Is 'Buy and Hold' a Lazy Strategy? A Modern Guide to Property Investment

Discover why strategically timing the market with data can outperform traditional approaches and how to decide when to hold or trade your Australian properties.

The Age-Old Debate: Time in the Market vs. Timing the Market

For generations, Australian property investors have been guided by a single mantra: 'buy and hold'. The philosophy is simple—purchase a quality asset, put it to bed for decades, and let time work its magic. This traditional, old-school mindset has certainly created wealth. However, in an era of unprecedented data access, the question arises: is this passive approach still the best, or is it simply a lazy way to invest?

Many investors, particularly first-timers or 'accidental landlords', fall into this strategy by default. They upgrade their home, retain the old one as an investment, and simply sit on it. While it’s a proven path, it overlooks the immense potential of a more active, data-informed strategy.

The Modern Alternative: Active Trading with Real Estate Data

Contrary to the passive nature of 'buy and hold', a trading strategy involves actively timing the market. This doesn't mean guessing; it means using key data indicators and historical cycle analysis to make calculated decisions. Today's investors can leverage powerful tools to understand when a market is poised for growth, when it's stagnating, and when it’s time to exit. By analysing market trends, you can identify opportunities that a passive strategy would miss.

This approach hinges on understanding opportunity cost. Holding an asset in a flat market like Perth from 2013 to 2019, or Melbourne for the last six years, meant missing out on significant gains elsewhere. A proactive investor uses real estate analytics to reallocate their capital—their 'chips' on the table—to markets with greater short-to-medium term potential.

When to Hold vs. When to Trade: It's All About Capacity

An active trading strategy isn't for everyone, and the decision to trade shouldn't be taken lightly. There are two key scenarios where holding an asset, even in a slower market, is the prudent choice:

1. If You Are Uneducated or Risk-Averse: For those not deeply familiar with market analysis, the simplicity of buying a quality asset and holding it long-term is a safe and reliable strategy. Doing something is often better than doing nothing. 2. If You Haven't Maximised Your Borrowing Capacity: This is the most crucial factor. If the bank is still willing to lend you more (typically 5-6 times your income), you haven't exhausted your primary tool for wealth creation: leverage. In this case, it's better to hold your current assets and borrow further to diversify into new markets, capturing upside in multiple locations simultaneously.

Trading becomes the optimal strategy once you have maxed out your serviceability. At that point, your only way to enter a new, high-potential market is to sell an existing asset to free up capital and borrowing power. It’s about strategically transferring your debt to where it can work hardest for you.

