Master Your Credit File: The Ultimate Guide for Australian Property Investors

Learn how to check, protect, and repair your credit history to secure better home loans and accelerate your investment journey.

Your Property Portfolio Starts with Your Credit File

Navigating the Australian property market requires more than just capital and market knowledge; it demands financial fitness. While many aspiring investors focus on saving a deposit and finding the right property, they often overlook the most critical document lenders will scrutinise: their credit file. A strong credit history is the bedrock of your borrowing power and can be the deciding factor between loan approval and rejection, or the difference of tens of thousands of dollars in interest over the life of a loan.

Whether you're aiming to buy your first investment or expand a multi-million dollar portfolio, understanding and actively managing your credit file is non-negotiable. A pristine file signals to lenders that you are a responsible borrower, unlocking access to better interest rates and higher loan amounts. Conversely, a file with negative listings—even minor ones—can halt your investment ambitions before they even begin.

What is a Credit File and Why Does It Matter for Investors?

Think of your credit file as your financial resume. It's a detailed record of your credit history, compiled by reporting bureaus like Equifax, Illion, and Experian. Lenders use this report to generate a credit score, a numerical summary that predicts your likelihood of repaying debt. This score is a critical part of a lender's assessment, often referred to as the 'Character' component of your application.

An excellent credit score can save you a significant amount of money. A borrower with a clean file might secure a home loan at a competitive rate, while someone with a lower score could be penalised with an interest rate 1-2% higher, or be forced to pay a larger Lender's Mortgage Insurance (LMI) premium. The opportunity cost is even greater; a damaged credit file could prevent you from securing finance for a prime investment property, costing you millions in potential capital growth over the long term.

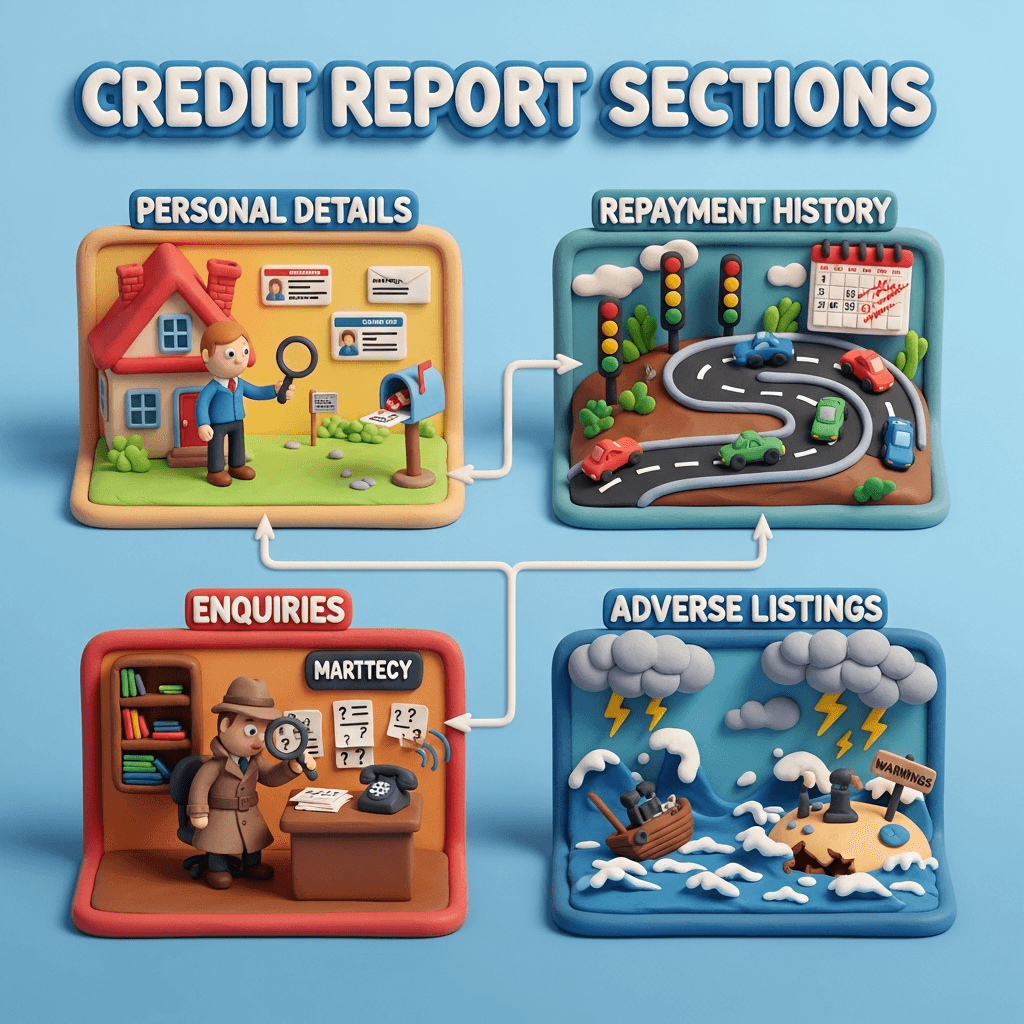

Decoding Your Australian Credit Report

Thanks to Comprehensive Credit Reporting (CCR), Australian lenders now share more detailed, positive information, creating a more transparent financial picture. This means your report shows more than just your mistakes; it also highlights your good habits. Key components include:

