How Australia's Rental Crisis Reveals Top Investment Hotspots

An in-depth analysis of vacancy rates and rental data to uncover the next property boom locations across the nation.

Understanding the Market Through the Rental Lens

To accurately predict movements in the Australian housing market, the first and most crucial signal to watch is the rental market. Right now, it's sending clear messages about where house prices are headed in the months and years to come. Australia is currently in the grip of one of the tightest rental markets in its history, with national vacancy rates at record lows. This scarcity creates a ripple effect, influencing both renter behaviour and investor confidence, ultimately driving property values.

What is a Vacancy Rate and Why Does It Matter?

A vacancy rate measures the percentage of all available rental properties that are unoccupied and available at a specific time. Historically, a 3% vacancy rate is considered the benchmark for a healthy, balanced market—one where there's a fair equilibrium between tenants seeking homes and landlords looking to fill them. When the rate drops significantly below this, it signals a landlord's market, characterised by intense competition, rising rents, and immense pressure on tenants.

Across the country, not a single major market is in balance. The national vacancy rate is critically low, with figures like Perth at 1.1%, Melbourne at 1.4%, Sydney at 1.6%, Brisbane at 1.7%, and Adelaide under 1%. Even Darwin, the highest at 2.1%, is still well below the 3% equilibrium point. This widespread shortage is the foundation of the current national housing pressure.

This extreme tightness in the rental market creates two powerful knock-on effects. Firstly, frustrated renters, facing steep rent increases and fierce competition, are increasingly pushed towards buying their own homes. Secondly, property investors, seeing guaranteed rental demand, gain immense confidence. Investor activity is now at 2017 levels, making up around 40% of the market. They are motivated by the certainty that their properties will be leased quickly, creating further demand in the sales market.

A State-by-State Analysis of Investment Potential

By examining the unique rental dynamics in each capital city, investors can uncover powerful insights. Understanding these nuanced stories is key to making informed decisions, which is where powerful real estate analytics become indispensable.

