A Data-Driven Guide to Analysing Australian Property Markets

Leverage key supply and demand metrics to forecast capital growth and make smarter, data-backed investment decisions.

Introduction

Navigating the Australian property market in mid-2025 can feel overwhelming. With conflicting advice from so-called experts and the constant noise of market speculation, it's easy to fall into analysis paralysis or make decisions based on emotion rather than evidence. The old-school approach of relying on 'gut feel' or driving around a suburb to check the state of the lawns is no longer sufficient. In today's complex landscape, a new paradigm is required—one built on objective, verifiable data.

This guide will demystify the process of property market analysis. We'll break down the core principles that drive capital growth, explore the key metrics you should be tracking, and explain how a data-first mindset can help you identify high-performing assets and avoid costly mistakes. By the end, you'll have a clear framework for making investment decisions with confidence, backed by the power of real estate analytics.

The Core Principle: Supply and Demand

At the heart of any property market analysis is the fundamental economic principle of supply and demand. This isn't just a textbook theory; it's the engine that drives price movements. When demand for property in an area outstrips the available supply, prices are pushed upwards. Conversely, when supply floods a market with low demand, prices stagnate or fall.

The critical shift for any serious investor is moving from vague concepts to quantifiable data points that measure these two forces. The initial challenge is identifying which metrics accurately reflect supply and which reflect demand.

For example, high auction clearance rates and low days on market clearly indicate strong buyer demand. A low number of properties for sale (stock on market) and minimal new development approvals signal tight supply. By systematically gathering and analysing data related to these forces, you can create a clear picture of a market's health and its potential for future growth.

From Guesswork to Algorithms: Building a Data Model

In the past, gathering this data was a painstaking, manual process. An investor might spend weeks researching a single suburb, only to compare it against a handful of others. This limited scope made it nearly impossible to know if they were truly looking at the best opportunities Australia-wide.

The solution was to automate the process. By combining property investing experience with IT skills, it became possible to gather dozens of metrics for all 15,000+ suburbs in Australia simultaneously. This led to the creation of sophisticated algorithms, like the Demand to Supply Ratio (DSR), which distill complex data into a single, easy-to-understand score. This score provides an objective benchmark to compare any suburb against another, removing emotion and subjective bias from the initial shortlisting process.

This data-driven approach acts as a powerful filtering mechanism. Instead of starting with a vague idea, you can instantly identify suburbs showing positive signs across multiple indicators. This is the foundation of a modern AI Property Search, which allows you to move beyond basic criteria and focus only on markets with statistically proven growth potential.

Key Metrics That Actually Predict Capital Growth

While an overall score is useful, understanding the underlying components is crucial for in-depth analysis. Not all metrics are created equal; some have a much stronger correlation with capital growth than others. Here are some of the most critical indicators to monitor.

