Melbourne's Best & Worst House & Land Estates 2025: A Data-Driven Analysis

Discover the key data points that separate high-growth infill estates from underperforming fringe developments, ensuring your investment delivers long-term value.

Introduction: Beyond the Brochure

Navigating Melbourne's property market in 2025 requires more than just a keen eye; it demands a data-driven strategy. House and land estates, often marketed as the quintessential Australian dream, present a landscape of both incredible opportunity and significant risk. While slick brochures promise idyllic lifestyles in new 'growth corridors,' the reality is that not all estates are created equal. Many investors are lured into underperforming areas that stagnate for years due to poor planning and a lack of amenities.

This guide cuts through the marketing hype to provide an objective, data-backed methodology for identifying the best—and worst—house and land estates in Melbourne. By focusing on fundamental drivers of capital growth, from socio-economic data to infrastructure access, you can learn to distinguish a prime investment from a potential financial trap.

The Key Drivers of Property Capital Growth

Successful property investment hinges on understanding that around 80% of a property's growth is driven by its location, not the dwelling itself. Before assessing any estate, it's crucial to analyse the suburb's fundamentals using key metrics.

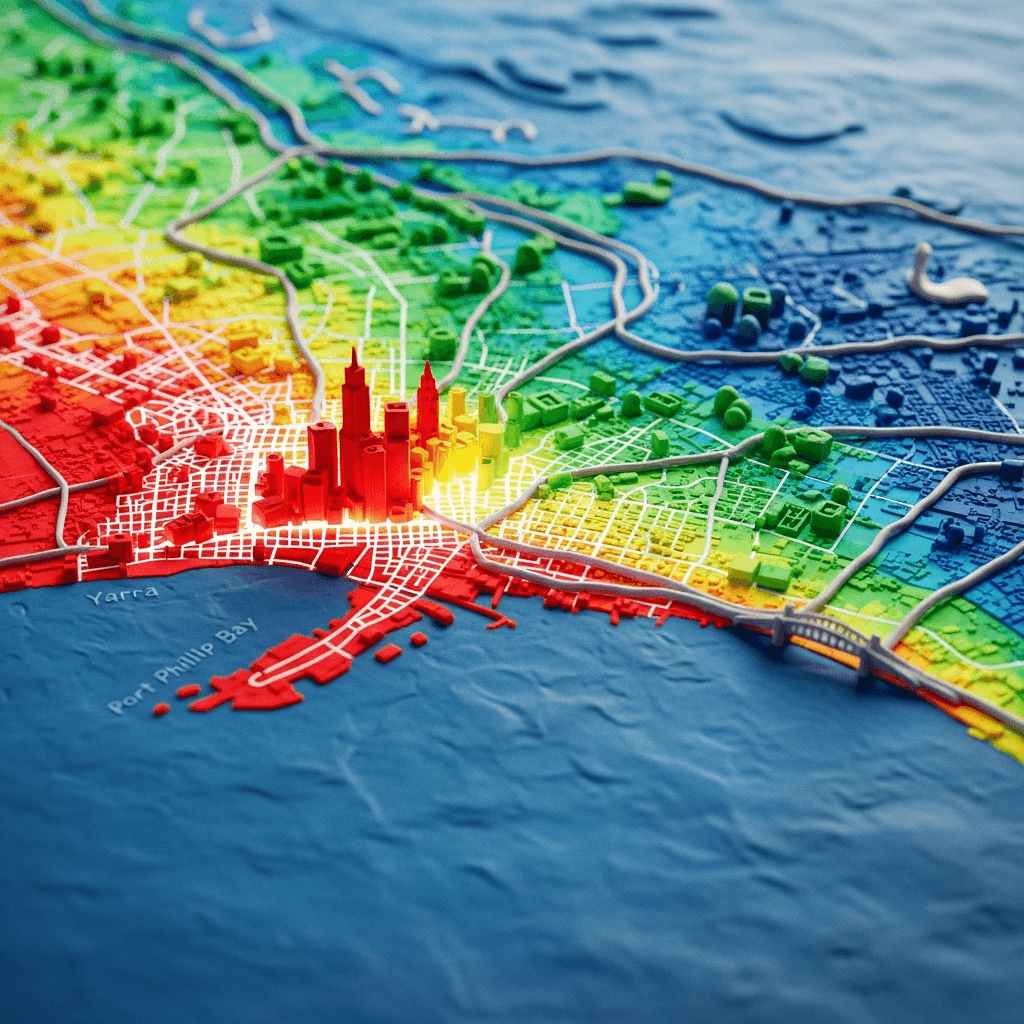

