The Truth About Rental Yields and Capital Growth: A Data-Driven Analysis

Learn to look past common investment myths and use data to identify properties with strong cash flow and growth potential.

Navigating the Australian property market in mid-2025 can feel overwhelming. Investors are constantly bombarded with conflicting advice, opinions packaged as facts, and marketing masquerading as education. One of the most persistent and confusing debates revolves around rental yields and capital growth. Are they mutually exclusive? Does a high rental return automatically signal a poor long-term investment? Many so-called experts would have you believe so, steering you exclusively towards low-yield, 'blue-chip' suburbs.

This article cuts through the noise. We're going to bust the most pervasive myths surrounding property investment by doing what most pundits don't: looking at the historical data. By understanding the true relationship between rental income and value appreciation, you can build a more resilient, profitable, and data-backed property portfolio. It's time to replace outdated opinions with powerful real estate analytics.

First, What Exactly is Gross Rental Yield?

Before we dive into the myths, it's crucial to be clear on the terminology. The Gross Rental Yield is a simple yet powerful metric that shows the annual rental income a property generates as a percentage of its market value.

The formula is straightforward:

`(Annual Rental Income / Property Value) x 100 = Gross Rental Yield (%)`

For example, if you purchase a property for $500,000 and it generates $20,000 in rent per year, your calculation would be:

`($20,000 / $500,000) x 100 = 4%`

This 4% yield gives you a clear snapshot of the property's cash flow potential relative to its cost. It’s important to note this is a 'gross' figure, as it doesn't account for expenses like maintenance, insurance, or property management fees. However, it remains a fundamental metric for comparing investment opportunities.

Myth 1: Regional Markets Have Slower Growth Than Capital Cities

One of the most common arguments against investing in higher-yield regional areas is the belief that they suffer from inferior capital growth. The theory goes that capital cities, with their larger populations and supposedly higher demand, are the only places to achieve significant long-term value appreciation. A typical claim is that regional locations have an 'abundant land supply and lower demand,' leading to 'slower land value appreciation.'

This sounds logical, but it's an opinion that crumbles under data-driven scrutiny.

What the Data Says

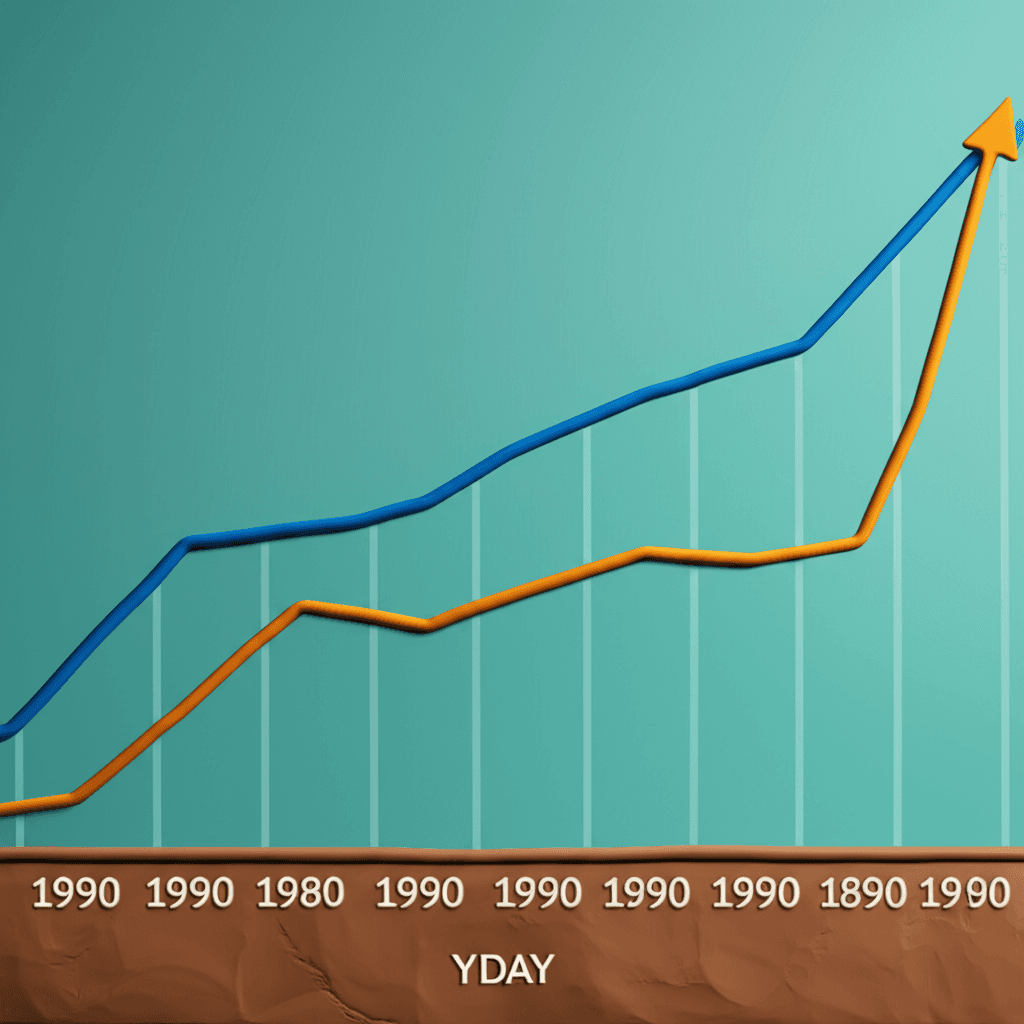

When we analyze decades of market performance, a very different picture emerges. A comprehensive look at the Australian property market from January 1990 to late 2023 reveals that, over the long term, the growth of regional markets and capital city markets has been remarkably similar—essentially neck and neck.

