Australia's Rental Crisis: A Renter's Guide to Regaining Control

Understand the forces driving record-high rents in 2025 and discover actionable strategies to cut costs and transition from renting to owning.

Introduction: The Great Australian Squeeze

Navigating Australia's property market in mid-2025 feels less like a search for a home and more like a battle for survival. If you're a renter, you're on the front lines. With jaw-dropping rent hikes becoming the norm, the dream of a stable, affordable home feels increasingly out of reach. You're not just paying more; you're compromising on location, features, and your financial future, often with little control over your living situation. This widespread challenge, confirmed by the 2025 PropTrack Origin Rental Reality Report, highlights a system under immense pressure, leaving millions of Australian households feeling powerless.

But knowledge is power. This guide is designed to cut through the noise, providing a clear-eyed view of the forces shaping the rental market. We'll break down the data, offer practical, low-cost strategies to reduce your energy bills, and map out a long-term plan to help you move from renting to the security of homeownership. It's time to regain control.

The State of the Nation: A Renter's Reality in Numbers

The scale of the rental crisis is staggering. Around a third of all Australian households—over 3 million—are renters, and that number is likely higher now than at the last census. The financial burden has escalated dramatically; nationally, renters are paying an average of $11,000 more per year than they were just five years ago.

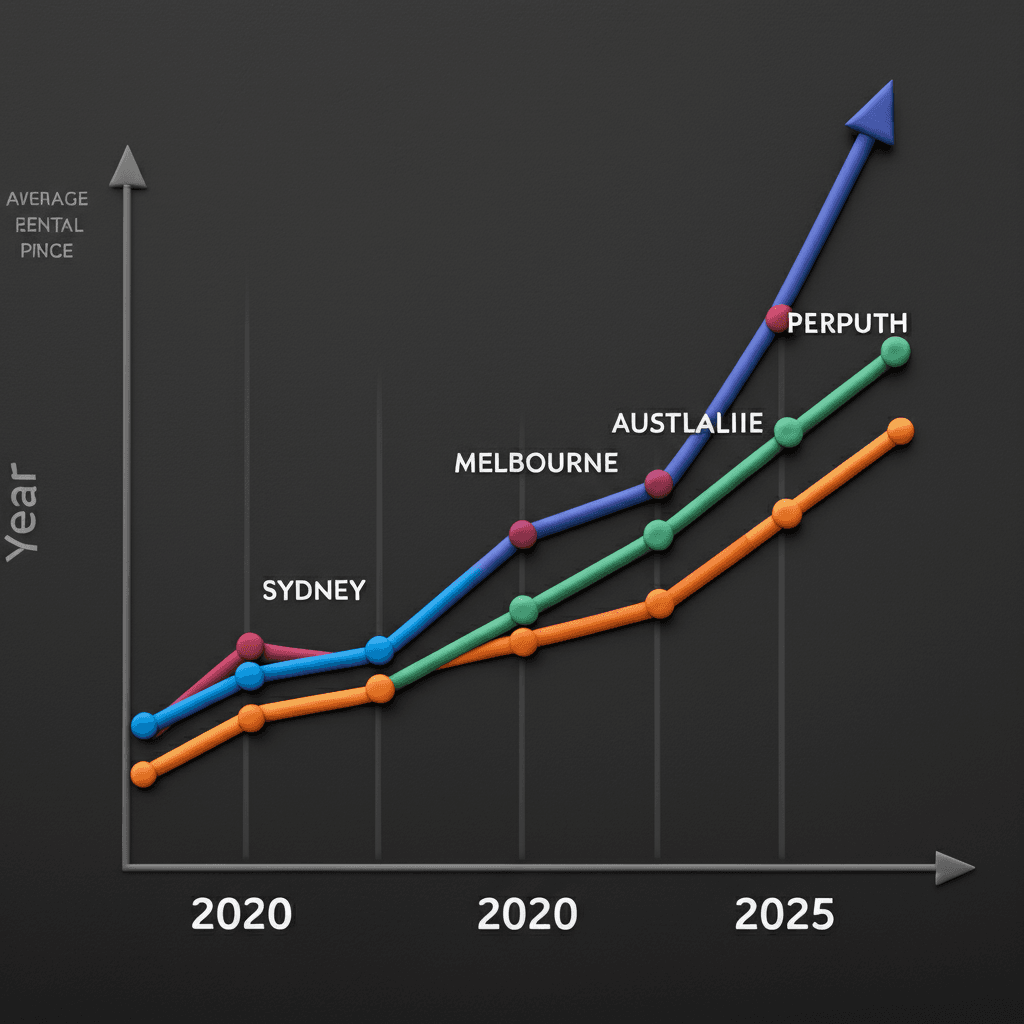

This isn't a uniform trend but a nationwide surge with specific hotspots feeling extreme heat:

Perth: Rents have skyrocketed by an almost unbelievable 90% in five years.

Brisbane & Adelaide: Both cities have seen rents jump by approximately 60%.

Sydney: Australia's largest city has experienced a 50% increase in rental costs.

Melbourne: Close behind, with rents climbing by around 40%.

These figures are more than just statistics; they represent immense pressure on household budgets. The report reveals that a household on a median income can only afford about 36% of the rentals currently available. This affordability crisis is pushing people further from city centres, jobs, and communities. For a deeper dive into these market dynamics, our real estate analytics hub provides the tools to track trends in your specific area.

Furthermore, the profile of the typical renter has changed. It's no longer just young people in their 20s. We're now seeing a significant increase in renters in their 30s, 40s, and beyond, including many families with children who are locked out of the property market.

