Using Home Equity to Build a Property Portfolio: An Australian Investor's Guide

Unlock the financial strategy smart investors use to leverage one property's growth to fund the purchase of many, accelerating your wealth creation.

Introduction: The Challenge of Building a Property Portfolio

Navigating the Australian property market in mid-2025 presents a significant hurdle for aspiring investors: the daunting task of saving a substantial cash deposit. The traditional path of saving 20% for a single property can feel like a slow, arduous journey, potentially taking years to accumulate the necessary funds for just one investment. This drawn-out process can delay your wealth creation goals, leaving you on the sidelines while the market continues to move.

However, what if there was a more efficient, strategic way to build your portfolio? A method that allows you to acquire multiple properties without needing to save a six-figure deposit for each one? This guide will demystify the powerful strategy of using the equity in one property to fund the purchase of others. We will break down the numbers, compare the slow way with the smart way, and show you how to accelerate your journey towards financial freedom through real estate.

The Conventional Path: The 20% Deposit Grind

For generations, the standard advice for buying property has been to save a 20% deposit to avoid Lenders Mortgage Insurance (LMI) and secure a loan for the remaining 80%. While this is a conservative and safe approach, it is also incredibly slow for portfolio building.

Let's consider a practical example. Imagine you want to purchase a $450,000 investment property.

