The True Cost of Buying and Holding an Australian Investment Property in 2025

A detailed breakdown of the entry and ongoing costs investors face, from stamp duty and deposits to land tax and maintenance.

Introduction

Building a real estate portfolio is a proven path toward financial freedom, but many aspiring investors are stopped by one critical question: what does it actually cost? Beyond the purchase price, a series of upfront and ongoing expenses determine the feasibility of an investment. This guide breaks down the true cost of buying and holding a property in Australia for 2025, using a real-world example to forecast the numbers and help you plan your strategy with confidence.

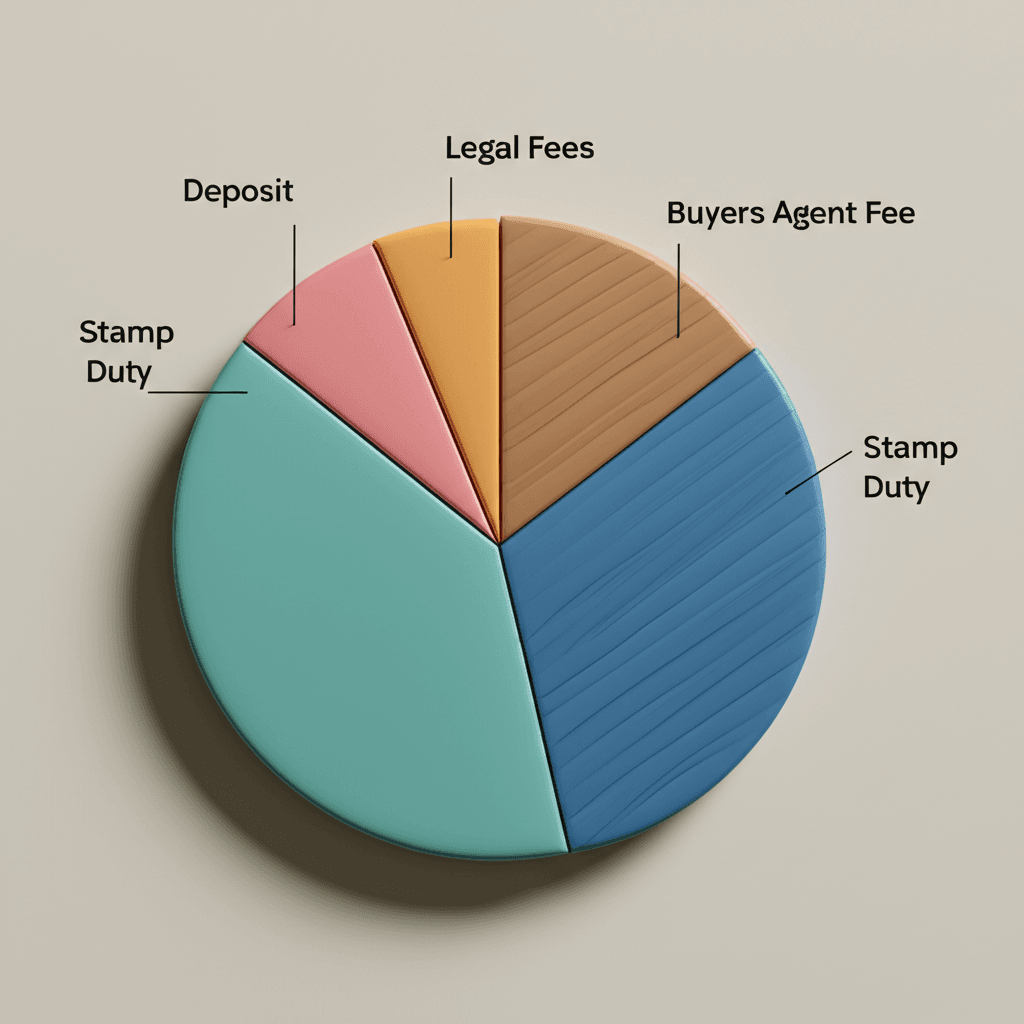

The Upfront Costs: Getting Into the Market

Your initial capital outlay is the first major hurdle. While many believe a 20% deposit is essential, a 10% deposit is often sufficient for an investment property. Let's analyse the entry costs using a typical $650,000 investment property in New South Wales as our example.