Behind the Headlines: Why Is This Happening?

Two core economic principles are driving this crisis: supply and demand.

1. Unprecedented Demand

Australia has experienced very strong population growth, largely driven by immigration. As noted by the Australian Bureau of Statistics (ABS), new arrivals are far more likely to rent for their first few years, placing immediate and immense pressure on the available rental stock. This surge in demand has not been met with a corresponding increase in available properties.

2. Critically Low Supply

Housing affordability has become a major barrier, trapping people in the rental market for longer. With property prices remaining stubbornly high and interest rates creating uncertainty, saving for a deposit is more challenging than ever. This difficulty in transitioning from renting to owning means fewer people are leaving the rental pool, keeping vacancy rates at historic lows and giving landlords the upper hand.

The Hidden Cost: Energy Inefficiency and Lack of Control

Beyond the weekly rent, tenants face another significant and frustrating expense: energy. The report found that half of all renters feel that adopting energy-efficient features is completely out of their control. Major upgrades that make a real difference—like solar panels, proper insulation, and double-glazed windows—are decisions for the property owner.

This lack of control is costly. A shocking 33% of renters reported having none of the common energy-saving features in their homes. Even more concerning, only 8% of rental properties are estimated to have sufficient insulation—a basic feature for a quality home. This inefficiency directly translates to higher energy bills, further squeezing already tight budgets.

While some landlords are investing in upgrades like solar panels to add value and attract long-term tenants, progress is slow. Governments are beginning to respond, with Victoria and the ACT introducing minimum standards for insulation and heating in rental properties. However, these changes are not yet national, leaving most renters to fend for themselves.

Taking Back Control: Actionable Tips to Cut Your Energy Bills

While you may not be able to install solar panels, you can take small but powerful steps to reduce your energy consumption and lower your bills. Nearly a third of renters haven't made any changes, representing a huge opportunity to save.

Low-Cost & Temporary Solutions:

Master the Drafts: Use a door snake (the humble hero of energy savings) to block drafts under doors. Check for drafts around windows and use temporary sealant tape for a cheap, effective fix.

Embrace Window Treatments: Heavy curtains or blinds provide an excellent thermal barrier, trapping heat in during winter and keeping it out in summer. You can also apply temporary plastic window film, which creates an insulating air gap similar to double glazing.

Heat the Person, Not the Room: A heated throw blanket uses a tiny fraction of the energy of a space heater. It's perfect for staying warm while watching TV or working from home.

Get Smart with Plugs: Smart plugs allow you to set timers for your appliances, ensuring they are completely off and not drawing standby power when not in use. This is a simple 'set and forget' way to cut down on phantom energy loss.

Rethink Your Kitchen: An air fryer uses significantly less energy than a conventional oven for cooking smaller meals. Similarly, always use a cold wash cycle on your washing machine unless absolutely necessary, as heating water is a major energy drain.

Strategic Investments:

Choose Efficient Appliances: When it's time to buy a new washing machine, dryer, or fridge, prioritize its energy star rating. An efficient appliance is an investment you take with you to your next home, and the long-term savings on your bills can be substantial.

The Ultimate Goal: Escaping the Rental Cycle

These tips provide immediate relief, but the ultimate form of control is ownership. With 90% of rental leases lasting 12 months or less, the constant uncertainty makes it difficult to feel settled. The cycle of inspections, rent increases, and the possibility of being asked to move creates significant stress and instability.

Transitioning to homeownership is the most effective way to secure your future, build wealth, and gain complete control over your living environment. While the path seems daunting, it's not impossible. The key is to move beyond generic advice and develop a personalised, data-driven strategy. Modern tools can demystify the process, helping you understand your borrowing capacity, identify suburbs with long-term growth potential, and find properties that match your specific lifestyle needs. An AI-powered property search can filter for homes based on criteria that matter to you, from school catchments to proximity to public transport.

Conclusion: Your Pathway Forward

The Australian rental market is undeniably tough. A combination of high demand and low supply has created a perfect storm of rising costs and intense competition. However, you are not powerless. By implementing smart, low-cost energy-saving strategies, you can immediately reduce your financial burden.

More importantly, you can start planning your long-term escape. The feeling of being trapped in the rental cycle is a powerful motivator to begin the journey toward homeownership. With the right tools and expert guidance, you can navigate the complexities of the property market and build a secure future for yourself.

Stop compromising and start owning. Explore how our AI Buyer's Agent provides a data-driven pathway from renting to homeownership.

Frequently Asked Questions

How can I find a rental property with energy-efficient features?

Finding a rental with features like solar panels or good insulation can be difficult. The best approach is to use an advanced search platform that allows for keyword-based filtering. Our AI Property Search lets you use natural language to find listings that mention specific features, saving you time and helping you identify more comfortable and cost-effective homes.

What data is most important for understanding local rental market trends?

To get a clear picture, you need to look beyond just the advertised rent. Key metrics include vacancy rates (a low rate indicates high demand), rental yields (important for investors, which affects supply), and population growth forecasts for the area. You can explore these data points and more using our real estate analytics tools to make more informed decisions.

Is it still realistic to plan to buy a home in 2025?

Absolutely, but it requires a more sophisticated strategy than ever before. Success in today's market depends on having a clear financial plan, understanding your borrowing capacity, and using data to identify opportunities others might miss. A guided process, like the one offered by our AI Buyer's Agent, can provide a personalised roadmap, helping you navigate the journey from saving a deposit to securing your first home.