APRA's New Lending Cap: What Australian Property Investors Must Know

A permanent change to debt-to-income limits is here. Discover what this means for your investment strategy and future borrowing power.

A Permanent Shift in Australia's Lending Landscape

The Australian Prudential Regulation Authority (APRA) has introduced a significant, permanent change to the nation's lending framework, directly targeting property investors. This isn't a temporary measure; it's a structural shift designed to reshape how credit is managed for the foreseeable future. Understanding this new rule is crucial for anyone looking to build or expand their property portfolio.

For years, the Australian lending system has been governed by one primary principle: the 3% serviceability buffer. This rule required banks to assess a borrower's ability to repay their loan at an interest rate 3% higher than the actual rate. This single, broad-stroke measure provided a safety net for the financial system, protecting against unforeseen circumstances like job loss or rising interest rates. But that simple system is now a thing of the past.

Introducing Rule Number Two: The Debt-to-Income Cap

APRA has now introduced a second, powerful rule. Banks and authorised lending institutions can now only issue a maximum of 20% of their new home loans to borrowers with a debt-to-income (DTI) ratio of six times or higher. In simple terms, your total debt (including the new loan) cannot exceed six times your gross annual income for more than one in five new loans a bank writes. This cap will be applied separately to both owner-occupiers and investors, creating distinct lending pools.

A Preemptive Strike, Not an Immediate Brake

Here’s the most critical detail: this announcement isn't about the market right now. APRA's own data reveals that currently, only 10% of new investor loans and 4% of new owner-occupier loans have a DTI ratio of six or more. Both figures are well below the new 20% ceiling. So, why introduce the change now?

This is a preemptive measure. APRA is looking ahead to a time when interest rates may fall, which historically fuels a surge in credit growth and borrowing capacity. During the market boom of 2021-2022, high DTI lending soared to nearly 25%. This new rule is a structural guardrail to ensure that a lending frenzy of that scale never happens again. It’s about building long-term stability into the system, not hitting the emergency brake today. For savvy investors, understanding these long-term trends is key to making informed decisions, a process made easier with advanced real estate analytics.