20% Deposit: $90,000

Associated Costs (Stamp Duty, Legal Fees etc.): ~$20,000

Total Cash Required: $110,000

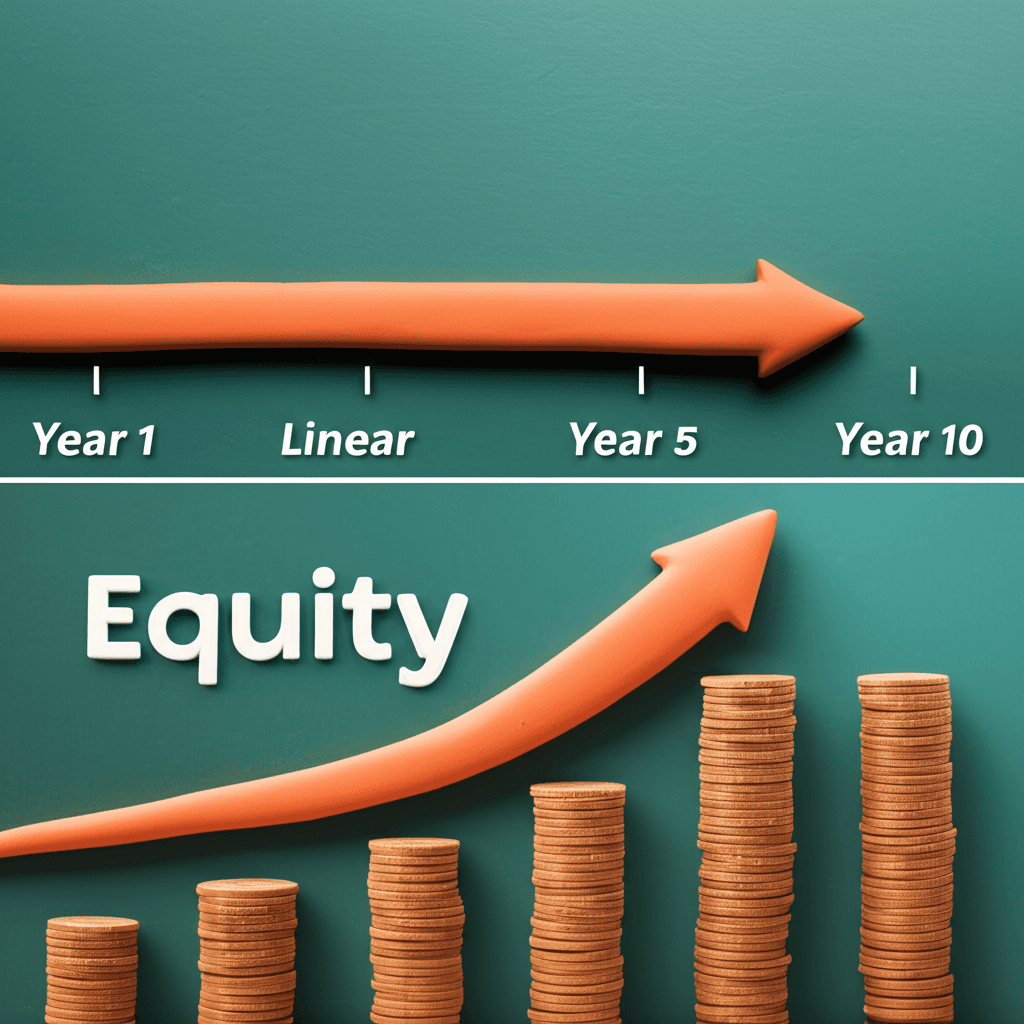

Saving over $100,000 is a monumental task for most Australians. If you manage to save this amount and buy your first property, the process to acquire a second one starts all over again. Assuming you need another three to four years to save the next deposit, it could take over a decade just to acquire three properties. This linear, cash-heavy approach significantly limits the speed at which you can build a substantial asset base.

This method is like choosing to walk 35 kilometres when you have a car available. While you'll eventually get there, you've lost your most valuable asset: time.

The Accelerated Path: Leveraging Equity for Rapid Growth

Smart investors understand that the true power of property lies not just in rental income, but in capital growth and the ability to leverage it. Instead of saving for years, you can use the increased value—the equity—in your existing property as the deposit for your next purchase. This transforms your portfolio from a linear progression into a potential exponential growth curve.

How Does It Work?

1. Purchase a High-Growth Asset: The strategy begins with acquiring a quality investment property in an area poised for growth. Making an informed decision here is critical, and leveraging sophisticated real estate analytics is non-negotiable. 2. Allow for Capital Growth: As the market value of your property increases over time (e.g., 12-18 months), you build equity. 3. Access the Equity: You work with a mortgage broker to refinance your loan or establish a line of credit, allowing you to access a portion of this newly created equity. 4. Reinvest: You use the accessed equity as the full deposit for your next investment property. 5. Repeat: As your portfolio grows, so does your equity base, allowing this cycle to repeat and accelerate, enabling you to buy more properties without contributing significant amounts of new cash from your salary.

This strategy hinges on one crucial factor: buying the right property that will actually grow in value. A dud investment won't generate the equity needed, and the entire strategy stalls.

A Practical Walkthrough: Calculating and Accessing Usable Equity

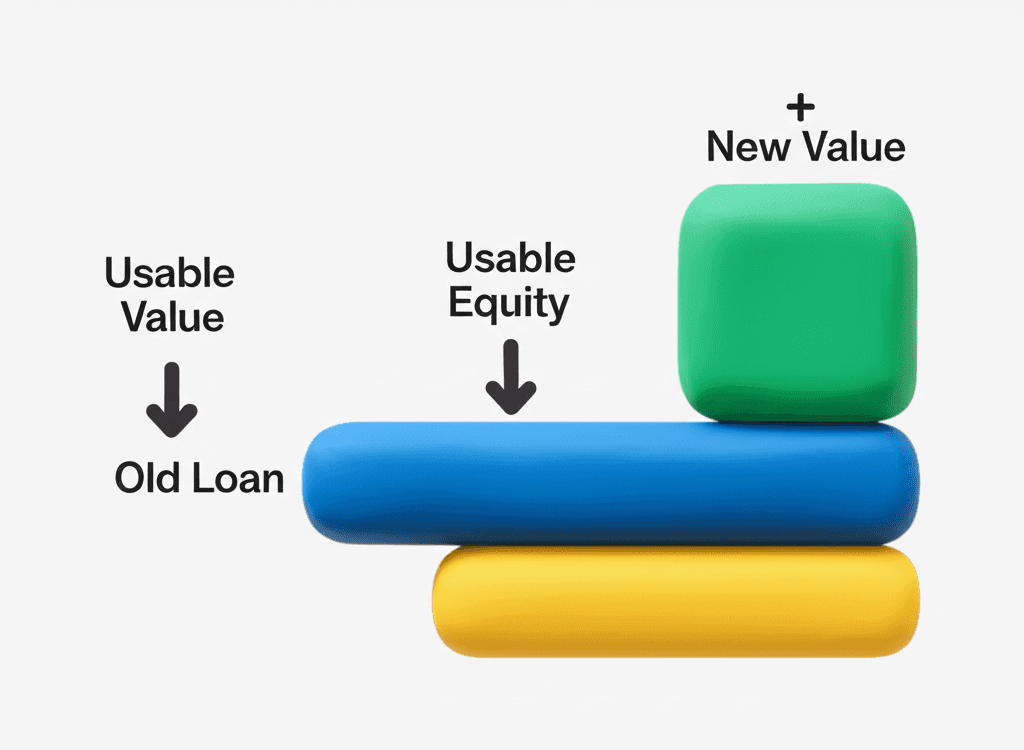

Understanding the numbers is key. Many investors mistakenly believe that if their property grows by $100,000, they can use all of that as a deposit. Banks, however, will only lend against a certain percentage of the property's new value, typically 80-90%. This accessible portion is called 'usable equity'.

