Modern Strategies for a Complex Property Market: An Insider's Guide

Discover how rentvesting, data analysis, and innovative financing are reshaping the path to property ownership for Australians.

The Evolving Australian Property Dream

Navigating the Australian property market has become increasingly complex, especially for aspiring homeowners under 35. The traditional path of buying in your local suburb is no longer the only, or even the best, option. Today, success requires a strategic, data-informed approach. Affordability challenges in major cities like Sydney and Melbourne are pushing buyers to think creatively, exploring new strategies like rentvesting, regional investment, and leveraging expert guidance to build wealth through real estate.

The Affordability Challenge: A Shift in Perspective

The narrative that housing affordability is an insurmountable barrier for young Australians is pervasive, but it often overlooks the power of a flexible strategy. Many successful young investors get their start not by buying their dream home first, but by making a strategic initial purchase. This often means looking beyond the capital cities. For instance, purchasing a first property in an affordable regional market for a fraction of the price of a city apartment can be a powerful first step. This approach allows you to enter the market sooner, build equity, and avoid exhausting your borrowing capacity on a single, high-cost property, preserving your options for future investments.

Broadening Your Horizons: The Power of 'Rentvesting'

One of the most effective modern strategies is 'rentvesting'—renting where you want to live and buying an investment property where you can afford. This decouples your lifestyle choices from your investment decisions, allowing you to live in a desirable, often expensive, area while your capital works for you in a market with higher growth potential or better rental yields. To succeed with this approach, it's crucial to analyse different markets. Using advanced platforms to compare suburb data, rental yields, and capital growth trends is essential for identifying these hidden opportunities. A deep dive into the numbers can reveal which markets are poised for growth, a task perfectly suited for a comprehensive real estate analytics platform.

The Rise of the Expert: Navigating Information Overload

In an age of endless information, the challenge isn't finding data—it's interpreting it correctly. Working a full-time job leaves little time for the exhaustive research required to make a sound property decision. This is why buyer's agents and mortgage brokers have become indispensable. These professionals streamline the process, from identifying the right loan structure to pinpointing high-performing properties that align with your financial goals. They cut through the noise, saving you time and preventing costly mistakes. An expert can provide personalised guidance, much like the sophisticated recommendations from an AI Buyer's Agent, ensuring your strategy is tailored to your unique circumstances.

