Capital Growth Over Cash Flow: A Data-Driven Guide to Scaling Your Property Portfolio

Discover why prioritising long-term capital growth and leveraging equity is the key to building substantial wealth in Australian real estate.

Navigating the Australian property market in mid-2025 can feel overwhelming. Investors are bombarded with conflicting advice, sensationalist headlines, and the alluring promise of 'cash flow positive' properties. The constant noise makes it incredibly difficult to separate genuine strategy from marketing hype. Many investors, particularly those starting out, are led to believe that high rental yields are the key to building a portfolio quickly. However, this common misconception can lead to years of stagnation and missed opportunities.

This guide cuts through the noise. We will demystify the relationship between capital growth and rental yield, demonstrate how to leverage equity for intelligent scaling, and provide a framework for making objective, data-driven decisions. By focusing on the fundamentals that truly drive wealth creation, you can build a high-performing portfolio that stands the test of time.

The Great Debate: Capital Growth vs. Rental Yield

For decades, investors have debated which metric is more important: immediate cash flow from high rental yields or long-term wealth creation from capital growth. While a positive cash flow sounds appealing, the data clearly shows that capital growth is the most powerful engine for building significant wealth in property.

Why Chasing High Yields Is a Trap

The pursuit of high rental yields often forces investors into a very small, and often riskier, segment of the market. When you set a high yield as your primary filter—say, 6% or more—you are systematically eliminating the vast majority of investment opportunities across Australia.

As our internal analysis shows, targeting a gross rental yield above 6% can rule out more than 90% of suburbs nationwide. The critical question is: what is the likelihood that the best growth prospects are hiding in the remaining 10%? The odds are not in your favour. You might gain an extra 2% in annual yield, but you could be sacrificing 5-10% in potential capital growth. This is a poor trade-off that compounds negatively over time.

Think of it this way: an extra $100 per month in cash flow is helpful, but 10% capital growth on a $600,000 property is $60,000 in tax-effective equity. It's this equity that provides the real fuel for scaling your portfolio.

A Balanced, Data-Led Approach

Instead of starting your search with yield, a smarter approach is to use powerful real estate analytics to identify clusters of suburbs with strong growth fundamentals—such as high demand, low supply, and positive economic indicators. Once you have shortlisted a handful of high-potential suburbs, you can then consider yield as a secondary factor. If two suburbs have similar growth prospects, it's perfectly logical to choose the one with the slightly better yield to ease holding costs. The key is that growth potential must always come first.

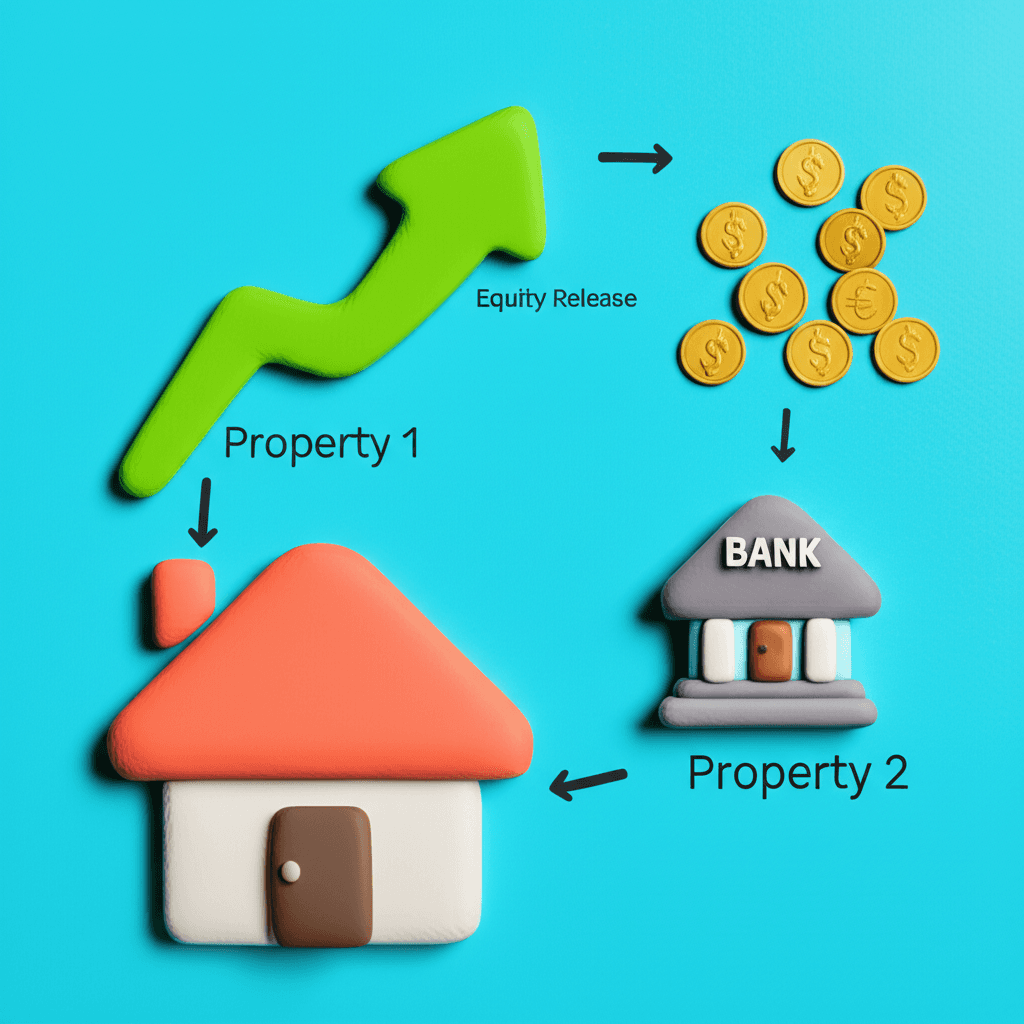

Leveraging Equity: The Key to Scaling Your Portfolio

Capital growth isn't just a number on a page; it's a tangible asset you can use to expand your portfolio. This process, known as leveraging equity, is how savvy investors accelerate their wealth creation journey without needing to save for another deposit from scratch.