Let's break down an example based on the accelerated model.

Step 1: The Initial Purchase

Instead of a 20% deposit, you opt for a 10% deposit to get into the market sooner.

Purchase Price: $450,000

10% Deposit + Costs (incl. LMI & potential buyer's agent fee): ~$75,000

Initial Loan Amount (90% LVR): $405,000

By using a smaller deposit, your initial cash outlay is reduced by $35,000 compared to the traditional method, allowing you to enter the market faster.

Step 2: The Impact of Capital Growth

Let's assume you've used an AI Property Search tool to find a property in a high-performing suburb. After 12 months, it experiences 12.5% growth, a realistic figure in strong markets as tracked by sources like CoreLogic.

Initial Value: $450,000

Growth (12.5%): +$56,250

New Property Value: $506,250

Your property is now worth significantly more, and this is where the opportunity lies.

Step 3: Calculating Your Usable Equity

Here’s the formula to determine how much cash you can actually pull out for the next deposit:

Usable Equity = (New Property Value x Max LVR%) - Existing Loan Balance

Let's use a 90% Loan-to-Value Ratio (LVR) for this calculation.

Maximum New Loan: $506,250 (New Value) x 90% = $455,625

Existing Loan Balance: $405,000

Usable Equity: $455,625 - $405,000 = $50,625

This $50,625 is the tax-free cash you can access from your loan to use as a deposit for your next investment.

Step 4: Purchasing Property #2

To buy your second $450,000 property, you again need a ~$75,000 deposit. With $50,625 available from your equity, you only need to save an additional $24,375 from your own income. This is a far more achievable goal than saving another $110,000 from scratch.

The Results: A Tale of Two Strategies (12-Month Comparison)

Let's see where each strategy leaves you after just one year.

Properties Owned: 1

Total Cash Outlay: $110,000

Portfolio Value (with 7% growth): $481,500

Equity Growth: $31,500

Properties Owned: 2

Total Cash Outlay: $75,000 (initial) + $24,375 (saved) = $99,375

Portfolio Value: $506,250 (Property 1) + $450,000 (Property 2) = $956,250

Equity Growth: $56,250

The investor using the equity strategy now controls a portfolio worth nearly double, has a higher rate of capital growth, and achieved it with less cash out of their pocket. This is how sophisticated investors build multi-million dollar portfolios in a decade, not a lifetime.

Conclusion: Build Your Portfolio the Smart Way

Building a property portfolio is one of the most effective ways to create long-term wealth, but the strategy you choose will determine your timeline to success. While the traditional method of saving large cash deposits is safe, it is painfully slow.

By understanding and correctly implementing an equity-based strategy, you can harness the power of capital growth to do the heavy lifting for you. This approach allows you to expand your asset base rapidly, build momentum, and achieve your financial goals years, or even decades, sooner. Success requires a data-driven approach to property selection, a solid understanding of the numbers, and the right expert team to guide you.

Ready to identify high-growth properties for your portfolio? Explore HouseSeeker's powerful real estate analytics to make data-driven decisions and find your next investment.

Frequently Asked Questions

What is LVR and why is it important for accessing equity?

LVR stands for Loan-to-Value Ratio. It represents the percentage of a property's value that is financed by a loan. For example, a $400,000 loan on a $500,000 property is an 80% LVR. It's crucial for accessing equity because banks set a maximum LVR they will lend against (e.g., 90%). Your ability to borrow is limited by this ceiling, which directly determines your usable equity.

Can I use the equity from my own home to invest?

Yes, absolutely. Using the equity from your Principal Place of Residence (PPoR) is one of the most common and effective ways to start or expand an investment portfolio. Because your own home is often your largest asset and has likely seen significant growth, it can be a powerful financial springboard for acquiring income-producing investment properties.

What are the risks of using equity to invest?

Leveraging equity increases your total debt, which comes with risks. If the property market declines, you could end up with a loan balance that is close to or even exceeds your property's value (negative equity). Additionally, a larger loan portfolio means higher repayments, which you must be able to service, especially if interest rates rise or you have a rental vacancy. It is essential to have a financial buffer and work with an expert team, including a mortgage broker and a service like our AI Buyer's Agent, to mitigate these risks.