Unlocking Your Portfolio's Potential: An Investor's Guide to Trust Lending

Discover how strategic financing and trust structures can help you scale your investments in today's fast-paced Australian property market.

The Unforeseen Property Boom is Here

Australia's property market is experiencing an unexpected surge, with an intensity that many experts compare to the post-COVID boom. A key indicator of this heated activity is the significant delay in bank loan processing times, with some lenders taking four to five weeks just to pick up a new application. This backlog signals a market flooded with buyers, creating a competitive environment where strategic advantages are more crucial than ever. For savvy investors, this isn't a time for hesitation; it's a time for sophisticated financial planning.

[INSERT_IMAGE: { "prompt": "A split-screen image showing a busy real estate auction on one side and a stressed bank employee surrounded by stacks of loan applications on the other, symbolizing a heated market.", "alt": "The Australian property market is experiencing a surge reminiscent of the COVID boom, indicated by extremely long bank processing times for loan applications." }]

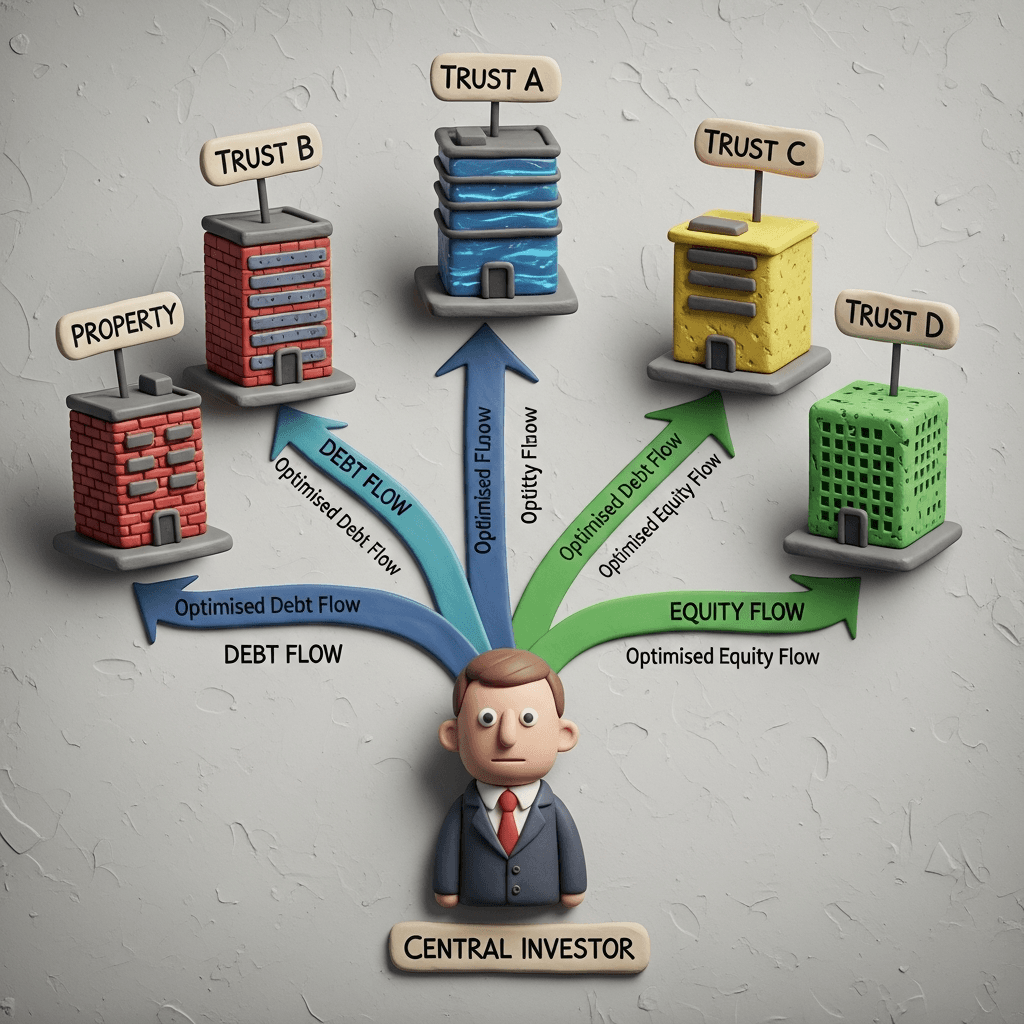

The Rise of Trust Lending for Portfolio Growth

In this high-stakes environment, experienced investors are moving beyond standard loan structures and embracing advanced strategies like trust lending. Previously a niche option, purchasing property within a trust has become a mainstream strategy for those looking to build a multi-property portfolio. The primary advantage lies in the ability to structure finances in a way that can enhance borrowing capacity. By setting up a new trust for each purchase, investors can often demonstrate to a new lender that previous investment debts are self-sufficient, effectively 'ring-fencing' them and freeing up serviceability for the next acquisition.

Navigating a Shifting Lending Landscape

This 'golden patch' of trust lending is, however, attracting scrutiny. Banks are beginning to tighten their policies in response to the rapid portfolio growth they are seeing, even on modest incomes. Major players like Macquarie Bank have already adjusted their rules, and it's anticipated that others will follow. Future restrictions could include capping Loan-to-Value Ratios (LVRs) at 80% or lower for trust loans, mandating accountant letters to prove a trust's self-sufficiency, or even requiring evidence that the property is neutrally geared. Staying ahead requires investors to be agile and well-informed, adapting their strategies as the lending environment evolves.

Why Strategic Equity Release Trumps a Low Interest Rate

For investors focused on growth, the primary goal isn't just securing the lowest interest rate—it's about maximising access to equity. A strategic mortgage broker understands that the right lender can unlock significantly more capital, which is the fuel for future purchases. For example, while several banks might value a property at $460,000 and offer a $64,000 equity release, another lender might provide a valuation of $560,000, releasing $164,000. That extra $100,000 in equity means an investor can fund the deposit for their next property without using their own cash, keeping those funds in an offset account and ready for the subsequent purchase. This is how portfolios are scaled from one property to three in rapid succession.