Purchase Price: $650,000

Deposit (10%): $65,000

Stamp Duty (NSW): ~$24,000

Buyer's Agency Fee: ~$20,000

Conveyancing & Legal Fees: ~$2,500

Building & Pest Inspections: ~$1,000

Combining these expenses, the total initial capital required is approximately $112,500. Note that Lenders Mortgage Insurance (LMI), applicable for deposits under 20%, can often be capitalised into the loan, reducing the immediate cash required. It's also important to distinguish this from schemes like the Home Guarantee Scheme, which offers benefits like a 5% deposit for owner-occupiers, not typically for pure investment scenarios.

Annual Holding Costs: The Ongoing Commitment

Once you've acquired the property, you need to budget for the ongoing costs of holding it. These expenses determine your annual cash flow position.

Interest Payments: On a $585,000 loan (90% of $650k) with an interest-only rate of 5.5%, monthly payments would be around $2,700.

Council & Water Rates: These are local government taxes that contribute to infrastructure and services.

Insurance: Landlord and building insurance can range from $1,500 to $3,000 annually, depending heavily on the property's location and risk factors like flood or bushfire zones. Proper due diligence is critical here, as a property in a high-risk zone could have premiums as high as $20,000, severely impacting its viability.

Property Management: Fees typically range from 7% to 15% of rental income, varying by state. While self-management is an option for a single local property, it isn't scalable for a diversified portfolio. Investing in a quality property manager ensures your asset is well-maintained and tenanted.

Maintenance Buffer: A buffer of around $2,000 per year is wise. Often, the highest maintenance costs occur in the first year of ownership as you address issues left by the previous owner. This fund covers unexpected repairs like a broken air conditioner or dishwasher down the line.

Calculating Your Cash Flow and The Impact of Negative Gearing

For a $650,000 property with a rental yield between 4.5% and 5.5%, the annual out-of-pocket cost, or negative cash flow, is typically between $7,000 and $12,000. Let's use a ballpark figure of $10,000 per year.

This is where tax deductions, or negative gearing, come into play. You can claim all your expenses—including interest, rates, and fees—against your taxable income. This can result in a tax refund of $2,000 to $4,000, reducing your actual post-tax holding cost to a more manageable $6,000 to $8,000 per year.

Two key variables will influence this over time: 1. Rental Growth: Rents typically increase by around 5% annually, which helps close the cash flow gap. 2. Interest Rates: As we move through the interest rate cycle, even a small drop of 0.50% can significantly reduce your holding costs. Over a 3-5 year period, these factors often allow a property to become cash-flow positive.

Strategic Planning: Understanding Land Tax

As you scale your portfolio, land tax becomes a significant consideration. It is levied by state governments on the unimproved land value of your investment properties, while your primary place of residence is exempt. Each state has a different tax-free threshold.

For example, the threshold in New South Wales is over $1 million. Once the total land value of your properties in that state exceeds this amount, you begin paying land tax. This is why diversification is a crucial strategy. By purchasing properties in different states, you can utilise each state's tax-free threshold, significantly reducing or eliminating your overall land tax bill. This requires deep market knowledge, which is where an expert team can provide immense value by identifying high-growth markets nationwide. For a deeper dive into market trends, explore our real estate analytics platform.

Conclusion

While buying and holding property involves significant initial and ongoing costs, a clear understanding of the numbers makes it an achievable and powerful wealth-building strategy. The annual holding cost of $6,000 to $8,000 after tax is a calculated expense for acquiring a high-growth asset. With a strategic approach that includes careful due diligence, professional management, and geographic diversification, you can effectively manage these costs and build a successful portfolio.

Ready to move from planning to action? Use HouseSeeker’s powerful Data Analytics Hub to analyse markets, compare suburbs, and find investment opportunities that align with your financial goals.

Frequently Asked Questions

How much deposit do I really need for an investment property?

For an investment property, a 10% deposit is often sufficient to secure a loan. While a 20% deposit allows you to avoid Lenders Mortgage Insurance (LMI), many investors prefer to use a smaller deposit and pay for LMI (or capitalise it) to get into the market sooner or to preserve capital for future purchases.

Is negative gearing a good investment strategy?

The goal of property investment is long-term capital growth, not a tax outcome. Negative gearing is a consequence of your expenses temporarily exceeding your rental income, which provides a tax benefit. The strategy is viable if the property's anticipated capital growth far outweighs the short-term holding costs.

Why is diversifying my portfolio across different states so important?

Diversification is crucial for two main reasons. Firstly, it minimises land tax by allowing you to take advantage of the tax-free threshold in multiple states. Secondly, it reduces risk by spreading your investment across different property market cycles, so you aren't solely reliant on the performance of one city or state. Finding the right properties across the country is made easier with tools like our AI Buyer's Agent.