The most significant factor influencing a suburb's desirability is the 'Lifestyle Triangle'—the time it takes for a resident to travel between home, work, and essential lifestyle locations like schools, cafes, and entertainment hubs. Areas where this triangle is small and convenient command a premium price. Modern infrastructure like freeways can shrink this triangle, making suburbs like Mitchum and Vermont South, once considered distant, highly sought after. When you want to find a property that perfectly matches your daily routine, you can use advanced tools to search based on lifestyle.

Data consistently shows a strong correlation between property value and proximity to the CBD, coastline, and local employment hubs. Interestingly, only about 20% of Melbourne's jobs are in the central business district; the other 80% are scattered across suburban hubs like Clayton, Box Hill, and Heidelberg. Furthermore, suburbs with the highest average taxable incomes—such as Toorak, Brighton, and East Melbourne—consistently outperform the market. Higher incomes mean greater borrowing capacity, which fuels competition and drives up property prices. To explore these suburb-level insights, you need access to powerful market trends.

Red Flags: Anatomy of an Underperforming Estate

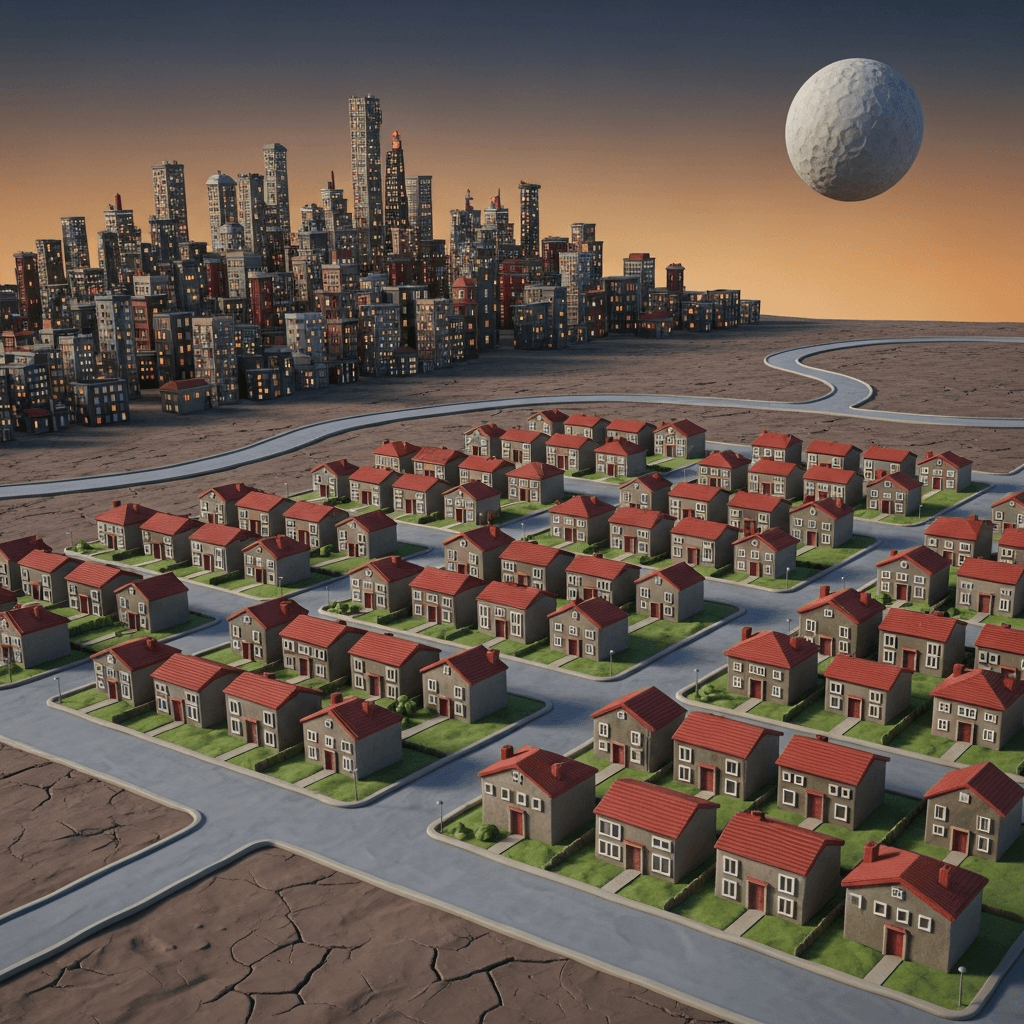

The most significant investment risks lie in fringe housing estates located in poorly planned 'growth corridors'. These areas are often plagued by issues that suppress capital growth for years, if not decades.

