Australia's Housing Supply Crisis: A Data-Driven Look at Future Property Growth

An in-depth analysis of construction data, government policies, and credit trends reveals why a 'perfect storm' is set to drive property prices higher.

The Perfect Storm in Australian Real Estate

The Australian property market is facing a critical imbalance. A confluence of factors—including a severe housing shortage, escalating construction costs, and demand-boosting government policies—is creating a 'perfect storm' that points towards sustained price growth for years to come. For prospective buyers and investors, navigating this landscape requires a deep understanding of the underlying forces at play. This analysis unpacks the hard-hitting data to reveal why the gap between supply and demand is set to widen, and what it means for your property journey.

To make sense of these complex dynamics, leveraging powerful real estate data analytics is more crucial than ever. By examining key trends in construction, affordability, and credit, we can forecast market movements and identify strategic opportunities.

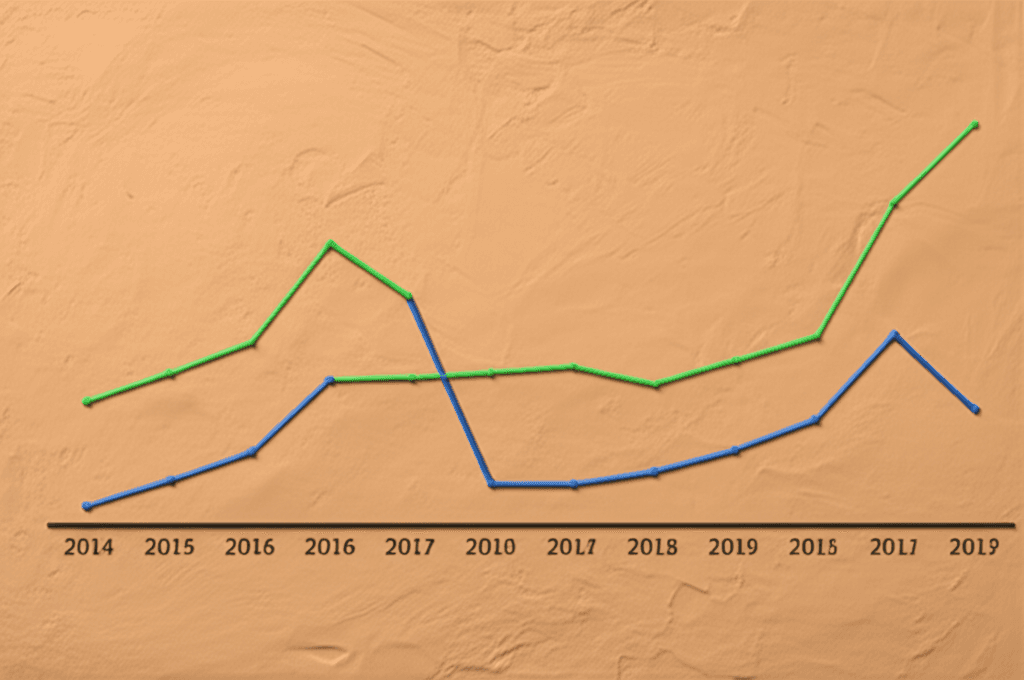

The Construction Shortfall: A Widening Supply Gap

At the heart of the issue is a chronic undersupply of new homes. The Australian government set an ambitious target of building 240,000 new dwellings per year, yet completion rates have consistently fallen short. Data shows a clear lag effect where approvals for new builds, which should lead completions, have also declined. The closest the market came to this target was around 2014, with completions peaking near 220,000 homes in 2016 before trending downwards.

Since 2016, completions have hovered around 180,000 per year and show no signs of accelerating. Even if construction ramped up to 2016 levels, it would be insufficient to cool the market. Today's demand, fuelled by record levels of immigration, is significantly higher than it was nearly a decade ago. This fundamental mismatch ensures that demand continues to outstrip supply, placing persistent upward pressure on prices.

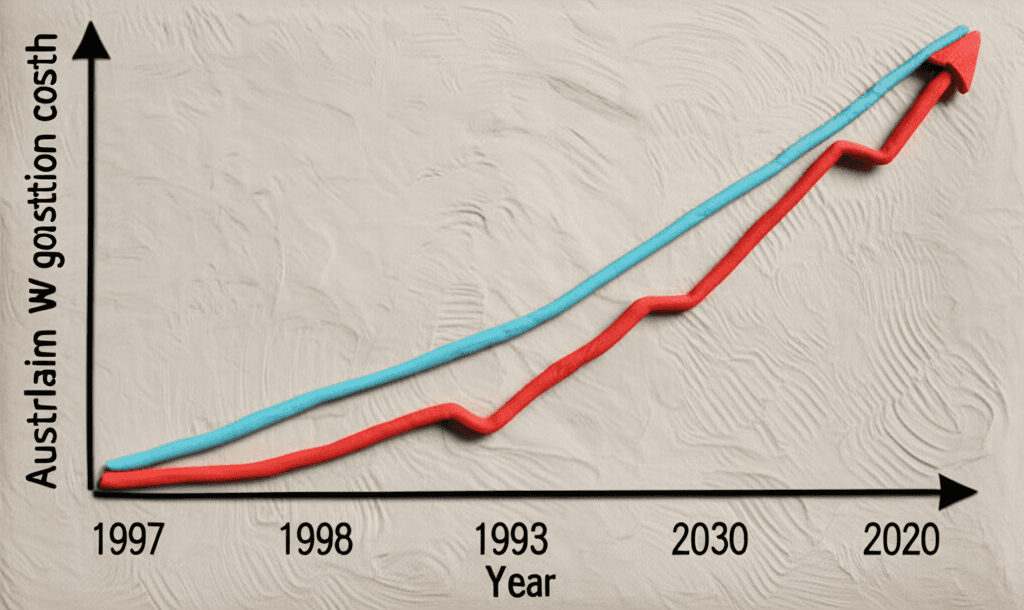

The Rising Cost of Building and Land

Compounding the supply issue is the soaring cost of construction. An analysis of costs versus wage growth since 1997 reveals a startling divergence. While wage growth has followed a relatively stable, linear path, the average cost to construct a new home has skyrocketed, particularly since the pandemic. This growing chasm makes it economically unviable for many developers to initiate new projects, as the final sale price may not guarantee a profit.

