Rental Yield vs. Capital Growth: A 20-Year Australian Market Analysis

Discover the long-term relationship between rental returns and property value appreciation to inform your investment strategy.

Introduction

For Australian property investors, a critical question looms over any potential purchase: do rental yields keep pace with long-term capital growth? Many investors focus heavily on price appreciation, but understanding the dynamics of rental yield is essential for sustainable, successful investing. This article dives into 20 years of market data to unravel the intricate relationship between rent and property values, helping you move beyond speculation and make data-driven decisions.

What is Rental Yield?

Rental yield is a key metric that measures the annual return from your rental income relative to the property's value. It's a straightforward calculation that provides a snapshot of an investment's cash flow potential.

The Formula: `(Annual Rental Income / Property Value) x 100 = Gross Rental Yield (%)`

For example, if you receive $500 per week in rent ($26,000 per year) on a property valued at $500,000, your calculation would be:

`($26,000 / $500,000) x 100 = 5.2%`

How Does Rental Yield Change?

Yield is not a static figure; it fluctuates based on the interplay between two key variables: rent and property value.

1. When Property Values Fall: If your rent remains at $26,000 per year but the property's value drops to $400,000, the yield increases to 6.5%. While a higher yield seems positive, it can sometimes signal a struggling market where values are declining. 2. When Rents Rise: Conversely, if the property value stays at $500,000 but the rent increases to $600 per week ($31,200 per year), the yield rises to 6.24%. This scenario is ideal, as your cash flow improves without a loss in capital.

Critically, if both rent and property value increase by the same percentage, the yield remains constant. This highlights the ongoing tug-of-war between capital growth and rental income.

