Victoria's Landlord Exodus: A Housing Crisis or a Win for First Home Buyers?

A deep dive into the data reveals an unexpected outcome for tenants and a potential opportunity for aspiring homeowners in the wake of Victoria's new property taxes.

Introduction

The Australian property market is no stranger to heated debate, and recent tax changes in Victoria have added fuel to the fire. New land taxes and levies aimed at property investors have sparked concerns of a 'landlord exodus,' leading many to predict a shrinking rental supply and soaring rents. But does this narrative hold up to scrutiny? By examining the latest market data, we can uncover the real impact these policies are having on investors, tenants, and most importantly, aspiring first home buyers.

The New Tax Landscape in Victoria

To understand the shift, we must first look at the policy changes. The Victorian government has significantly increased the holding costs for investment properties by implementing higher land taxes, expanding levies, and, crucially, reducing the tax-free threshold from $300,000 to just $50,000. This means a much larger pool of investors is now liable for land tax, with marginal rates also increasing for those holding multiple properties. Unsurprisingly, this has led thousands of investors to reconsider their portfolios, with many choosing to sell.

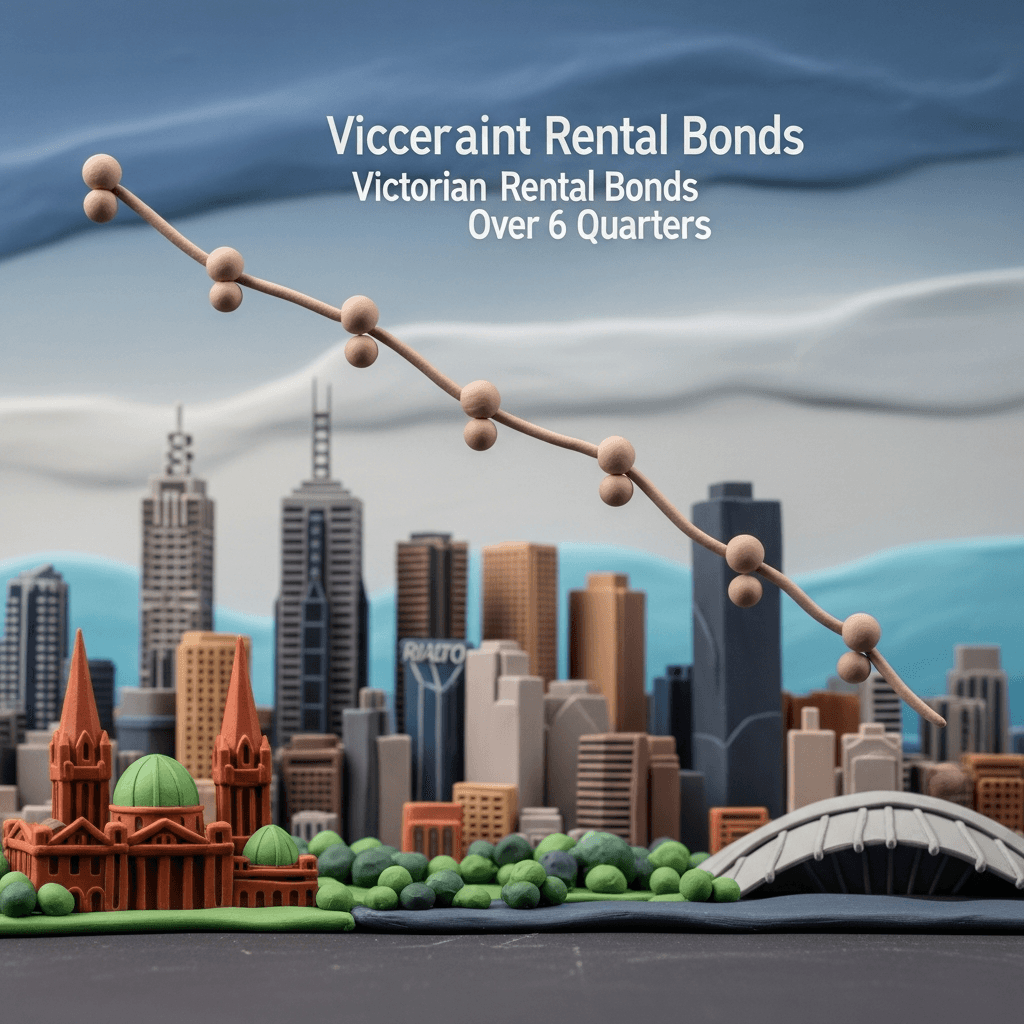

Is Rental Supply Really Shrinking?

On the surface, the data seems to support the concern over a diminishing rental market. The latest Victorian Government rental report shows a consistent decline in the number of active rental bonds for six consecutive quarters. This indicates that the total number of homes available for rent has indeed shrunk as investors exit the market. This trend is a key piece of evidence used by those arguing that the tax changes are negatively impacting rental availability for tenants.