This challenge is amplified by the rising cost of land itself. Over the ten years to September 2024, median lot prices have roughly doubled in major markets like Sydney, Melbourne, and Brisbane. For developers, the combined expense of acquiring land and managing inflated construction costs creates a significant barrier to increasing housing supply. They will often wait for market prices to rise further before committing to new builds, thereby perpetuating the shortage.

Government Schemes: Fuelling Demand, Not Supply

Government initiatives like the 5% deposit Home Guarantee Scheme are designed to improve housing accessibility but often have the unintended consequence of inflating prices. By enabling more buyers to enter the market with smaller deposits, these schemes directly boost demand. Economic forecasts suggest such programs could add an additional 3.5% to 9.9% to home prices in targeted segments.

This creates a ripple effect across the entire market. As intense competition drives up the prices of homes under the scheme's price caps (e.g., $1.5 million in NSW), properties valued just above the cap also appreciate in value. This upward momentum lifts all segments of the market, making the challenge of finding the right properties even more acute for aspiring homeowners.

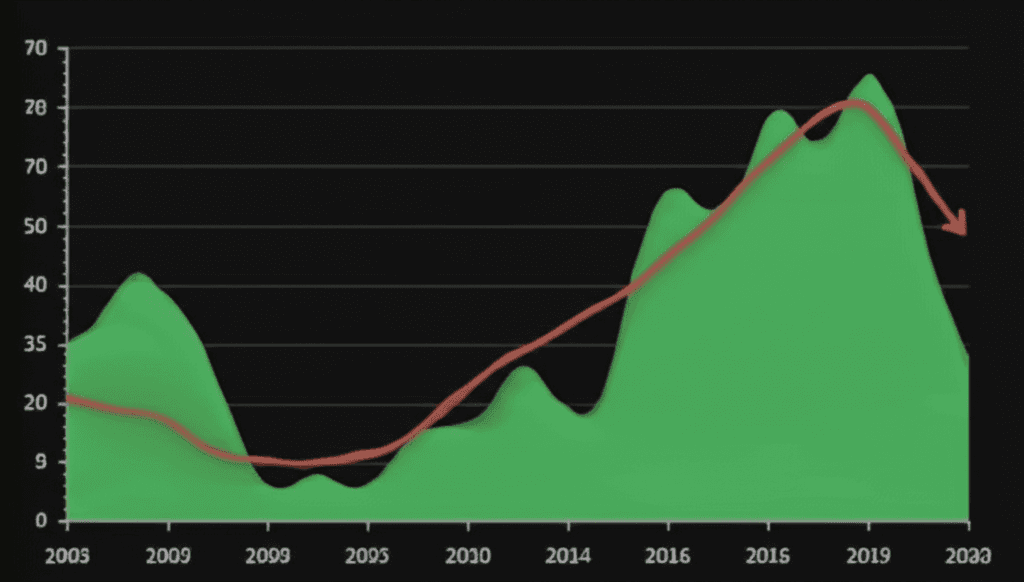

Credit Growth: The Engine of the Property Market

The availability of credit is a powerful catalyst for the housing market. Historical data shows a strong correlation between periods of high credit growth and rising property prices. Following a credit slowdown after 2016 which saw the market soften, credit availability tightened further as interest rates rose. However, the trend is now reversing.

We are currently witnessing an increase in credit flow, which, combined with anticipated interest rate cuts, will enable more people to borrow larger sums. This influx of capital into the market will act as a powerful accelerant for price growth. As credit availability continues to expand, it will fuel buyer activity and push property values towards new highs, long before housing supply can catch up.

Conclusion

The Australian property market is caught in a perfect storm. The combination of a chronic housing undersupply, prohibitive construction costs, demand-boosting government policies, and expanding credit growth creates a powerful formula for sustained price appreciation. Projections from housing associations suggest this supply-demand imbalance may not reach equilibrium until 2029, meaning several years of potential growth lie ahead. For buyers, this means that waiting for the market to fall could be a costly mistake. Success will depend on having a clear strategy, sound financial structuring, and access to the best market intelligence.

In a market defined by complexity and competition, data-driven insights are your greatest advantage. Explore HouseSeeker's comprehensive real estate analytics to identify high-growth suburbs and make confident investment decisions.

Frequently Asked Questions

Why aren't developers just building more homes to meet demand?

Developers face significant financial hurdles. The combination of soaring land prices and inflated construction costs has squeezed profit margins, making many potential projects economically unviable. They often pause development until they can be confident that rising market prices will cover their costs and provide a reasonable return on investment.

Will government grants for first home buyers make housing more affordable?

While these schemes help individuals overcome the deposit hurdle, they tend to increase overall demand in the market. This surge in competition for a limited supply of homes often leads to higher property prices, which can offset the benefit of the grant and impact affordability across the board.

When is the Australian property market expected to cool down?

Based on current data, a significant market cooldown is unlikely in the short to medium term. The severe housing shortage is the primary driver of price growth, and industry experts predict that it will take until at least 2028 or 2029 for new housing supply to begin catching up with demand. Until then, market fundamentals point towards continued growth.