Wage Growth vs. Capital Growth: Debunking a Common Property Myth with Data

We put the popular 'follow the money' theory to the test. The results might surprise you and change how you approach property investment.

The Alluring Simplicity of 'Following the Money'

In the world of property investment, you'll often hear the advice: "Follow the money." The logic seems simple and intuitive—areas with high and rising incomes should see strong property price growth. Many so-called experts claim that analysing wage growth is the most important piece of data for predicting future capital growth. They argue that as people earn more, they can afford to pay more for housing, driving prices up.

This theory suggests that by identifying suburbs where incomes are growing faster than the state average, you can pinpoint the next property hotspots. It’s a compelling narrative, but is it backed by real-world data, or is it just clever marketing disguised as expert insight?

The Theory in Action: A Tale of Two Postcodes

To test this theory, let's examine a case study often presented by its proponents, comparing two postcodes in Victoria. The first, Postcode 3011 (including suburbs like Footscray and Seddon), is presented as the 'ideal' investment, having shown exceptional wage growth. The second, Postcode 3337 (covering the Melton area), is flagged as an area to 'avoid' due to its wage growth lagging behind the state average.

Charts based on Australian Bureau of Statistics census data show a clear trend. From 1991 to 2021, Postcode 3011 started with lower average wages than the Victorian average but quickly outpaced it. In contrast, Postcode 3337 consistently had wage growth below the state average. Based on the 'follow the money' theory, the investment choice seems obvious: buy in 3011.

