Strategic Property Investment: Building Long-Term Wealth for Retirement in Australia

Discover how a data-backed property strategy can overcome inflation and build a foundation for true financial independence, moving you beyond reliance on the age pension.

Introduction: Navigating the Economic Noise of 2025

Navigating the Australian economic landscape in mid-2025 can feel overwhelming. Daily headlines scream about inflation, interest rates, and the rising cost of living, creating a cycle of short-term anxiety. For many, this noise makes long-term goals like a comfortable retirement seem distant and unattainable. The unfortunate reality is that for 99% of people, the conventional path of earning a salary and saving is no longer enough to secure a prosperous future. But what if you could change that reality?

This guide is designed to shift your perspective. We will cut through the short-term panic and focus on the timeless principles of wealth creation through strategic property investment. By understanding the data, adopting the right mindset, and implementing a clear strategy, you can build a future where you are not just surviving, but thriving. It's time to stop reacting to the market and start making the market work for you.

The Unseen Threat: How Inflation Erodes Your Wealth

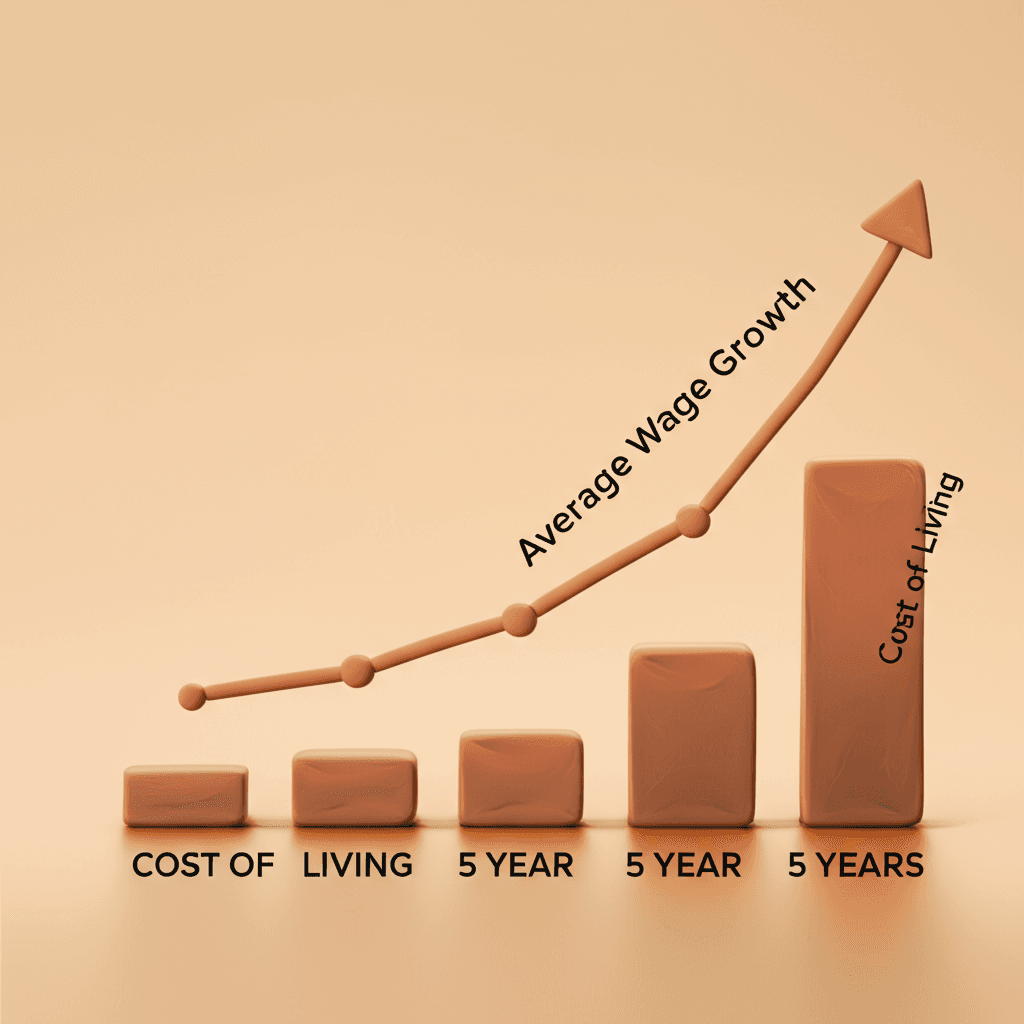

To build a secure future, you must first understand the forces working against you. The most persistent of these is the gap between wage growth and inflation. While headlines may celebrate a 3% rise in wages, it means very little if the cost of living, or inflation, increases by 7% in the same period. This isn't a hypothetical; it's the reality Australians have faced.

According to data from the Australian Bureau of Statistics (ABS), periods where inflation outpaces wage growth result in a decline in 'real' wages. In simple terms, your hard-earned money buys you less each year.

Positive Real Wages: If your income grows by 10% (perhaps through a promotion) while inflation is at 5%, your purchasing power increases by 5%. You are getting ahead.

Negative Real Wages: If your income grows by 3% but inflation is 7%, your purchasing power decreases by 4%. You are falling behind, despite earning more.

This slow erosion of wealth is why simply saving money in a bank account is a losing strategy over the long term. To truly get ahead, your capital needs to grow at a rate significantly higher than inflation. This is where strategic asset acquisition becomes not just an option, but a necessity.

The Pension Reality Check: A Safety Net, Not a Retirement Plan

Australia is fortunate to have a government age pension system, but relying on it as your primary retirement plan is a path to financial constraint, not freedom. Let's look at the numbers.

