High-Yield Property Traps: Why That 'Bargain' Investment Might Be a Dud

We analyse a $129,000 unit with a 10% rental yield to reveal the hidden risks that data can uncover. Learn to spot a bad deal before you invest.

The Alluring Promise of a Low-Cost, High-Yield Property

For aspiring investors, the numbers are almost irresistible: a property for just $129,000, renting for $250 a week. On paper, this calculates to a rental yield of over 10%—a figure that seems like a cash-flow machine in today's market. This type of deal, often found in tourist-heavy locations like Cairns, is designed to attract newcomers with its low entry barrier and impressive headline figures. However, a deeper dive into the data reveals a far more precarious financial story, one where alluring yields quickly dissolve under the weight of hidden costs and inherent risks.

When High Yield Doesn't Mean High Cash Flow

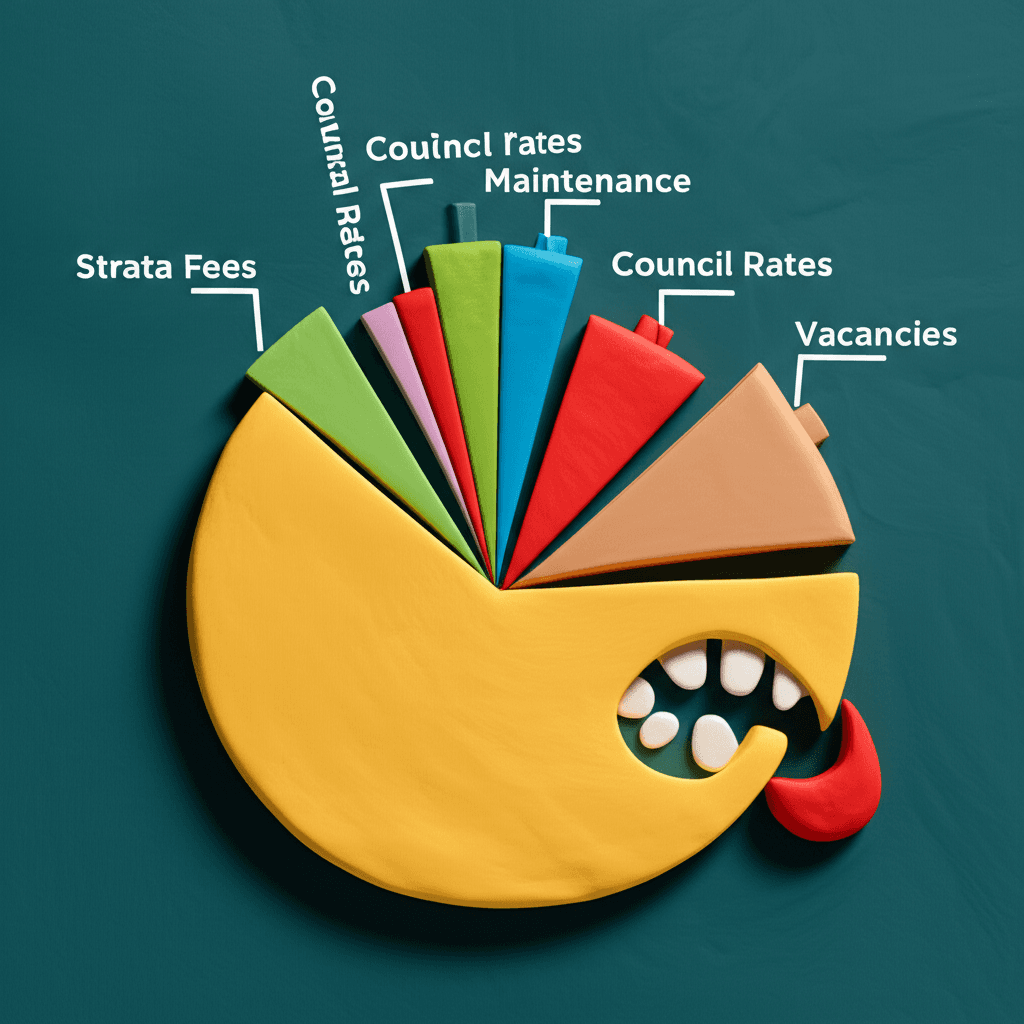

The most critical mistake an investor can make is confusing gross rental yield with actual cash flow. While the initial income looks strong, a series of significant, non-negotiable expenses immediately begins to erode any potential profit. For this specific Cairns property, the high strata fees, a common feature of resort-style complexes with pools and manicured gardens, are the first major red flag.

Let's break down the numbers:

Gross Weekly Rent: $250

Annual Strata Levies: ~$3,900, which is approximately $75 per week.

Annual Council Rates: ~$3,000, which is approximately $58 per week.

After just these two expenses, the weekly income plummets from $250 to a mere $117. This doesn't even account for property management fees, landlord insurance, maintenance, and the high probability of vacancies in a transient, resort-style location. Once all costs are factored in, this 'cash cow' is likely negatively geared, costing you money each year despite its impressive 10% yield.

The Double Jeopardy of Financing and Scarcity

Beyond the immediate cash flow problem, this type of property presents two fundamental growth hurdles: financing and scarcity. Most banks and lenders are hesitant to finance small studio apartments, especially those under 40 or 50 square metres. This property, at just 28 square metres, is considered high-risk, meaning a buyer may need a deposit as high as 50% of the purchase price. That's over $60,000 in cash tied up in an underperforming asset, capital that could have served as a strong deposit on a far better property.

