Melbourne Property Market Forecast: Why 2025 is the Time to Buy

Explore the key data driving Melbourne's potential property boom, focusing on affordability, migration, and rental market dynamics for savvy buyers.

Navigating the Australian property landscape in mid-2025 can feel overwhelming. Conflicting headlines and complex data often lead to decision paralysis for aspiring homeowners and investors alike. While other capital cities have experienced dramatic price surges, Melbourne has been quietly building a foundation for significant, sustainable growth. The data suggests that a unique window of opportunity is opening, particularly for those who know where to look.

This article cuts through the noise to provide a clear, data-driven analysis of the Melbourne property market. We'll explore the fundamental drivers pointing towards a market upswing in 2025 and identify the specific sectors poised for the most substantial growth, empowering you to make your next move with confidence.

The Key Indicators Pointing to a Melbourne Market Shift

While past performance is no guarantee of future results, a convergence of powerful economic and demographic factors creates a compelling case for Melbourne's property market. To understand this potential, you need to look beyond surface-level trends and dive into the core numbers with powerful real estate analytics.

Unprecedented Affordability Gap with Sydney

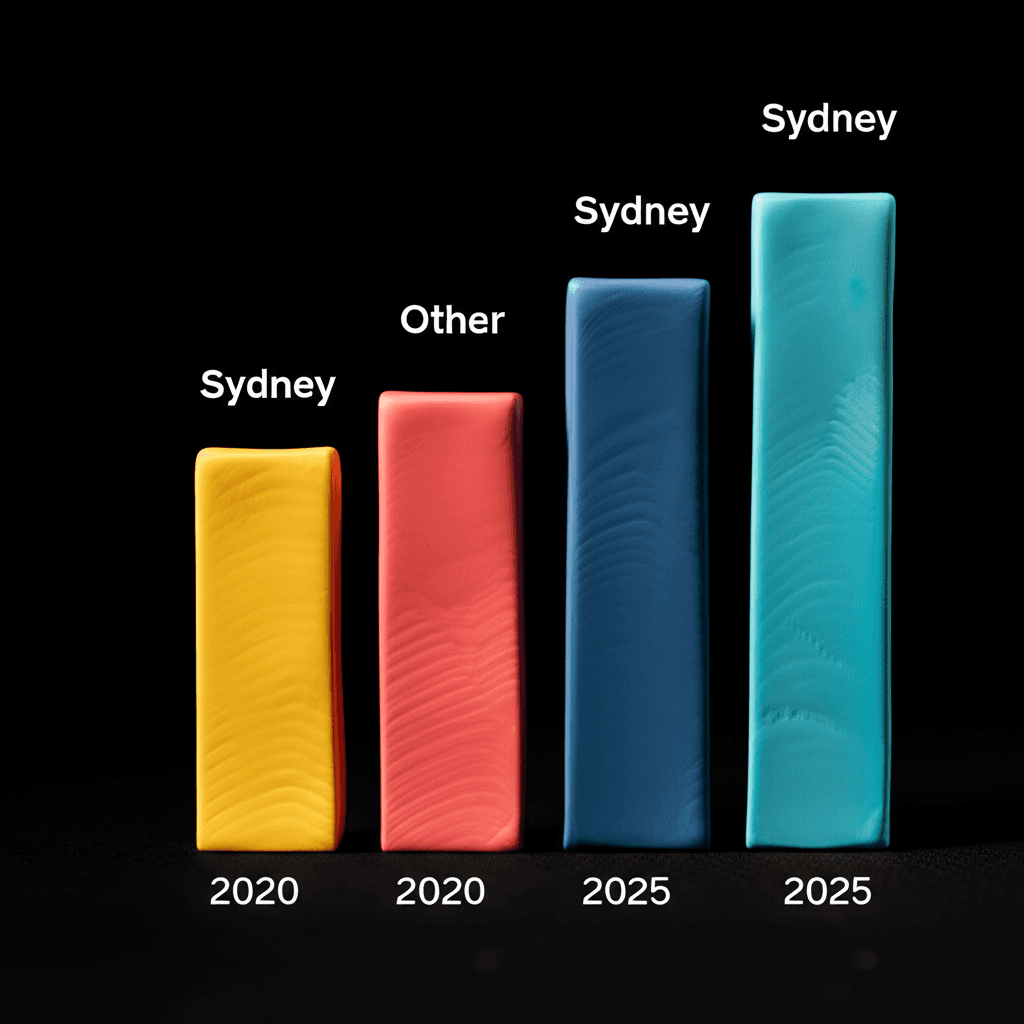

Historically, Sydney's median house price has been approximately 29% higher than Melbourne's. As of mid-2025, that gap has widened to a staggering 64%—the largest differential ever recorded. This creates a powerful value proposition for Melbourne. As affordability pressures in Sydney reach a breaking point, both migrants and interstate movers will increasingly look to Melbourne for its relative value, robust jobs market, and renowned lifestyle.