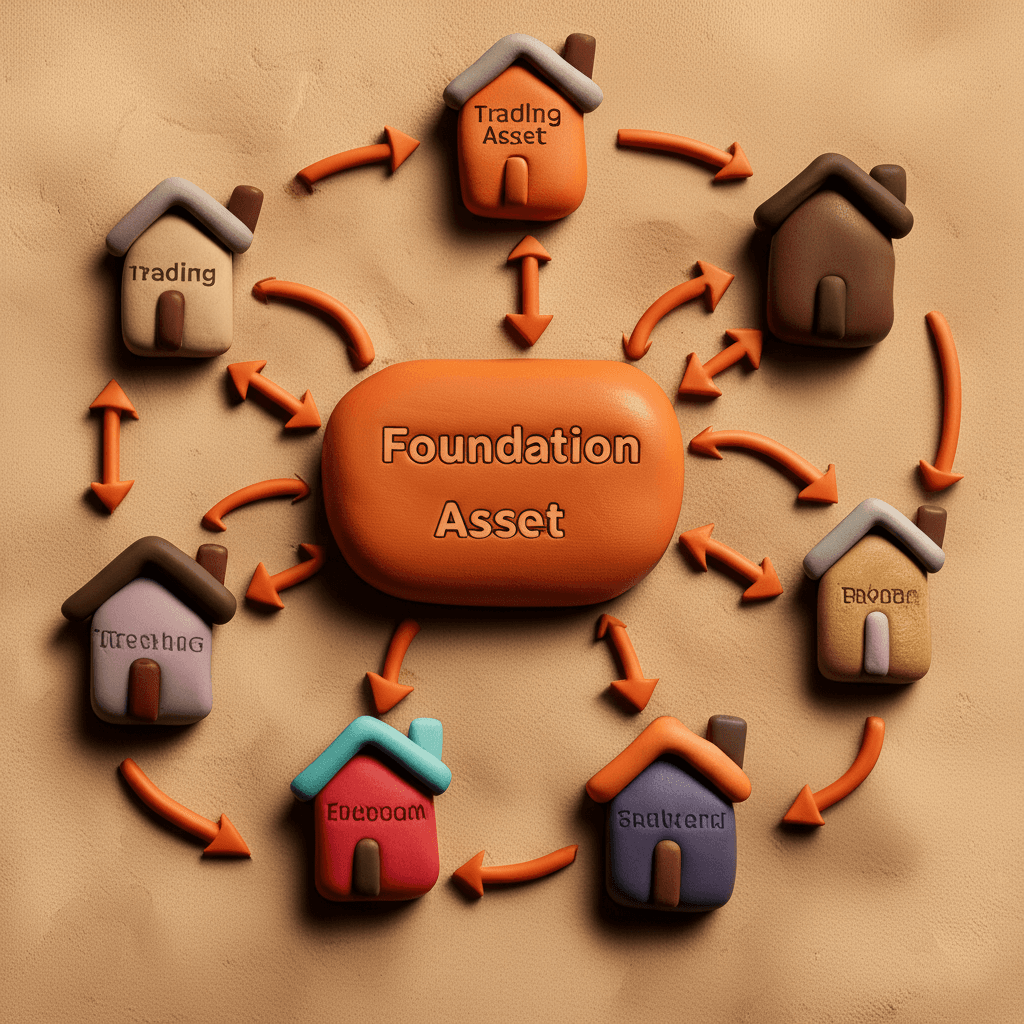

Building a Hybrid Portfolio: Foundation and Trading Assets

A sophisticated portfolio often contains a blend of two distinct asset types, each serving a different purpose. This hybrid approach offers both long-term stability and the flexibility to accelerate your financial goals.

Foundation Assets: These are your 'keepers'. Typically A-grade, blue-chip properties in desirable, family-oriented locations with strong owner-occupier appeal. Think of the 'worst house on the best street'. They are low-risk, high-quality assets you plan to never sell, forming the bedrock of your portfolio.

Trading Assets: These are often found in areas with lower entry points and higher investor concentration, making them more volatile. The strategy here is precise: get in, ride a significant growth wave (e.g., 60% upside), and get out before the market cools. The profits from these trades can be used to pay down debt on foundation assets or your own home, fast-tracking your journey to being debt-free. A powerful AI property search can help distinguish between these different types of opportunities.

Conclusion: The Verdict on 'Buy and Hold'

So, is the 'buy and hold' strategy dead? Not entirely, but for the majority of ambitious investors, it's a lazy and suboptimal approach. While it provides a safe baseline, it leaves significant capital gains on the table by ignoring opportunity cost.

The modern, winning formula is a dynamic one. It involves using data to understand market cycles, building a blended portfolio of foundation and trading assets, and knowing when to strategically trade based on your borrowing capacity. This active management, guided by a clear plan, is the key to outperforming the market and achieving your financial goals faster.

Ready to move beyond a passive strategy? Leverage the power of market data to make smarter, more profitable investment decisions. Explore HouseSeeker's advanced real estate analytics to identify Australia's next high-growth markets.

Frequently Asked Questions

Is the 'buy and hold' strategy completely outdated?

No, it still has its place, especially for new or risk-averse investors who prefer a simple, hands-off approach. It's also the default strategy for anyone who hasn't yet maximised their borrowing capacity. However, for those looking to actively build wealth, it is often a 'lazy' strategy that misses significant opportunities.

What is the biggest risk of a property trading strategy?

Timing. The primary risk is exiting a market too late after it has peaked. In high-volatility areas, a market downturn can quickly erase recent gains, leaving you trapped in negative equity. A successful trading strategy requires robust data, clear exit targets, and the discipline to sell—even if it feels like you're leaving some profit on the table.

Should my property portfolio include both holding and trading assets?

For most investors, yes. A blended strategy is ideal. 'Foundation' assets provide long-term stability and security, while 'trading' assets provide the capital boosts needed to accelerate major financial goals, such as paying off your primary residence mortgage in 6-8 years instead of 30.