront expenses to leveraging financial tools and strategies that can help you secure your first investment property faster than you thought possible.

Understanding the True Upfront Costs

Before you can invest, you need a precise understanding of the total capital required. It's more than just the deposit. The two primary components are your deposit and the associated purchase costs.

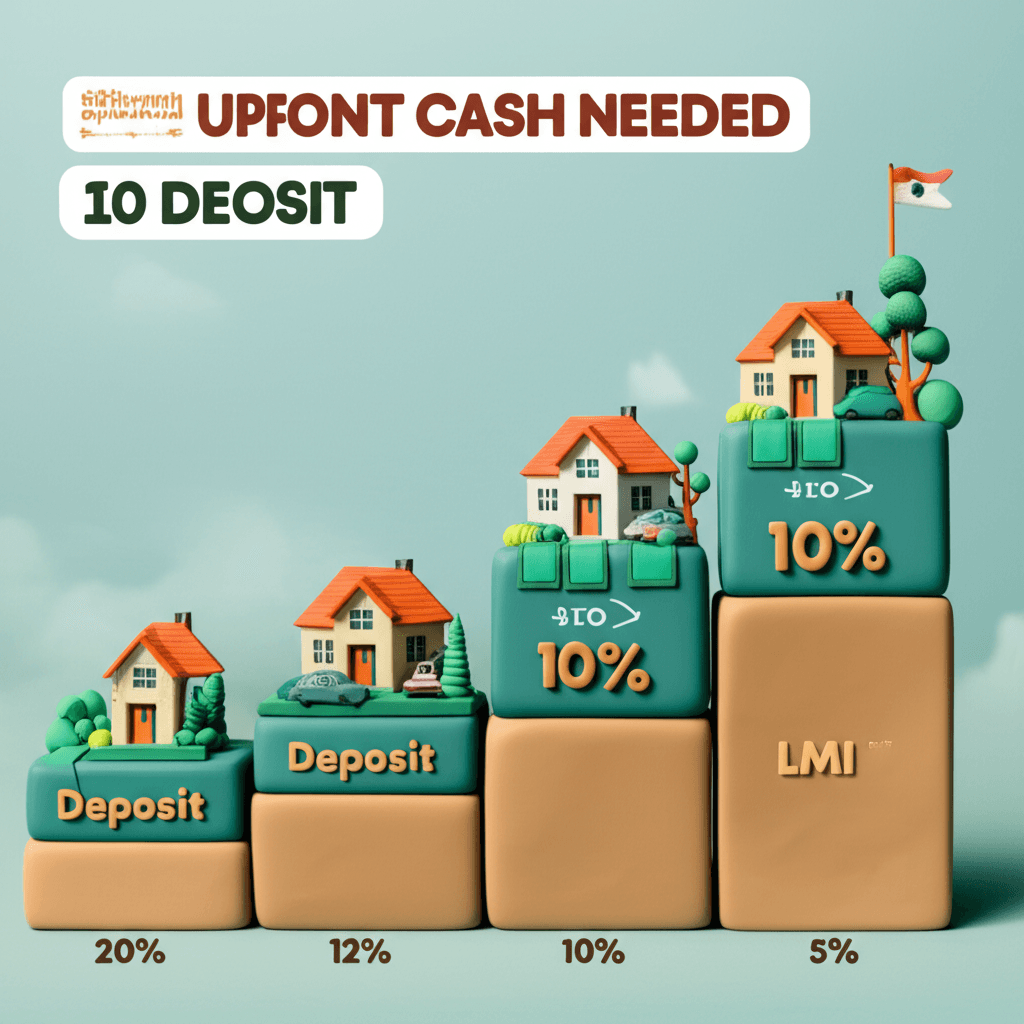

The Deposit: Beyond the 20% Rule

The 20% deposit is often cited as the gold standard for purchasing property. For a $400,000 property, this amounts to an $80,000 deposit. The primary reason for this benchmark is that lenders view a 20% deposit (an 80% Loan-to-Value Ratio or LVR) as a lower-risk loan. With this level of equity from day one, banks are confident they can recover their funds if the borrower defaults.

