How to Outperform 99% of Real Estate Investors in Australia for 2025

Master advanced concepts like LMI, interest-only loans, and data-driven asset selection to accelerate your property investment journey.

Navigating the Australian property market can feel overwhelming. With conflicting headlines and conventional wisdom that often feels outdated, it's easy to feel stuck. However, a small percentage of savvy investors consistently outperform the market by understanding and applying a handful of powerful, often misunderstood, strategies. This guide will demystify seven core concepts that, when executed correctly in 2025, can place you in the top 1% of property investors.

We will break down complex ideas into simple, actionable steps, moving beyond the noise to focus on what truly drives wealth accumulation in Australian real estate. Whether you're just starting or looking to scale your existing portfolio, these principles will provide a clear roadmap for success.

1. Rethink Lenders Mortgage Insurance (LMI)

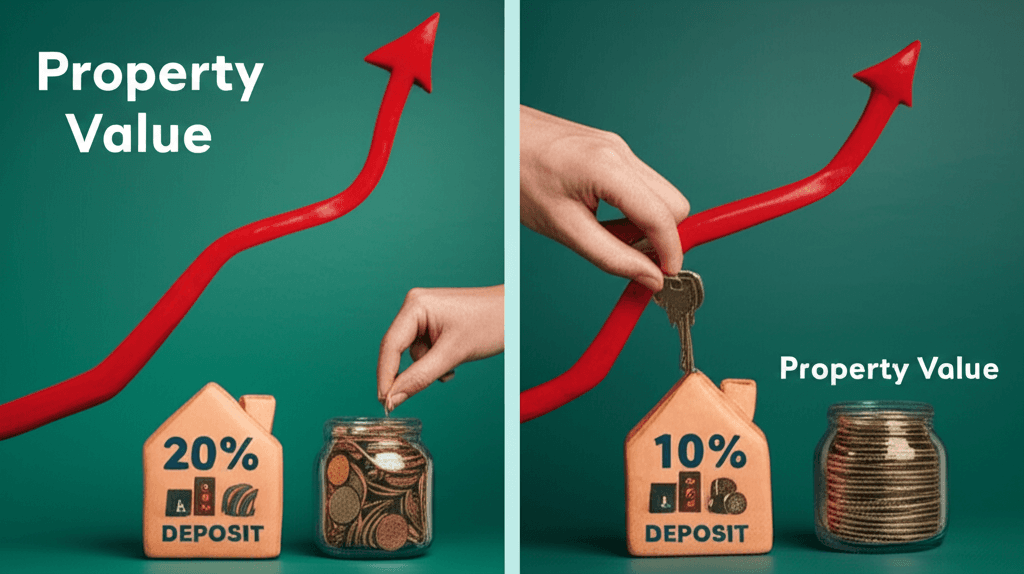

One of the biggest hurdles for aspiring investors is saving the traditional 20% deposit. The media often frames this as an insurmountable barrier, but it ignores a crucial tool: Lenders Mortgage Insurance (LMI).

What is LMI?

LMI is an insurance policy that protects the lender, not you, if you default on your loan. It's typically required when you borrow more than 80% of a property's value. While it's an added upfront cost, viewing it as a strategic expense rather than a penalty can be a game-changer.

The Cost of Waiting vs. The Cost of LMI

The critical question isn't if you should pay LMI, but what the cost of avoiding it is. Consider this scenario:

Property Value: $800,000

20% Deposit: $160,000

10% Deposit: $80,000

How long would it take you to save the extra $80,000? For many, this could be 12 to 24 months. In that time, if the property market grows by just 5%, that $800,000 property is now worth $840,000. The capital gain you missed ($40,000) could easily outweigh the cost of LMI, which might have been $15,000-$20,000.

By entering the market sooner with a smaller deposit, you gain more 'time in the market,' which is the single most critical factor for capital growth. Furthermore, it allows you to deploy capital more efficiently. Instead of putting a $200,000 deposit on one $1 million property, you could potentially use it as two separate 10% deposits for two $1 million properties, effectively doubling your exposure to market growth.

The Risk: The main downside is the risk of negative equity if the market falls shortly after you buy. If your $800,000 property drops to $700,000 and your loan is $720,000, you owe more than the asset is worth. This is why precise asset selection, backed by deep real estate analytics, is non-negotiable when using this strategy.

2. Strategic Debt Management: Interest-Only vs. Principal & Interest

During the wealth accumulation phase, your primary goal is to acquire high-quality, growth-oriented assets. How you structure your debt is central to achieving this.

The Accumulation Mindset

Think of it this way: you are in a race to build your asset base. Taking on debt to buy property (accumulation) while simultaneously trying to aggressively pay it down (reduction) is like trying to run a sprint while blindfolded and drinking water. You're working against yourself.

An Interest-Only (IO) loan requires you to only pay the interest component for a set period (typically 1-5 years). A Principal and Interest (P&I) loan requires you to pay back both the interest and a portion of the original loan amount.

For an investor focused on scaling, an IO loan offers a significant advantage: cash flow. By lowering your monthly repayments, you free up cash. This improved serviceability can be the difference between being able to hold one property on P&I versus two properties on IO. Your goal is to control more high-growth assets, and IO loans are a tool to facilitate that by minimising holding costs.

The focus should be on building a foundational portfolio of buy-and-hold properties first. Once that foundation is solid, you can shift your focus to debt reduction or more aggressive strategies like developing.

