Melbourne's 2025 Property Boom: Top Suburbs Tipped for 18% Growth

Discover the economic drivers and data-backed predictions pinpointing which Melbourne suburbs are set for significant capital growth in the coming year.

Introduction

Navigating the Australian property market in mid-2025 can feel overwhelming. After a period of economic uncertainty and rising living costs, many investors and homebuyers are cautiously waiting for a clear signal. That signal is here. History is echoing the conditions of the early 2000s, suggesting Melbourne is on the precipice of its next major growth cycle. While a rising tide lifts all boats, not every suburb is created equal. The key to successful investing lies in identifying the specific areas poised to outperform the market dramatically.

This article cuts through the noise to provide a data-driven forecast of Melbourne's property landscape. We'll explore the macroeconomic factors creating this opportunity and, using independent data, reveal the council areas and suburbs predicted to soar by up to 18.4%. Forget guesswork; it's time to focus on strategic, informed decision-making to secure your financial future.

The Economic Tailwinds: Why Melbourne's Market is Shifting

For the past few years, inflation has been the dominant challenge for the Australian economy. The Reserve Bank of Australia's (RBA) strategy of increasing interest rates to curb spending has successfully brought headline inflation back towards the target 2-3% range. Projections for late 2025 and 2026 show inflation is expected to stabilise, creating a favourable environment for economic recovery.

What does this mean for the property market? With inflation under control, the pressure to raise interest rates has subsided. In fact, forecasts from major banks and economists point towards a series of interest rate cuts by the RBA. While the initial cuts may seem small, their real power lies in signalling a new direction for the economy. Historically, the RBA doesn't make one-off cuts; they implement a sequence over time to stimulate activity. This shift is the primary catalyst that will unlock pent-up demand and fuel the next wave of capital growth.

[INSERT_IMAGE: "A vibrant chart showing capital growth trends in major Australian cities"]

The Power of Consumer Sentiment

The direction of interest rates has a profound psychological impact on the market. When rates are rising, buyers become hesitant, deferring major purchases like upgrading their homes or buying an investment property. As we enter a cycle of rate cuts, this sentiment reverses. Confidence returns, and people feel more secure in their financial future, leading to increased spending and borrowing.

Recent surveys from organisations like CoreLogic confirm this changing tide. A growing majority of real estate agents—over 65%—now anticipate house prices to rise, a significant increase from the previous year. This positive outlook from industry professionals reflects the broader recovery in consumer sentiment. As buyers re-enter the market with renewed optimism, demand in desirable, middle-class, and affluent suburbs is set to surge, driving prices upward.