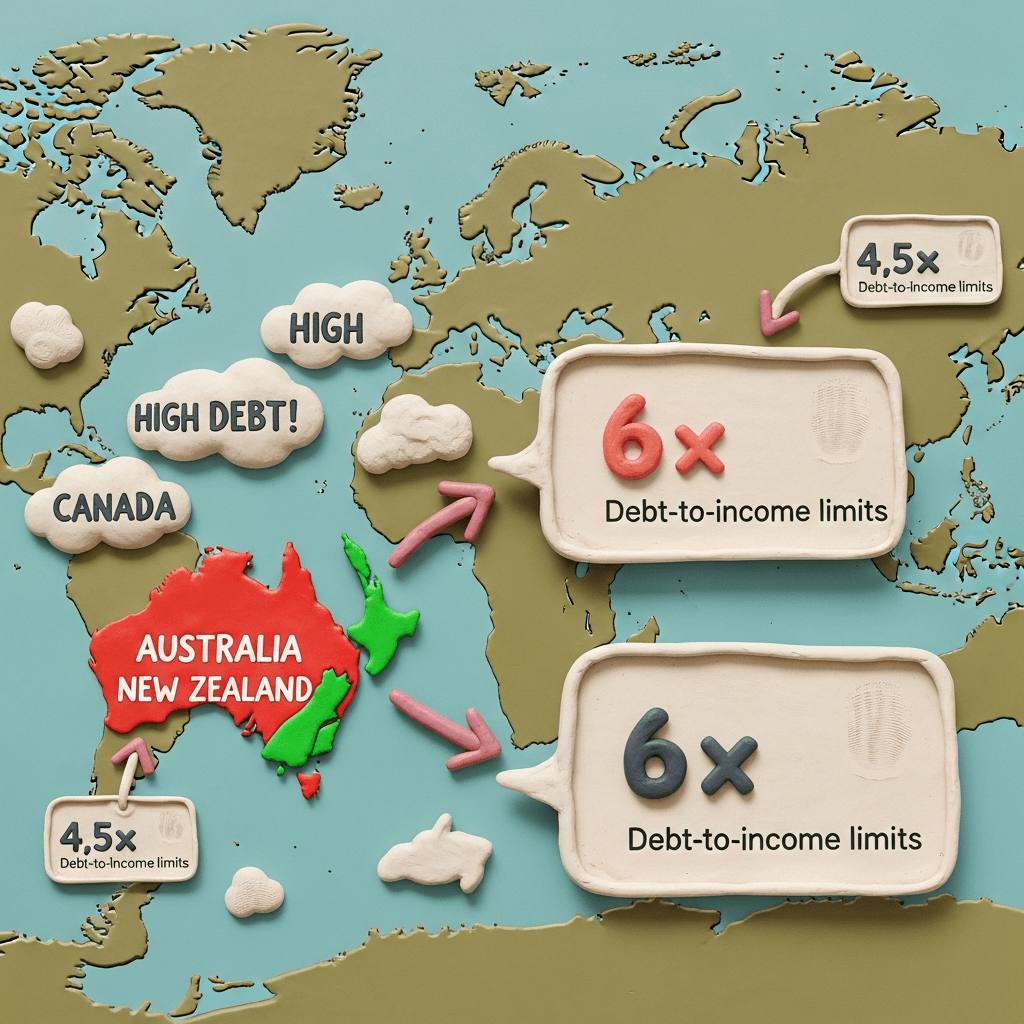

How Does Australia Compare Globally?

APRA’s own analysis provides fascinating context. Compared to other developed nations, Australia has long been more permissive with its lending. While our new DTI benchmark is six, other countries have much stricter limits:

Canada: 4.5x income

United Kingdom: 4.5x income

Ireland: 3.5x income

Norway: 5x income

This comparison helps explain why Australian house prices are among the least affordable in the world. Our system has historically allowed for a greater supply of credit relative to income, directly pushing property values higher. This new cap, while still generous by international standards, is a step toward aligning with global norms for financial prudence.

What This Means for Your Investment Strategy

For the average investor, not much will change overnight. However, those who rely on pushing their borrowing capacity to the absolute limit will feel the impact most. Some lenders who have historically been more aggressive with high DTI loans will now have to tighten their policies to stay under the 20% cap. This means that access to maximum leverage will become more constrained.

Interestingly, the rule primarily targets Authorised Deposit-taking Institutions (ADIs), which are the major banks. Smaller, non-ADI lenders often operate with different serviceability buffers (e.g., 1%) and may not be immediately affected. For now, these lenders remain a strategic option for investors looking to expand their portfolios beyond what the major banks will allow. Navigating this fragmented lending environment requires a clear plan, something a service like an AI Buyer's Agent can help strategise.

Conclusion: Posturing and Prudence

Ultimately, APRA's new rule is more about posturing and long-term prudence than immediate market intervention. It sends a clear signal to banks and investors that the era of unrestrained, high-leverage borrowing is being permanently curtailed.

While the market is currently hot with investor activity, it will likely self-regulate as high interest rates and falling rental yields make the numbers less compelling. This change from APRA acts as a backstop, ensuring that when conditions do become favourable again, the market won't be able to overheat as it has in the past. For now, the key for investors is to understand the new landscape, plan their financing strategy carefully, and focus on high-quality assets. Successful investing requires staying ahead of the curve, and tools from HouseSeeker are designed to give you that edge.

The takeaway for property investors is clear: the rules of the game have fundamentally shifted. While the immediate impact is minimal, the long-term implications for portfolio growth are significant. Strategic planning and a deep understanding of market data are now more critical than ever.

Ready to build a data-driven investment strategy that thrives in this new regulatory environment? Explore our cutting-edge tools at the HouseSeeker Data Analytics Hub.

Frequently Asked Questions

Does APRA's new rule mean I can't borrow more than six times my income?

Not necessarily. The rule is a portfolio limit for lenders, not a hard ban on individuals. Lenders can still issue these loans, but they are capped at 20% of their new loan book for investors. Your ability to secure such a loan will depend on the lender's specific policies and how much of their quota is available at the time of your application.

How does this change affect my current investment loans?

This new rule applies to new lending only. It does not retroactively affect your existing mortgages. However, it will be a key factor when you apply for new loans to expand your portfolio or seek to refinance and increase your total borrowing.

Is this change good or bad for the property market?

It's a move designed to enhance long-term financial stability by reducing high-risk lending. In the short term, it may cool investor sentiment and place a soft ceiling on aggressive price growth. Over the long term, it aims to prevent a potential housing market crash fueled by excessive debt, which ultimately protects all homeowners and investors.