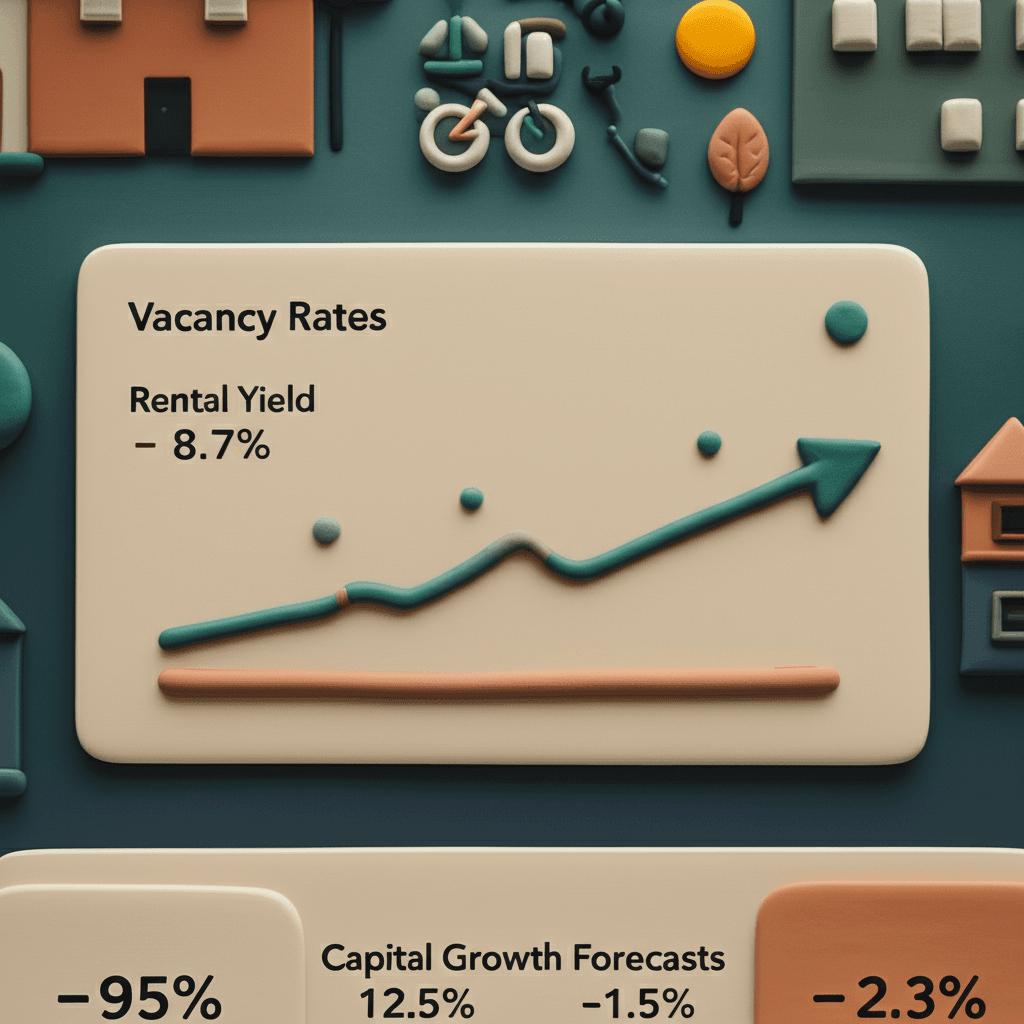

Rental Yield and Vacancy Rates

Rental yield is often a significant drawcard for investors, but it's more than just a cash flow indicator. A rising yield, driven by strong rental growth, can be a precursor to capital growth. Renters are more agile than buyers; they can move into an area quickly, signalling a location's growing appeal. This initial wave of rental demand often precedes a wave of buyer interest.

However, a high yield is meaningless without a low vacancy rate. A vacancy rate is a direct measure of rental demand versus supply. A market with persistently low vacancy rates (typically below 1.5%) indicates a severe rental shortage, which puts upward pressure on rents and, consequently, property values. Be wary of projecting rental income without first verifying the long-term vacancy trend for that specific market.

The Truth About Population Growth

A common piece of advice is to "follow population growth." While it sounds logical, this metric can be dangerously misleading at the suburb level. Most people assume population growth reflects a queue of people waiting to move in, representing pure demand. In reality, official population figures are updated after people have moved into newly constructed homes.

Therefore, at a localised level, a spike in population growth is often an indicator of new supply, not organic demand. People don't move to an area and live on the streets; they occupy available dwellings. For accurate demand analysis, it's far more effective to look at metrics like search interest, enquiry levels, and the speed of sales, rather than lagging indicators like population data from sources like the Australian Bureau of Statistics (ABS).

Stock on Market & Future Supply

Understanding supply is just as important as understanding demand. The 'Stock on Market' percentage—the number of properties for sale as a proportion of total dwellings—is a powerful real-time supply indicator. A low percentage suggests that homeowners are reluctant to sell and inventory is tight, creating a competitive environment for buyers.

The biggest risk, especially for unit investors, is future supply. An area might have excellent demand metrics today, but a pipeline of new apartment towers can quickly flood the market and decimate growth prospects. Researching council development applications is one way to gauge this, but a simpler, lower-risk strategy is to focus on established houses in built-up areas where significant new supply is physically impossible to add.

Market Cycle Timing (Mean Reversion)

No market booms forever. The concept of 'mean reversion' suggests that a market that has significantly underperformed for a long period may be due for a period of strong growth to catch up. Conversely, a market that has just experienced a massive boom is likely to enter a period of flat or slower growth.

