First Home Buyer Case Study: $85k Equity Growth in 12 Months

Learn how a 23-year-old investor skipped the grants, avoided a common mistake, and achieved 20% capital growth on his first property.

Introduction: The First-Time Buyer's Crossroads

Navigating the Australian property market in mid-2025 is a formidable challenge, especially for young, aspiring buyers. Faced with immense pressure, many feel pushed towards two seemingly logical paths: buying a familiar local apartment or chasing government grants to get a foot on the ladder. But what if the safest path is actually the biggest financial mistake?

This case study explores the journey of Rohit, a 23-year-old software engineer who, on the verge of buying a high-supply apartment in Western Sydney, made a strategic pivot. By prioritising data over emotion and long-term growth over short-term incentives, he acquired an investment property that generated $85,000 in tax-free equity in just 12 months. His story is a powerful blueprint for any first-time buyer looking to build real wealth from their very first purchase.

The Common Trap: Chasing Grants in a Saturated Market

Like many young professionals with a healthy disposable income, Rohit's initial plan was to purchase his first home near where he lived in Parramatta. He scouted apartments along the train line in Westmead and Pendle Hill, with a budget of around $600,000 to $650,000, aiming to secure a First Home Owner Grant. The idea was to live in it for the mandatory period before turning it into an investment property.

However, during his inspections, a sense of unease grew. The apartments he saw felt like poor value, and he correctly identified the risk of being severely negatively geared. This is a classic first-home-buyer trap: focusing on a familiar geographical area without understanding the underlying market dynamics. These areas, while conveniently located, often suffer from a high supply of apartments, which suppresses capital growth. The allure of a government grant can blind buyers to the reality of acquiring a low-performing asset.

According to data from the Australian Bureau of Statistics (ABS), population growth is a key driver of housing demand, but when supply outstrips this demand in a specific dwelling type (like high-rise units), prices can stagnate or even fall.

The Strategic Pivot: Data-Driven Investing for Superior Returns

Realising the local apartment strategy was flawed, Rohit turned to expert guidance. This decision marked a crucial shift from an emotional, convenience-based approach to a logical, data-driven one. The goal was no longer just to 'get into the market,' but to acquire an asset with the best possible prospects for long-term growth.

Instead of a $650,000 apartment, the strategy focused on a completely different asset class and location identified through powerful real estate analytics. The result was the purchase of a 4-bedroom, modern (2013 build) house on a 500sqm block in regional Queensland for just $425,000.

This property ticked all the boxes for a prime investment:

Scarcity: A freestanding house on a decent land parcel, offering inherent value over a unit in an apartment complex.

Strong Demand: Located in a region with robust economic drivers and population growth, ensuring high tenant demand.

Positive Cash Flow: The rental income was strong from day one, mitigating financial risk.

This is where a sophisticated AI Property Search becomes invaluable, allowing investors to uncover high-potential suburbs and properties well beyond their own backyard.

The Results: A 12-Month Performance Breakdown

The decision to prioritise investment fundamentals over familiarity paid off spectacularly. After just one year of ownership, the numbers speak for themselves.