Furthermore, the unit exists within a massive complex containing hundreds of nearly identical properties. This complete lack of scarcity creates a hyper-competitive environment. When vacancies arise, you're not just competing with other rentals in the suburb; you're competing with dozens of identical listings in the same building. This dynamic suppresses rental growth—as owners undercut each other to attract tenants—and severely limits the potential for capital appreciation. Finding a unique property is a key part of a successful strategy, something a sophisticated platform like an AI-powered buyer's agent is designed to help with.

A Volatile History: What Past Performance Data Reveals

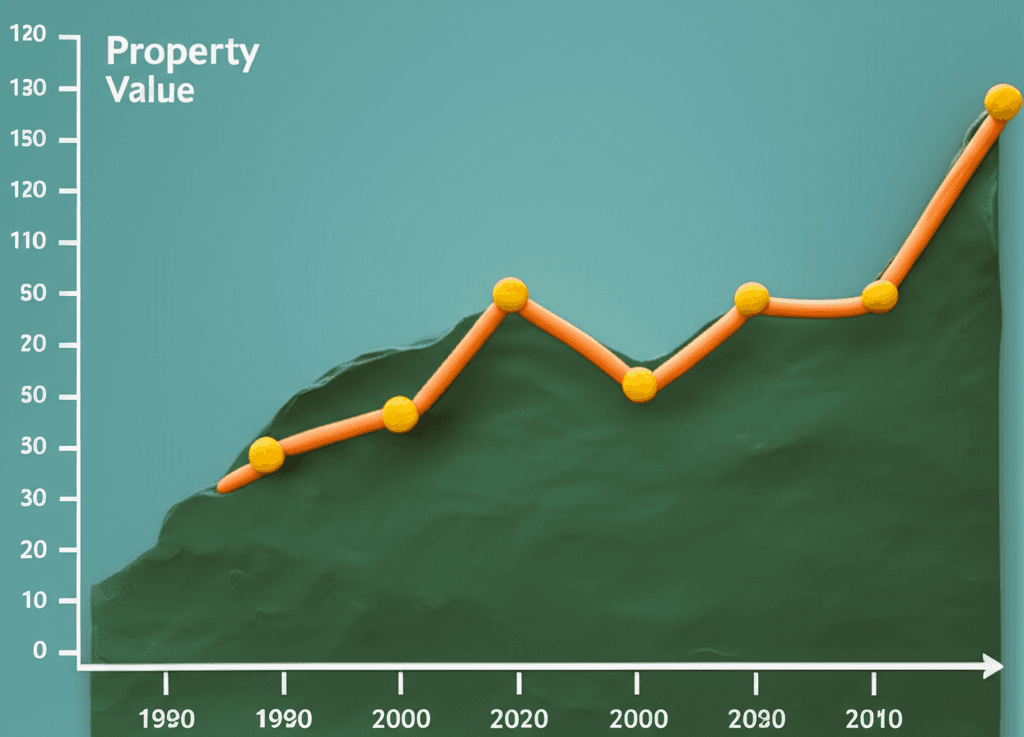

The most damning evidence against this 'deal' comes from its historical performance. A thorough analysis of sales data shows that these units were selling for similar prices—around $120,000—back in 2007. In the years following, the market for these assets collapsed, with some selling for as little as $21,000. The current asking price isn't a sign of strong growth; it's merely a return to a peak reached nearly two decades ago.

This extreme volatility is characteristic of markets heavily reliant on single industries like tourism, which can be affected by factors completely out of an investor's control. In contrast, properties in major capital cities with diverse economies and consistent population growth tend to demonstrate far more stable and reliable long-term growth. True investment success isn't about timing a volatile market; it's about identifying fundamentally sound assets. Using the right real estate analytics is crucial for distinguishing between temporary peaks and sustainable growth trends.

Conclusion: Look Beyond the Headlines for True Value

While a low price point and a high rental yield can seem incredibly tempting, they often mask a deeply flawed investment. This Cairns studio serves as a perfect case study in what to avoid: high hidden costs that destroy cash flow, financing difficulties, a lack of scarcity that stifles growth, and a history of extreme volatility. A savvy investor knows that the real deal is rarely the one advertised with flashy numbers. It's the one that stands up to rigorous, data-driven scrutiny.

Don't get caught in an investment trap. Arm yourself with the right information and learn how to analyse properties like an expert. Explore our comprehensive real estate analytics tools to make smarter, data-backed investment decisions.

Frequently Asked Questions

What is the difference between rental yield and cash flow?

Rental yield is a simple calculation of the annual rental income as a percentage of the property's value. Cash flow, on the other hand, is the actual profit or loss remaining after all expenses—including mortgage payments, strata fees, council rates, insurance, and maintenance—have been deducted from the rental income.

Why do banks require a larger deposit for small studio apartments?

Lenders consider properties under a certain size (typically 40-50 sqm) to be higher risk. Their value can be more volatile, and the pool of potential buyers is smaller compared to standard one or two-bedroom apartments. To mitigate this risk, banks often require a lower Loan-to-Value Ratio (LVR), which translates to a larger upfront deposit from the borrower.

Is it always a bad idea to invest in regional or tourist-heavy locations?

Not necessarily, but it requires much deeper analysis. The key is to look for locations with diverse and growing economies, not just a single industry like tourism. Sustainable growth is driven by factors like infrastructure development, diverse job opportunities, and consistent population growth—metrics that can be tracked with robust market trend data.