Decoding Australia's Housing Affordability Crisis in 2025

Explore the data behind record-low affordability and learn strategies to navigate the challenging mid-2025 property market.

Introduction: The Great Australian Dream on Hold

Navigating the Australian property market in mid-2025 feels more challenging than ever. For countless aspiring homeowners, the goalposts seem to be perpetually shifting further away. Whether you're a first-home buyer feeling disillusioned, a growing family trying to upsize, or even a high-income earner shocked at your limited options, you're not alone. The question echoes across the nation: "Can anyone afford to buy a house anymore?"

This isn't just a feeling; it's a reality backed by sobering data. A recent comprehensive study, the 2025 Proptrack Affordability Report, confirms that housing affordability has plummeted to its lowest level in at least three decades. This article unpacks the key findings from that report, exploring the factors that brought us here, how different income levels are being impacted, and what it means for your property journey. By understanding the data, you can move from frustration to informed action.

The State of Play: Affordability at a 30-Year Low

The headline finding is stark: the share of homes that a typical Australian household can afford is the lowest it's been in a generation. To understand this, it's crucial to define what 'affordable' means in this context. The standard industry metric considers a property affordable if the mortgage repayments consume no more than 25% of a household's gross (pre-tax) income on a standard 80% loan-to-value ratio mortgage.

So, what's driving this crisis? It's a perfect storm of economic factors:

1. Surging Property Prices: Following the boom during the pandemic, property prices continued to climb, with a national increase of 6.6% over the last year alone. 2. Rapid Interest Rate Hikes: The aggressive interest rate increases that began in early 2022 have drastically reduced the borrowing capacity for all households. A person with the same income can now borrow roughly a third less than they could just a few years ago.

These two forces have combined to create an environment where income growth has failed to keep pace, pushing home ownership further out of reach for many.

[INSERT_IMAGE: "A vibrant chart showing capital growth trends versus wage growth in major Australian cities over the last five years"]

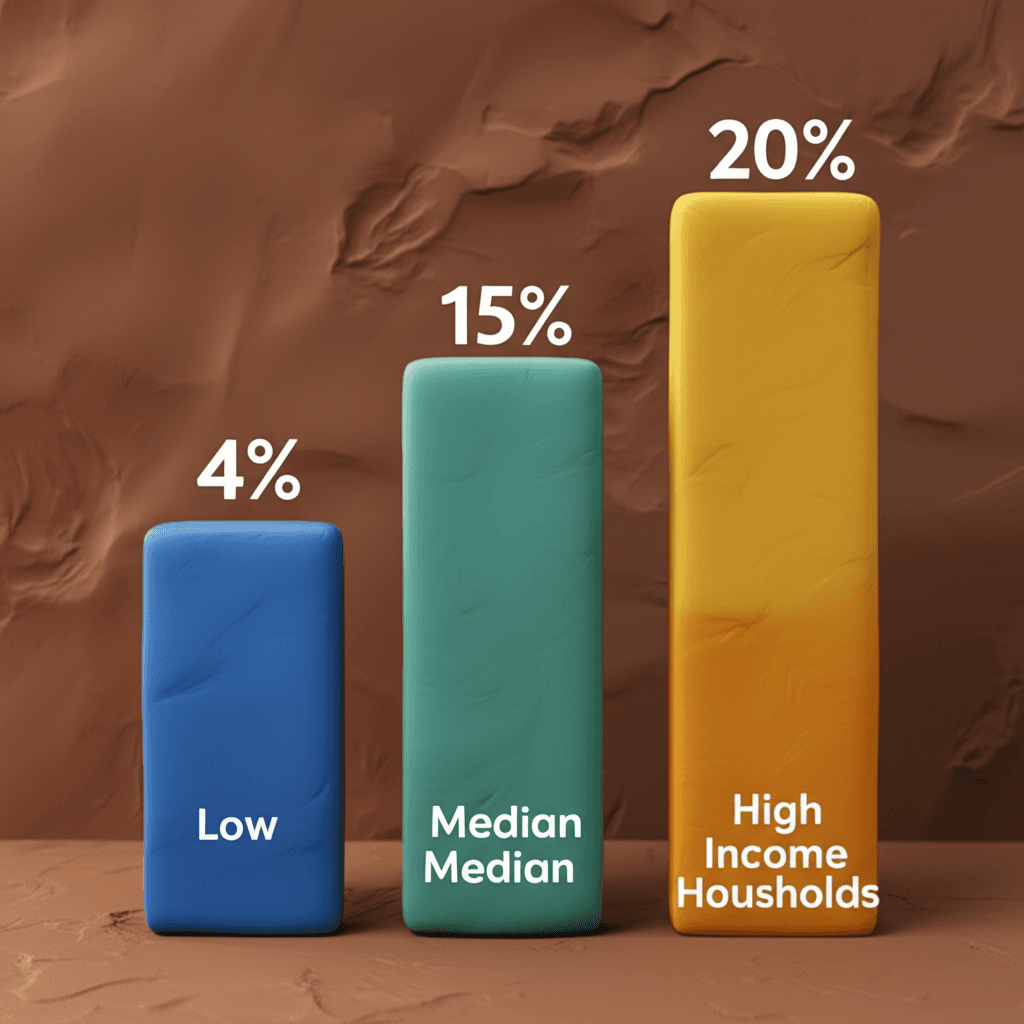

A Tale of Three Incomes: Who Can Afford What?

