Brisbane Property Market Forecast: A Data-Driven Analysis for 2026

An in-depth look at the key metrics, growth drivers, and investment opportunities shaping Queensland's capital city property market.

An Overlooked Powerhouse

While Sydney and Melbourne have historically dominated discussions about Australian real estate, Brisbane has quietly emerged as one of the nation's strongest performing markets. To illustrate, an investment in a median-priced Brisbane property just five years ago would have yielded a capital gain of over $250,000 today. Despite nationwide affordability pressures, Brisbane continues to attract a strong flow of buyers, investors, and migrants, maintaining a growth momentum that other capitals are struggling to match.

Today, Brisbane's median property price sits at approximately $875,000, reflecting an 8% increase in the last 12 months and a 3% rise in the most recent quarter alone. With major catalysts like the 2032 Olympics, accelerating infrastructure spending, and sustained interstate migration, Brisbane is not just keeping pace—it's setting it. This analysis will delve into the current market dynamics, explore the critical balance of supply and demand, and provide a forecast for the next 12 months, including strategic areas for investment.

Brisbane's Current Market Performance: A Statistical Snapshot

Brisbane's growth has been robust and consistent. Recent data shows a 1.2% monthly and 3.0% quarterly increase. When annualised, this quarterly rate projects a growth of 12% per annum, a figure second only to Perth nationally. This performance firmly entrenches Brisbane as a top-performing capital city, significantly outpacing Sydney's 4.8% and Melbourne's 3.2% annual growth.

However, this long-term trend, which has seen property values effectively double since 2012, has pushed the market towards an affordability ceiling. Understanding these financial pressures is crucial for any potential buyer or investor looking to enter the market. Comprehensive suburb comparison tools can help identify pockets of value that still exist.

The Affordability Challenge: A Double-Edged Sword

According to recent affordability reports from ANZ, Brisbane has reached critical levels. Servicing a new mortgage now requires over 50% of a typical household's income—a significant jump from the historical comfort level of 40%. While still below Sydney's 60%, it signals considerable strain on household budgets. Furthermore, the dwelling value to income ratio has hit 8.2, surpassing the traditional affordability threshold of 8.

This pressure is causing a spillover effect into surrounding regions in Southeast Queensland. Areas like Ipswich, Logan, Moreton Bay, and the Gold Coast are experiencing similar growth spurts, fuelled by buyers seeking relative affordability. However, even these markets are becoming increasingly expensive, highlighting a widespread challenge across the region.

