The Truth About Positive Cash Flow Property: A Data-Driven Analysis

Learn to use real estate analytics to weigh rental income against capital growth for smarter investment decisions in the Australian market.

Navigating the Australian property market in mid-2025, many investors are driven by a single, seductive goal: to buy a property that costs them nothing to hold. The idea of a 'positive cash flow' property—one that puts money back in your pocket every week—is incredibly appealing, especially in a high-interest-rate environment. But is this singular focus on yield a golden ticket to wealth, or a risky trap that could cost you in the long run?

This guide cuts through the noise. We'll dismantle the myths surrounding positive cash flow, break down the real numbers behind a typical investment, and reveal why a balanced, data-driven strategy focused on capital growth is the true engine of wealth creation. Forget the long-term excuses and learn how to target markets with the highest probability of growth in the near term.

What Exactly is Positive Cash Flow Property?

Before we dive into the strategy, let's clarify the terminology. A property is considered positive cash flow when its after-tax income is greater than its after-tax expenses. It's a simple equation:

Income (Primarily Rent) > Expenses (Loan Interest, Council Rates, Insurance, Maintenance, Management Fees)

Many investors confuse this with their weekly budget. They might see a large principal-and-interest loan repayment and think their property is costing them a fortune. However, for tax purposes (negative gearing), only the interest portion of the loan is considered a deductible expense. The principal repayment is you paying down debt and building equity, not a running cost.

A Typical Investment Property: A Numbers Breakdown

To understand why achieving positive cash flow is so challenging right now, let's model a standard investment scenario. Imagine purchasing a property for $500,000.

Here are the typical figures:

Purchase Price: $500,000

Deposit (20%): $100,000

Stamp Duty & Costs: $25,000

Total Cash Outlay: $125,000

Loan Amount (80% LVR): $400,000

Interest Rate (Variable): 6.5%

Rental Yield (National Average): 4.3% (approx. $414/week rent)

Now, let's tally the annual expenses:

Loan Repayments (Interest Only): $26,000

Council Rates, Insurance, Maintenance & Fees: $8,400

Total Expenses: $34,400

Total Rental Income: $21,528

In this scenario, the property has an annual cash flow shortfall of -$12,872, or about -$247 per week before tax. After applying a 32.5% marginal tax rate deduction (negative gearing), the property still costs approximately $167 per week to hold. This is a standard, negatively geared property—the complete opposite of the positive cash flow dream.

[INSERT_IMAGE: "A vibrant chart showing capital growth trends in major Australian cities"]

The Hidden Engine of Wealth: Why Capital Growth Matters Most

If a typical property costs money to hold, why do investors bother? The answer is capital growth. This is the appreciation in the property's value over time, and it's where real wealth is built.

Let's add capital growth to our example. The long-term average annual growth for Australian property is around 6%. For our $500,000 property, that's $30,000 in growth in the first year.

Annual Growth: +$30,000

Annual Holding Cost (After Tax): -$8,688

Net Profit (Year 1): +$21,312

By investing $125,000 in cash, you've generated a net profit of $21,312. This translates to a Return on Investment (ROI) of 17%. When compared to the 8-10% long-term returns often touted by super funds, property investment, even when negatively geared, demonstrates its power as a superior wealth creation vehicle.

The key is not to throw a dart at a map and hope for long-term growth. The goal is to use powerful real estate analytics to identify markets poised for growth within the next two to four years, maximizing your returns sooner.

The Two Paths to Positive Cash Flow: Are They Worth It?

So, how can you make that same $500,000 property cash flow positive? There are two primary methods, but both come with significant trade-offs.

Path 1: Using a Massive Deposit

You can force a property to be cash flow positive by drastically reducing your loan. In our example, instead of borrowing $400,000, imagine you only borrowed $170,000. This would require a cash outlay of $355,000 ($330,000 deposit + $25,000 costs).

Your interest payments would plummet, and the property would now generate a tiny positive cash flow of about $3 per week. However, your ROI would collapse from 17% to just 8.5%. You've invested far more of your own capital for a much weaker return. A smarter strategy is to borrow the maximum sensible amount and park your extra cash in an offset account. This reduces your interest payments while keeping your funds liquid and accessible.

Path 2: Chasing Extremely High Yields

The other path is to find a property with an exceptionally high rental yield. To make our $500,000 property cash flow neutral with an 80% loan, you would need a gross rental yield of 7.9%. This is nearly double the national average.

While this looks fantastic on paper—boosting your theoretical ROI to 24% (assuming the same 6% growth)—finding such properties is incredibly difficult and fraught with risk.