As of mid-2025, the full age pension provides approximately:

$26,869 per year for a single person.

$40,238 per year for a couple.

While this provides a basic standard of living, it's a world away from a 'rich' retirement. Furthermore, eligibility is determined by strict income and asset tests (excluding your primary home). For a homeowner couple, having assets over $935,000 makes you ineligible. When you've worked for over 40 years, this threshold is surprisingly easy to exceed, yet the pension amount itself is far from aspirational.

The critical flaw in a pension-reliant mindset is its vulnerability. If a high-inflation environment persists, that $40,000 for a couple will buy significantly less, squeezing your quality of life when you can least afford it. The goal isn't to qualify for the pension; the goal is to build your own private pension through investments that you control—one that grows, adapts, and provides you with choices.

The Core Strategy: How Two Properties Can Redefine Your Future

The idea of building a multi-million dollar portfolio can sound intimidating, but the principle is surprisingly simple. Let's break down a powerful, achievable strategy centered on acquiring just two well-chosen investment properties. The goal here is to use a single, focused year of disciplined saving and action to set up the next 30 years of passive wealth creation.

The Power of Compounding in Real Estate

Imagine you are 35 years old. You dedicate the next 12 months to securing two investment properties with a combined value of $900,000 (e.g., two properties at $450,000 each). Historically, Australian property has seen an average annual growth rate of around 7%. Using sophisticated real estate analytics, you can identify markets with the potential to meet or exceed this average.

Let's project this forward over 30 years:

Initial Investment: $900,000

Annual Growth Rate: 7%

Time Period: 30 years

Using a compound growth calculator, your initial $900,000 investment would grow to a staggering $6.85 million by the time you are 65. This represents a 661% return on the asset value.

What makes this even more powerful is the principle of leverage. You didn't pay $900,000 in cash. You likely used a 20% deposit, meaning your initial cash outlay was closer to $180,000. Growing $180,000 into a multi-million dollar asset base is the true magic of property investment.

De-Risking Your Strategy

Of course, we must account for inflation. Let's be conservative and say that inflation erodes half of your gains, meaning your 'real' growth is 3.5%. Your purchasing power at retirement would be equivalent to $3.4 million in today's money. This is still a phenomenal outcome that places you firmly in control of your financial destiny.

To further mitigate risk:

Diversify Location: Purchase properties in two different markets to protect against localized downturns.

Focus on Fundamentals: Use an AI property search to find areas with strong population growth, infrastructure spending, and low vacancy rates.

Get Expert Guidance: A modern AI Buyer's Agent can help you navigate the entire process, from identification to negotiation, ensuring you buy the right asset at the right price.

With these two properties working for you in the background, you can spend the next 29 years focusing on your career, family, and other investments, knowing your retirement foundation is securely in place.

Redefining 'Filthy Rich': Time, Freedom, and Choice

What does it mean to be 'filthy rich'? A survey by Finder revealed that many Australians believe it means earning over $336,000 per year. But true wealth isn't just a number on a payslip; it's about having control over your most valuable, non-renewable asset: time.

Imagine you've followed the two-property strategy. At age 65, you decide to sell the two properties, now worth a combined $3.4 million (in today's purchasing power). You place that capital into a conservative investment earning 4% per year. This would generate a passive income of $136,000 per year for you, or $272,000 per year for a couple, without ever touching the principal amount.

This income is nearly seven times what the age pension offers for a couple. This is financial independence. It's the freedom to travel, to support your family, to pursue hobbies, or to work on projects you are passionate about, not because you have to, but because you want to.

More importantly, this strategy gives you options. You don't have to wait until 65. If you choose to sell the assets at 55, the portfolio might be worth less, but you've just bought back 10 years of your life. Money can always be made, but time only moves in one direction.

Conclusion: Your Journey Starts Today

Weathering short-term economic pain is the price of admission for long-term financial gain. While others are paralyzed by the news cycle, the 1% who achieve true financial freedom are those who focus on a long-term, data-driven strategy.

Building wealth through property isn't about risky speculation or complex financial wizardry. It's about understanding the fundamentals of compounding growth, using leverage intelligently, and having the discipline to execute a simple, powerful plan. By acquiring just two well-chosen assets, you can create a future of choice, freedom, and security that far surpasses any government safety net.

Your retirement will arrive faster than you think. The decisions you make today will determine the life you live tomorrow. Don't let market noise dictate your future. Start building your asset base and take control.

Ready to move from theory to action? Explore our powerful real estate analytics to identify high-growth suburbs and begin your journey towards financial independence today.

Frequently Asked Questions

Is it too risky to invest in property with high interest rates?

While higher interest rates increase short-term holding costs, they should not deter a long-term strategy. Strategic investors focus on the 30-year outlook, not the 12-month interest rate cycle. High-quality assets in areas with strong demand fundamentals will perform well over time, regardless of short-term rate fluctuations. The key is to ensure your finances can comfortably manage the holding costs during the initial phase.

How do I find properties with the potential for 7% annual growth?

Achieving this requires deep market analysis beyond simply looking at past performance. You need to use advanced tools to assess leading indicators of growth, such as population migration trends, infrastructure investment, school catchment performance, and supply-demand dynamics. This is where leveraging powerful real estate analytics becomes critical to making informed, data-backed decisions rather than emotional ones.

Why focus on property instead of shares or other assets?

The primary advantages of residential real estate are the ability to use leverage (a bank loan) to control a large asset with a small deposit, its tangible nature, and its historically lower volatility compared to the stock market. This allows for significant compounded growth on a relatively small initial capital outlay, making it a uniquely powerful vehicle for long-term wealth creation for everyday Australians.