Unveiling Melbourne's High-Growth Hotspots for 2025

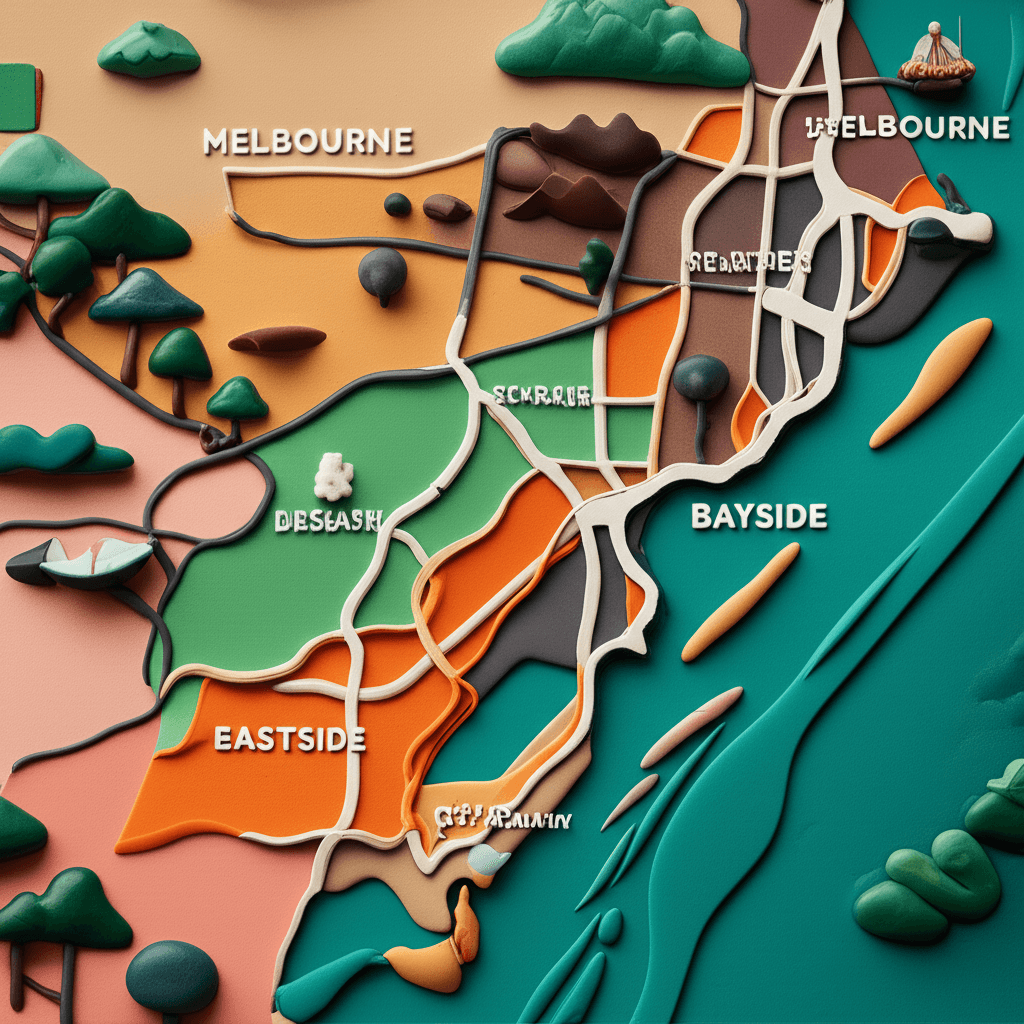

While the entire Melbourne market is expected to perform well, certain areas are positioned to capture a disproportionate share of the growth. Analysis based on the impact of a 1% reduction in the cash rate pinpoints several key council areas, predominantly in the blue-chip eastern and bayside corridors. These are areas where affluent buyers have been waiting on the sidelines and are now ready to act.

Understanding these micro-markets requires deep real estate analytics. The data highlights areas with strong fundamentals: excellent schools, robust infrastructure, desirable amenities, and high-income demographics. Below are the top-performing council areas and the suburbs within them that investors should be targeting right now.

Top Melbourne Council Areas by Predicted Growth:

Whitehorse: 18.4%

Moonee Valley: 18.0%

Manningham: 17.4%

Boroondara: 17.3%

Bayside: 16.4%

Yarra: 16.3%

Glen Eira: 15.6%

Monash: 12.9%

Deep Dive: Whitehorse Council (Predicted Growth: 18.4%)

Leading the charge, the City of Whitehorse is a powerhouse of established, family-friendly suburbs. It combines leafy streets with exceptional access to transport and amenities.

Key Suburbs: Box Hill, Blackburn, Mont Albert, Surrey Hills, Vermont, Mitcham.

What to Look For: Box Hill stands out as a mini-CBD with phenomenal growth drivers, including its major hospital, transport hub, and school zone. Premium, modern townhouses with 4-5 bedrooms and a dedicated home office are in high demand, reflecting the post-pandemic need for flexible living spaces.

Deep Dive: Moonee Valley Council (Predicted Growth: 18.0%)

Located north-west of the CBD, Moonee Valley offers a blend of historic charm and modern vibrancy. Suburbs here have undergone significant rejuvenation, attracting high-income earners and families.

Key Suburbs: Moonee Ponds, Essendon, Ascot Vale, Flemington.

What to Look For: Moonee Ponds has transformed into a lifestyle hub with a thriving cafe and restaurant scene. Essendon is renowned for its prestigious schools and grand homes. Properties that offer quality and location in these tightly-held areas are set to perform exceptionally well.

Deep Dive: Manningham Council (Predicted Growth: 17.4%)

Known for its green, spacious landscape and large blocks, Manningham is a magnet for those seeking a suburban lifestyle with easy access to world-class retail.

Key Suburbs: Doncaster, Doncaster East, Templestowe, Donvale.

What to Look For: The major drawcard is Doncaster, home to Westfield Doncaster, one of Melbourne's premier shopping centres. High-quality, architecturally designed townhouses, especially those with unique features like rooftop terraces, cater to the aspirational demographic in this area.