Strong Migration Fuelling Housing Demand

Australia's population is growing, and Victoria is a primary beneficiary. With an influx of approximately 104,000 people annually, the demand for housing is immense. According to the Australian Bureau of Statistics (ABS), consistent population growth is a primary driver of housing demand. These new residents need a place to live, and with a shortage of over 100,000 dwellings in the state, the pressure on the existing housing stock is intensifying.

Record-Low Vacancy Rates and Soaring Rents

In early 2025, Melbourne's rental vacancy rate plummeted to a critical low of 1%, far below the 3% figure that indicates a balanced market. This has ignited rental prices, with reports of 11% increases in the previous year and a further 4% rise this year. With rents consuming 30% or more of a tenant's income—edging closer to the 40% often allocated to a mortgage—the financial incentive to transition from renting to owning has never been stronger. This pressure is forcing many tenants to actively enter the buying market, fuelling demand from the ground up.

Identifying the Growth Sector: Boutique Apartments & Townhouses

The most significant opportunity in Melbourne isn't in the high-end housing market, but rather in the more affordable and resilient sector of boutique apartments and townhouses, particularly within the $600,000 to $750,000 price bracket.

The First-Home Buyer Surge

This price point represents the sweet spot for a large cohort of buyers: first-home buyers, young professionals, and couples who are being pushed out of the rental market. Unlike the previous cycle driven by cheap interest rates, this potential boom is built on the fundamental need for housing. Suburbs like Richmond and other inner-ring locations offer two-bedroom apartments in this range, providing an accessible entry point into the market with strong lifestyle amenities. To find these specific opportunities, you can use an AI property search to filter by price, property type, and proximity to transport and cafes.

Why Boutique Builds Outperform High-Rises

Astute buyers are looking past the high-rise towers with their prohibitive body corporate fees. The focus is on older, boutique blocks and well-designed townhouses. These properties offer several advantages:

Lower Body Corporate Fees: Makes holding the property more affordable long-term.

Larger Floor Plans: Often more spacious than their modern high-rise counterparts.

Scarcity Value: Developers find it less economical to build these smaller complexes, meaning supply is naturally limited.

The Shifting Landscape for Property Investors

While the outlook for owner-occupiers is bright, the environment for property investors in Victoria has become more complex due to rising costs and new tax regulations. This has led to a strategic pivot for many.

The Impact of Property Taxes and Rising Costs

Increased land taxes, soaring insurance premiums, and high maintenance costs have eroded the profitability of holding investment properties. Many 'mom and dad' investors, who make up the majority of the market, are finding that their properties are negatively geared and the administrative headache is no longer worth the potential capital gains. The risk of a single large repair bill, such as an $8,800 roof leak, can wipe out an entire year's profit.

The Pivot to an Owner-Occupied Focus

In response, a growing number of Victorians are selling their investment properties to focus on their primary place of residence (PPOR). The PPOR remains a tax-free haven for capital growth. Homeowners are choosing to pay down their home loan, invest in renovations, or use debt-recycling strategies to build wealth through other asset classes like managed funds, offering diversification without the complexities of being a landlord.

Conclusion: Your Window of Opportunity is Now

The Melbourne property market is at a critical inflection point. The combination of relative affordability, high migration, and an intensely tight rental market has created the perfect storm for price growth, particularly in the apartment and townhouse sector. Clearance rates are consistently hitting the 70% mark, and prices have been rising month-on-month—the upward trend has already begun.

For those who have been waiting on the sidelines, the message is clear: the danger of being priced out of the market is very real. The time to act is now. By getting strategic advice, understanding your financial capacity, and focusing on high-demand property types, you can secure your foothold before the market moves further away.

Ready to uncover the data-driven opportunities in Melbourne's property market? Explore HouseSeeker's powerful real estate analytics to make your next move with confidence.

Frequently Asked Questions

What price range shows the most potential in Melbourne for 2025?

The $600,000 to $750,000 bracket is showing the most potential, as it captures strong demand from first-home buyers and former renters. This segment, focusing on boutique apartments and townhouses in well-located suburbs, is poised for sustainable growth.

Is it better to invest in a property or my own home in Victoria right now?

Due to increasing taxes and holding costs on investment properties, many people are finding it more financially prudent to focus on their owner-occupied home. Your primary residence is exempt from capital gains tax, making it a powerful vehicle for wealth creation.

How can I find properties before they hit the major websites?

The market is moving quickly, and competition is fierce. Partnering with a professional, such as a buyer's agent, can give you a significant advantage. They often have access to off-market properties and can help you execute a purchase quickly and efficiently. Our AI Buyer's Agent can provide personalized recommendations to streamline this process.