Understanding Market Dynamics and Future Risks

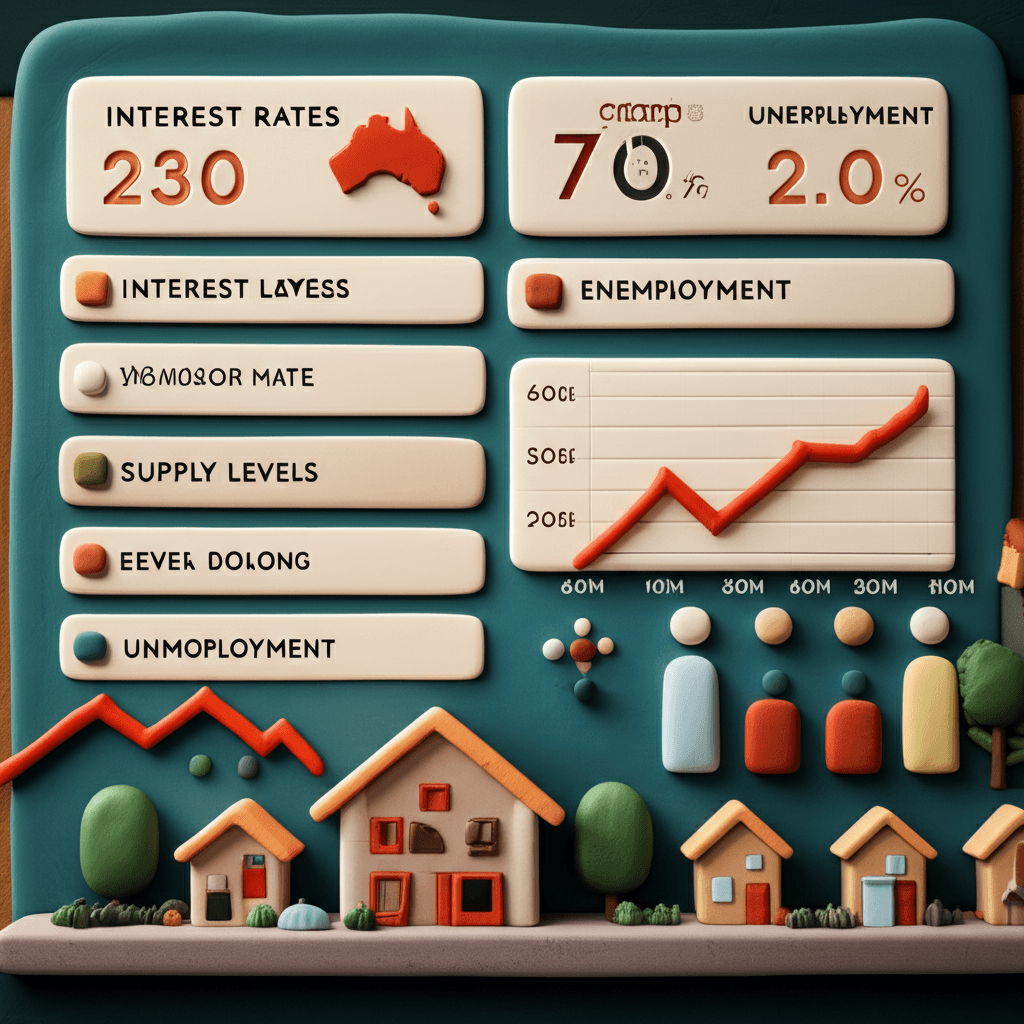

While property has historically been a strong driver of wealth in Australia, it's not without risks. Factors like rising unemployment, changes in tax legislation, and housing supply shortages can significantly impact market performance. For example, tax changes in Victoria led to a slowdown in the Melbourne market, while a persistent undersupply of housing nationally has propped up prices even during interest rate hikes. Staying ahead requires a constant analysis of these macroeconomic trends. Investors must base their decisions on solid data, not just headlines, to mitigate risks and position themselves for long-term growth.

Conclusion: A New Blueprint for Property Success

The path to property ownership in Australia has changed. The old mantra of 'pay down debt as fast as possible' is giving way to a more nuanced understanding of leverage as a tool for wealth creation. Success is no longer guaranteed by simply buying any property; it demands a proactive and informed strategy. By broadening your search criteria, considering options like rentvesting, and leveraging expert analysis, you can still achieve your property goals. The key is to be flexible, data-driven, and strategic in your approach.

Ready to make your next move with confidence? Explore HouseSeeker's advanced Real Estate Analytics tools to uncover market trends, compare suburbs, and find your ideal investment property today.

Frequently Asked Questions

What is rentvesting?

Rentvesting is a property strategy where you continue to rent in a location you enjoy living in, while purchasing an investment property in a more affordable area with strong growth potential. It allows you to enter the property market sooner without sacrificing your lifestyle.

Is it still possible for young people to enter the Australian property market?

Yes, absolutely. While affordability in major cities is a challenge, opportunities still exist. Success often involves shifting strategy, such as looking at regional markets, considering duplexes or townhouses instead of standalone houses, and utilising strategies like rentvesting to get a foothold in the market.

Why should I use a buyer's agent?

A buyer's agent is a licensed professional who specialises in searching, evaluating, and negotiating the purchase of property on behalf of the buyer. In a complex and time-consuming market, they provide expert knowledge, access to off-market deals, and professional negotiation skills to save you time, stress, and money.