Australia's Rental Affordability Hits Record Low: A Data-Driven Analysis

With rents now consuming over a third of the average household income, we break down the market forces impacting tenants and investors across the country.

The Unprecedented Challenge for Australian Renters

Navigating Australia's property market has become an increasingly daunting task, especially for tenants. Recent industry data paints a stark picture: the cost of renting has surged to historic highs, placing unprecedented pressure on household budgets. What was once a manageable expense has now become a significant financial burden for millions. This analysis dives into the key data points that define the current rental crisis and explores the underlying factors driving this alarming trend.

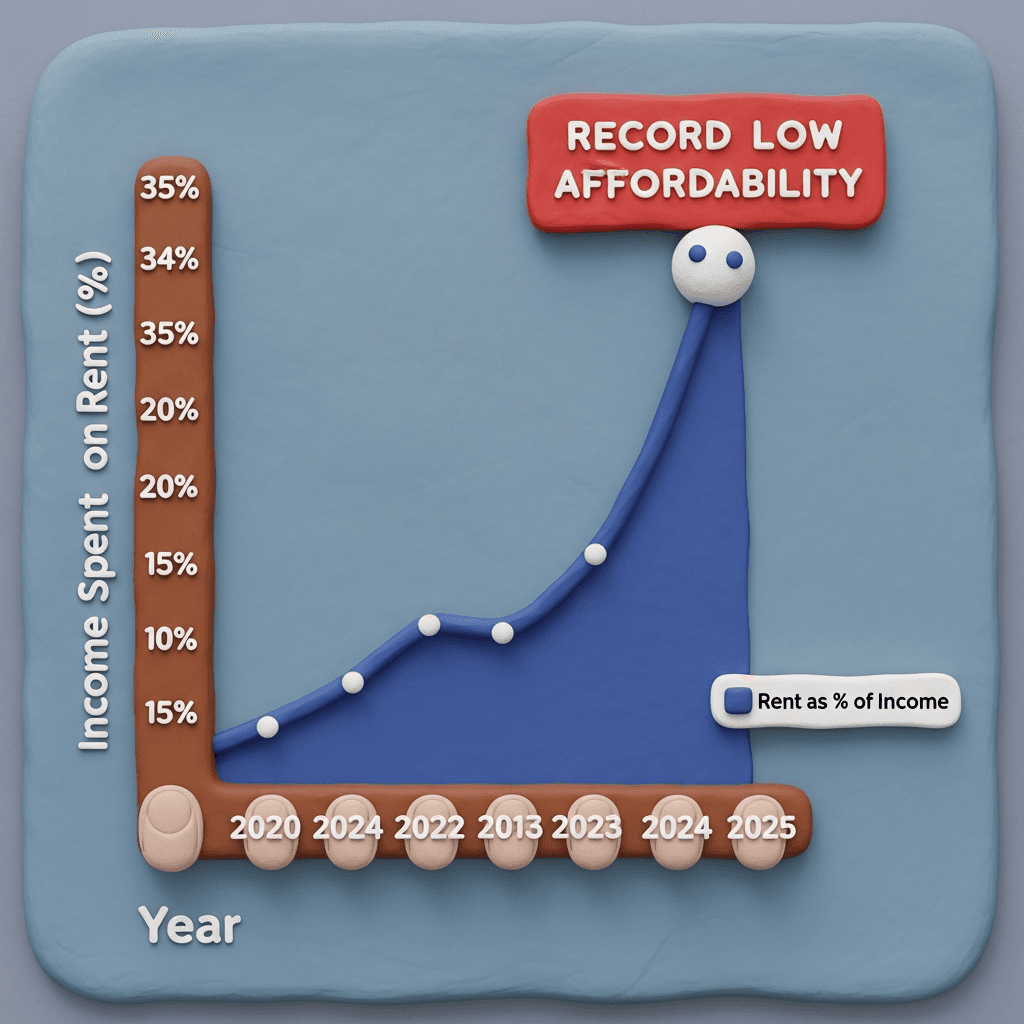

By the Numbers: The Sharp Decline in Affordability

Recent analysis highlights a dramatic deterioration in rental affordability. In the fourth quarter of 2020, the median tenant household spent a relatively manageable 26.2% of their income on rent, marking a 15-year low. Fast forward to the third quarter of 2025, and that figure has skyrocketed to 33.4%—the worst level in recorded history. This means that over a third of the average renter's income is now dedicated solely to housing costs, significantly impacting their ability to save and spend on other essentials. In just five years, the median rent in Australia has climbed by a staggering 53.3%.