An Advanced Strategy: Refinancing into a Trust

An even more sophisticated technique involves refinancing a loan for a property held in personal names into a trust structure, while the ownership remains personal. This allows the investor to continue claiming negative gearing benefits personally, while the debt is effectively ring-fenced within the trust from the perspective of some lenders. This can free up personal borrowing capacity for future investments. However, this is a complex strategy with significant caveats. It's only available through a handful of lenders, and the inability to claim negative gearing within the bank's servicing calculator can sometimes reduce, rather than increase, overall borrowing power if not planned correctly.

Conclusion

The current property market presents both immense opportunity and significant challenges. Thriving in this 'COVID-esque' boom requires moving beyond conventional thinking. By prioritising strategic outcomes over simple metrics like interest rates, investors can unlock their portfolio's true potential. Advanced strategies like trust lending and a relentless focus on equity release are the keys to rapid, sustainable growth. As the lending landscape continues to shift, partnering with experts who understand these complex structures is essential for making informed, powerful, and wealth-building decisions.

Ready to make smarter, data-driven investment decisions? Explore HouseSeeker's Real Estate Analytics Hub to analyse market trends and uncover your next opportunity.

Frequently Asked Questions

What is trust lending for property investment?

Trust lending involves obtaining a mortgage where the borrower is a trust entity rather than an individual. This structure is often used by property investors to separate assets, provide asset protection, and strategically manage debt to maximise borrowing capacity for building a larger portfolio.

Why is maximising equity more important than a low interest rate for investors?

For investors focused on scaling, equity is the capital needed to purchase more properties. While a low interest rate saves money on repayments, unlocking an extra $50,000 or $100,000 in equity can provide the entire deposit for the next investment property. This allows for faster portfolio growth than slowly saving a new deposit, making it a higher priority for accumulation-phase investors.

Are banks making it harder to get investment loans through trusts?

Yes, the lending landscape is tightening. Due to the popularity and effectiveness of trust lending strategies, some banks are introducing stricter policies. This may include lower LVR limits, mandatory P&I repayments on higher LVRs, and stricter verification requirements to ensure that existing trust debts are genuinely self-sufficient before approving new loans.