However, saving 20% is a significant challenge for many. Fortunately, it's not the only way in. Options with lower deposits, such as 5%, 10%, or 12%, are widely available, but they come with an additional cost: Lenders Mortgage Insurance (LMI).

Purchase Expenses: The Hidden Costs

Beyond the deposit, you must budget for purchase expenses, which typically amount to 4-6% of the property's value. These costs are unavoidable and include:

Stamp Duty: A state-based government tax on property transactions. This is often the largest single expense after the deposit. Its cost varies significantly between states; for instance, Victoria's is generally higher than Queensland's. You can use an online calculator from a state revenue office to get an accurate estimate.

Legal and Conveyancing Fees: The cost for a solicitor or conveyancer to handle the legal transfer of property ownership.

Building and Pest Inspections: Essential for due diligence to uncover any potential structural or pest-related issues with the property.

Buyer's Agent Fees: If you engage a professional to find and secure a property on your behalf.

Minor Renovations/Buffer: It's wise to have a small cash buffer for immediate touch-ups or repairs to make the property tenant-ready.

For a $400,000 property, these costs could easily add another $20,000 to $24,000 to your total upfront capital requirement, bringing the total for a 20% deposit purchase to over $100,000.

What is Lenders Mortgage Insurance (LMI)?

Lenders Mortgage Insurance (LMI) is a one-off insurance premium that protects the lender, not the borrower, against the risk of the borrower defaulting on their loan. It is typically required when your deposit is less than 20% of the property's value (i.e., your LVR is above 80%).

While it's an added cost, LMI can be a powerful strategic tool. It allows you to enter the property market with a smaller deposit, which is crucial in a rising market where property values may be increasing faster than you can save. Chasing a moving target can be frustrating; LMI helps you secure a property sooner.

LMI in Action: A $400,000 Property Example

Let's break down the numbers to see how LMI impacts your total entry costs. Assume purchase costs are fixed at $24,000 (6%).

Scenario 1: 12% Deposit ($48,000)

Estimated LMI: ~$4,500

Total Cash Needed: $48,000 (Deposit) + $24,000 (Costs) = $72,000

Scenario 2: 10% Deposit ($40,000)

Estimated LMI: ~$7,000

Total Cash Needed: $40,000 (Deposit) + $24,000 (Costs) = $64,000

Scenario 3: 5% Deposit ($20,000)

Estimated LMI: ~$17,000

Total Cash Needed: $20,000 (Deposit) + $24,000 (Costs) = $44,000

As you can see, the lower your deposit, the higher the LMI premium, reflecting the increased risk to the lender. Often, the LMI premium can be capitalised, meaning it's added to your total loan amount rather than being paid out-of-pocket.

Important Considerations for LMI

Interest Rates: Be aware that loans with a higher LVR (e.g., above 90%) may attract a higher interest rate, as the lender perceives greater risk.

Tax Deductibility: For an investment property, the LMI premium is generally tax-deductible. It's typically claimed over a five-year period. Always confirm this with your accountant.

The 'Sweet Spot': Many investors and brokers find that an 88% LVR (a 12% deposit) strikes a good balance. It allows entry with a lower deposit without incurring the significantly higher LMI premiums and interest rates associated with 90%+ LVRs.

Strategic Pathways to Fund Your Property Purchase

Beyond saving a cash deposit, several powerful strategies can help you fund your investment.

1. Equity Release: Unlocking Your Existing Property's Potential

If you already own a property—whether it's your home or another investment—that has increased in value, you may be able to access the accumulated equity. An equity release involves refinancing your existing loan to borrow against this growth.

For example, imagine your home is valued at $1,000,000 and your current mortgage is $500,000. Lenders will typically allow you to borrow up to 80% of the property's value, which is $800,000 in this case. This gives you access to up to $300,000 in usable equity.