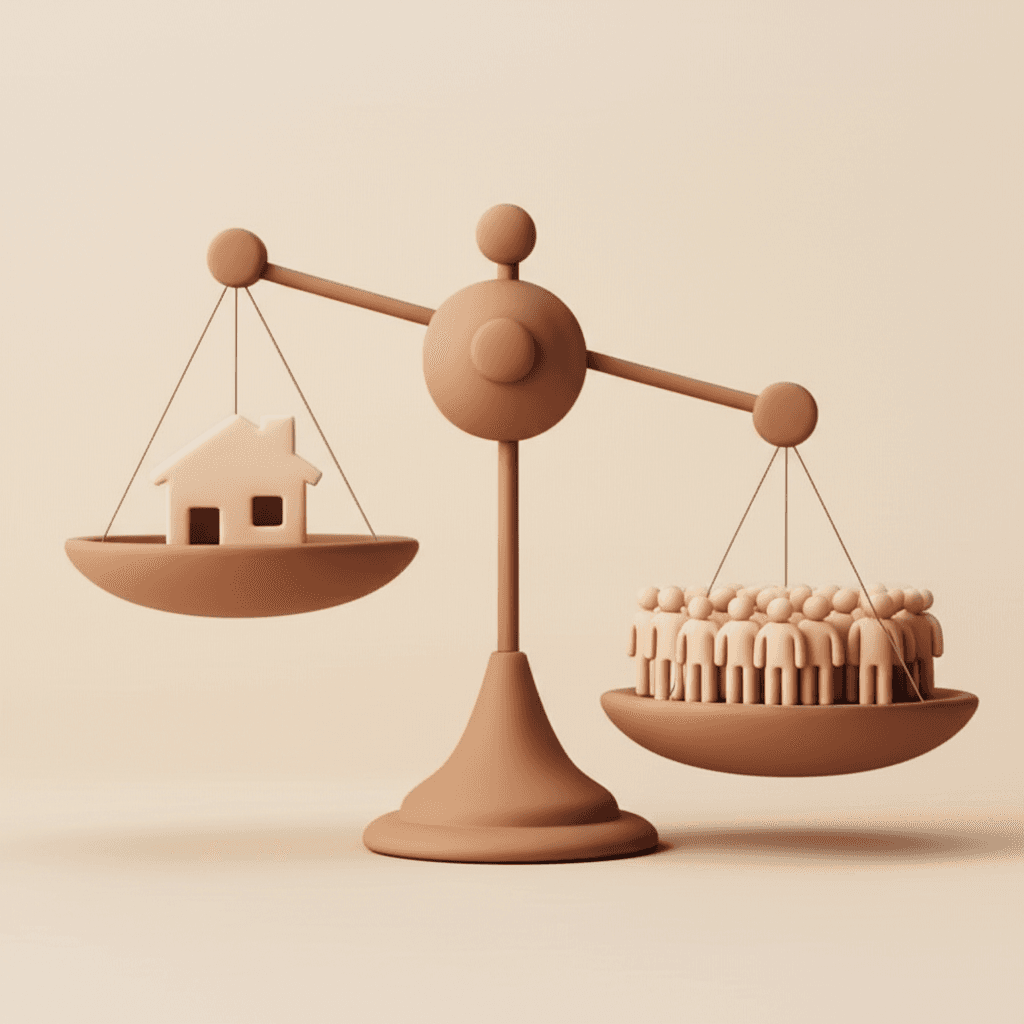

The Core Equation: Unpacking Supply and Demand

Brisbane's sustained price growth can be attributed to a classic economic imbalance: demand far outstrips supply. A closer look at the data reveals the extent of this disparity.

Supply Side: The Listings Crunch

A significant listings crunch is constricting the market. Both new and total property listings in Brisbane are down by 16% compared to the same period last year. This means thousands of homes that would typically be for sale are being held back, as sellers anticipate further growth. This scarcity of available stock intensifies competition among buyers and applies relentless upward pressure on prices.

Market Pace and Transaction Volume

Properties are still moving quickly, with the average days on market at 22—well below the decade average of 50-60 days. This indicates a market that is slower than red-hot but far from cold. Furthermore, vendor discounting is minimal at just -2.7%, meaning sellers rarely need to lower their asking price to secure a sale. Despite the sharp drop in listings, total sales volumes have only decreased by 3.2%, demonstrating that active and determined buyers are absorbing the limited supply as soon as it becomes available.

The Rental Market Under Pressure

The tight sales market has a direct impact on rentals. Brisbane rents have increased by 5.3% over the past year. While this is slower than the double-digit growth of previous years, it remains a healthy rate. Vacancy rates are hovering at a record low of just 0.8%, according to SQM Research. In a market where anything below 2% is considered extremely tight, this means tenants have very few options, allowing landlords to continue increasing rents.

Interestingly, gross rental yields have compressed to a decade-low of 3.6%. This may deter some new investors, which could further reduce the available rental stock and, paradoxically, place even more upward pressure on rents in the short to medium term.

Brisbane Property Outlook: Three Scenarios for the Next 12 Months

Based on current market trends, here are three potential scenarios for Brisbane's property market over the coming year.

This is the most likely scenario, assuming listings remain tight, population growth continues at its current strong pace (1.86%), and confidence remains high due to Olympics-related infrastructure projects that create jobs and attract interstate migrants.

For this to occur, supply would need to tighten even further, and credit conditions would need to loosen, likely requiring two or more rate cuts from the RBA. A continued surge of investor activity would also be necessary, potentially positioning Brisbane to lead the nation's property growth alongside Perth.

This less likely scenario would be triggered by a rise in unemployment or an unexpected spike in construction completions that eases the supply crunch. Government initiatives, however, are expected to provide a floor for the market, making a significant downturn improbable.

Strategic Investment: Where to Focus in Brisbane Today

For those investing in the current market, success requires a strategic approach. The days of relying on the market to do all the heavy lifting are over. Using a platform like HouseSeeker's AI Buyer's Agent can help pinpoint assets with the right fundamentals.

Key areas of focus should include:

1. Mid-Tier Family Suburbs: Data shows the lower 25% and middle 50% of the market are driving growth. Focus on suburbs with good schools, transport links, and local amenities. 2. Prestige-Adjacent Areas: Instead of targeting premium blue-chip suburbs where growth may have peaked, look to neighbouring suburbs. These areas benefit from the ripple effect as buyers seek affordability without straying far from desired locations. 3. Value-Add Opportunities: Seek properties with potential for subdivision, renovation, or development (subject to zoning). Manufacturing your own equity is becoming essential for maximising returns in a mature market.

Conclusion

Brisbane's property market possesses undeniable stamina, fuelled by record-low listings, strong buyer demand, and the long-term promise of the 2032 Olympics. While affordability is a growing concern, the fundamental drivers remain firmly in place. We expect mid-to-high single-digit growth over the next year, with potential for more if supply constraints persist. For savvy investors and homebuyers, opportunities still exist, but they require careful, data-informed selection.

Ready to uncover the next high-growth suburb in Brisbane? Leverage the power of big data with HouseSeeker's Real Estate Analytics Hub to make smarter, data-driven investment decisions.

Frequently Asked Questions

Why is Brisbane's property market outperforming Sydney and Melbourne?

Brisbane's strong performance is driven by a combination of factors: its relative affordability compared to southern capitals, high levels of interstate migration, a severe shortage of property listings, and significant long-term confidence fuelled by Olympics-related infrastructure spending.

Is Brisbane still an affordable city for property investment?

While historically more affordable, Brisbane is rapidly approaching its affordability ceiling. The dwelling-to-income ratio is now over 8, and mortgage serviceability requires over half of a household's income. This means that while there are still pockets of value, careful analysis using tools like an AI property search is essential to find them.

What impact will the 2032 Olympics have on Brisbane's property market?

The Olympics serve as a major catalyst for growth, driving billions in infrastructure investment, creating jobs, and boosting population growth. This enhances market confidence and is expected to support property values over the long term, especially in suburbs that benefit directly from new transport and amenities.