3. Unlocking Growth: Using Equity to Scale Your Portfolio

Saving a new deposit for every property purchase is the slow road to wealth. The fastest way to scale is by using the equity created in your existing properties. Equity is the difference between your property's current market value and the amount you still owe on the loan.

As your property increases in value and you pay down a small portion of the loan, your equity grows. Lenders will typically allow you to borrow against this equity, up to 80% of the property's new value. This unlocked equity can then be used as the deposit for your next investment purchase.

This creates a powerful compounding effect: a well-chosen property grows in value, creating equity that funds the purchase of the next property, which then does the same. This is how sophisticated investors rapidly build multi-property portfolios without saving for years between acquisitions.

4. Gearing for Success: Positive vs. Negative Gearing

Media headlines often stir debate around negative gearing, but successful investors focus on the numbers, not the politics.

Negative Gearing: A property is negatively geared when the rental income is less than the expenses (like mortgage interest, strata, and maintenance). The investor makes up the shortfall from their own pocket, which can be claimed as a tax deduction.

Positive Gearing (or Positive Cash Flow): The property's rental income is greater than all its expenses, putting money back into your pocket.

While positive cash flow is the ideal end state, you shouldn't dismiss a property just because it's initially negatively geared. In a high-interest rate environment, many high-quality assets might be neutral or slightly negative. However, this is often a temporary state. As strong rental demand pushes rents up over the next 1-3 years and interest rates eventually stabilise or fall, as projected by sources like the RBA, today's negatively geared property can become tomorrow's positive cash flow engine.

The key is to look ahead. By purchasing when others are fearful of negative cash flow, you face less competition and can secure a better asset. When the property becomes cash flow positive, not only will you have benefited from capital growth, but you'll also own an asset that everyone else now wants.

5. Asset Selection: Beyond the Units vs. Houses Debate

Too many investors get caught in the simplistic 'houses vs. units' argument. The truth is that the type of dwelling is less important than its specific characteristics and its market context.

A rundown house in a low-demand area with no growth drivers will always underperform a unique, well-located apartment in a supply-constrained, high-demand suburb. The key is to find assets with scarcity and strong owner-occupier appeal.

When analysing any property, use a powerful platform for real estate analytics to answer these questions:

Supply: Is there a flood of new high-rise developments planned for the area that could dilute value? Or is it a tightly held boutique block?

Demand: Who wants to live here? Is it a demographic with growing income? Are they families who need houses, or young professionals who value proximity to amenities and prefer units?

Uniqueness: Does the property have a desirable floor plan, natural light, a view, or a unique architectural style that sets it apart?

A balanced portfolio often contains a mix of houses, townhouses, and units, each chosen for its specific strengths within its own market.

6. The Professional Edge: Buyer's Agent vs. Real Estate Agent

A common mistake for new investors is believing the seller's real estate agent is there to help them. A real estate agent is a sales agent, legally and financially bound to achieve the best possible outcome—the highest price—for the person paying them: the vendor.

A buyer's agent works exclusively for you, the buyer. Their role is to find, analyse, negotiate, and secure the best possible property at the best possible price. Just as you wouldn't use the seller's lawyer in a legal dispute, you shouldn't rely on the seller's agent for impartial advice.

Engaging a professional service like an AI Buyer's Agent provides you with market expertise, access to off-market deals, and a data-driven strategy to avoid emotional mistakes and costly errors.

7. The 'Rentvesting' Advantage: Live Where You Want, Invest Where it Counts

'Rentvesting' is a powerful strategy, especially for young Australians in expensive capital cities. It involves renting in a location that suits your lifestyle while investing your capital in a different area where the numbers make more sense for growth and yield.

This approach decouples your personal living situation from your investment strategy. You can enjoy the flexibility and lifestyle of renting in a desirable inner-city suburb, without being tied down to a large, non-deductible mortgage on a home that may not be a great investment.

Meanwhile, your deposit can be directed towards a property in a high-growth corridor interstate, identified through our AI property search tools. This property can deliver superior capital growth and rental returns, accelerating your wealth far faster than an emotionally-driven purchase in your own backyard. You get the best of both worlds: lifestyle freedom and an optimised, wealth-building asset base.

Conclusion

To outperform the average investor in 2025, you must think differently. It's about making calculated, strategic decisions based on data, not emotion or outdated advice. By understanding and applying these seven concepts—leveraging LMI, using interest-only loans for accumulation, unlocking equity, looking ahead on gearing, selecting assets based on scarcity, engaging professional help, and embracing rentvesting—you can build a robust property portfolio that sets you on the fast track to financial freedom.

Ready to stop guessing and start making data-backed investment decisions? Explore HouseSeeker's powerful real estate analytics to find your next high-growth property today.

Frequently Asked Questions

Isn't paying LMI just throwing money away?

It's a calculated business expense. If the cost of LMI allows you to enter the market 12-18 months earlier and capture capital growth that far exceeds the LMI premium, it's a strategically sound investment in your time in the market.

Is negative gearing a bad strategy with today's interest rates?

Not necessarily. A property that is slightly negatively geared today could become cash flow positive within 1-2 years as rents rise. Buying when others are hesitant due to cash flow concerns often means less competition and better long-term value. The key is to ensure you have the financial buffer to cover the shortfall in the short term.

Can I really build a portfolio without a buyer's agent?

Yes, it is possible, but it requires a significant investment of time, research, and emotional discipline. For investors who lack the time, specific market knowledge, or confidence to negotiate effectively, using a service like an AI Buyer's Agent can de-risk the process, prevent costly mistakes, and provide access to better opportunities, often saving you more than their fee in the long run.