A common misconception is that high population growth automatically translates to high capital growth. However, areas like Wyndham and Melton have seen massive population increases but have lagged in property value. This is because they suffer from critical flaws:

Infrastructure Lag: These estates are often built without essential infrastructure. Residents face a daily reality of no train stations, inadequate roads, a lack of medical centres, and few shops, as seen in the infamous case of Thornhill Park.

Isolation and Lack of Amenities: Being located on the far fringes, often in former cow paddocks, means there are no established cafes, restaurants, or community hubs. This creates a dysfunctional and isolating environment.

Oversupply and Low Resale Value: Developers in these corridors often hold vast land banks, releasing blocks in stages. This creates a constant state of oversupply, making it difficult for existing homes to appreciate in value. The primary market is first-home buyers, with little to no secondary market for established properties.

Higher Mortgage Stress: Data reveals that these outer suburbs consistently have the highest rates of mortgage stress. This leads to more forced sales, further suppressing local property prices.

Finding Gems: Hallmarks of a High-Performing 'Infill' Estate

In stark contrast to fringe developments, the most successful house and land estates are 'infill' projects. These are new communities built on pockets of land within established, desirable suburbs. They offer the best of both worlds: a brand-new home with immediate access to a mature, amenity-rich environment.

Key characteristics of a top-tier infill estate include:

Established Location: Surrounded by prestigious and desirable suburbs with a proven track record of capital growth.

Existing Infrastructure: Immediate access to high-quality schools, transport links, shopping strips, parks, and hospitals.

Scarcity: A finite number of properties are available. Once sold out, there is no more land, creating scarcity that drives up long-term value.

High Local Demand: A significant percentage of buyers are often locals who already know and value the area, confirming its desirability.

Examples of successful infill locations can be found in suburbs like Mulgrave, Keilor East, and Altona North. These areas offer excellent lifestyle triangles and are surrounded by employment hubs and top-tier amenities, making them prime targets for investment.

Conclusion: Invest with Data, Not Hope

When it comes to investing in Melbourne's house and land estates, the path to success is paved with data, not emotion. The allure of a big new home on the city's edge can quickly fade when faced with hour-long commutes, non-existent amenities, and stagnant growth. The smartest investors look past the marketing and focus on the fundamentals.

Prioritise infill estates in established suburbs that are supported by strong infrastructure, high-income demographics, and a scarcity of land. By analysing the lifestyle triangle and leveraging deep market data, you can confidently identify properties with the greatest potential for long-term capital appreciation. A guided approach can make all the difference, and a smart platform can help you navigate the buying process with confidence.

Ready to make a data-driven investment? Explore HouseSeeker's Real Estate Analytics Hub to uncover Melbourne's next high-growth areas.

Frequently Asked Questions

What is the 'lifestyle triangle' and why is it important for property value?

The 'lifestyle triangle' refers to the time and convenience of travel between a person's home, workplace, and their most frequented lifestyle destinations (like schools, shops, and parks). Suburbs with a compact and efficient lifestyle triangle are more desirable, as people are willing to pay a premium for convenience and time savings, which directly drives up property values.

Why is an 'infill' estate typically a better investment than a 'fringe' estate?

An infill estate is built within an already established suburb, giving it immediate access to mature infrastructure like transport, top-rated schools, and amenities. This creates high demand and scarcity. A fringe estate is built on the edge of the city, often without any of these features, leading to resident isolation, oversupply issues, and poor capital growth.

Does high population growth always mean high capital growth?

No. This is a common myth. While population growth is a factor, it doesn't guarantee capital growth if the area lacks the fundamentals to support it. Many outer-suburban 'growth corridors' have experienced massive population booms but have underperformed due to poor planning, lack of infrastructure, low-income demographics, and an oversupply of new housing, which all combine to suppress property price appreciation.