The affordability crisis doesn't impact everyone equally. The data reveals a widening chasm between different income brackets, creating a fractured and challenging market for buyers at every level.

The Squeezed Middle: The 'Typical' Household

A household earning a typical or median income—around $112,000 per year combined—is facing an incredibly steep climb. This group, arguably the backbone of the economy, has seen its purchasing power decimated.

In 2021: A median-income household could afford to purchase 43% of all homes sold across Australia.

In 2025: That same household can now only afford 14% of homes.

This staggering decline in just a few years highlights the core of the problem. A household with a very decent salary, once able to consider a wide range of properties, is now restricted to a tiny fraction of the market. In a state like New South Wales, this figure drops to just one in ten homes. To navigate this reality, buyers need access to powerful real estate analytics to identify the few remaining pockets of opportunity.

The High-Income Squeeze

It might be tempting to think that high-income earners are immune to this crisis, but the data tells a different story. The top 20% of Australian households, earning over $213,000 annually, have also seen their options shrink dramatically.

A few years ago: This top quintile could afford more than 75% of homes on the market.

Today: They can comfortably afford just over 50%.

Even more shocking is the maximum property price they can comfortably afford based on income and standard mortgage repayments alone: approximately $700,000. With the median house price in cities like Melbourne and Sydney pushing well over a million dollars, this reveals a critical truth: even for top earners, purchasing a typical family home often requires significant existing wealth, generational assistance, or taking on mortgage stress. The reliance on the 'bank of mum and dad' is no longer just for first-home buyers; it's becoming a necessity for a growing portion of the market.

Locked Out: The Low-Income Reality

For low-income Australians, the dream of homeownership has become almost entirely unattainable. The report paints a concerning picture for the lowest 20% of households, earning around $50,000 per year.

This cohort can afford to buy a mere 3% of homes sold across the entire country. The properties within this price bracket—typically under $300,000—are almost exclusively located in remote regional areas, often far from employment centres and essential services. This data confirms that for one in five Australian households, homeownership without a significant relocation or external financial support is effectively off the table. This systemic lockout has profound long-term consequences for wealth inequality, as detailed in reports from organisations like the Australian Bureau of Statistics (ABS).

The Market Maze: Upsizers and First Home Buyers

The affordability crunch is creating blockages throughout the property lifecycle, impacting both those trying to get in and those trying to move up.

The First Home Buyer Hurdle

Getting into the market is a two-part challenge: servicing the loan and saving the deposit. The latter has become a monumental task. In the 1990s, it took an average of three years to save a 20% deposit. Today, that has nearly doubled to 5.5 years. Aspiring buyers are trying to save while paying record-high rents, often feeling like they can't save faster than property prices are rising—a demoralizing experience that fuels buyer fatigue.

The 'Golden Handcuffs' for Upsizers

The knock-on effect is also felt by existing homeowners. Families who bought their first home a few years ago with plans to upsize are now finding themselves hamstrung. While they may have built up significant equity, their reduced borrowing capacity means they can often only get approved for the same loan amount they already have. This prevents them from moving to a larger home to accommodate a growing family, stretching the intended 3-4 year stay in a first home to 7, 8, or even 9 years. This market stagnation reduces the turnover of entry-level homes, further squeezing supply for first-time buyers.

Navigating these distinct challenges requires a tailored approach. A sophisticated tool like an AI Buyer's Agent can help buyers define their goals and find properties that fit their unique financial circumstances in a difficult market.

Conclusion: Navigating the New Normal with Data

The 2025 property market is defined by a deep and pervasive affordability crisis that impacts buyers across all income levels. The path to homeownership is narrower and steeper than it has been in decades, driven by a combination of high property prices, reduced borrowing power, and a critical lack of housing supply. From low-income households being locked out entirely to high-earners needing generational wealth to buy a typical home, the challenges are systemic.

While the short-term outlook hinges on potential interest rate decreases, the long-term solution lies in substantial structural changes, primarily increasing housing supply. However, waiting for the market to fix itself is not a strategy. For prospective buyers, the key to navigating this environment is knowledge and data. Understanding your true borrowing capacity, exploring areas you may not have previously considered, and leveraging powerful analytical tools are no longer optional—they are essential.

The current market is daunting, but data provides clarity. Don't navigate it blind. Explore HouseSeeker's powerful real estate analytics to uncover market trends, compare suburbs, and identify opportunities that align with your financial reality. Take control of your property journey today.

Frequently Asked Questions

What is the main reason housing affordability has worsened so quickly?

The rapid deterioration is due to a two-pronged impact. First, significant property price growth during the 2020-2021 pandemic period created a high price base. This was immediately followed by the fastest interest rate hiking cycle in decades, which drastically cut the amount of money banks would lend to households, squeezing buyers from both ends.

Is it still possible for a first-home buyer to enter the market in 2025?

Yes, but it requires significant compromise and strategy. Buyers must be flexible on location, potentially looking further from city centres or in regional hubs. They may also need to consider different property types, such as apartments or townhouses instead of standalone houses. Using an AI property search can help identify suburbs that meet specific lifestyle and budget criteria that might otherwise be overlooked.

Will building more homes solve the affordability crisis?

In the long run, increasing housing supply is widely seen as the most critical solution. The national goal to build 1.2 million new homes over the next five years is a positive step. However, construction takes time, and this initiative will not be a quick fix. It will likely take many years for this new supply to have a meaningful impact on market-wide affordability, making data-driven purchasing decisions all the more important in the interim.