To purchase a $500,000 investment property, you might release $130,000 ($100,000 for a 20% deposit and $30,000 for purchase costs). This new loan of $130,000 is secured against your home, but because the funds are used for investment purposes, the interest is tax-deductible. This is a clean, efficient way to fund a purchase without needing to save a new cash deposit. Utilizing sophisticated real estate analytics can help you track your property's value and identify the optimal time to consider an equity release.

2. Parental Guarantor Loans

A guarantor loan allows a family member, typically a parent, to use the equity in their own property as additional security for your loan. This can help you avoid LMI entirely by covering the 20% deposit portion.

It’s crucial to understand that the guarantor is not providing cash or helping with repayments. They are simply providing security. The borrower must demonstrate full borrowing capacity to service the entire loan amount. This is a great way to get into the market sooner, and the goal is to build enough equity in your new property to refinance within a few years and release the parents' property from the guarantee. To do this quickly, it's vital to select a property with strong growth potential, a task where an AI Property Search tool can provide a significant advantage.

3. Government Assistance Schemes

The Australian government offers schemes to help eligible buyers purchase a home with a smaller deposit. While primarily for owner-occupiers, they are relevant for 'rentvestors'.

First Home Guarantee: This scheme, detailed on the Housing Australia website, allows eligible first-home buyers to purchase a home with as little as a 5% deposit without paying LMI. The government guarantees the difference to the lender. Price caps and income limits apply.

First Home Super Saver (FHSS) Scheme: This allows you to make voluntary contributions to your superannuation to save for your first home. You can then withdraw these contributions (and associated earnings) to use as a deposit, benefiting from the concessional tax treatment of super.

4. Other Funding Avenues

Joint Ventures (Siblings/Family): Purchasing with a family member can help pool resources. However, this can impact future borrowing capacity, as lenders often attribute 100% of the debt but only 50% of the rental income to each individual. A 'property share' loan agreement can mitigate this but requires careful setup.

Gifts from Family: A non-repayable gift from family can be used as a deposit, though lenders will want a statutory declaration to confirm it is not a loan.

Conclusion: Your Path to Investment Success

There is no single 'right' amount of money needed to start investing in property. While a 20% deposit plus costs is the simplest route, it is far from the only one. By understanding tools like LMI, strategies like equity release, and available government support, you can tailor a funding strategy that aligns with your financial position and goals.

Success lies in building a strong team—a knowledgeable mortgage broker, a sharp accountant, and potentially a buyer's agent. They can help you navigate the complexities and structure your finances for long-term growth. Don't let the daunting task of saving a massive deposit discourage you; with the right knowledge and a clear plan, your property investment goals are within reach.

Ready to move from planning to action? Explore how HouseSeeker's powerful [real estate analytics](https://houseseeker.com.au/features/real-estate-analytics) can help you identify high-growth suburbs and make data-backed investment decisions to build your portfolio.

Frequently Asked Questions

Is Lenders Mortgage Insurance (LMI) tax-deductible?

Yes, for an investment property, the LMI premium is typically considered a borrowing expense and can be claimed as a tax deduction over a five-year period. It is not deductible for owner-occupied properties. We always recommend consulting with a qualified tax accountant for personalized advice.

How does an equity release affect my existing mortgage?

An equity release increases the loan amount secured against your existing property. For example, if you have a $500,000 loan and release $130,000 in equity, your total loan on that property becomes $630,000. This new loan portion should be structured separately (e.g., as an interest-only split) to maintain clear records for tax purposes, as its interest is deductible when used for investment.

Can I use a parental guarantor if my parents are retired?

It can be challenging, but not impossible. Some lenders are hesitant to accept retired guarantors, as they want to see that the parents remain in a strong financial position for the future. However, a select few lenders may consider it, so it's essential to work with an experienced mortgage broker who knows which lenders are open to this scenario.