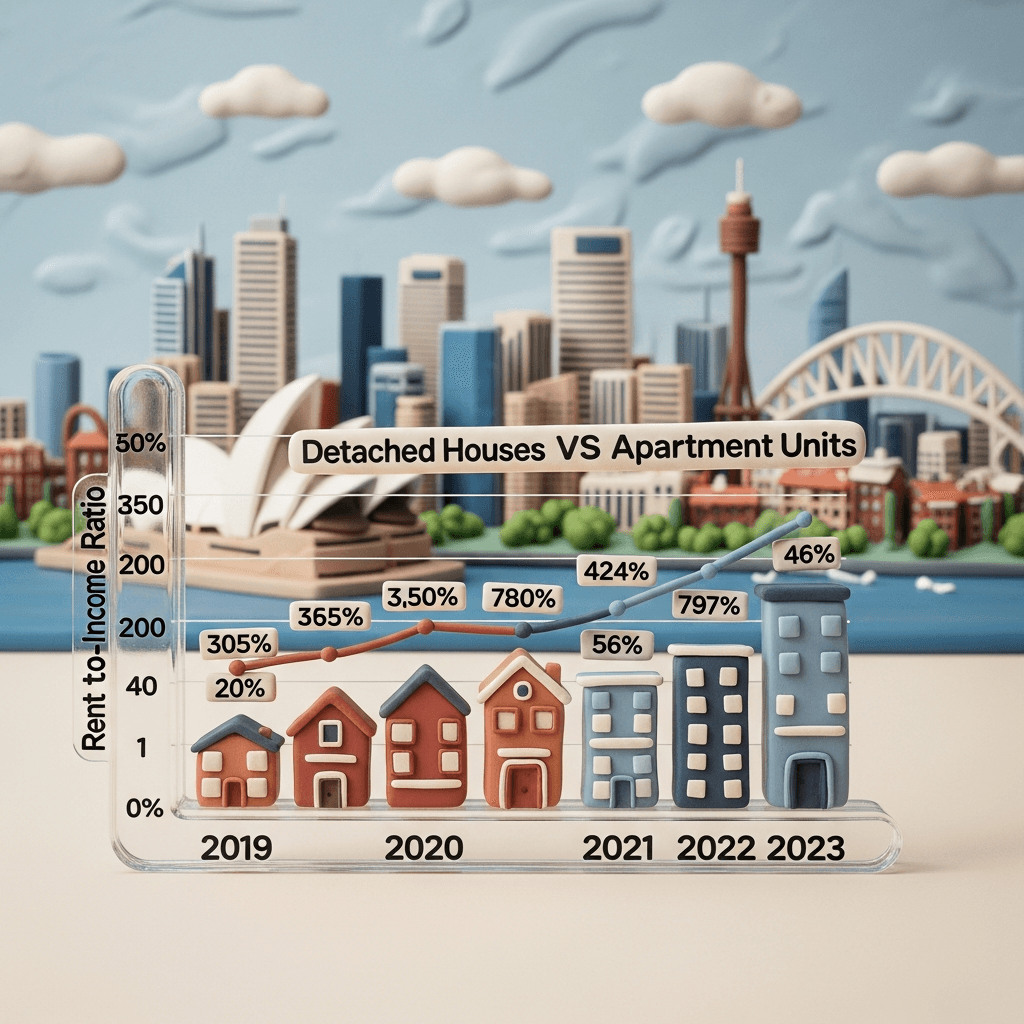

A Widespread Crisis: Houses and Units Equally Affected

This isn't a problem confined to one type of property; the pressure is being felt across the board. For tenants in detached houses, the portion of income spent on rent has jumped from a low of 26.6% in 2020 to a record 34.1% today. Unit dwellers have faced a similar trajectory, with their rent-to-income ratio rising from 24.8% to a new peak of 31.8%. This data confirms that whether you're looking for a family home or a city apartment, the challenge remains the same. Finding a suitable and affordable home requires a more sophisticated approach, where tools like an AI-powered property search can help filter options based on specific budget and lifestyle needs.

The Driving Forces: High Demand Meets Critically Low Supply

The current crisis is a classic case of supply and demand imbalance, supercharged by several key factors. Record net overseas migration has significantly increased population growth, injecting a huge number of new residents into a housing market that was already heavily supply-constrained. This has led to a re-acceleration in advertised rents across most capital cities and regional areas. Compounding the issue is a collapse in rental listings, which has driven national vacancy rates to an all-time low. With more people competing for fewer available properties, landlords can command higher rents, and the market continues to tighten. Understanding these dynamics is crucial, which is where powerful real estate analytics become invaluable for both investors and tenants trying to make informed decisions.

Conclusion: Navigating a Tough Market Ahead

The outlook for Australia's rental market remains challenging. The combination of high demand and critically low supply suggests that affordability pressures are unlikely to ease in the short term, continuing to punish tenant households. For renters feeling trapped, and for investors seeking to understand the volatility, leveraging data-driven insights is no longer just an advantage—it's a necessity. For those considering a shift from renting to buying, exploring new pathways with a service like HouseSeeker's AI Buyer's Agent can provide a guided and data-backed journey to homeownership.

In a market this volatile, data is your greatest asset. Dive deeper into market trends, compare suburb performance, and uncover hidden opportunities with HouseSeeker's Real Estate Analytics tools to stay ahead of the curve.

Frequently Asked Questions

Why are rents so high in Australia right now?

Rental prices are at record highs primarily due to a severe imbalance between supply and demand. Key factors include record net overseas migration boosting population growth, a long-term shortage in housing supply, and a collapse in the number of available rental listings, which has pushed national vacancy rates to an all-time low.

What does 'rental affordability' mean?

A rental affordability measure calculates the percentage of a median household's income that is required to pay the median rent in a specific area. When this figure rises, properties are considered less affordable. A common benchmark for housing stress is when a household spends more than 30% of its gross income on housing costs.

How can data analytics help me in the current rental market?

Data analytics tools can provide a significant advantage by offering deep insights into market trends. You can use them to identify suburbs with slightly better affordability or vacancy rates, compare rent prices more accurately, understand historical growth, and make faster, more informed decisions when applying for properties or considering an investment.