The Rarity and Risk of High-Yield Properties

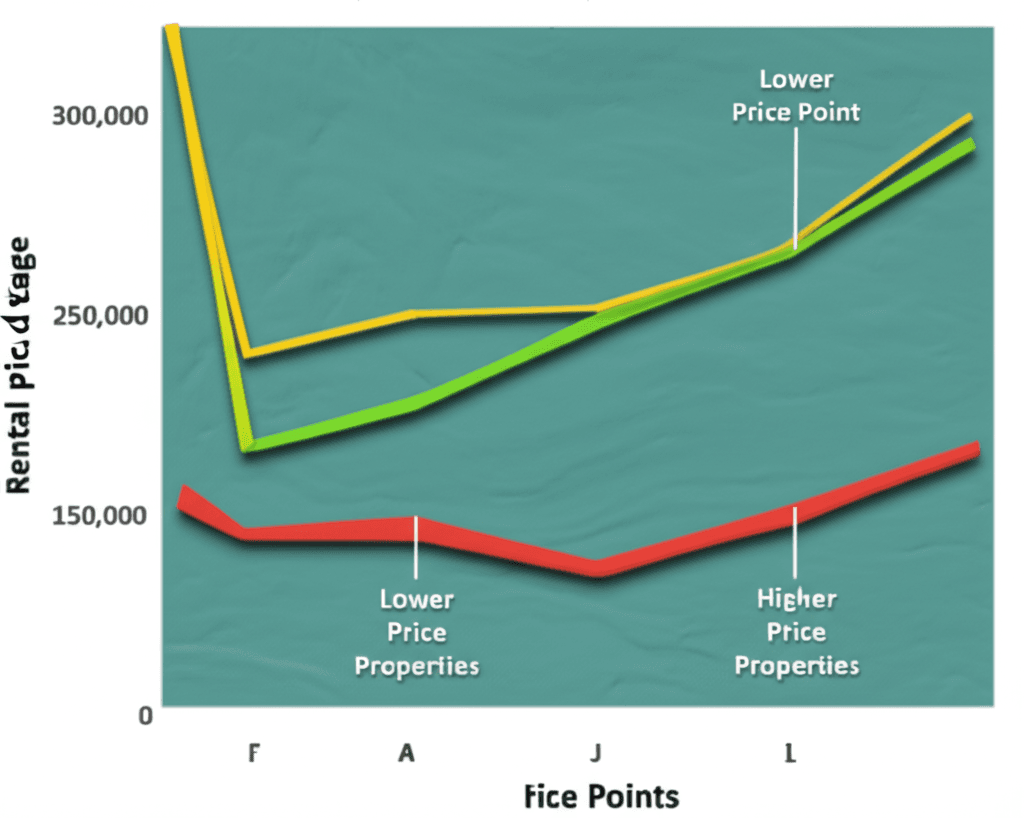

High-yield properties are not a secret waiting to be discovered; they are rare for a reason. Our analysis of thousands of statistically reliable suburbs across Australia shows just how rare they are.

The Statistical Reality: A yield of 7.9% or higher represents a 1-in-100 rarity. If you exclusively target cash flow positive properties, you are limiting your search to only 1% of the market.

The Growth Compromise: These high yields are almost always found in cheaper markets, often with weaker economic fundamentals and lower potential for capital growth. By focusing obsessively on yield, you dramatically shrink your pool of high-growth opportunities.

The Instability of Yield: High rent is not guaranteed. A study of markets with a 7.9%+ yield found that three years later, less than half still maintained that high yield. Of those that did, half experienced below-average capital growth, with some even seeing negative growth.

Chasing an extreme yield drastically narrows your chances of success. In contrast, finding a market with 4% above-average growth is four times more common than finding one with 4% above-average yield.

Finding the Sweet Spot: A Balanced Strategy for Success

The most successful investment strategy isn't about choosing between yield and growth; it's about finding the optimal balance. The data suggests the sweet spot lies in a more modest mix:

Target Yield: Aim for a yield that is slightly above average, around 4.9% - 5.9%. This is healthy, achievable, and keeps your holding costs manageable.

Target Growth: Focus on markets forecast to deliver above-average growth, around 9% or higher.

This balanced approach gives you the greatest chance of maximizing your overall return. It opens up a much wider range of quality suburbs to choose from, increasing your probability of securing an asset that delivers both sustainable cash flow and strong capital appreciation. You need to leverage deep market insights, going beyond simple suburb data to find these prime opportunities. Reliable data on current interest rates from sources like the Reserve Bank of Australia (RBA) can further refine these calculations.

Conclusion: Prioritise Growth, Manage Cash Flow

The pursuit of a purely positive cash flow property is often a beginner's mistake. While it sounds safe, it forces investors into a tiny fraction of the market, sacrificing the far more powerful wealth-building engine of capital growth. So long as you can comfortably manage the weekly holding costs, your focus should be on growth.

A balanced portfolio, built with a modest mix of yield and a strong emphasis on growth, is the most reliable path to financial freedom. Don't get caught in the cash flow trap. Instead, use data to make informed decisions that will put you in the best position for long-term success.

Ready to look beyond the headlines and find properties with the perfect balance of yield and growth? Explore HouseSeeker's powerful [real estate analytics](https://houseseeker.com.au/features/real-estate-analytics) platform to uncover data-driven opportunities and build a high-performing portfolio.

Frequently Asked Questions

What is the difference between positive cash flow and positive gearing?

Positive cash flow means your property's income exceeds its expenses after tax. Positive gearing is a technical tax term where the assessable income (rent) from your property is greater than the total deductible expenses (like interest, rates, and depreciation), meaning you pay tax on the profit. While related, a property can be cash flow positive but still be negatively geared if depreciation claims are high.

Why is capital growth more important than cash flow for wealth accumulation?

Cash flow provides income, but capital growth builds your net worth. A $500,000 property growing at 8% annually adds $40,000 to your equity. A small weekly positive cash flow of $50 only adds $2,600 a year. The leveraged nature of property means that growth on the total asset value delivers returns that far outstrip rental profits, allowing you to build a substantial asset base over time.

How can I find markets with a good balance of yield and growth?

This requires looking at leading indicators of supply and demand, vacancy rates, population trends, and local economic drivers. Tools that offer advanced filtering and lifestyle-based queries, like HouseSeeker's AI Property Search, can help you quickly narrow down thousands of suburbs to find those that meet your specific investment criteria for both yield and growth potential.