The Surprising Reality: When Data Contradicts the Narrative

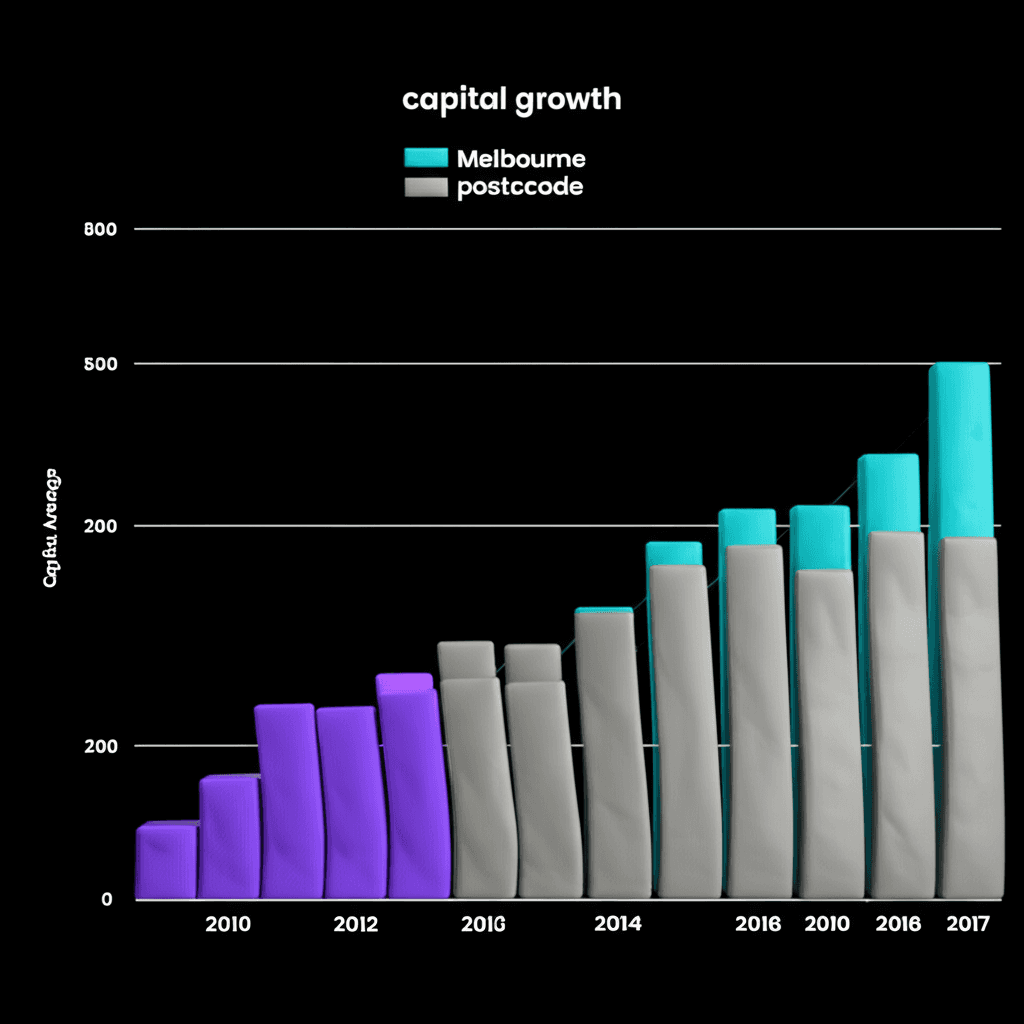

If the wage growth theory held true, investing in Postcode 3011 during its peak growth periods should have yielded superior returns. The data shows two standout periods to buy were in 2011 and 2016, when its wage growth was more than double the state average. So, what happened to property prices?

The results are staggering and completely contradict the theory. An analysis of capital growth from those key buying periods to early 2025 reveals that the 'ideal' high wage-growth area (Postcode 3011) significantly underperformed. It not only failed to beat the state average but was also outperformed by the supposedly 'inferior' low wage-growth area (Postcode 3337).

In fact, for investors who bought in 2016, the Melton area (3337) delivered more than double the capital growth of the Footscray area (3011). The very metric that was supposed to guarantee success led investors to a drastically underperforming asset. This demonstrates the immense danger of relying on a single, oversimplified indicator for complex investment decisions.

Beyond the Hype: The Need for Deeper Analysis

Why does this popular theory fail so spectacularly? Because property markets are complex ecosystems driven by dozens of interconnected factors. Wage growth is just one small piece of the puzzle. A rise in average income could be due to gentrification, with wealthier individuals moving in, rather than existing residents getting pay rises. Furthermore, higher earners don't necessarily spend their extra income on property; it could go towards holidays, cars, or other investments.

Critical drivers of capital growth often include:

Supply and Demand: The fundamental balance of available properties versus the number of buyers.

Infrastructure Investment: New transport, schools, and hospitals can transform an area.

Demographic Shifts: Changes in population size, age, and household structure.

Market Sentiment: The overall confidence of buyers and sellers.

Relying on a single metric is not just lazy analysis; it's a misleading marketing tactic. True property investment success comes from a holistic approach that examines a wide range of data points to understand the full story of a location. This is where comprehensive tools, like those offered by HouseSeeker's Data Analytics Hub, become essential.

Conclusion

The belief that high wage growth automatically leads to high capital growth is an appealingly simple but dangerously flawed theory. As our analysis shows, the 'ideal' location based on this metric was a significant underperformer, while the 'avoid' location delivered exceptional returns. This highlights a critical lesson for all investors: be wary of anyone selling a silver-bullet solution. The key to outperforming the market is not to follow a single indicator but to embrace comprehensive, multi-faceted data analysis and challenge every assumption.

Ready to move beyond the hype and make truly data-driven decisions? Explore HouseSeeker's powerful real estate analytics to uncover genuine investment opportunities based on what truly drives market growth.

Frequently Asked Questions

Is wage growth completely useless for property analysis?

Not entirely. It can be a useful secondary indicator for understanding the economic profile of a suburb. However, it should never be the primary or sole basis for an investment decision. It is one small piece of a much larger and more complex puzzle.

What are some more reliable indicators of capital growth?

More reliable leading indicators often relate directly to supply and demand dynamics. These include metrics like Days on Market (DOM), stock on market levels, building approval rates, auction clearance rates, and vacancy rates. Analysing these in combination provides a much more accurate picture of a market's potential.

How can I avoid being misled by property market hype?

Always be critical of advice that relies on a single data point or a simple narrative. Seek out analysis that is transparent about its methodology and considers a wide range of variables. Using an independent platform like HouseSeeker's AI Buyer's Agent can help you access unbiased data and cut through the marketing noise to make informed decisions.