Is the Perth Property Boom Over? A Data-Driven Analysis for 2025

An expert look at Perth's key market indicators—from affordability to supply—reveals why the current growth cycle is far from finished.

Introduction

Conflicting headlines are causing confusion for property investors. One article claims the Perth market is slowing, while another insists the boom shows no signs of stopping in 2025. When faced with such contradictory information, how can you separate fact from fiction? The answer lies in the data. By analysing the core fundamentals driving the market, we can cut through the noise and understand the true health of Perth's property cycle.

The Four Pillars of a Healthy Market

To accurately assess any property market, we need to look beyond sensationalism and focus on four key metrics: supply versus demand, affordability, and overall market confidence. When we apply this framework to Perth, every indicator points towards continued strength and growth, debunking the idea that the cycle has peaked.

1. Demand Side: Population Growth and a Tight Rental Market

The primary driver of property demand is population growth. Unlike the 2013-14 period when 15,000-20,000 people were leaving Western Australia annually, Perth is now experiencing a strong net positive migration. This influx of people from interstate and overseas puts immediate pressure on the housing supply. This is most evident in the rental market, where vacancy rates remain well below 1%—a clear sign of intense demand. A balanced market typically has a vacancy rate of 2.5-3%, meaning Perth is exceptionally under-supplied.

2. Supply Side Squeeze: Critically Low Stock and Lagging Construction

While demand is surging, the supply of available housing is critically low. With fewer than 5,000 properties currently listed for sale, buyers are competing for a very limited pool of homes. Furthermore, the construction pipeline isn't keeping up. In January, only 987 new dwellings were approved. Annually, this equates to around 15,000-18,000 new homes, which is nowhere near enough to accommodate the 85,000 people who moved to WA in the last year. This fundamental imbalance between high demand and low supply is a powerful force that will continue to support price growth.