Advanced real estate analytics can analyse historical growth patterns to determine where a market is in its cycle. Identifying a suburb that has been dormant but is now showing early signs of pressure building can be one of the most effective strategies for timing an entry into a market just before it takes off.

The Art vs. The Science: Why Data Outperforms Gut Feel

Many traditional property advisors talk about investing being "part science, part art." While experience is valuable, the "art" component often refers to gut feel, intuition, and subjective assessments—things that are impossible to quantify or replicate. The problem with this approach is its inconsistency and susceptibility to personal bias.

Data, on the other hand, is objective. It provides a consistent benchmark for every single market. You can directly compare a suburb in Perth with one in Brisbane using the same metrics, something that is impossible with a 'gut feel' approach. Data removes the emotion that leads to common mistakes, such as buying in a familiar area despite poor growth prospects or chasing a "hot" market after the best growth has already occurred.

Navigating the Data: Practical Application for Investors

Having access to data is one thing; knowing how to interpret and apply it is another. Here are some practical rules for using data effectively.

The Dangers of a Single Metric

Never rely on a single metric to make an investment decision. A suburb might have an incredibly high rental yield, but also a looming oversupply issue or a volatile local economy. A holistic approach is essential. The strongest investment prospects are those where a multitude of different indicators all point in the same direction—high rental demand, low vacancy, tight supply, positive market cycle timing, and high buyer interest.

Data Reliability and Lag Times

No dataset is perfect. There will always be anomalies and lag times, especially with data from sources like the census, which can be years out of date. The key is to favour more current, high-frequency data (like weekly vendor metrics or monthly vacancy rates) and to prioritise statistical reliability. A metric derived from 100 sales is far more reliable than one derived from two. Look for trends over time rather than reacting to a single month's data point, which could be a statistical blip.

Should You Hold or Sell an Underperforming Asset?

The age-old advice to "always hold" property is outdated in the data age. If you're holding a property that has seen little to no growth for years, you have an opportunity cost—that capital could be working harder for you elsewhere. A data-driven review can forecast the likely future performance of that asset. If the data shows pressure is building and the market is about to turn, holding on may be the right move. But if the data indicates years of stagnation ahead, selling and redeploying your equity into a market with stronger prospects is the logical choice. This is where a service like an AI Buyer's Agent can help, by identifying superior opportunities based on your specific goals.

Conclusion

The era of property investing based on guesswork and anecdotal evidence is over. The future belongs to investors who can harness the power of data to make objective, informed, and strategic decisions. By focusing on the core driver of supply and demand and using a multi-layered approach to analyse key metrics, you can dramatically increase your probability of success.

Remember to look for a confluence of evidence—don't rely on a single metric. Understand a market's position in its cycle, be wary of future supply, and always prioritise reliable, recent data. This disciplined approach will allow you to cut through the noise, identify genuine growth markets, and build a high-performing property portfolio.

Ready to stop guessing and start making data-driven investment decisions? Explore HouseSeeker's powerful [real estate analytics](https://houseseeker.com.au/features/real-estate-analytics) to uncover Australia's next property hotspots.

Frequently Asked Questions

How long can data accurately forecast property growth?

Forecasting property market movements is complex, but data models focused on supply and demand have historically been most accurate over a short-to-medium-term window. Typically, these indicators are most reliable for predicting performance over the next one to three years. Beyond that timeframe, market dynamics can shift, making long-range forecasts less certain.

Is population growth a reliable indicator for property investment?

No, at a suburb or local level, population growth is often a misleading indicator. It is a lagging metric that typically reflects new housing supply that has already been built and occupied. It's more effective to analyse leading demand indicators, such as online search interest, auction clearance rates, and days on market, which measure current buyer and renter activity.

Can I rely on a single data point like rental yield to choose a property?

Absolutely not. Relying on a single metric is one of the most common mistakes investors make. A high rental yield, for example, could be a red flag for a high-risk area or a market with an impending oversupply of rental properties. The most reliable investment signals come from a 'cluster' of positive metrics, where multiple indicators for demand, supply, and market timing are all pointing towards future growth.