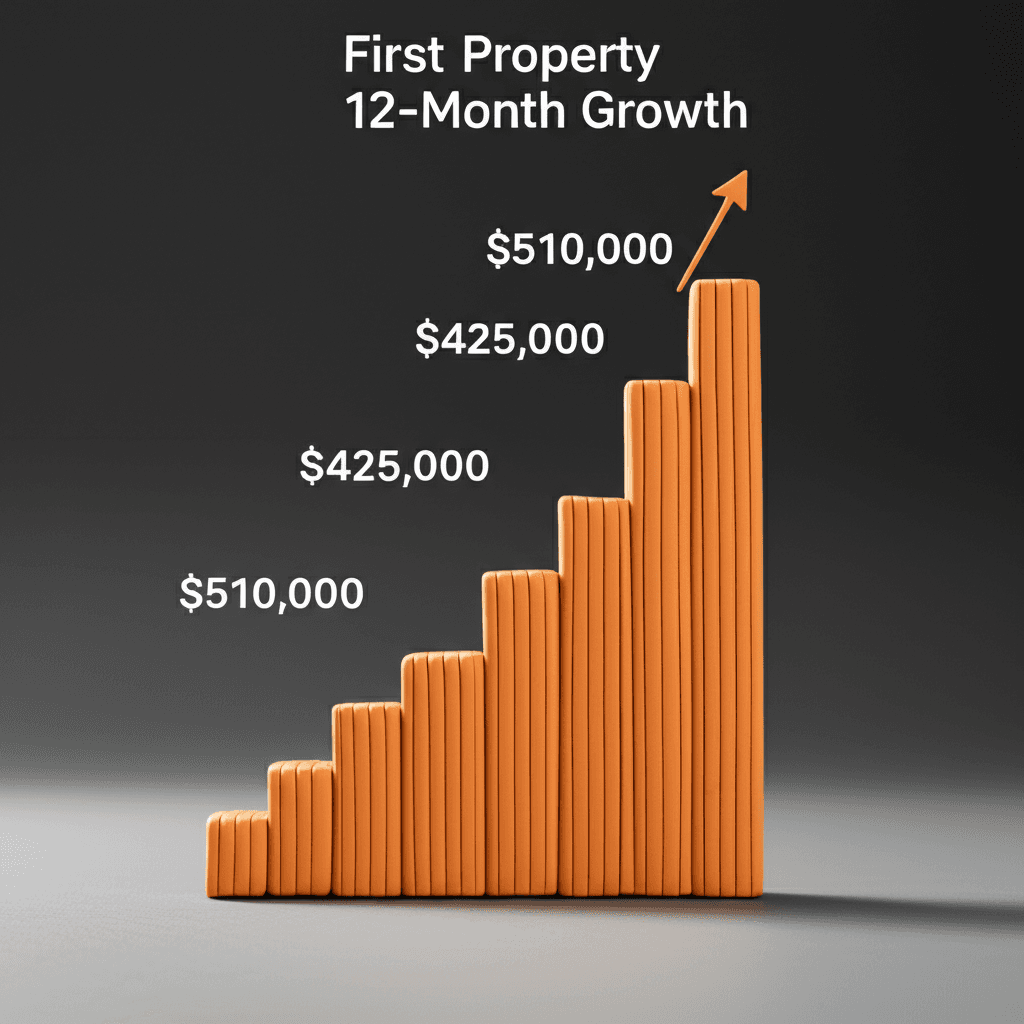

Purchase Price: $425,000

Valuation (12 Months Later): $510,000

Total Capital Growth: $85,000

Annual Growth Rate: 20%

Tax-Free Equity Gained Per Month: Approximately $7,083

Furthermore, the property’s cash flow improved dramatically. The initial rent of $450 per week was increased to $510 per week within months, with projections indicating it could soon reach $530-$550, further strengthening the investment's financial position. This level of performance is a testament to what's possible when you leverage detailed market real estate analytics to make informed decisions.

Key Lessons from Rohit's Success

Rohit's journey from a hesitant first-home buyer to a successful property investor offers several critical lessons for anyone starting out.

1. Expert Guidance Outweighs Short-Term Grants

The $85,000 in equity growth Rohit achieved in one year completely eclipses any government grant he might have received. Choosing the right asset is infinitely more valuable than a short-term cash incentive tied to a poor-performing one.

2. The Power of Leverage in Property

Having previously lost money in volatile stocks, Rohit experienced first-hand the power of responsible leverage in property. Using a deposit of just 12% (around $51,000 plus costs), he controlled a $425,000 asset and captured all the upside of its growth—a return on his initial capital that is difficult to achieve in other asset classes.

3. A Stress-Free Process is Possible

One of Rohit's key takeaways was the value of a seamless, stress-free process. By engaging a professional team, the complexities of sourcing, negotiating, and settling the property were handled for him. This is the core benefit of a service like an AI Buyer's Agent, which manages the entire journey, from strategy to settlement, allowing you to focus on your career and life while your portfolio grows.

Conclusion: Your First Property Can Be Your Best

Rohit's story is definitive proof that your first property purchase doesn't have to be a compromise. At just 24, he has already built a powerful financial foundation and is preparing to purchase his second investment property. His success wasn't due to luck; it was the result of a deliberate, data-backed strategy that prioritized investment quality over convenience.

By avoiding the common trap of buying locally, he unlocked a high-growth opportunity that has fast-tracked his wealth creation journey by several years. This is the new blueprint for ambitious first-time buyers in Australia.

Rohit's story is a powerful example of how guided expertise can transform your financial future. If you're ready to avoid common mistakes and build a portfolio of high-performing properties, discover how HouseSeeker's AI Buyer's Agent can create a personalised strategy for you.

Frequently Asked Questions

### What would the apartment Rohit nearly bought be worth now?

While it's impossible to know for certain, the transcript notes that similar new apartments in the Western Sydney suburbs he was considering often experience price stagnation due to oversupply. In contrast to his 20% growth, it's likely the apartment would have seen minimal, if any, capital appreciation and may have even decreased in value after factoring in costs like strata fees.

### Is it better to buy an investment property first or a home to live in?

This strategy, often called 'rentvesting', is what Rohit did. He chose to buy a high-performing investment property in an affordable location while continuing to rent in a location he enjoys. For many young Australians in expensive capital cities, rentvesting is a powerful way to build wealth without sacrificing their lifestyle or waiting years to save a massive deposit for a home in their desired area.

### How much deposit did Rohit need for this property?

Rohit used a 12% deposit, which on a $425,000 purchase price is $51,000. On top of this, buyers need to account for costs like stamp duty, legal fees, and loan establishment fees. Generally, a deposit of 10-20% is required for an investment property, though some lenders may have different criteria.