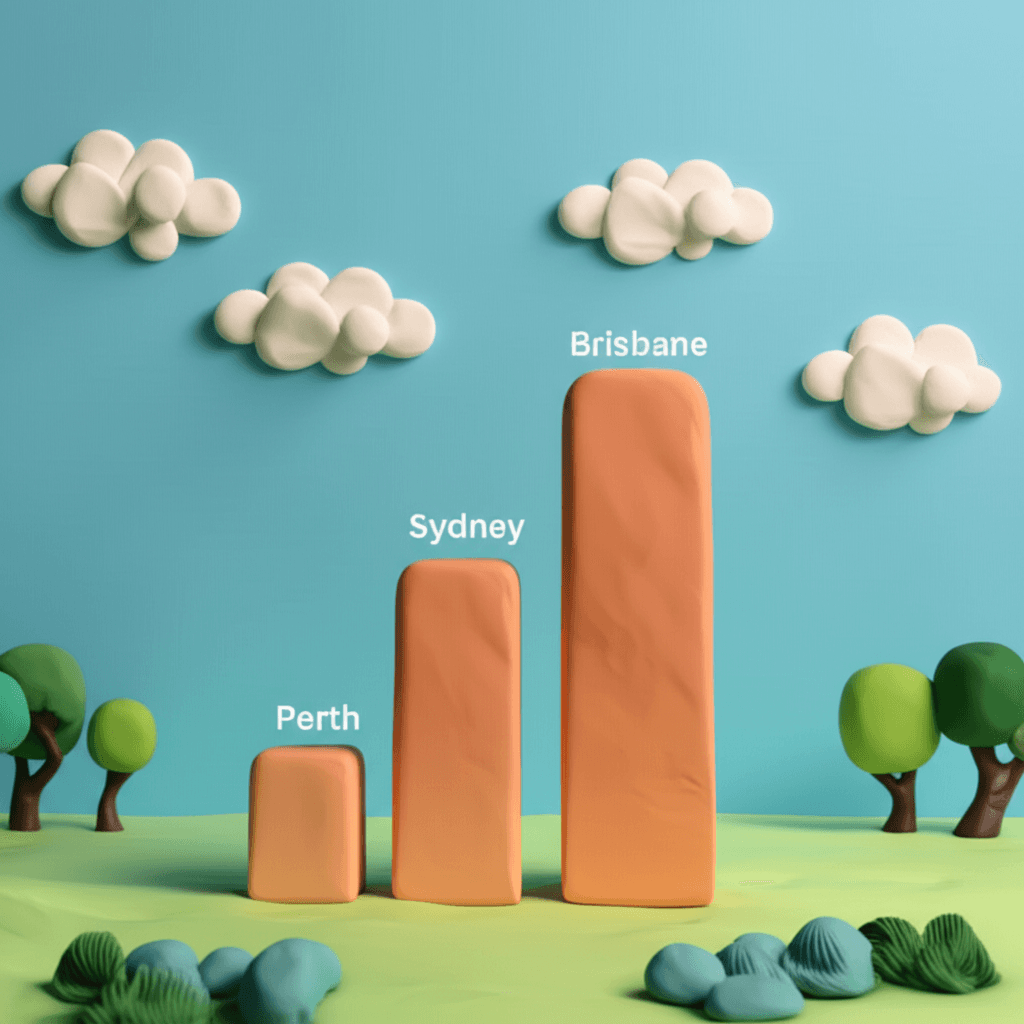

3. The Affordability Myth: How Perth Stacks Up

Many headlines question whether Perth has become unaffordable, but the data tells a different story. The affordability index—which measures the portion of an average wage needed to service an average mortgage—sits at 46% in Perth. While this is higher than a few years ago (30%), it remains significantly more affordable than Sydney (92%) and Brisbane (54%). Historically, Perth's affordability index reached 59% during its last major growth cycle. For the market to reach that previous peak today, assuming stable interest rates and wages, prices would need to increase by another 60%.

4. Market Confidence: A Diversified Economy and Strong Employment

Confidence is the fuel of a property market, and Perth has it in abundance. WA boasts the lowest unemployment and underemployment rates in the country, meaning more people have secure jobs and growing wages. Crucially, today's economy is far more diverse than in previous booms. While mining remains a key industry, sectors like construction, tourism, and technology now play a much larger role. This economic resilience gives buyers and investors the confidence to enter the market, knowing it's not solely reliant on a single industry.

Lessons from History: Perth's Previous Growth Cycles

Historical performance provides valuable context for the future. In Perth's last two major growth cycles (early 1990s and 2000-2006), property prices increased by over 200% within a 5-6 year period. The current cycle has seen growth of around 60-70% so far. While it's unlikely to repeat a 200% surge, history suggests that the current cycle is far from reaching its historical potential and has significant room left to run.

Conclusion

When you move past the headlines and analyse the core data, the verdict is clear: the Perth property cycle is not finished. The fundamentals—strong population growth, chronic undersupply of housing, relative affordability compared to other capitals, and high economic confidence—all point towards continued market strength. Investors and buyers who base their decisions on these facts rather than fiction are well-positioned to capitalise on the opportunities that remain.

Ready to uncover opportunities in the Australian property market? Explore deeper insights and make data-backed investment decisions with HouseSeeker's powerful real estate analytics tools.

Frequently Asked Questions

Is Perth property still considered affordable?

Yes, relative to other major Australian cities and its own historical peaks. Perth's affordability index, which measures mortgage repayments against average income, is significantly lower than in Sydney and Brisbane. Data suggests prices could rise substantially before reaching previous affordability ceilings.

How does Perth's economy affect its property market?

Perth's economy is a major driver of its property market. With the lowest unemployment rate in the country and a more diversified industrial base than in the past, strong employment and wage growth are giving people the confidence and financial capacity to buy property, fuelling demand.

What do low dwelling approvals mean for the market?

The consistently low number of new dwelling approvals means the housing supply shortage will not be resolved in the short to medium term. With demand far outstripping the creation of new homes, this supply-side constraint will continue to put upward pressure on both property prices and rents for the foreseeable future.