Master Your Money: The Ultimate Guide to Financial Control for Aspiring Property Investors

Unlock your path to property ownership by implementing proven strategies for tracking, budgeting, and intentional spending.

Introduction

Navigating the Australian property market in mid-2025 can feel overwhelming, especially when you're trying to build a deposit while living paycheck-to-paycheck. The dream of financial freedom seems distant when rising rents and daily expenses consume your income. Many aspiring investors feel stuck, unsure how to bridge the gap between their current financial situation and their property goals. The truth is, the journey to successful property investment doesn't start with market analysis or suburb selection; it begins with mastering your personal finances. This guide will provide you with a clear, step-by-step framework to take control of your money, build a powerful savings habit, and lay the essential groundwork for your future property portfolio.

The Mindset Shift: From Spending to Wealth Building

Before you can change your habits, you must change your mindset. As author Morgan Housel notes in The Psychology of Money, "The highest form of wealth is the ability to wake up every morning and say, ‘I can do whatever I want today.’” This isn't about greed; it's about control. True wealth provides the freedom to control your time, make career changes without financial stress, and build a secure future for yourself and your family.

Many people fall into the trap of equating wealth with visible possessions. A flashy car or a designer wardrobe, often funded by debt, is mistaken for success. This pursuit of outward appearances is often the fastest way to have less money. The goal isn't to look rich; it's to become genuinely wealthy, and that success is often hidden in disciplined habits and smart financial decisions. The first step is to shift your focus from short-term gratification to the long-term goal of financial independence.

Step 1: Confronting Your Financial Reality

Many people avoid looking at their financial situation due to complexity or fear of what they might find. However, you cannot manage what you do not measure. Gaining clarity is the most empowering first step you can take.

Where to Begin: The Six-Month Lookback

Instead of getting bogged down in complicated budgeting apps, start with a simple historical review. Go back through your last six months of bank and credit card statements. For each month, note your total income and total expenses. Ask yourself a simple question: is my net worth (the total balance of my accounts) growing, stagnant, or shrinking?

This exercise will quickly reveal your actual surplus or deficit. You might believe you should be saving $1,000 a month, but the numbers will show the reality. This isn't about judgment; it's about gathering data. This initial analysis is the foundation upon which you can build a more robust financial plan, similar to how an investor uses real estate analytics to understand a market before buying.

Step 2: Building Your Money Management System

Once you understand where your money is going, the next step is to create a system that directs it where you want it to go. Relying on willpower alone is a recipe for failure. Automation is your most powerful ally.