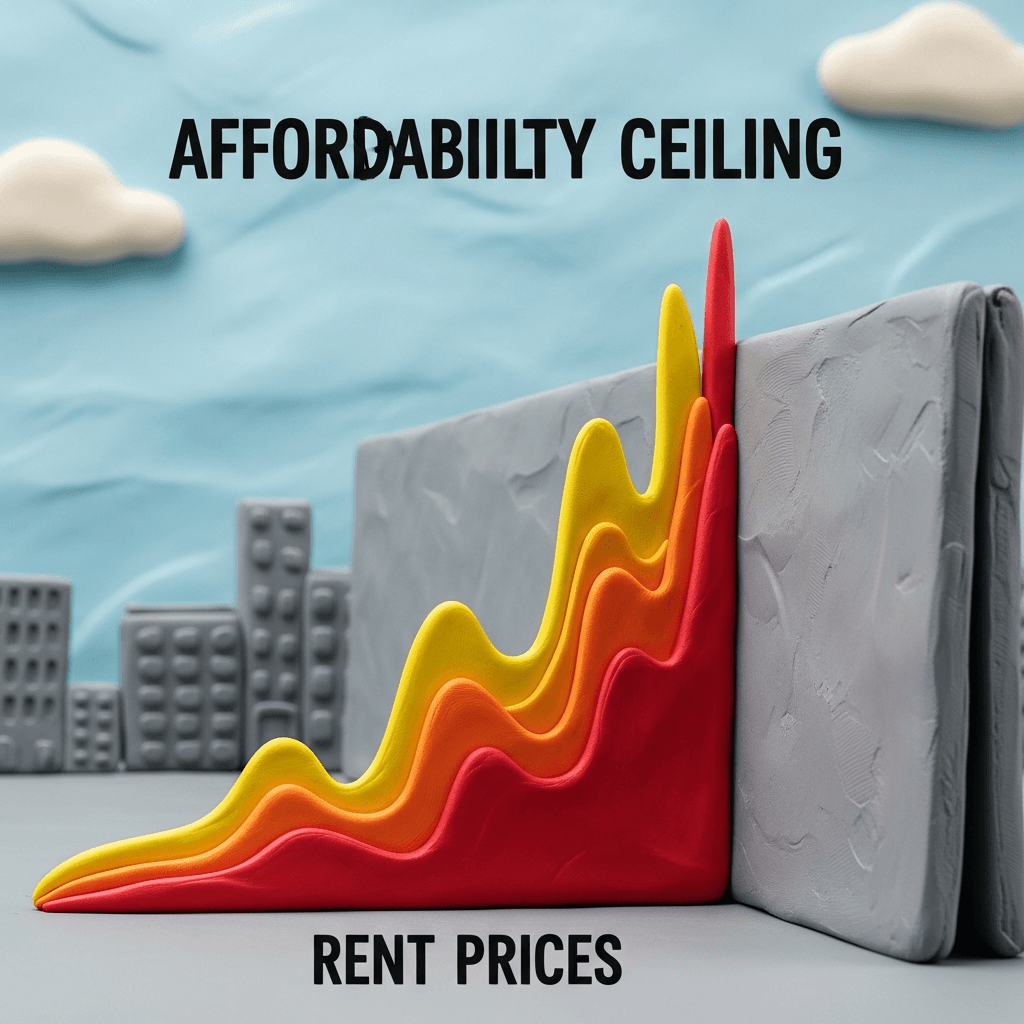

Adelaide has Australia's lowest vacancy rate at just 0.9%, yet rental growth has completely stalled. This strange phenomenon points to a critical market condition: the affordability cap. Despite overwhelming demand, tenants in Adelaide have reached their financial limit and simply cannot afford to pay more in rent. For investors, this is a red flag. If rents can't rise, the potential for capital growth is also severely limited. While secure, Adelaide's boom has likely already occurred, and investors seeking growth may be five years too late.

Perth presents a compelling story. Rental prices have climbed 5.6% over the last year, and rental yields are a healthy 4%. Critically, Perth has some of the highest average incomes in Australia. Unlike Adelaide, residents here have the financial capacity to absorb further rent and price increases. With extremely low listings for both sale and rent, the intense supply-and-demand imbalance suggests Perth will continue to be one of the highest-performing markets in 2025.

For years, Melbourne's property market has underperformed, with only 15% growth over five years while other cities nearly doubled. That is now changing. The city's rental market is incredibly tight, with a vacancy rate of just 1.4%. House prices are beginning to rise, and there's a huge affordability gap between its current prices and its potential ceiling. Melbourne has the capacity to rise 50-70% without hitting the affordability limits seen elsewhere, making it arguably the best investment opportunity in Australia right now for those seeking significant capital growth.

Darwin has shown incredible resilience. Despite a massive influx of investors, its vacancy rate has held steady at 2.1%, and rents are rising. This indicates a genuine, underlying economic strength that is comfortably absorbing new supply. Similarly, Tasmania is showing signs of a building frenzy. With rents up 6% in Hobart and on-the-ground reports of intense activity, an investor herd mentality could soon take hold, positioning Tasmania for its next property boom.

Sydney remains a solid market, but its high prices place it close to its affordability limit. It has potential for 10-15% growth in the current cycle, but lacks the explosive potential of Melbourne. Brisbane's unit market has been a star performer, nearly doubling in three years, but it too is now showing signs of hitting affordability constraints, particularly in the apartment sector. Growth will likely continue for another year before slowing.

Conclusion: Using Data to Find Your Next Investment

The Australian rental market is more than just a story of tenant hardship; it's a predictive tool for savvy investors. The data clearly shows that different cities are at vastly different stages of their property cycles.

Markets Hitting Affordability Caps (Adelaide, Brisbane): Offer security but limited future growth.

Markets with Strong Fundamentals (Perth, Darwin): Continue to offer robust performance due to high incomes and supply shortages.

Markets with Untapped Potential (Melbourne, Tasmania): Represent the most exciting opportunities for significant capital appreciation in the near future.

By looking beyond the headlines and diving into the underlying data, you can identify which markets are poised for growth and which have already peaked. Making the right choice requires a deep understanding of these complex trends.

Ready to uncover hidden opportunities in the Australian property market? Explore HouseSeeker's Data Analytics Hub to access the insights you need to make smarter, data-driven investment decisions today.

Frequently Asked Questions

Why is a low rental vacancy rate important for property investors?

A low vacancy rate signals high tenant demand and a shortage of rental supply. For investors, this means a lower risk of their property sitting empty, upward pressure on rental prices (leading to better cash flow), and increased confidence in the overall stability and growth potential of the local housing market.

What is an "affordability cap" in a property market?

An affordability cap is a point where prices (either for rent or for sale) can no longer increase, despite high demand, because the local population does not have the income to support higher payments. As seen in Adelaide's rental market, this effectively puts a ceiling on growth, even in a supply-constrained environment.

Which Australian city currently shows the most potential for property price growth based on rental data?

Based on the current rental market pressure and affordability analysis, Melbourne shows the most significant potential. Having experienced minimal price growth over the past five years compared to other capitals, it has a large gap to close before hitting its affordability cap. Combined with a very tight rental market (1.4% vacancy), it has strong foundations for substantial price appreciation.