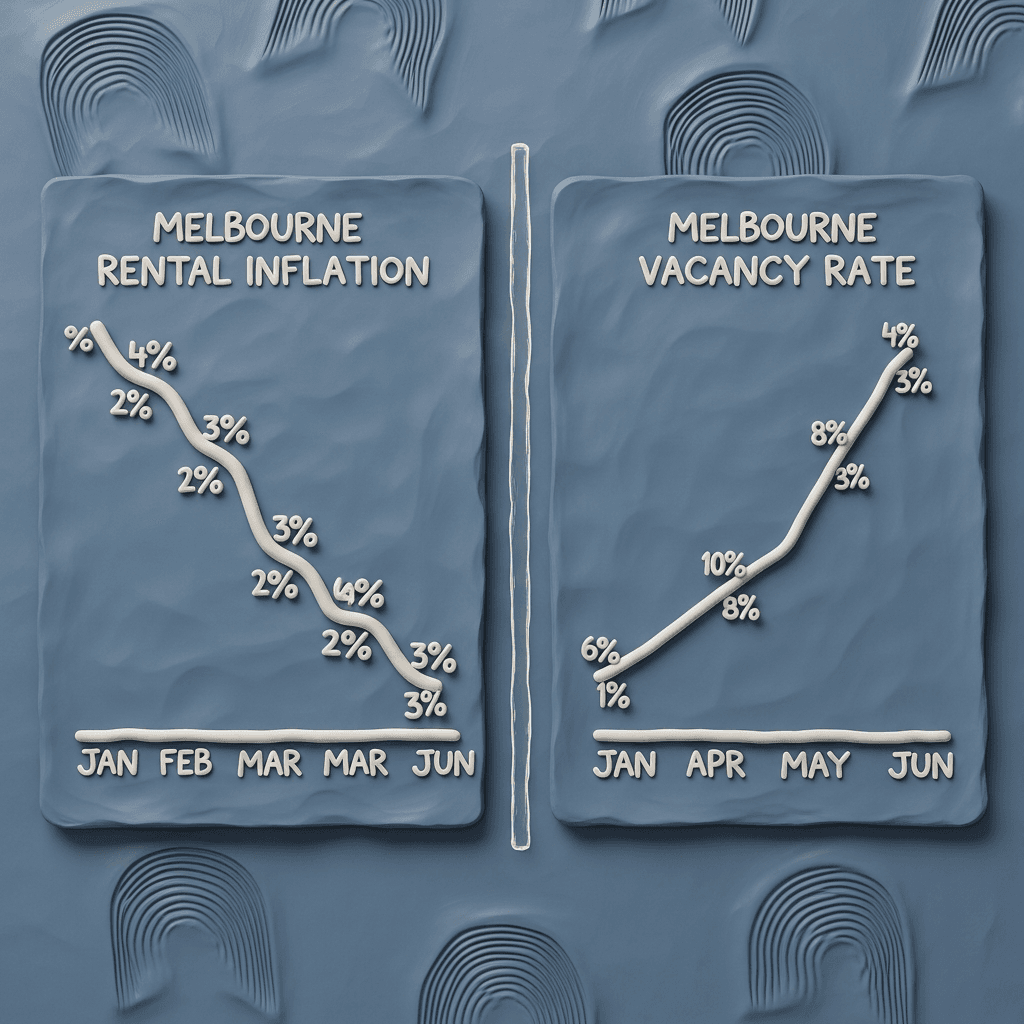

An Unexpected Twist: Slowing Rent Growth

Here is where the story takes a surprising turn. Despite the clear reduction in rental supply, the anticipated surge in rents hasn't materialised. In fact, annual rental inflation in Melbourne has slowed to 2.5%, which is below the long-term average. Furthermore, Victoria’s rental vacancy rate has actually trended higher in Melbourne. This data challenges the simple supply-and-demand logic and suggests other market forces are at play. Understanding these nuances is key to smart property decisions, a core principle we champion at our Data Analytics Hub.