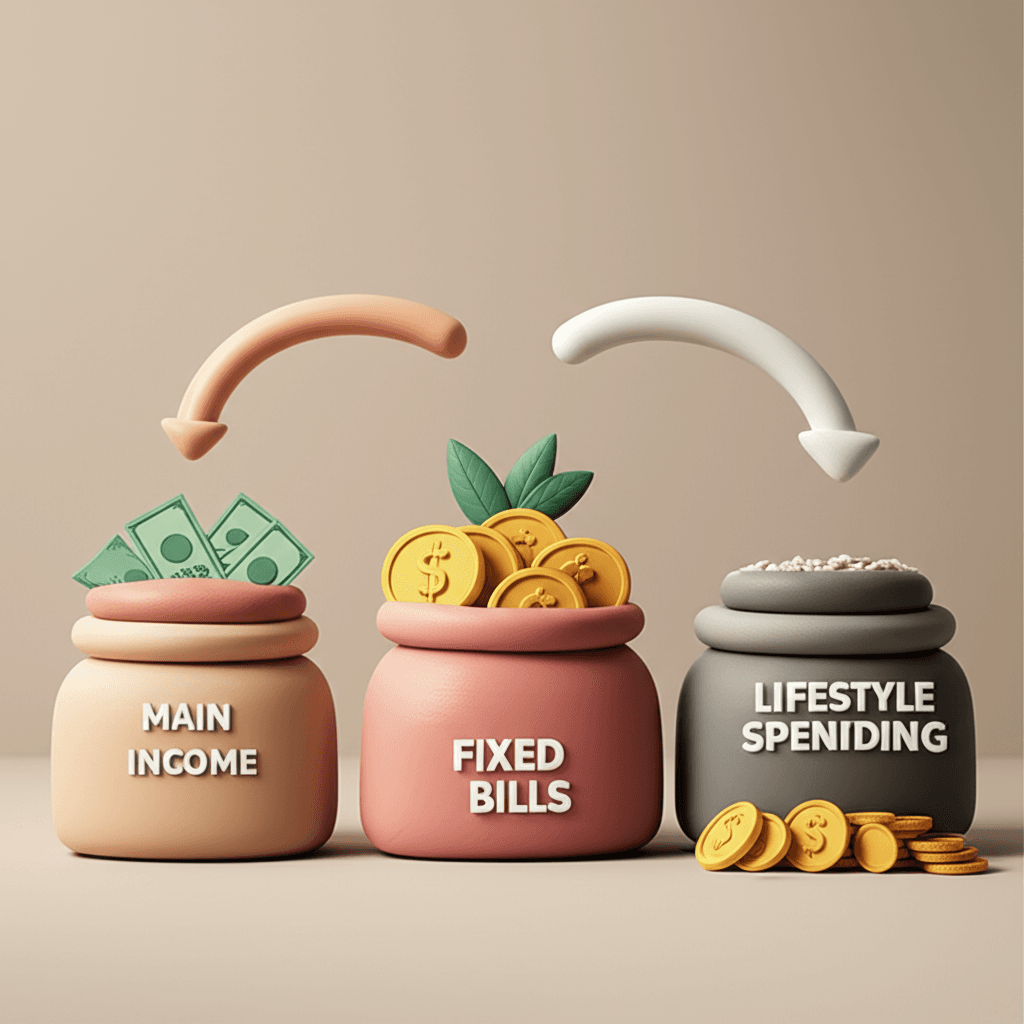

The Three-Account System

A simple and highly effective method is the three-account system. This structure automates your financial discipline and makes it harder to overspend:

1. The Main Hub Account (Savings/Income): This is your primary account where all your income is deposited. Its main purpose is to accumulate savings and act as a central point for distribution. This is your wealth-building engine. 2. The Fixed Expenses Account (Bills): Calculate the total monthly cost of all your predictable, recurring bills—rent/mortgage, insurance, utilities, loan repayments, subscriptions. Set up an automatic transfer from your Main Hub to this account each pay cycle to cover these costs. All your direct debits should come from this account. 3. The Variable Expenses Account (Lifestyle): This account is for your day-to-day discretionary spending—groceries, dining out, coffee, clothes, and entertainment. Allocate a realistic weekly or monthly budget and transfer this amount automatically from your Main Hub. This is your guilt-free spending money. When it's gone, it's gone—no dipping back into your savings.

This system works because it forces you to trap your surplus first. The money for your goals stays in the Main Hub, protected from impulsive lifestyle spending.

Common Pitfalls to Avoid

The Credit Card Trap: While credit cards can offer rewards, they also make overspending frictionless. If you use one, ensure its balance is paid off in full from your Fixed or Variable accounts each month. Don't let high-interest debt derail your progress.

Subscription Creep: Review your subscriptions regularly. Are you using that gym membership? Do you need four different streaming services? Cut anything that doesn't provide real value.

Impulse Buys: Social media and online shopping are designed to trigger impulse purchases. Implement a 48-hour rule: if you want to buy a non-essential item, wait two days. More often than not, the urge will pass.

Step 3: Spending with Intention

Building wealth is not about being excessively frugal or depriving yourself of all joy. It's about spending intentionally on things that genuinely add value to your life.

Frugality vs. Value

Ask yourself what you truly value. If a daily coffee from a local cafe helps you reset and be productive, that $5 might be a great investment. But if you have a wardrobe full of cheap clothes you never wear, that's wasted money. The goal is to maximize the value you get from every dollar you spend, a concept economists call 'utility'. This aligns with official data from sources like the Reserve Bank of Australia, which often discusses household consumption patterns.

This principle applies to major life decisions as well. Do you need an expensive, brand-new car right now, or could a reliable used vehicle free up thousands of dollars for your property deposit? Making conscious sacrifices today, like downgrading your car or moving back home temporarily, can accelerate your path to owning an asset by years.

The Goal: From Saving to Investing

Every dollar you save and every system you implement is a step towards the ultimate goal: using your money to build a portfolio of assets. Once you have a strong financial foundation and a consistent savings habit, the prospect of property investing becomes far less intimidating. You will have a clear understanding of your borrowing capacity and the ability to manage the cash flow of an investment property.

This discipline transforms you from a passive consumer into an active investor. You'll be ready to leverage powerful tools to find the right opportunities, such as an AI Property Search that can match locations to your specific financial goals and lifestyle needs.

Conclusion: Your Path to Financial Freedom

Taking control of your finances is the single most impactful step you can take toward building long-term wealth and achieving your property investment goals. It's a journey that begins with a simple decision to understand, plan, and act. By shifting your mindset from consumption to ownership, confronting your financial reality through a simple audit, and implementing an automated system for saving, you build the bedrock of financial discipline. This isn't about sacrifice; it's about empowerment. It's about making conscious choices today that will give you the freedom to live the life you want tomorrow.

Ready to turn your financial discipline into a tangible asset? Our [AI Buyer's Agent](https://houseseeker.com.au/features/ai-buyers-agent) can guide you through the next steps of your property journey, from assessing your borrowing power to finding the perfect investment.

Frequently Asked Questions

What's the easiest first step to start tracking my finances?

The simplest and most effective starting point is to conduct a historical review. Download your last three to six months of bank and credit card statements and categorise your spending. This gives you a realistic, data-driven picture of where your money is actually going, without the need for complex spreadsheets or apps initially.

Do I have to give up everything I enjoy to save for a property?

Absolutely not. The goal is intentional spending, not extreme deprivation. A smart budget allocates funds for things you genuinely value—whether that's travel, dining out, or hobbies. The key is to cut spending on things that don't bring you real joy or value, freeing up cash for what truly matters, including your savings goals.

How does my personal budgeting affect my ability to get a home loan?

Lenders and banks heavily scrutinise your spending habits and savings history when assessing your loan application. A well-managed budget with a consistent record of saving demonstrates financial responsibility and proves you can handle mortgage repayments. It directly impacts your borrowing capacity and the likelihood of loan approval.