The 18-Month Performance Review

How do you know if your property is performing well enough to leverage? A good rule of thumb is to conduct a thorough performance review after 18 months. At this point, you have enough data to determine if your property has delivered solid capital growth, ideally outperforming the national average. If it has, you can approach your mortgage broker to arrange a valuation and explore an equity release.

This 18-month checkpoint is also a critical moment to assess if you've made a mistake. If the property has underperformed, you can make an objective decision: hold on and hope for the best, or cut your losses and reallocate your equity to a market with better prospects.

Using Equity Wisely

When you pull out equity, it's crucial to have a clear purpose. Lenders will want to know what the funds are for. Using it as a deposit for your next investment property is a strategic move that builds your asset base. Using it to fund a luxury car or a holiday is not. The goal is to reinvest the equity into another growth asset, creating a cycle of acquisition and appreciation.

To find that next high-potential property, you can leverage advanced tools. HouseSeeker's AI Buyer's Agent can take your specific goals and financial situation to generate personalised property recommendations, streamlining the entire process.

Removing Emotion from the Investment Equation

The biggest obstacle for many investors isn't the market—it's their own emotional biases. Making decisions based on familiarity, fear, or anecdote is a recipe for underperformance. A disciplined, data-driven approach is essential for consistent success.

The Dangers of 'Backyard Bias'

One of the most common mistakes is investing only in your local area because you 'know it well.' Knowing where the best cafes are has zero correlation with capital growth drivers. The probability that the single best investment location in all of Australia happens to be in your postcode is infinitesimally small. To illustrate, over the last three years, an investor who bought a unit in parts of Perth (WA) could have seen over 45% growth, while someone who bought a unit in many parts of Sydney (NSW) might have seen less than 10%. By staying local, you risk massive opportunity cost.

Look Past the Surface Level

Investors often reject high-potential areas because of outdated reputations or superficial characteristics. A suburb might have a higher-than-average crime rate or a lower socioeconomic profile, causing an emotional reaction. However, data might show that it also has critically low vacancy rates, surging demand from renters, and significant infrastructure investment on the horizon—all powerful drivers of growth. According to data from sources like the Australian Bureau of Statistics (ABS), population shifts often precede property booms. Emotional investors miss these opportunities; data-driven investors seize them.

Protecting yourself in these markets is straightforward: 1. Landlord's Insurance: A non-negotiable safety net. 2. Expert Property Management: Hire a top-tier property manager to vet tenants thoroughly. 3. Strategic Rent Setting: Price your rent slightly below the market rate to attract a larger pool of high-quality applicants.

Avoid Analysis Paralysis and FOMO

Fear can work in two ways: fear of making a mistake (analysis paralysis) and Fear Of Missing Out (FOMO). Both are damaging. The solution is to trust a consistent, data-backed process. Use a platform with an AI property search to narrow down thousands of suburbs to a manageable shortlist based on your criteria. Once the data confirms a strong opportunity, you must have the confidence to act decisively.

Conclusion

Building a successful property portfolio in 2025 and beyond requires a clear strategy and the discipline to stick to it. By shifting your focus from the seductive but limiting allure of high rental yields to the wealth-building power of capital growth, you align your strategy with what truly matters.

Leverage comprehensive data to make unemotional decisions, strategically release equity to scale your holdings, and never let personal bias cloud your judgment. This disciplined approach will not only protect you from costly mistakes but also put you on the fast track to achieving your financial goals.

Ready to move beyond guesswork and build your portfolio with confidence? Explore HouseSeeker's powerful [real estate analytics](https://houseseeker.com.au/features/real-estate-analytics) to uncover Australia's next high-growth markets.

Frequently Asked Questions

Is a cash-flow positive property ever a good investment?

A cash-flow positive property can be a good investment, but it should never come at the expense of strong capital growth prospects. The ideal scenario is a property in a high-growth area that also happens to have a decent yield. However, if forced to choose, an investor focused on long-term wealth should almost always prioritise the property with higher growth potential over the one with slightly better cash flow.

How long should I wait before accessing the equity in my investment property?

While there's no magic number, a common guideline is to review a property's performance after 18-24 months. This provides enough time for market trends to emerge and for you to see tangible capital growth. Accessing equity too soon might not be possible, and waiting too long could mean missing out on the next buying opportunity. The decision should be based on the property's performance and your capacity to service additional debt.

Why shouldn't I just invest in my local area since I know it so well?

Your familiarity with local cafes, parks, and school reputations is lifestyle knowledge, not investment data. True investment analysis involves understanding supply and demand dynamics, vacancy rates, population growth, and economic drivers. The best investment opportunities are located by analysing data across the entire country, not just within a 10km radius of your home. A borderless investing approach dramatically increases your chances of finding a top-performing asset.