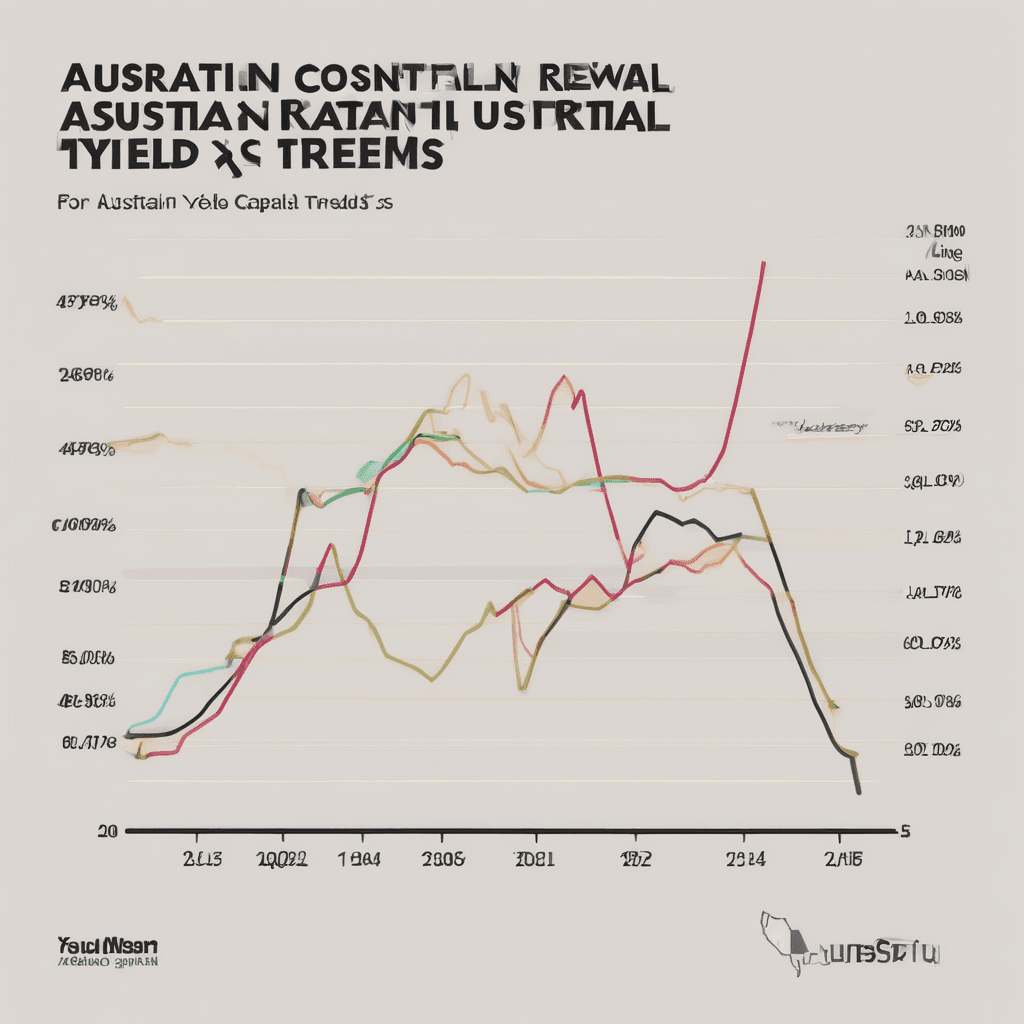

The 20-Year Relationship: Yields vs. Price Growth

Historical data shows that rental yields and capital growth do not always move in perfect harmony. There are distinct periods where one outpaces the other.

An analysis of the Australian property market over the last two decades reveals that yields have experienced cycles. There have been times, particularly when interest rates were very low, where rapid price growth suppressed yields. More recently, aggressive rent growth has caused yields to climb back towards their long-term averages.

This fluctuation is a normal part of the market cycle. It's driven by fundamental supply and demand dynamics, which affect tenant and buyer behaviour differently and at different times. Tracking these trends requires robust real estate analytics to see the full picture beyond a single point in time.

Market Dynamics: The Tug-of-War of Supply and Demand

The property market is a self-balancing ecosystem. If yields become too low, investors may sell, reducing the supply of rental properties. This undersupply, coupled with consistent tenant demand—driven by factors like population growth as tracked by the Australian Bureau of Statistics (ABS)—forces rents to rise. Higher rents then make property investment more attractive, drawing investors back into the market and increasing supply once again.

The same demand drivers influence both renters and buyers. Factors like proximity to good schools, cafes, public transport, and employment hubs make a suburb attractive for everyone. Our AI Property Search helps you find locations where these fundamental demand drivers are strong, supporting both long-term growth and rental demand.

How to Use Rental Yield in Your Investment Strategy

While rental yield is not the primary predictor of future capital growth, it is an indispensable tool for financial management.

Your primary use for yield should be cash flow analysis. Before purchasing, you must model how the property's income and expenses will impact your personal budget. A property with a higher yield might be positively geared sooner, while a lower-yield property in a high-growth area might require more significant out-of-pocket contributions.

Ultimately, a balanced approach is best. A solid investment strategy, often guided by a tool like our AI Buyer's Agent, considers both capital growth potential and the cash flow required to hold the asset for the long term.

Conclusion

Rental yields and capital growth are intrinsically linked in a constant dance of market forces. While they don't always grow in unison, they tend to balance each other out over the long term. A savvy investor doesn't chase one metric at the expense of the other. Instead, they use rental yield as a vital sign for an investment's cash flow health while focusing on properties in areas with strong, fundamental drivers of demand that will fuel both rental and capital appreciation over time.

Ready to move beyond guesswork and use powerful data to find your next investment? Explore the HouseSeeker [real estate analytics](https://houseseeker.com.au/features/real-estate-analytics) platform to uncover market trends, compare suburbs, and analyse properties with precision.

Frequently Asked Questions

Is a high rental yield always a good sign?

Not necessarily. While a high yield can indicate strong rental demand, it can also be a red flag for a market where property values are falling. It's crucial to investigate the reason behind the high yield.

Do rents and property values always grow at the same rate?

No. Historical data shows they move in different cycles. There are periods where price growth outpaces rent increases, causing yields to fall, and other times when strong rent growth pushes yields back up. This is a normal function of the property market.

What underlying factors drive both rent and price growth?

Both are driven by supply and demand. Key demand factors include population growth, local job opportunities, interest rates, and lifestyle amenities like schools, public transport, and shops. You can use an AI Property Search to identify properties in areas with these strong fundamental drivers.