Deep Dive: Boroondara Council (Predicted Growth: 17.3%)

Arguably Melbourne's most prestigious municipality, Boroondara contains some of Australia's most expensive real estate. It's the definition of a blue-chip investment area where the wealthiest residents choose to live.

Key Suburbs: Kew, Hawthorn, Camberwell, Canterbury, Balwyn, Surrey Hills.

What to Look For: These are 'forever home' suburbs. While entry prices are high, the long-term capital growth is virtually assured. Well-appointed townhouses in prime school zones offer a more accessible entry point into this exclusive market.

Deep Dive: Bayside Council (Predicted Growth: 16.4%)

For those who prefer the coast, the Bayside area offers an unparalleled lifestyle of beaches, cafes, and a relaxed community atmosphere. It's where the city meets the sea.

Key Suburbs: Brighton, Beaumaris, Black Rock, Sandringham, Hampton.

What to Look For: While Brighton's prices are prohibitive for most investors, suburbs like Beaumaris and Black Rock offer exceptional value and lifestyle appeal. These tightly-held communities are seeing strong demand for family-sized townhouses that allow residents to enjoy the coveted bayside living.

Investment Strategy: What to Target and What to Avoid

Across these high-growth corridors, a clear trend emerges. The ideal investment is not a sprawling house on a huge block, which comes with significant land tax implications. Nor is it a shoebox apartment in a high-rise tower. The sweet spot is the modern, well-designed townhouse.

Target:

Blue-Chip Suburbs: Let the trend be your friend. Focus on the established eastern and bayside suburbs where high-income earners want to live.

Quality Townhouses: Look for properties with 3-4 bedrooms, multiple bathrooms, a double garage, and a functional layout. A ground-floor bedroom or dedicated study/office is now a highly sought-after feature.

Proximity to Amenities: Properties within top school zones and walking distance to transport, parks, and shops will always command a premium.

Avoid:

High-Density Apartments: The Melbourne apartment market, particularly in the CBD and fringe areas, is facing issues with oversupply, build quality concerns, and high body corporate fees. These factors severely limit capital growth potential.

House and Land Packages: While appealing on paper, these are often located in outer-fringe areas that lack the established infrastructure and scarcity needed for strong, consistent growth.

Finding the right property that matches these criteria can be challenging. Using an advanced AI Property Search allows you to filter for these specific attributes, while a service like our AI Buyer's Agent can provide personalised recommendations based on your investment goals.

Conclusion: Your Window of Opportunity is Now

Melbourne's property market is at a pivotal turning point. The economic headwinds are clearing, interest rates are set to fall, and confident buyers are returning. Projections of 18%+ growth are not speculative fantasy; they are grounded in economic modelling and historical precedent. Long-term forecasts predict the median house price in Melbourne could reach over $5 million in the next 20 years, driven by relentless population growth and a critical housing shortage.

This is the moment to act. By focusing on the right property type—modern townhouses—in the data-backed, high-performing suburbs of the eastern and bayside corridors, you position yourself to ride the coming wave of growth. The opportunity to build substantial, life-changing wealth is here, with or without you. The question is, will you take it?

Ready to uncover your own high-growth opportunities? Dive deeper with HouseSeeker's powerful real estate analytics to compare suburbs, track market trends, and make your next move with confidence.

Frequently Asked Questions

What is driving the predicted property boom in Melbourne?

The primary drivers are the stabilisation of inflation, forecast interest rate cuts from the RBA, and a significant recovery in consumer sentiment. This combination is expected to release pent-up demand, particularly in desirable, high-value suburbs.

Which property types are best for investment in these suburbs?

Modern townhouses with 3-4 bedrooms, multiple bathrooms, and dedicated work-from-home spaces are the ideal investment vehicle. They offer a balance of land value and modern living that appeals to the core demographic of families and high-income professionals, without the high maintenance and land tax of a large house. It is advisable to avoid new high-density apartments due to concerns over quality and capital growth potential.

How can I find properties in these specific high-growth areas?

Finding the right on-market and off-market opportunities requires sophisticated tools. You can use an AI Property Search to apply advanced filters for specific suburbs, property types, and features like school zones. For a more guided experience, an AI Buyer's Agent can curate personalised property shortlists that match your specific investment strategy and financial goals.