Personal Details: Your name, date of birth, address history, and employment history.

Repayment History: A 24-month record of your payments for loans and credit cards, showing if they were made on time.

Credit Enquiries: A list of every time a lender has accessed your file for a credit application. Too many in a short period can be a red flag.

Adverse Listings: These are negative entries that seriously impact your score, such as defaults (overdue payments of $150+), court judgments, and bankruptcy records.

Accounts: A list of your open and closed credit accounts, including credit cards, home loans, and personal loans.

Proactive Strategies for a Squeaky-Clean Credit File

Maintaining a healthy credit file is an active process, not a passive one. As a serious investor, you must monitor your financial health with the same diligence you use for property market analysis. Here are essential strategies to implement:

1. Check Your File Regularly: You are entitled to a free copy of your credit report from each bureau annually. For active investors, consider a paid subscription service (often as low as $10-$15 per month) that provides real-time alerts whenever your file is accessed. This is your first line of defence against errors and identity fraud. 2. Pay Everything on Time: This is the golden rule. Late payments, even for small utility or telco bills, can be recorded on your file and drag down your score. If you dispute a bill, the safest approach is to pay it first to avoid a default, then formally challenge the charge to get a refund. The cost of a $500 default is far greater than the disputed amount itself. 3. Build a Positive History: Lenders want to see a history of responsible borrowing. If you have a limited credit history, a low-limit credit card that you pay off in full each month can help establish your reliability. However, avoid opening too many accounts. 4. Manage Your Enquiries: Don't shop around for loans by submitting multiple applications. Each formal application leaves an enquiry on your file. Instead, work with a mortgage broker who can assess your eligibility across multiple lenders with a single enquiry. An AI-powered tool like HouseSeeker's AI Buyer's Agent can help you prepare and understand your position before you even approach a lender.

Fixing a Damaged Credit File: A Path to Loan Readiness

What happens if your credit file already has blemishes? Don't despair. Errors happen, and adverse listings aren't always permanent. Many defaults, judgments, or incorrect late payment records can be challenged and removed if they were listed unlawfully or incorrectly.

This is where specialist credit repair services can be invaluable. These firms, often run by lawyers, understand the complex legislation governing credit reporting. They analyse your file to identify grounds for removal and liaise with creditors on your behalf. Successfully removing even one default can dramatically boost your credit score, transforming your creditworthiness in the eyes of a lender and making you 'loan ready'.

Conclusion: Your Credit File is a Valuable Asset

For Australian property investors, a clean and accurate credit file is not just a 'nice to have'—it's a critical asset that directly impacts your ability to build wealth. By understanding its components, managing it proactively, and taking steps to repair any damage, you position yourself for financial success. Stay vigilant, monitor your file like you monitor the market, and ensure your financial resume is as impressive as your property ambitions.

Ready to pair your strong financial profile with powerful market insights? Explore our Data Analytics Hub to analyse market trends and find investment-grade properties that align with your goals.

Frequently Asked Questions

How often should I check my credit report?

As a property investor, it's wise to check your full credit report from all three major bureaus at least once a year. If you are actively preparing to apply for a loan, you should check it 3-6 months in advance to allow time to fix any potential issues. Subscribing to a credit monitoring service for real-time alerts is also highly recommended.

Will paying off a debt default automatically remove it from my file?

No. When you pay a defaulted debt, its status on your credit report will be updated to 'paid', but the default listing itself will remain for five years. While a 'paid' default is better than an unpaid one, the listing still negatively impacts your score. To have it removed entirely, you must prove it was listed in error or unlawfully, which often requires professional assistance.

How do 'Buy Now, Pay Later' services affect my credit score?

Historically, most 'Buy Now, Pay Later' (BNPL) services did not impact credit scores. However, this is changing rapidly. Major BNPL providers are beginning to participate in Comprehensive Credit Reporting, meaning your repayment history with them—both positive and negative—will appear on your credit file and influence your score. It's crucial to treat these services like any other form of credit and always make payments on time.