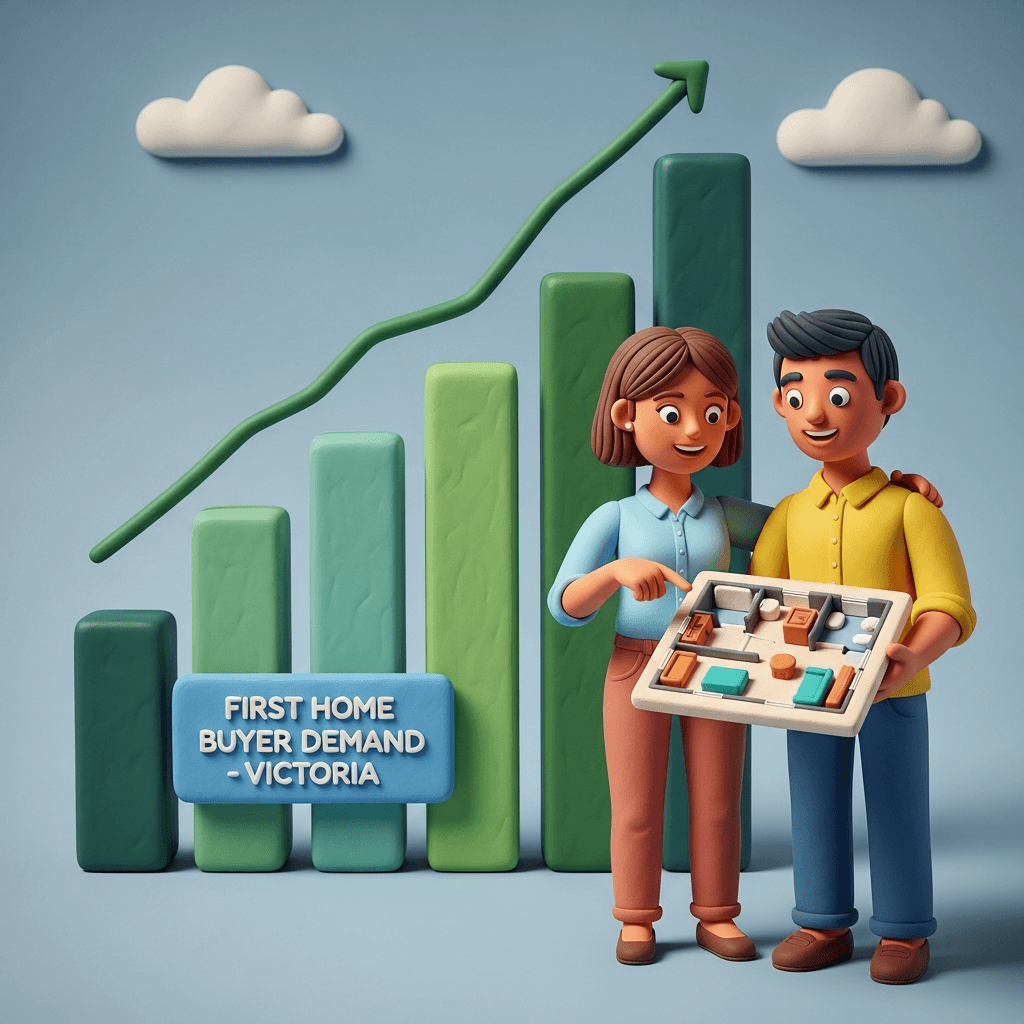

The Rise of the First Home Buyer

The national data provides another critical piece of the puzzle. According to CoreLogic, Melbourne has recorded the softest annual rental growth of any capital city in the nation. So, what is balancing the market? The answer lies in the historic inverse relationship between investors and first home buyers. As investor mortgage demand has fallen in Victoria, first home buyer demand has surged to levels well above the decade average. In essence, many of the properties being sold by investors are being purchased by those looking to own their own home, preventing these properties from being completely removed from the housing pool.

Conclusion

The data suggests that while Victoria's tax changes have successfully encouraged investors to sell, it hasn't led to the widely feared rental crisis. Instead, it appears to have eased rental pressure in Melbourne and, most significantly, opened a new door for first home buyers to enter the market with less competition. This complex outcome highlights the importance of looking beyond headlines and digging into the data to understand the true dynamics of the property market. For aspiring homeowners, this shift represents a valuable opportunity to secure a property.

Ready to find your first home in this changing market? The HouseSeeker AI Property Search can help you identify opportunities that match your specific lifestyle and financial goals, while our AI Buyer's Agent provides personalised guidance every step of the way.

To make your own data-driven decisions, explore the powerful tools available at HouseSeeker's Real Estate Analytics Hub and turn market complexity into your advantage.

Frequently Asked Questions

Have Victoria's property tax changes caused a rental crisis?

While the number of rental properties has decreased, the data does not point to a crisis. Rental inflation in Melbourne has actually slowed to below-average rates, and vacancy rates have trended higher, suggesting the market is rebalancing rather than breaking.

Are there fewer investors in the Victorian market now?

Yes. Data on the decline in rental bonds and a corresponding fall in investor mortgages strongly indicates that a significant number of property investors have sold their properties or are holding off on new purchases in Victoria.

How can first home buyers take advantage of this market shift?

With less competition from investors, first home buyers may find more opportunities and slightly less upward pressure on prices. It's an ideal time to leverage advanced tools like an AI property search to analyse suburbs and find properties that might have previously been snapped up by investors.