While there are certainly periods where one market type pulls ahead of the other, these cycles of divergence and convergence are a constant feature. For instance, capital cities might surge for a few years, making them appear unaffordable. This, in turn, drives buyers and investors to seek better value in regional centres, causing those markets to catch up and even overtake the capitals.

This cyclical relationship demonstrates that the winner of a 'capital growth race' is often determined more by the start and end dates chosen for the analysis than by any inherent superiority of one market type. The long-term data shows no sustained outperformance by capital cities. Attributing strong growth prospects solely to capital cities is a dangerous oversimplification that can cause investors to overlook incredible opportunities.

Myth 2: A High Rental Yield Is a Red Flag for Poor Capital Growth

This myth is a direct consequence of the first. The flawed logic is that if a property offers a high rental yield, say 6% or more, it must be as a trade-off for weak capital growth. Proponents of this idea often claim that for a property with a 6% yield, 'the chances of capital growth exceeding 4% per annum are very slim.' This presents investors with a false choice: you can have good cash flow or good growth, but not both.

The Data Tells a Different Story

Once again, this assertion doesn't hold up. By examining historical market data, we can isolate property markets at points in time when they were delivering a gross rental yield of around 6% (specifically, between 5.5% and 6.5%). We can then track their subsequent capital growth performance.

Did these markets struggle to achieve 4% growth? Far from it. On average, markets with a ~6% rental yield went on to produce an average capital growth rate of 7.7% per annum.

Even more telling is the comparison to their lower-yielding counterparts. Markets with a more 'typical' yield of less than 5.5% during the same period saw an average capital growth of just over 6% per annum. The data suggests that, contrary to popular belief, properties in the 6% yield bracket not only delivered strong capital growth but actually outperformed the lower-yielding markets.

This completely busts the myth that a high yield is a red flag. In many cases, it can be a green light, indicating an undervalued market with strong rental demand—a key ingredient for future growth.

Rethinking "Investment Grade": Why Blue Chip Isn't Always Best

The term 'investment grade' is thrown around frequently in property circles, often used to describe expensive properties in affluent, 'blue-chip' suburbs. These are typically low-yield, high-price-point assets located in major capital cities. The narrative is that these are the only 'safe' and 'reliable' locations for long-term investment.

However, a data-driven approach challenges this definition. A true investment-grade asset should deliver a combination of:

1. Strong Capital Growth: Long-term appreciation in value. 2. Healthy Cash Flow: Sufficient rental income to minimise out-of-pocket expenses. 3. Low Risk: Stability and resilience through market cycles.

When viewed through this lens, the argument for exclusively targeting expensive, low-yield properties weakens significantly.

A More Balanced View of Risk and Return

Cash Flow & Risk: Higher-yield properties provide a superior cash flow buffer, reducing financial strain on the investor. This makes the investment less risky and more sustainable. Furthermore, concentrating all your capital into one expensive 'blue-chip' asset means putting more eggs in one basket, which is inherently riskier.

Volatility: Historical data, such as that available from the Reserve Bank of Australia, shows that the most expensive segments of the market are often the most volatile. They experience sharper downturns during market corrections compared to more affordable markets.

Growth: As we've already demonstrated, there is no evidence to suggest that lower-yield properties produce superior long-term capital growth.

An investor armed with the right tools can find properties that tick all three boxes. Using an AI property search platform allows you to filter for locations that exhibit both high rental demand and the underlying economic drivers for future growth, regardless of whether they are in a capital city or a thriving regional hub.

Conclusion: Trust Data, Not Dogma

The Australian property landscape is too complex for outdated rules of thumb. The beliefs that regional areas underperform and that high yields signal poor growth are not just incorrect—they are dangerous myths that can lead investors to make poor decisions, overpay for assets, and miss out on superior returns.

The key takeaway is this: A successful investment strategy must be built on a foundation of comprehensive data analysis, not popular opinion. By leveraging powerful real estate analytics, you can identify markets with the optimal balance of cash flow, growth potential, and manageable risk. It’s time to move beyond the myths and let the numbers guide your next investment.

Ready to build a smarter property portfolio? Explore HouseSeeker's powerful [real estate analytics tools](https://houseseeker.com.au/features/real-estate-analytics) to uncover Australia's next high-growth, high-yield hotspots.

Frequently Asked Questions

What is a good rental yield in Australia?

A 'typical' gross rental yield in Australia often sits around 3-4%, especially in major capital cities. However, a 'good' yield is one that aligns with your investment strategy. As this article shows, yields of 5-6% or even higher can be found, often in markets that also possess strong growth drivers. The key is not to view yield in isolation but as part of a holistic analysis.

Should I prioritise capital growth or rental yield?

The ideal strategy doesn't force you to choose. The goal for most investors is to find properties that offer a healthy balance of both. Strong cash flow from a good rental yield makes the investment sustainable and less risky, while capital growth builds your long-term wealth. The data shows that it is entirely possible to find assets that deliver on both fronts.

How can I find high-yield properties with good growth potential?

Finding these properties requires moving beyond surface-level metrics. You need to perform deep data analytics to identify suburbs with strong economic fundamentals, growing populations (as tracked by sources like the ABS), low vacancy rates, and infrastructure investment. Platforms like HouseSeeker's AI Property Search are designed to help investors pinpoint these exact opportunities by analysing thousands of data points simultaneously.